In this May 10, 2023 Agilent Technologies (A) post, I disclose the addition of this Diagnostic & Research company to the FFJ Portfolio to go along with my exposure to Danaher Corporation (DHR); DHR posts are accessible through the Archives section of this site.

I like the long-term outlook of the Diagnostic and Research industry. Therefore, on May 17 I added Thermo Fisher Scientific (TMO) to the FFJ Portfolio.

I last reviewed TMO in this March 20, 2021 post. In hindsight, I should have bought TMO shares when I wrote this post as shares were trading at ~$445.

TMO’s valuation based on forward adjusted diluted earnings is now marginally better than in March 2021. My recent purchase, however, was at ~$515/share. For roughly the same amount I paid to acquire 52 shares, I could have purchased 60 shares in March 2021.

Business Overview

When I wrote my prior post, the FY2020 Annual Report was the most current available. The FY2022 Annual Report and Form 10-K are now available; I recommend reading Part 1, Item 1 to gain a good understanding of the business.

The Corporate Overview on the company’s website also provides a very high-level overview of TMO’s FY2022 Revenue Profile; it generated ~$44.9B in FY2022 revenue.

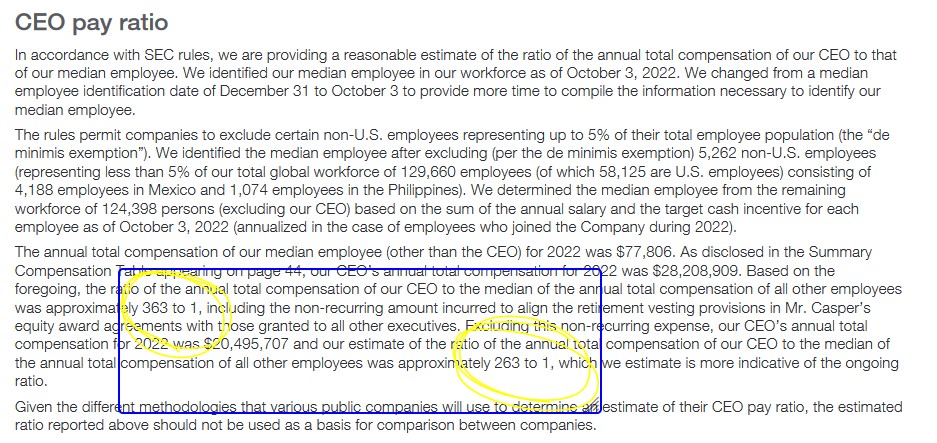

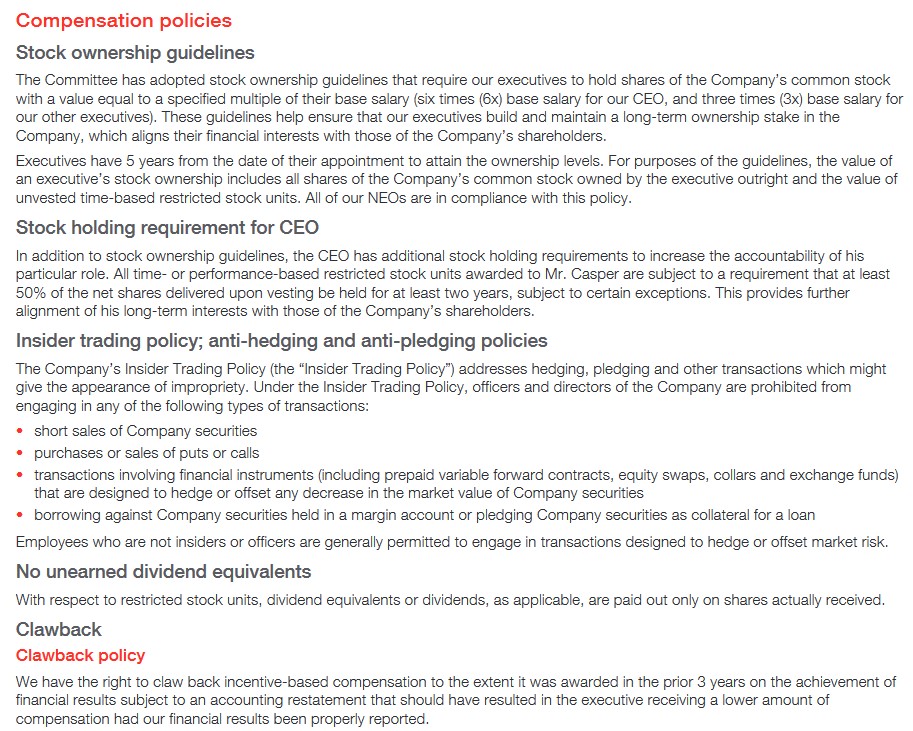

CEO and NEO Compensation

I reference TMO’s 2023 Proxy Statement which includes an explanation of TMO’s CEO and Named Executive Officers (NEO) compensation.

