Contents

Summary

Summary

- This BCE Inc. stock analysis is based on Q4 and FY2016 financial results and outlook for FY2017.

- BCE Inc. is Canada’s largest telecommunications company. It has expanded its position through the very recent acquisition of Manitoba Telecom Services Inc..

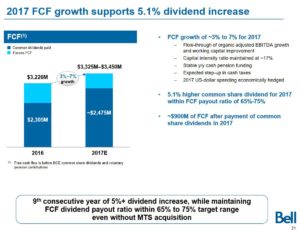

- BCE reported solid results for FY2016 and FCF and EPS projections for FY2017 are such that BCE’s Board authorized a 5.1% increase in the annual dividend to $2.87/year.

- While not priced at “fire sale” levels, BCE would be a worthwhile addition to an investor’s portfolio if a safe dividend income stream is a desired outcome from an investment.

BCE’s Business and Major Competitors

BCE (NYSE: BCE) is Canada's largest communications company. It offers services under the Bell, Bell Aliant and Bell MTS (Manitoba Telecom Services Inc.) brands. These include fibre-based IPTV, Canada’s fastest high-speed Internet services, 4G LTE wireless, home phone services as well as business network and communications services, including data hosting and cloud computing through the its network of data centres.

It is currently expanding its broadband Fibe network, including its Gigabit Fibe Internet footprint in Ontario, Québec, and Atlantic Canada. On March 17, 2017, BCE completed its acquisition of all of the issued and outstanding common shares of MTS. With this recent acquisition, BCE has indicated it plans to make capital investments of $1 billion over the next 5 years.

Bell Media is Canada's premier multimedia company with leading assets in television, radio, out of home and digital media, including CTV, Canada's #1 television network, and the country's most-watched specialty channels.

To accelerate Bell’s broadband content strategy, BCE is a significant investor in Canada’s leading sport and entertainment institutions, the Montreal Canadiens and Maple Leaf Sports and Entertainment.

BCE also operates the most extensive network of retail outlets; this includes its 650 “The Source” locations; “The Source” is one of Canada’s leading consumer electronics and cell phone retailers. Its history in Canada goes back over 40 years. Initially it was Radio Shack and subsequently became “The Source by Circuit City”. In 2009, BCE purchased the assets of InterTAN from its parent, American retailer Circuit City.

BCE’s current market cap is in excess of $39.77B. It closest rivals are:

- Rogers Communications Inc. (NYSE: RCI) – $23B market cap

- Telus Corporation (NYSE: TU) – $19.2B market cap

- Shaw Communications Inc. (NYSE: SJR) – $10.24B market cap

No other Canadian competitor has a market cap in excess of $3B.

Q4 and FY2016 Financial Results (expressed in CDN $)

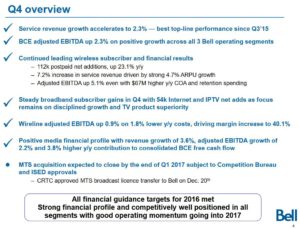

On February 2, 2017, BCE reported its Q4 and FY2016 results and announced its 2017 financial targets.

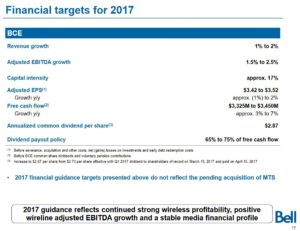

Outlook for FY2017 (expressed in CDN $)

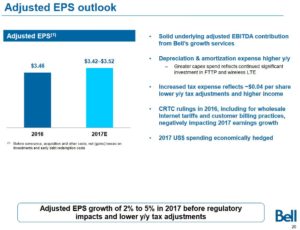

BCE announced a 5.1% increase in its annual dividend to $2.87/year. This is supported by its projected strong FCF and forecasted adjusted EPS range of $3.42 - $3.52 for FY2017.

Valuation

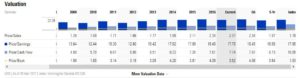

BCE is currently trading at a PE just shy of 17.70. This is slightly elevated relative to historical levels but it has pulled back from a level that was in excess of 18.4.

BCE is a company I would be prepared to acquire at a PE of 17.70. Using the midpoint of management’s adjusted EPS forecast for FY2017 ($3.47), which is reasonably close the mean EPS estimate of $3.46 from 11 analysts (see below), it would be reasonable to acquire BCE shares at a level below CDN $60 or USD $45; shares are currently trading at CDN $58.77 and USD $44.06.

BCE’s dividend yield using the recently announced annual dividend of CDN $0.7175/quarter or CDN $2.87/year is just over 4.8%. This is attractive in today’s environment. It is particularly attractive for Canadian shareholders since BCE’s dividends will not attract the 15% withholding tax which is levied against dividends earned from US listed companies if shares are held outside a Registered Retirement Savings Plan (RRSP) or Registered Retirement Income Fund (RRIF).

BCE Inc. Stock Analysis - Final Thoughts

BCE is currently held in the FFJ Portfolio and has been a core holding in other investment accounts for a few decades. It is actually the first company in which I have owned shares as my parents acquired shares in trust for me in the early 1960s.

There are not many companies listed on the Canadian stock exchanges that appeal to a conservative investor such as me. BCE, however, is one of the few publicly traded companies in Canada where I feel reasonable confident that I can put my head on the pillow and I won’t wake up the following morning to some unpleasant news.

In my opinion, BCE is one of those companies where you acquire shares, tuck them away, and just collect/automatically reinvest the dividends.

While I recommend BCE as a long-term hold, I will not be acquiring additional shares as we currently hold a full position. Should BCE get caught up in some catastrophic market correction, however, I would very seriously entertain the acquisition of additional BCE shares.

Disclaimer: I have no knowledge of your circumstances and am not providing individualized advice or recommendations. I encourage you to conduct your own research and due diligence and to consult your financial advisor about your situation.

Disclosure: I am long BCE.

I wrote this article myself and it expresses my opinions. I am not receiving compensation for it and have no business relationship with any company mentioned.