Genuine Parts Company (GPC) has increased its dividend for 63 consecutive years. This article looks at valuation based on FY2018 results and FY2019 guidance.

Summary

- GPC has just released Q4 and FY2018 results, provided FY2019 guidance, and has increased its dividend for the 63rd consecutive year.

- GPC failed in its efforts to extricate itself from the underperforming Business Products Group.

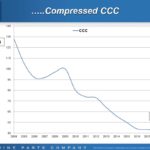

- Strong Free Cash Flow generator a dramatic improvement in the cash conversion cycle (~133 days in 2004 reduced to ~47 days in 2018).

- Shareholder friendly company.

- When compared to current other top 30 holdings I am unlikely to increase my GPC exposure other than through the automatic reinvestment of dividends.

- Valuation appears to be rich at current level.

Introduction

I initiated a 300 share position in Genuine Parts Company (GPC) on July 24, 2017 for the FFJ Portfolio and have subsequently been reinvesting all dividends.

GPC is currently not within my top 30 holdings and is unlikely to enter that group but I nevertheless view it as a long-term investment.

In my April 19, 2018 article I wrote that the ~18% pullback in the stock price subsequent to its late January 2018 high should be viewed as an opportunity to acquire shares in this company at a more reasonable valuation.

When I wrote my July 20, 2018 article, I no longer viewed GPC as being as attractive as 3 months prior. I was, however, of the opinion that shares were still reasonably valued based on the company’s growth opportunities.

At the time of that July article, management indicated it was still continuing to work toward the closing of its definitive agreement to merge S.P. Richards with Essendant. Following GPC’s announcement, however, Staples (owned by Sycamore Partners) stepped into the picture with an offer of its own for Essendant shareholder consideration.

Long story short, an affiliate of Sycamore Partners acquired Essendant. Staples, a Sycamore portfolio company and the world’s largest workplace solutions provider, will work together with Essendant to give reseller customers access to an expanded product assortment, innovative technology and world-class supply chain capabilities and support. Essendant and Staples’ sales teams will continue to operate separately.

So here we are, roughly 10 months following GPC’s April 12, 2018 Press Release and GPC is still stuck with S. P. Richards. In my opinion, S. P. Richards adds little value to GPC and I certainly hope it can be spun off sooner rather than later.

Despite GPC’s lack of success in spinning off S.P. Richards, GPC has been active on the acquisition front having announced various bolt-on acquisitions in 2018 and 2019 to expand its Automotive and Industrial segments.

Investor Presentations to accompany GPC’s Quarterly and Annual Earnings Releases are rare. Nevertheless, GPC has an informative Investor Presentation (not dated) found on its website which provides investors with a good overview of the company; the current presentation was prepared before GPC discontinued its pursuit of Essendant late 2018 and before acquisitions made by GPC in late 2018 and early 2019.

As you can see from the following image extracted from GPC’s Investor Presentation, the company is a serial acquirer.

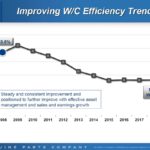

I pay close attention to the level of efficiency a company demonstrates when it comes to its working capital.

Note from the following images that GPC has made a considerable improvement over the past several years in how it manages its working capital; working capital efficiency appears to have improved to the extent where further improvement might be difficult. This perhaps explains why the efficiency ratio has hit a plateau at a low level.

We also see that GPC has shortened its Days Inventory Outstanding and that Days Sales Outstanding has just risen slightly. Its Days Payables Outstanding, however, has skyrocketed from 39 days in 2004 to 104 days in 2018.

The following image shows how the cash conversion cycle has dropped from 133 days in 2004 to 47 days in 2018. This either means GPC is doing a great job now or was doing a terrible job back in 2004. Perhaps a combination of the two?

Investors should also pay very close attention to a company’s Free Cash Flow (FCF) because FCF allows a company to pursue opportunities that enhance shareholder value. In addition, FCF is more difficult to manipulate than net income.

Source: GPC Investor Presentation

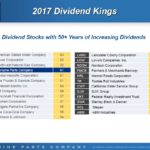

I fully recognize many investors will be attracted to GPC because of its track record of having increased its dividend for 63 consecutive years; on February 19, 2019 it announced a ~6% increase in its dividend ($2.88/share increased to $3.05/share).

A great many investors are probably currently acquiring GPC shares primarily based on GPC being part of the exclusive ‘Dividend King’ group of companies (50+ years of consecutive dividend increases).

