On January 3, 2019, I acquired 300 Apple (AAPL) shares @ $143.6168 (1200 shares and ~$36/share when we account for the end of August 2020 4:1 stock split). I disclosed this purchase in my January 4, 2019 post at which time I suggested investors load up on AAPL shares. Following that post, AAPL’s share price proceeded to steadily climb until early December 2021 when the share price briefly touched ~$183. Since then, AAPL’s share price has been somewhat volatile and has retraced to ~$131.40 as I compose this post.

The share price viewed in isolation, however, is meaningless as it merely indicates market sentiment rather than how the company is performing. With AAPL having fallen out of favour of late, I revisit AAPL.

Business Overview

Most investors are undoubtedly familiar with AAPL. I, however, provide a link to the FY2022 Form 10-K in which Item 1 provides a good overview of the company together with the major Risk Factors.

Financial Review

Q4 and FY2022 Results

On October 27, 2022, AAPL released Q4 and FY2022 results (refer to Form 8-K and the FY2022 Form 10-K).

Risk Assessment

AAPL’s domestic senior unsecured debt ratings are:

- Moody’s: Aaa with a stable outlook; and

- S&P Global: AA+ with a stable outlook.

The rating assigned by Moody’s is the top tier and defines AAPL as having an extremely strong capacity to meet its financial commitments.

The rating assigned by S&P Global is the top tier in the high-grade investment-grade category and is one tier below AAA. This rating defines AAPL as having a very strong capacity to meet its financial commitments. It differs from the highest-rated obligors only to a small degree.

AAPL’s credit risk fits my risk profile.

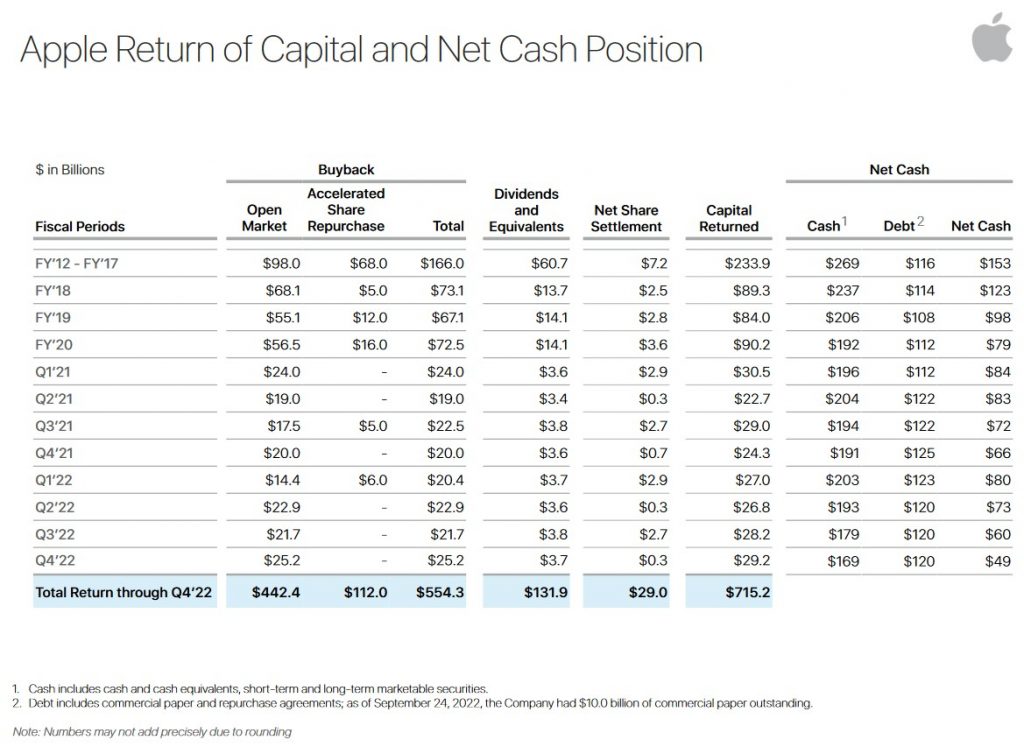

The following table reflects AAPL’s Return of Capital and Net Cash Position over the years.