I think CEOs and NEOs are often obscenely compensated relative to all other employees. However, I own so few shares in the companies in which I have exposure that my shareholder votes are irrelevant. I must resign myself to being unable to effect any changes to the compensation structure of senior executives, and therefore, must determine if the compensation structures of CEOs and NEOs align with my long-term interests.

If the long-term incentive component makes up a large percentage of their compensation, I envision they will make decisions that align with my interests.

The following is from TMO’s 2023 Proxy Statement.

Based on my review of the CEO’s and NEOs’ compensation structures, it appears they are incentivized to position TMO to succeed over the very long term.

Financials

Q1 2023 Results

TMO’s Q1 2023 earnings release of April 26 is accessible here and the GAAP/Non-GAAP Reconciliation and Financial Package is accessible here.

The May 18, 2022 Investor Day presentation is also accessible here. However, TMO is hosting its 2023 Investor Day on May 24 at which time we can expect to receive more current information.

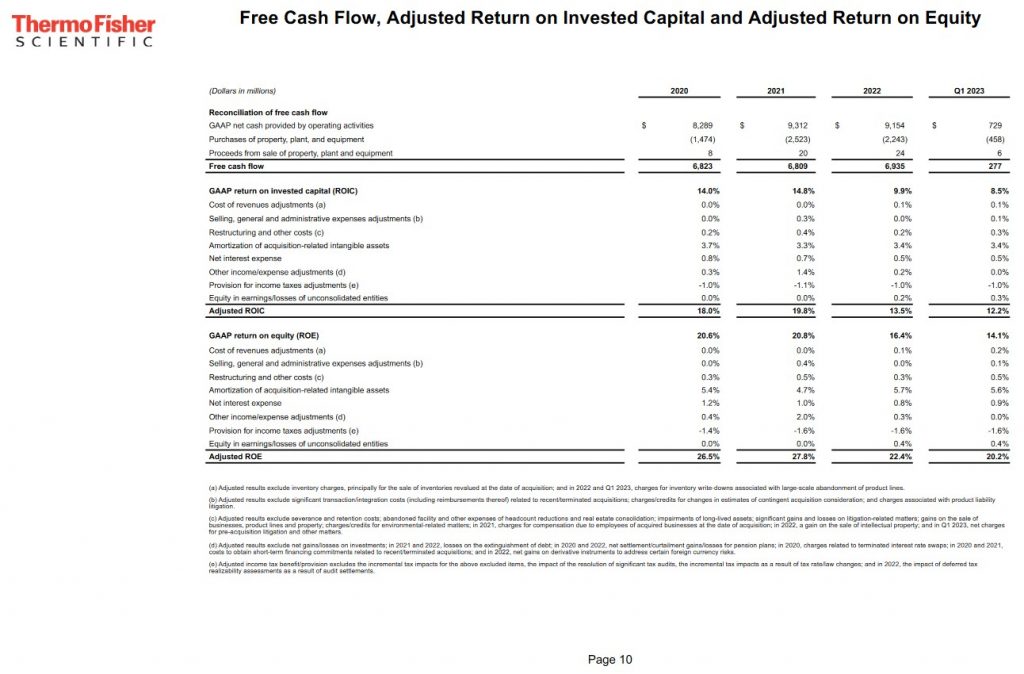

Free Cash Flow (FCF)

In FY2013 – FY2022, TMO generated FCF of (in millions of $): 1,728, 2,192, 2,519, 2,814, 3,497, 3,785, 4,047, 6,815, 6,789, and 6,911. In Q1 2023, it generated ~$271.

