I last reviewed S&P Global (SPGI) in my November 3 post following the release of Q3 and YTD2023 results on November 2. Using the recently released Q4 and FY2023 results and FY2024 guidance, I remain of the opinion that wide moat S&P Global is too richly valued.

Business Overview

Until such time as the FY2023 Form 10-K becomes available, please read Part 1 – Item 1 – Business in the FY2022 Form 10-K.

Financials

Q4 and FY2024 Results

The quarterly earnings material released on February 8 is accessible here.

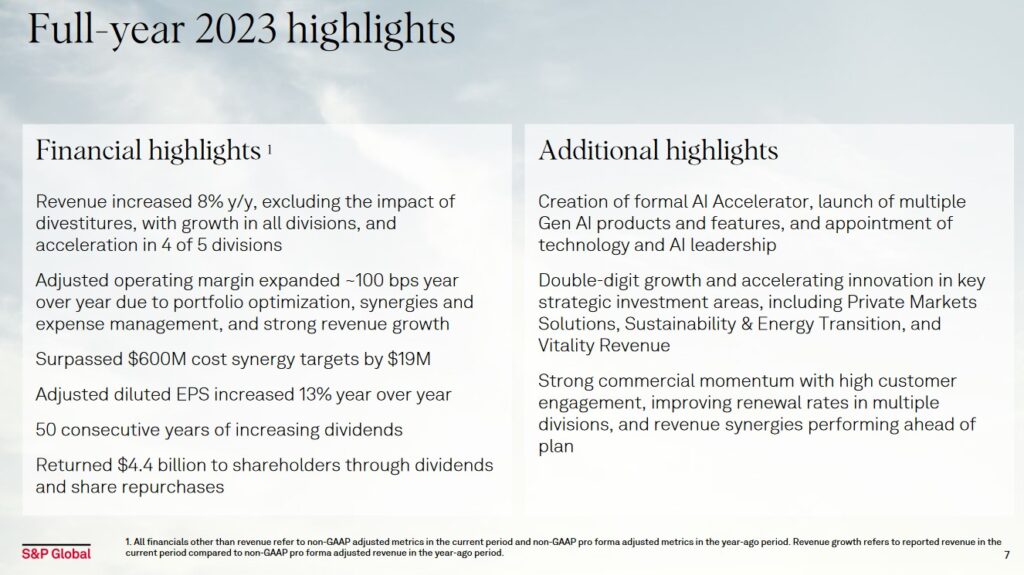

Source: SPGI Q4 Earnings Presentation – February 8 2024

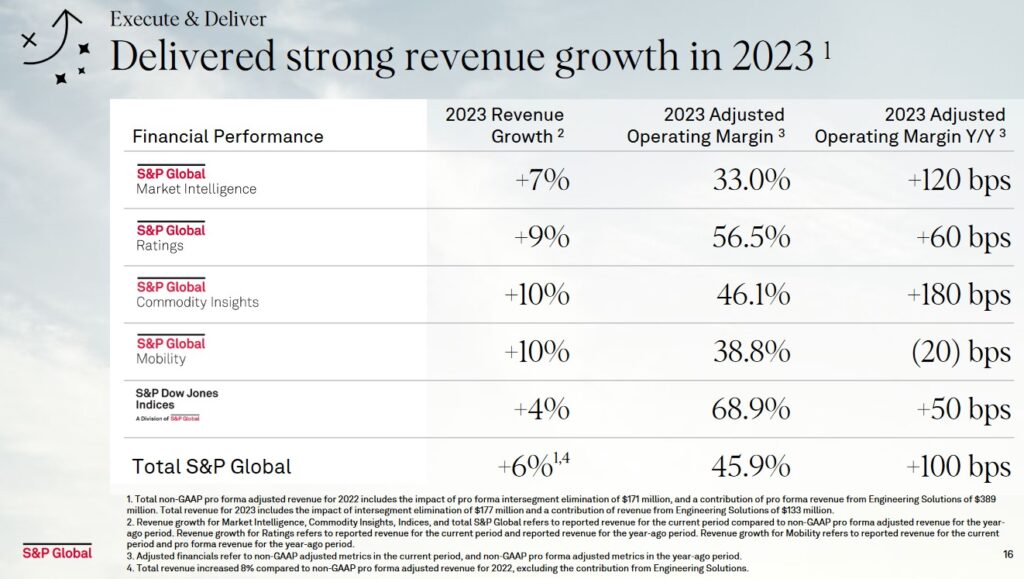

SPGI continues to experience a lengthening of the sales cycle which management believes is driven by customer sensitivity around spending. The firm’s cross-selling efforts are also creating larger contracts, which typically take longer to close.

