Summary

Summary

- As a long-term Broadridge investor I am pleased with its FY2017 results and optimistic it will meet its FY2018 projections. Both were released August 10, 2017.

- Broadridge continues to make bolt-on acquisitions to enhance its product/service offering with the Spence Johnson acquisition being the most recent.

- The repurchase of Issued and Outstanding shares and Dividend increase trends continue.

- BR’s shares are very rarely inexpensive but are currently reasonably valued if you use consensus adjusted EPS estimated for FY2018.

Introduction

This is a follow up to my February 9, 2017 and May 13, 2017 Broadridge Financial (NYSE: BR) posts.

Should you be unfamiliar with the company you may wish to go here to familiarize yourself with its service/product offerings.

BR is a company which flies under the radar. Its market cap is only ~$8.5B and it is not a name that makes the headlines. It does, however, provide services that are integral to publicly traded companies. For example, it handles millions of trades a day involving trillions of dollars. It also provides support communications that reach 75% of North American households and it manages shareholder voting in 90 countries.

BR continues to expand its service offering by making tuck-in acquisitions. An example of this is its July 2017 acquisition of Spence Johnson Limited (“Spence Johnson”) which is a leading provider of global institutional data and intelligence to the asset management industry.

BR continues to expand its service offering by making tuck-in acquisitions. An example of this is its July 2017 acquisition of Spence Johnson Limited (“Spence Johnson”) which is a leading provider of global institutional data and intelligence to the asset management industry.

This acquisition is another example of what BR President and CEO (Richard Daly) means about focusing on “bite sized” enhancements to its product/service offering versus the development of products and services.

While BR is presented with roughly 10 acquisition opportunities per year, only 1 or 2 may meet BR’s stringent acquisition criteria:

- The target company must be a strategic fit;

- BR must be confident it will be a better owner of the asset being acquired than the current owner;

- Every acquisition must be able to meet a minimum return “bar”.

Clearly, Spence Johnson met these hurdles.

FY2017 Results

On August 10, 2017, BR released its FY2017 results and forecast for FY2018 which can be found here.

Highlights of FY2017 are as follows.

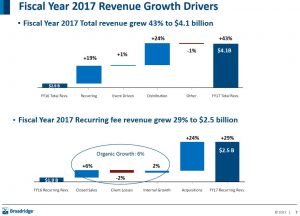

You can see recurring fee revenue grew substantially this past fiscal year.

You can see recurring fee revenue grew substantially this past fiscal year.

This is a good sign in that it means clients are pleased with BR’s services and service levels. In addition, it is also much less costly to upsell and to service existing clients than it is to acquire new clients. While BR needs new clients, it definitely makes it much easier to manage a business when you know that a substantial portion of your revenue is reasonably certain to materialize.

This is a good sign in that it means clients are pleased with BR’s services and service levels. In addition, it is also much less costly to upsell and to service existing clients than it is to acquire new clients. While BR needs new clients, it definitely makes it much easier to manage a business when you know that a substantial portion of your revenue is reasonably certain to materialize.

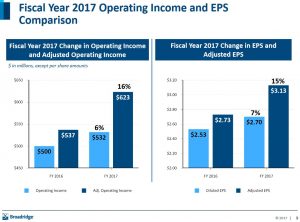

Fiscal Year 2017 Operating Income and EPS on a diluted and on an adjusted basis grew nicely this past fiscal year.

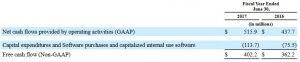

FCF levels in 2012 – 2016 were $0.244B, $0.22B, $0.334B, $0.365B, and $0.362B. In FY2017, FCF amounted to $0.4B which ended up being at the upper end of guidance.

FCF levels in 2012 – 2016 were $0.244B, $0.22B, $0.334B, $0.365B, and $0.362B. In FY2017, FCF amounted to $0.4B which ended up being at the upper end of guidance.