The numbers reflected below differ slightly from my FCF calculations because TMO adds the proceeds from the sale of property, plant, and equipment to determine FCF.

FY2023 Guidance

Investors need to remember that the financial performance of many companies in the Healthcare sector was artificially inflated by COVID-19-related income in FY2020, FY2021, and to a lesser extent in FY2022. It should not, therefore, be surprising to see that some companies anticipate FY2023 results to be weaker than in prior recent years.

TMO’s FY2023 guidance continues to consist of $45.3B of revenue, 7% core organic revenue growth, and adjusted EPS guidance of $23.70. While there is no net change overall in TMO’s guidance, the manner in which TMO expects to achieve this guidance differs from plans released at the beginning of FY2023.

TMO now expects $0.25 of additional headwinds to adjusted EPS of which $0.15 is from the business mix and $0.10 is from FX due to changes in rates and the expected mix of TMO’s currencies. These headwinds are to be offset by ~$0.20 through cost management and $0.05 through other actions.

Within the 7% core organic revenue growth, TMO expects $0.5B of vaccines and therapies revenue in 2023. This is $1.2B less than in FY2022. The majority of TMO’s vaccine and therapy revenue in 2023 is expected to be in the pharma services business.

TMO continues to assume ~$0.4B of testing revenue in 2023. The Binding Site Group acquisition in January 2023 is expected to contribute ~$0.25B to TMO’s reported revenue growth in FY2023; The Binding Site Group is a leading provider of oncology testing for the detection and monitoring of multiple myeloma.

Management’s FY2023 net interest expense projection is ~$0.48B.

FY2023 guidance is for CAPEX of ~$2B and ~$6.9B of FCF.

FY2023 adjusted operating margins are expected to be in the range of 23.8% – 23.9%.

The adjusted tax rate assumption has improved slightly from initial guidance and is now expected to be 10.8% for FY2023.

Management now expects a slightly higher weighting of revenue and adjusted EPS in the second half of FY2023. The current assumption is that the first half of the year represents ~48% of FY2023 revenue dollars and ~44% of FY2023 adjusted diluted EPS.