In Q4, SPGI reported adjusted operating margin of 44.1%, down from 47.0% in Q3 with weakness reflected in each business segment.

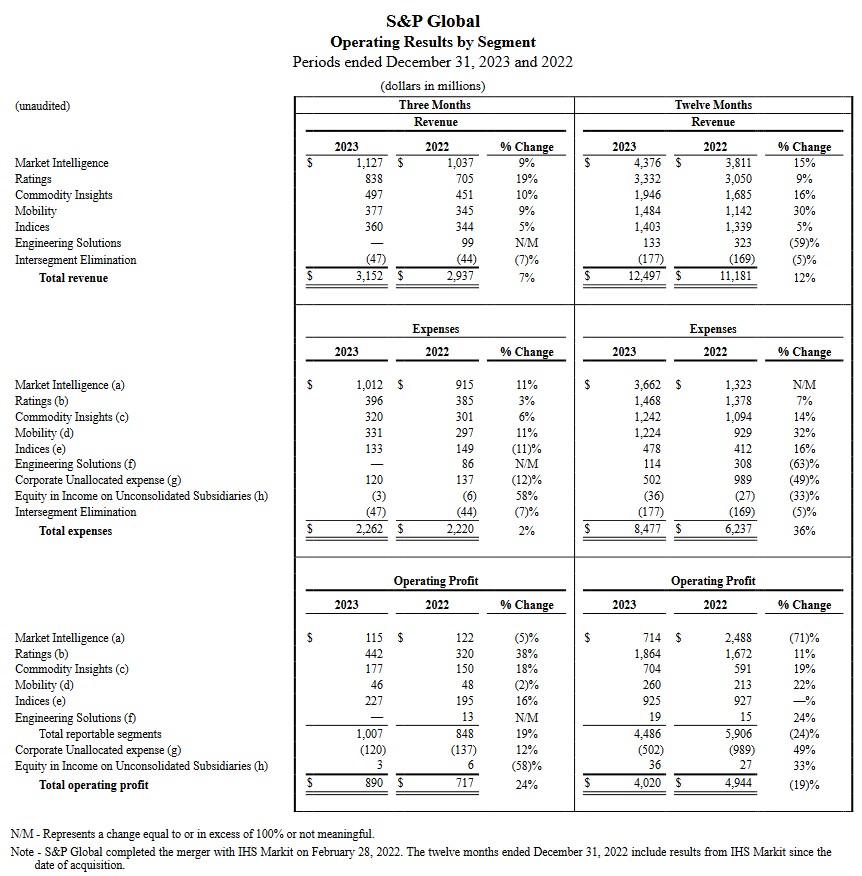

The ratings business is the firm’s largest operating profit driver. This business segment’s operating profit grew 11% in FY2023.

It grew 19% in Q4 thus enabling this segment to report 9% revenue growth.

Market intelligence, the largest segment by revenue, experienced a 15% increase revenue increase relative to FY2022. It, however, experienced higher cancellations from financial services clients amidst client budget constraints.

NOTE: The Engineering Solutions segment was sold in FY2023.

