Summary

- ADP released its Q2 2018 results January 31, 2018 making further positive revisions to its FY2018 Outlook.

- While ADP’s forecasts for FY2018 keep being revised upward, the stock price has risen significantly in recent months. This has resulted in ADP being even more overvalued than when I last analyzed the company in August 2017.

Introduction

On August 11, 2018 I analyzed Automatic Data Processing’s (NASDAQ: ADP) FY2017 results and guidance for fiscal 2018 which were released July 27, 2018. On January 31, 2018, ADP released its Q2 2018 results and provided guidance for the remainder of fiscal 2018.

In this post I compare ADP’s forecast presented in July 2017 and November 2017 with current projections and provide my opinion as to whether ADP’s current valuation presents a buying opportunity or not.

Q2 2018 and 6 Month Results

ADP’s Q2 2018 and 6 month results for fiscal 2018 can be found here.

Source: 2Q Fiscal 2018 ADP Earnings Call & Webcast presentation – January 31, 2018

Client Funds Portfolio Extended Investment Strategy

The purpose of ADP’s Client Funds Portfolio Extended Investment Strategy is to generate income from the significant client fund balances. When deemed prudent, ADP will further enhance its investment returns by investing long and borrowing short to take advantage of the yield spread.

At the time of my August 11, 2018 post, ADP projected it would generate the following from its Client Funds Portfolio Extended Investment Strategy.

Source: Fiscal 2017 ADP Earnings Call & Webcast presentation – July 27, 2017

Source: Fiscal 2017 ADP Earnings Call & Webcast presentation – July 27, 2017

When ADP released its Q1 results, it revised these estimates upward.

Source: 1Q Fiscal 2018 ADP Earnings Call & Webcast presentation – November 2, 2017

Source: 1Q Fiscal 2018 ADP Earnings Call & Webcast presentation – November 2, 2017

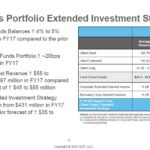

The estimates have now been, once again, revised upward.

Source: 2Q Fiscal 2018 ADP Earnings Call & Webcast presentation – January 31, 2018

Fiscal 2018 Outlook

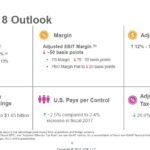

On July 27, 2017, ADP released the following outlook for FY2018.

Source: Fiscal 2017 ADP Earnings Call & Webcast presentation – July 27, 2017

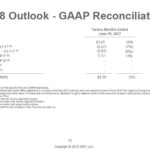

On November 2, 2017, ADP made the following revisions.

Source: 1Q Fiscal 2018 ADP Earnings Call & Webcast presentation – November 2, 2017

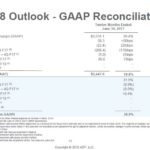

The November 2, 2017 outlook has now been revised.

Source: 2Q Fiscal 2018 ADP Earnings Call & Webcast presentation – January 31, 2018

Dividend, Dividend Yield, Dividend Payout Ratio, and Share Repurchases

ADP’s dividend history can be found here. With a $2.52 forward annual dividend and a stock price of $123.63 as of the close of business January 31, 2018, ADP’s dividend yield is ~2.00%.

When I wrote my August 11, 2017 post, ADP’s annual dividend was $2.28 and the stock was trading at $109.66 resulting in a ~2.01% dividend yield.

In August 2017, $3.82 was the projected adjusted diluted EPS from continuing operations for FY2018. On this basis the $2.28 dividend represented a ~60% dividend payout ratio. Now that the adjusted diluted EPS has been revised upward to ~$4.16 and the annual dividend is $2.52, the dividend payout ratio is ~60.5%.

ADP’s diluted weighted average shares outstanding (in millions) as at June 30, 2013 – 2017 amounted to 487.1, 483.1, 475.8, 459.1, and 450.3. The diluted weighted average shares outstanding (in millions) for the 3 months ending December 31, 2017 amounted to 444.4 million.

Valuation

At the time of my August 10, 2017 post, ADP had recently reported $3.70 in adjusted diluted EPS from continuing operations (Non- GAAP) for fiscal 2017 and was projecting growth in the 2 % – 4% range (see Fiscal 2018 Outlook section above).

On that basis, I used $3.82 as my projected adjusted diluted EPS from continuing operations for FY2018 and the August 9th closing stock price of $109.66. This gave me a forward adjusted diluted PE of 28.7. Based on this I was of the opinion ADP was overpriced.

ADP has now revised its projections (see Fiscal 2018 Outlook section above) to reflect a higher growth rate in its adjusted diluted EPS for FY2018. A gain of 8-9% gain in EPS and a gain of 12% – 13% in adjusted diluted EPS (non-GAAP) is now forecast; this increase reflects the ongoing estimated benefits from tax reform. As opposed to the previous adjusted diluted EPS figure of $3.82, ADP is now expecting ~$4.16.

Using the closing stock price of $123.63 as at January 31, 2018, we now get a forward adjusted diluted PE of 29.72. In essence, ADP is even more expense than it was at the time of my August 2017 post.

ADP’s stock price has jumped ~12.4% since the most recent low of ~$110 late November 2017. Even if ADP’s stock price were to retrace to $110, the forward adjusted diluted PE would be ~26.5. That level is a bit rich but depending upon the circumstances I might be willing to pay up to acquire more shares in this wonderful company at the $110 level.

Final Thoughts

I have held ADP shares for well over a decade outside the FFJ Portfolio and have been pleased with its performance because I did not acquire shares at a lofty valuation.

I would be happy to acquire more ADP shares but my concern at this stage is with what I perceive to be an ‘overvaluation’. Given this I will patiently wait for a pullback to $110 or below before entertaining the thought of adding more ADP shares to our holdings.

Note: Thanks for reading this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long ADP.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.