I don’t mind investing in a company with such a track record but at the same time I, like you, want to ensure shares are fairly valued when I acquire them. Having said this, GPC’s share price has been on a tear following the late December broad North American market pullback.

Q4 and FY2018 Financial Results

GPC’s February 19, 2019 Earnings Release can be found here.

Global Automotive Group

US

Solid Q4 and FY2018 results with the Q4 sales increase driven by commercial and retail customer growth; the commercial segment represents 75% – 80% of total U.S. Automotive sales.

Canada

Continue to benefit from creative tuck in acquisitions which have expanded Canadian presence.

Mexico

GPC has operated for the last several years under the legacy Autototo business model and NAPA Mexico. The long-term strategy has been to move to one banner in Mexico and the Autototo business will no longer be under the GPC banner effective March 1, 2019; Autototo represents ~$0.1B in annual automotive revenues and is not a significant contributor to GPC’s overall profitability.

Europe

In November 2018, GPC celebrated the one-year anniversary of the AAG acquisition.

Solid Q4 and FY2018 results were turned in despite unusually mild weather in many regions of Europe during Q4 as well as the continued political unrest in France and ongoing Brexit concerns in the UK.

GPC sees additional opportunities for acquisitions in Europe. In fact, GPC started FY2019 with the closing of the Hennig Group acquisition on January 8. This is one of Germany’s leading suppliers of vehicle parts with 31 branches across Germany and estimated annual revenues are $0.19B.

Australia and New Zealand

Another strong year and this is expected to continue in 2019.

The economic growth in Australia is fairly robust. The favorable economy and sound aftermarket fundamentals combined with the ongoing execution of GPC’s growth plans bode well for the continued growth of GPC’s Australasian automotive business.

Industrial Parts Group

In Q4, 14 of GPC’s major product groups posted sales gains with especially strong results and safety products and industrial supplies, hose, pumps and pneumatics. Sales to 10 of the Top 12 industries served were up with double digit increases reported in the iron and steel, chemicals and allied products, oil and gas extraction and rubber and plastic industries.

Growth initiatives include ongoing strategic acquisitions. The most recent acquisition (Axis New England) was very recently announced and is expected to close in March. This is a leading automation and robotics business which further expands GPC’s capabilities in the area of Industrial plant floor automation.

In addition to future growth prospects in North America, GPC is planning to expand its industrial footprint into Australasia in 2019 with the full purchase of Inenco to be completed in 2019; GPC originally made a 35% investment in Inenco in 2017 and annual sales are ~$0.4B.

This Australian based distribution company has operations in New Zealand as well as the growing presence in Indonesia and Singapore.

Business Products Group

S.P. Richards reported the 3rd consecutive quarter of sequential sales improvement in Q4. Sales were up in 3 of 4 product categories for the second straight quarter.

S.P. Richards represents the only independent national business products wholesaler in the U.S. and GPC has indicated it will continue to invest in this business where and when appropriate.

Overall

In Q4, all 3 segments earned additional supplier incentives due to improved volumes.

There continues to be emphasis on margin initiatives and GPC expects 2019 gross margin rates to remain relatively in line with FY2018.

GPC has experienced an inflationary pricing environment across each segment with more normal inflation in the industrial and business products and more pronounced inflation in the automotive segment.

The impact of tariffs was not significant in 2018 but, nevertheless, GPC passed on the supplier increases to its customers to maintain its growth margin. This is expected to continue in 2019.

Increased investments in facilities and people in FY2018 as well as rising costs in areas such as payroll, freight, delivery IT, cyber security impacted operations.

In order to improve on operating expenses, GPC is continuing to work toward a lower cost infrastructure. Plans include steps to accelerate the integration of acquisitions, investments to enhance productivity and supply chains, and strategies to unlock greater savings and efficiencies across the global operations.

Receivable quality remains strong and the GPC team is tightly managing inventory levels.

Management is comfortable with total debt of $3.1B as at FYE2018.

$1.1B in cash was generated from operations in 2018 – up 41% from 2017.

Free cash flow, which excludes capital expenditures and the dividend, improved to ~$0.5B from $0.263B in 2017.

FY2019 Guidance

GPC has a cautiously optimistic outlook for 2019 in that there is the potential for an economic slowdown and a slowing industrial economy in the second half of 2019. It also anticipates a more challenging sales environment in Europe in 2019.

FY2019 forecast is for $1.1B – $1.2B in cash from operations.

Free cash flow in the $0.4B range is targeted.

Guidance for diluted EPS is $5.75 – $5.90, or an adjusted EPS of $5.81 – $5.96 before the impact of the 1% currency headwind.