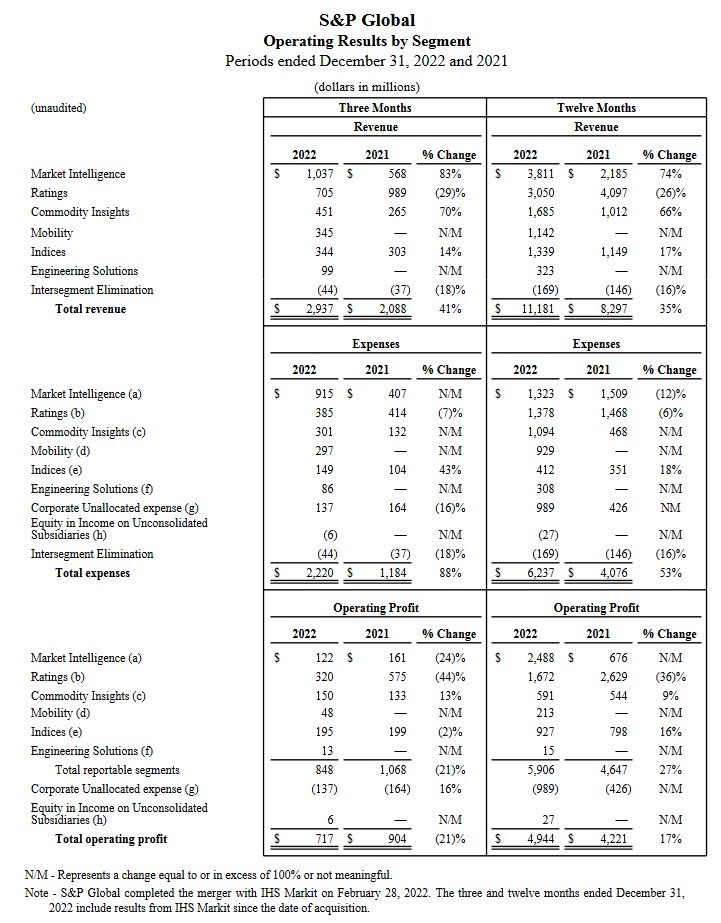

The following compares FY2021 and FY2022 operating segment results.