Credit Ratings

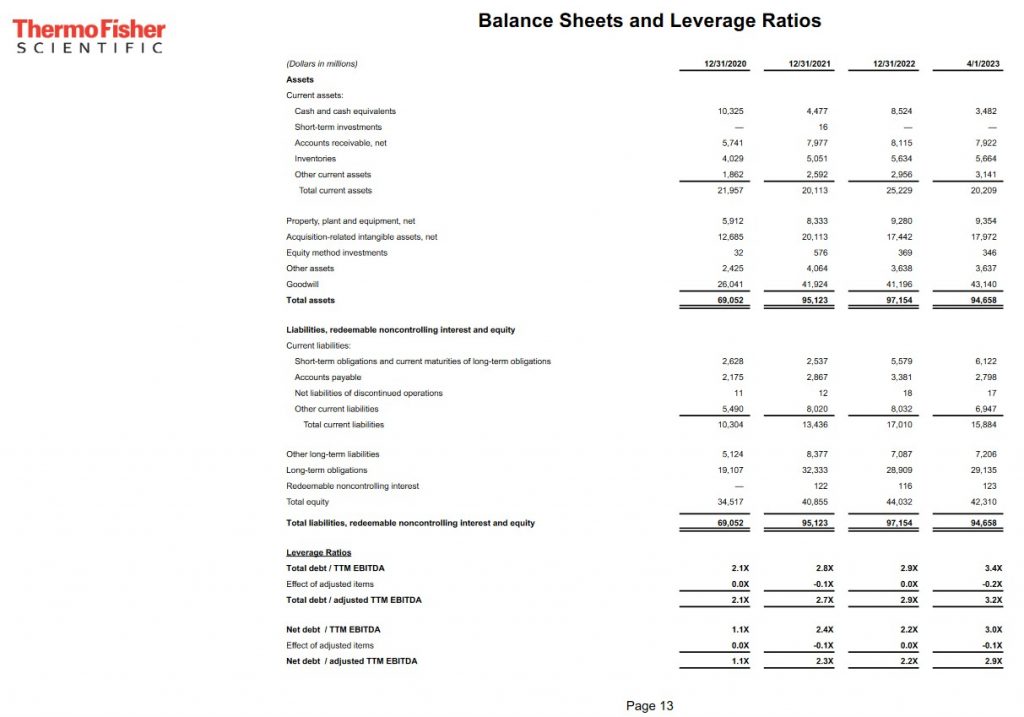

TMO’s Q1 2023 leverage ratios have deteriorated relative to recent fiscal year ends. However, Moody’s assigns an A3 rating to TMO’s domestic unsecured long-term debt. This rating was upgraded in January 2022 from Baa1.

In June 2022, S&P Global upgraded its BBB+ rating to A-.

Both ratings are the bottom tier of the upper medium grade investment grade category. They define TMO as having a strong capacity to meet its financial commitments. TMO, however, is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

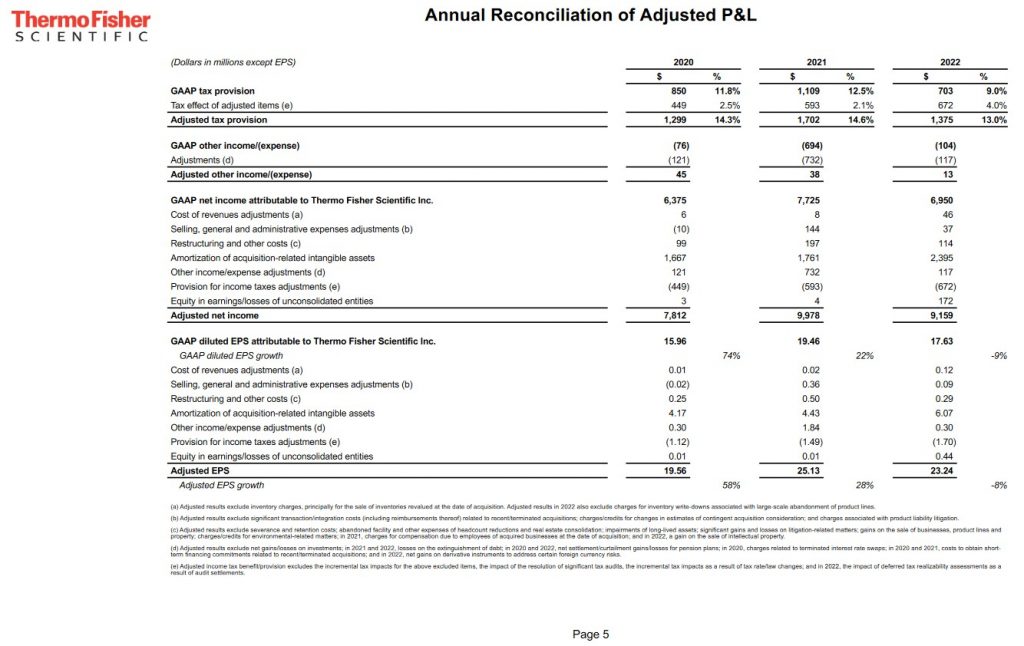

Source: TMO – GAAP/Non-GAAP Reconciliation and Financial Package – April 26, 2023

Source: TMO – GAAP/Non-GAAP Reconciliation and Financial Package – April 26, 2023

Source: TMO – GAAP/Non-GAAP Reconciliation and Financial Package – April 26, 2023

Fitch has not amended its rating since March 2021, when it upgraded TMO’s domestic unsecured long-term debt to BBB+ from BBB. This rating is the top tier of the lower medium-grade investment grade category. This rating defines TMO as having an adequate capacity to meet its financial commitments. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial obligations.