Dividends and Dividend Yield

AAPL’s dividend history is accessible here.

Investors can expect AAPL to announce 1 more $0.23 quarterly dividend toward the end of January for distribution in early February 2023. Using AAPL’s current ~$131.40 share price, the dividend yield is ~0.7%.

I anticipate AAPL will announce an increase in its quarterly dividend to $0.24 toward the end of April.

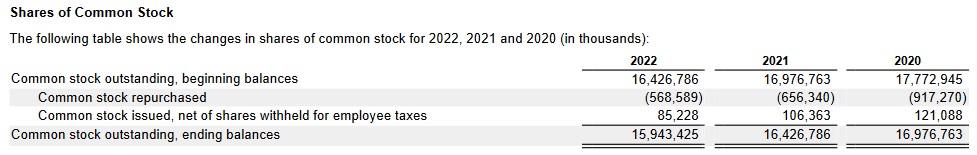

The weighted average number of shares outstanding (in billions rounded) is 26, 24, 23, 22, 21, 20, 19, 18, 17, and 16 in FY2013 – FY2022.

During FY2022, AAPL repurchased ~569 million shares of its common stock for $90.2B under a share repurchase program authorized by the Board. The program does not obligate AAPL to acquire a minimum amount of shares.

Valuation

In FY2014 – FY2018, AAPL generated diluted EPS of $6.45, $9.22, $8.31, $9.21, and $11.91. Its annual PE in the FY2009 – 2018 timeframe was 20.6, 18.0, 14.6, 12.1, 14.1, 17.1, 11.4, 13.9, 18.4, and 13.2.

At the time of my January 4, 2019 post, I thought that until the US/China trade dispute was resolved, AAPL was highly unlikely to generate results similar to recent years. I, therefore, estimated that AAPL would generate $9.00 of EPS in FY2019; the subsequent 4:1 stock split reduces this to $2.25. This estimate was well off the mark as AAPL generated EPS of $2.97 in FY2019.

In FY2020 – FY2022, AAPL generated $3.28, $5.61, and $6.11. Its average PE during this timeframe was ~40.45, ~31.65, and ~22.17.

Using the current ~$131.40 share price and adjusted diluted EPS guidance from the brokers which cover AAPL, the following are the FY2023 forward adjusted diluted PE levels.

- FY2023 – 38 brokers – mean of $6.20 and low/high of $5.40 – $6.87. Using the mean estimate, the forward adjusted diluted PE is ~21.

- FY2024 – 34 brokers – mean of $6.77 and low/high of $6.01 – $7.36. Using the mean estimate, the forward adjusted diluted PE is ~19.4.

- FY2025 – 12 brokers – mean of $7.10 and low/high of $6.44 – $7.82. Using the mean estimate, the forward adjusted diluted PE is ~18.5.

There is a wide variance in broker estimates. Given that the FY2023 and FY2024 mean earnings estimates are based on input from more than 30+ brokers, I consider them to be a reasonable expectation of how AAPL is likely to perform over the next 2 fiscal years. I place no reliance on earnings estimates beyond the next 2 fiscal years.

Final Thoughts

Following a 4:1 stock split in August 2020 I ended up with 1200 shares at an average cost of ~$36. In March 2021, I transferred these shares from one account to another for tax planning reasons. This triggered a capital gain and increased my average cost. Following the automatic reinvestment of dividend income, there are now 1214 shares in a ‘Side’ account within the FFJ Portfolio at an average cost of ~$123.50.

On just about every earnings call I have listened to in the past several weeks, senior management expresses caution about 2023. Given this, investors would be wise to dial back risk. In AAPL, we have an exceptionally strong company that is currently fairly valued. I have, therefore, established a 100-share position @ ~$130.98 in one of the ‘Core’ accounts within the FFJ Portfolio.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long AAPL.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.