The drawback I see is that BR’s long-term debt has increased dramatically in the last few years as a result of its string of acquisitions and repurchase of its shares. On a positive note, none of the long-term debt is due within the next 12 months. Another positive is that interest rates on the debt taken on in recent years is lower than that on the debt incurred within the first few years of being a stand-alone entity.

The drawback I see is that BR’s long-term debt has increased dramatically in the last few years as a result of its string of acquisitions and repurchase of its shares. On a positive note, none of the long-term debt is due within the next 12 months. Another positive is that interest rates on the debt taken on in recent years is lower than that on the debt incurred within the first few years of being a stand-alone entity.

- As at fiscal YE 2102 (page 25 of 100), LTD was $524MM, Treasury Shares was $580MM, and Goodwill and Intangible Assets was $923MM.

- As at March 31, 2017, LTD was $1.142B, Treasury Shares was $1.292B, and Goodwill and Intangible Assets was $1.645B.

- As at June 30, 2017, LTD was $1.102B, Treasury Shares was $1.399B, and Goodwill and Intangible Assets was $1.646B.

I am satisfied that BR has the wherewithal to meet its debt obligations and am comfortable with BR’s current debt levels.

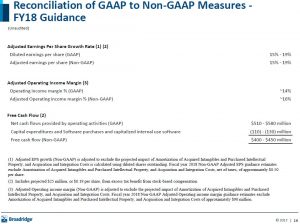

FY2018 Guidance

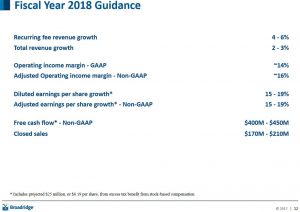

BR is projecting another steady year of growth and is calling for another “Broadridge type of year“.

Dividends

Dividends

As at the time I compose this post, the dividend history on the company’s website has not been updated subsequent to the December 14, 2015 record date; you will also note the payable date is incorrect in that it should reflect January 4, 2016 versus 2015. I very recently emailed the company requesting they update this section of the site but at the moment this information is stale dated.

Having said this, rest assured BR has increased its dividend from the $0.30 last reflected. It has been paying $0.33/quarter and on August 10, 2017 it was announced that the Board had approved an 11% increase in BR’s annual dividend to $1.46/share or $0.365/share/quarter. This means BR has raised its dividend every year since becoming a public company in 2007 and that FY2018 marks the 6th consecutive year of double digit percentage increase and the 10th consecutive increase in the annual dividend.

Valuation

BR closed at $72.28 on August 10, 2017. If I take the FY2017 adjusted EPS of $3.13 and use management’s 15% – 19% growth expectations for FY2018, the projected adjusted EPS range is $3.60 – $3.72. Using the mid-point of this range ($3.66) and today’s closing stock price, I get a forward PE of 19.75. This is a far cry from the current PE which is in the upper 20s.

Coincidentally, my $3.66 mid point is the current mean adjusted EPS estimate from 5 brokers and does not seem excessive to me given BR’s growth potential.

Broadridge Financial Solutions Stock Analysis – Final Thoughts

Broadridge Financial Solutions Stock Analysis – Final Thoughts

BR is a leader in its space and continues to make bolt-on acquisitions to expand the range of services it can offer clients. I perceive its success in retaining clients as a huge plus and am willing to pay up for the predictability of BR’s relatively stable growth in earnings.

In addition, I view BR as an attractive investment because it has a track record of increasing its annual dividend and it buys back more shares than what are issued by way of stock options. I am, in essence, being paid to be patient long-term investor; over the course of the FY2008 – FY 2017 period, BR’s share count has dropped from 141 million shares to 116.5 million shares.

I have owned BR shares outside the FFJ Portfolio from the time BR was spun-off from ADP in 2007. I have no intention of parting ways with these shares in the foreseeable future. In fact, I acquired additional shares subsequent to my May 13, 2017 post and intend to acquire a few additional BR shares within the next 72 hours.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this post. As always, please leave any feedback and questions you may have in the “Contact Me Here” section to the right.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long BR.

I wrote this article myself and it expresses my own opinions. I do not receive compensation nor do I have a business relationship with any company mentioned.