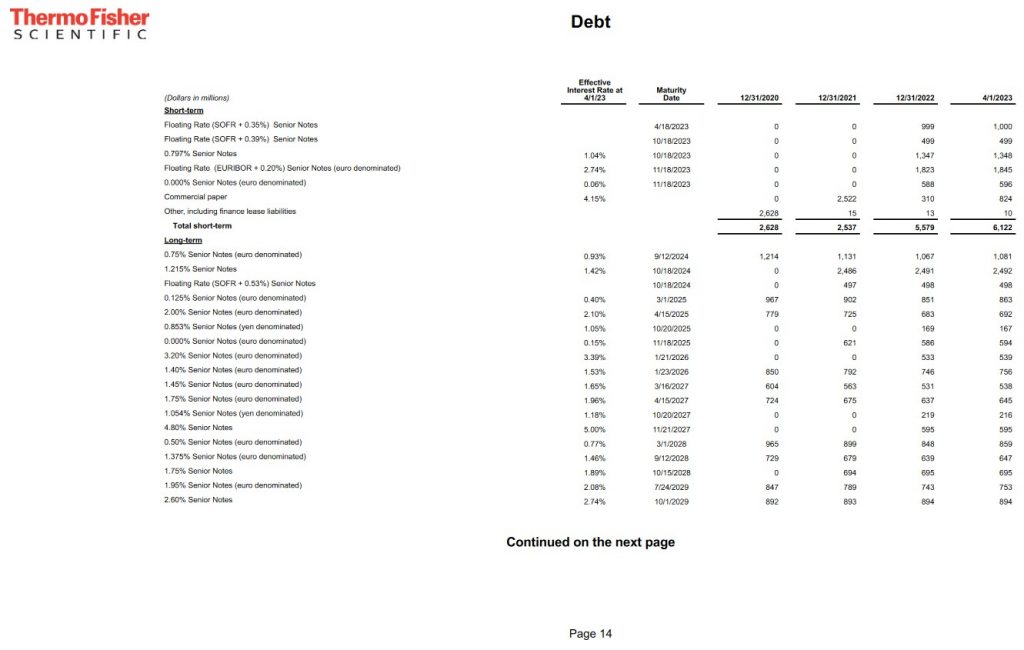

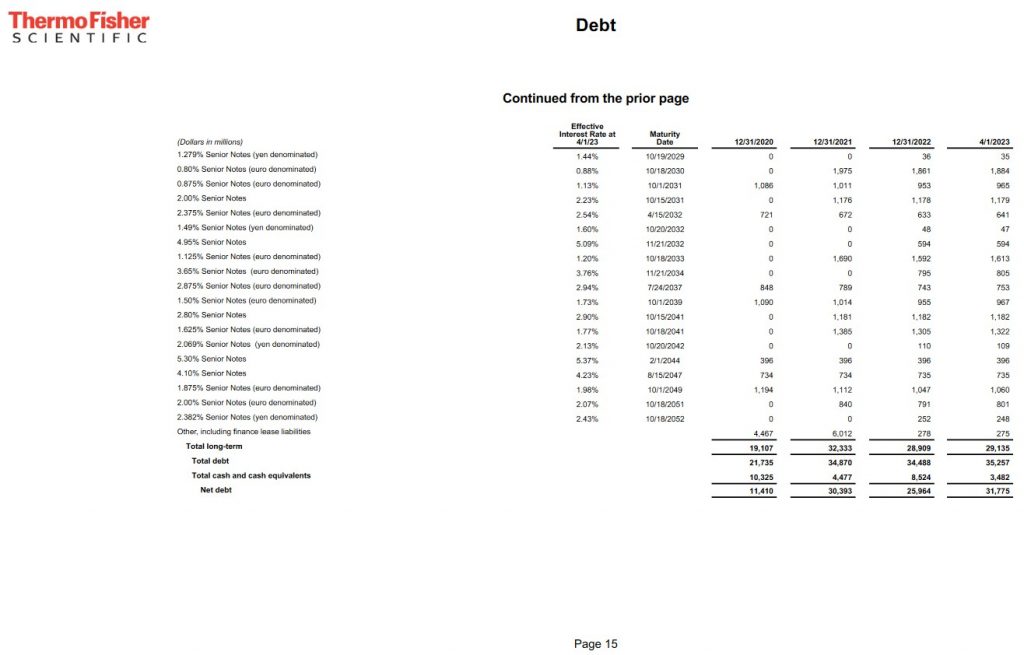

Note 7 within TMO’s Q1 2023 Form 10-Q reflects a schedule of the ‘Debt and Other Financing Arrangements’ (commences on page 13). The maturity of the various financing arrangements is well structured and the Senior Fixed Rate Notes are attractively priced.