A tax rate of ~25.0% is expected in 2019.

GPC’s key priorities for cash remain the re-investment in the businesses, share repurchases, strategic acquisitions, and dividend increases.

Credit Ratings

GPC’s debt is not rated by the ratings agencies.

Valuation

When I initiated a position in GPC on July 24, 2017, management had just indicated on its Q2 2017 conference call with analysts that full year adjusted EPS outlook was being revised downward to $4.70 – $4.75 from its previous guidance of $4.75 – $4.85.

At the time, GPC was trading at $82.71. I erred on the side of caution and used $4.70 to arrive at a forward adjusted PE 17.60. FY2018 guidance called for adjusted EPS of ~$5.15 thus giving me a forward adjusted PE of 16.07; actual FY2018 adjusted EPS came in at $4.71/share.

When I wrote my April 19th article, GPC was trading at ~$88.15. Based on management’s $5.60 – $5.75 FY2018 adjusted diluted EPS projection, GPC’s forward adjusted PE range was ~15.3 – ~15.74.

Fast forward to my July 20, 2018 article and GPC’s stock had risen to ~$98. With no change to adjusted diluted EPS guidance we arrived at a forward adjusted PE range of ~17 – ~17.5.

We now see that GPC generated $5.50 in diluted EPS and $5.68 in adjusted diluted EPS in FY2018. Shares are trading at ~$109 thus giving us a diluted PE of ~19.82 and an adjusted diluted PE of ~19.2.

FY2019 guidance now calls for diluted EPS of $5.75 – $5.90 ($5.825 mid-point) or an adjusted $5.81 – $5.96 ($5.885 mid-point). Using the current ~$109 share price and the mid-points we arrive at a forward diluted PE of ~18.71 and forward adjusted diluted PE of ~18.52.

Dividend, Dividend Yield, and Dividend Payout

GPC’s dividend history can be found here and its stock split history can be found here. I also indicated earlier that on February 19, 2019 a ~6% increase was announced giving us a new annual dividend of $3.05/share.

With GPC now trading at ~$109, the forward dividend yield is ~2.8% versus ~3.26% at the time of my April 19, 2018 article and ~2.9% at the time of my July 20, 2018 article.

The dividend payout ratio now stands at ~55.5% (new $3.05 annual dividend and FY2018 diluted EPS of $5.50).

On the basis of projected diluted EPS of $5.825 the new $3.05 dividend is a ~52.4% dividend payout ratio. I view this level as acceptable and am encouraged to see a slight reduction in this ratio from that reported in each of the past 3 years.

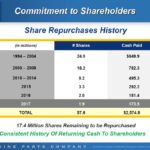

Share Repurchases

GPC repurchased ~1 million GPC shares in 2018. There is currently 16.4 million shares authorized and available for repurchase.

No set pattern for share repurchases has been set but GPC expects to be active in the program over the long term since management continues to believe GPC’s stock is an attractive investment and when combined with the dividend, provides the best return to shareholders.

The Weighted average common shares outstanding as at FYE2017 and FYE2018 amounted to 147,701 million and 147,241 million.

Option Strategy

I view GPC shares as somewhat expensive. Given this I have looked into writing covered call contracts on my GPC holding. I prefer to write short-term contracts and since GPC will be issuing its Q1 earnings right around the May 17, 2019 contract expiry date I would prefer to write contracts which expire in April 2019.

I do not want to part with my GPC shares so am looking at out of the money covered calls. I have looked at $155 April 18, 2019 covered calls contracts which would generate $0.85/share. I hold just over 300 shares meaning I would only generate $255 before commission. I do not intend to initiate this trade for so little potential reward.

Final Thoughts

I am reluctant to acquire additional GPC shares at current levels. I would be open to acquiring additional shares at ~$100 which, on the basis of the FY2019 mid-pint EPS guidance of $5.825, gives us a forward diluted PE of ~17.2.

At~$100, investor would be getting a forward dividend yield of ~3.05%. This is not as attractive as when I wrote my April 19, 2018 article but is certainly better than the current ~2.8% forward dividend yield.

I view GPC as being well managed and expect it will continue to generate strong and steady cash flow which should enable it to reward shareholders through:

- Reinvestment

- Acquisitions

- Dividends

- Share repurchases

Having said this, I don’t know if GPC will ever crack our top 30 holdings. While it is a great company I look at our other holdings and am far more likely to increase our investment in the likes of Visa (V), Mastercard (MA), the Brookfield companies, etc.. I view those companies as having the ability to generate superior long-term returns.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long GPC.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.