Dividends, Share Repurchases, and Stock Splits

Dividend and Dividend Yield

TMO’s dividend history is accessible here.

The dividend yield is negligible considering the current quarterly dividend is $0.35/share and my recent purchase price is ~$515.

Despite this thin dividend yield, TMO’s FY2023 assumptions call for the return of ~$0.54B of capital to shareholders this year through dividends which is a 17% increase over 2022.

I envision the bulk of TMO’s future total investment return will continue to be predominantly in the form of capital appreciation.

Share Repurchases

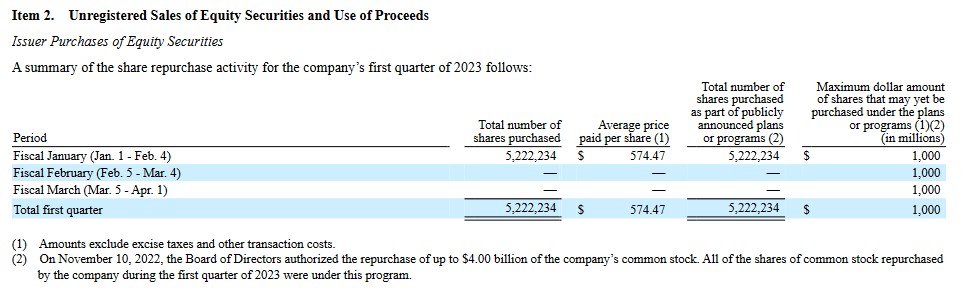

TMO repurchased ~$3B (5.222 million shares) of its common stock in Q1 2023. Management estimates the full-year average diluted share count will be ~388 million shares.

On November 10, 2022, TMO’s Board authorized the repurchase of up to $4B of the company’s common stock; all of the shares of common stock repurchased by TMO during Q1 2023 were under this program. On May 5, 2023, authorization remained for $1B of future repurchases of common stock.

Source: TMO – Q1 2023 Form 10-Q

Stock Splits

TMO had three 3 for 2 stock splits in the 1990s (1993, 1995, and 1996).

Valuation

In FY2013 – FY2022, TMO generated diluted EPS of $3.48, $4.71, $4.92, $5.09, $5.59, $7.24, $9.17, $15.96, $19.46, and $17.63 and its diluted PE levels were 30.67, 30.26, 28.83, 28.16, 32.24, 35.30, 36.54, 38.18, 30.98, and 30.96.

There is typically a wide variance between GAAP EPS and Adjusted EPS. Most of the variance is attributed to the amortization of acquisition-related intangible assets which is not surprising given the number of acquisitions TMO has made over the years.

Source: TMO – GAAP/Non-GAAP Reconciliation and Financial Package – April 26, 2023

While TMO only generated $3.32 in GAAP EPS and $5.03 in adjusted diluted EPS in Q1 2023, management’s FY2023 adjusted diluted EPS guidance is $23.70. Using my recent ~$515 purchase price, the forward-adjusted diluted PE is ~21.7.

The current forward-adjusted diluted broker estimates and valuation using my ~$515 purchase price are:

- FY2023 – 23 brokers – mean of $23.68 and low/high of $23.22 – $23.76. Using the mean estimate, the forward-adjusted diluted PE is ~21.8.

- FY2024 – 22 brokers – mean of $26.57 and low/high of $24.89 – $27.61. Using the mean estimate, the forward-adjusted diluted PE is ~19.4.

- FY2025 – 17 brokers – mean of $30.19 and low/high of $28.30 – $31.57. Using the mean estimate, the forward-adjusted diluted PE is ~17.

Final Thoughts

I like the long-term outlook of the Diagnostic and Research industry in the Healthcare sector and now have exposure through TMO, DHR, and A. Depending on their valuation, I intend to increase my exposure to these companies as funds permit.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long TMO, DHR, and A.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.