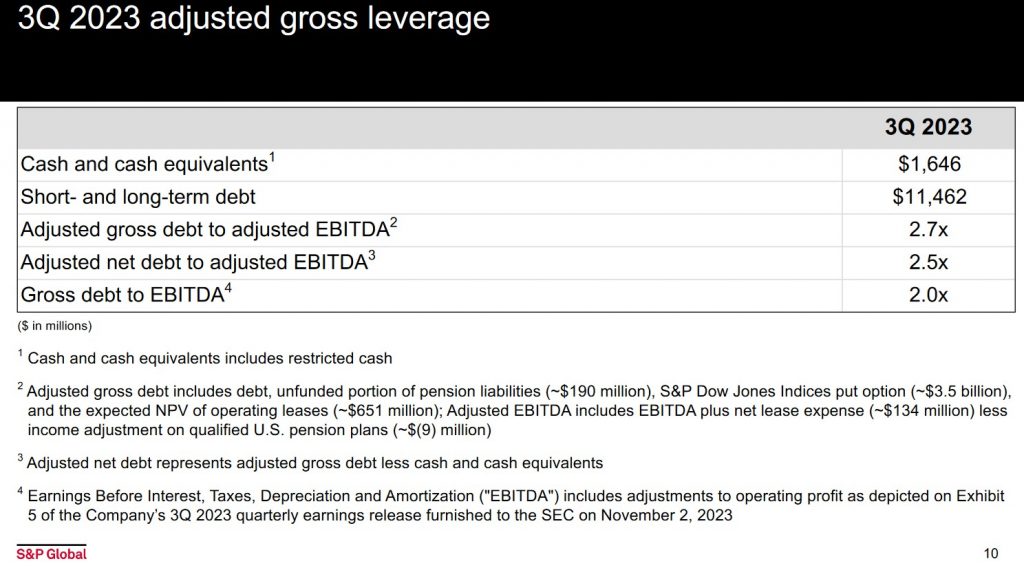

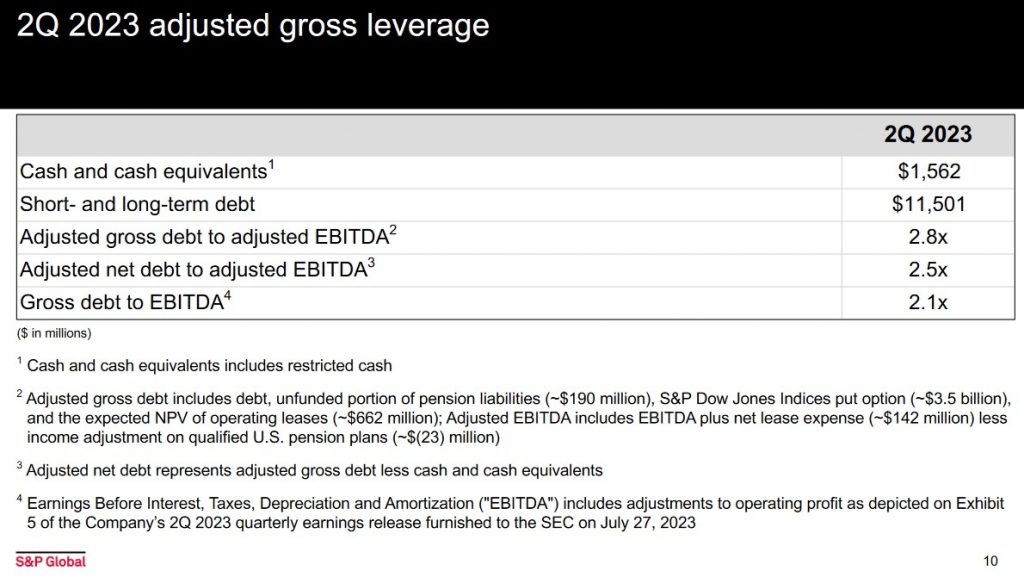

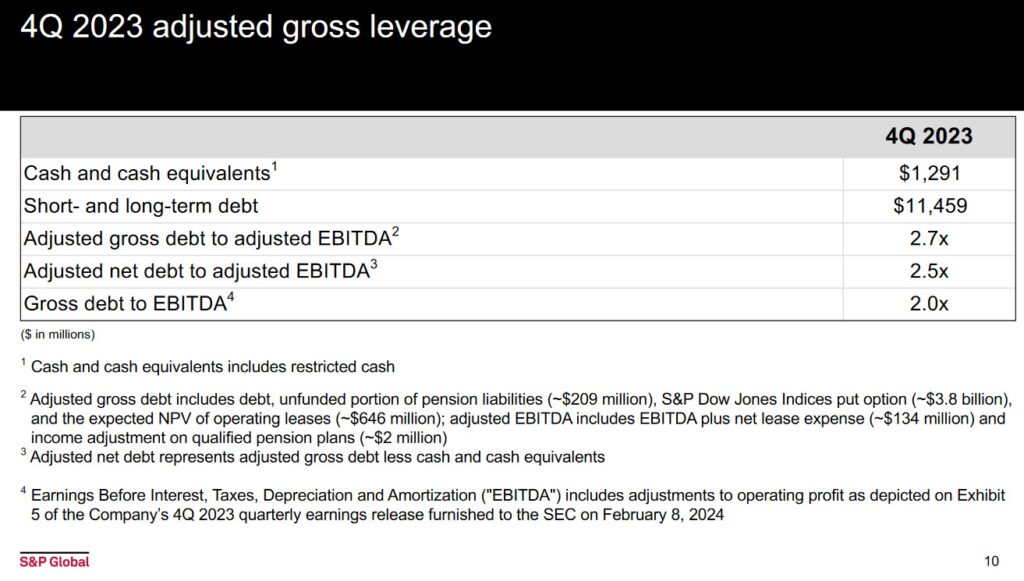

Leverage

SPGI’s adjusted gross leverage to adjusted EBITDA target is 2.0x – 2.5x. The company remains fully committed to maintaining an investment-grade rating and restoring the ratio to within the target range.

Source: SPGI – Q4 2023 Earnings Supplemental Disclosure – February 8, 2024

The adjusted gross leverage ratios in Q2 – Q3 2023 are provided for comparison purposes.

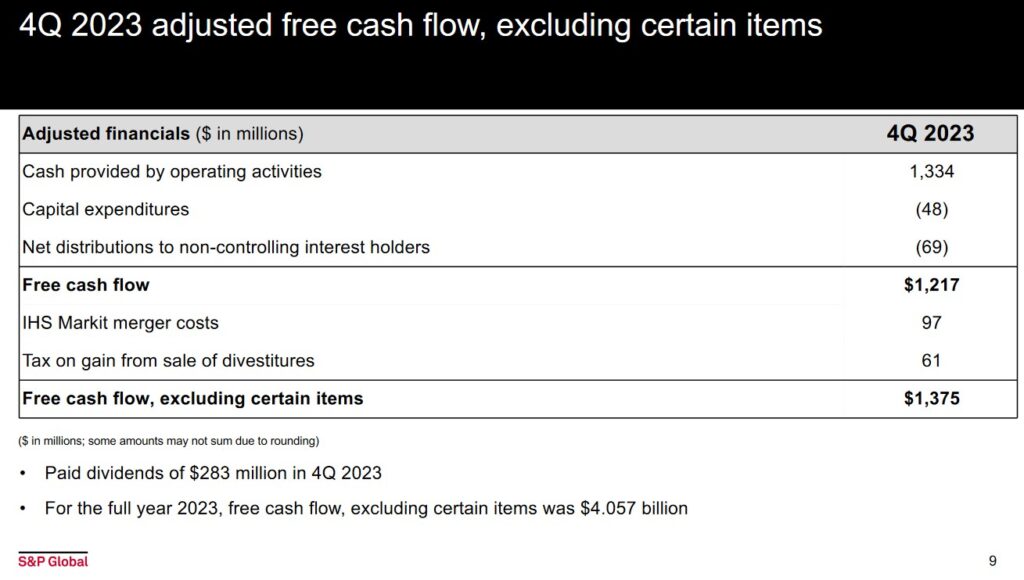

Free Cash Flow (FCF)

SPGI’s FY2013 – FY2023 FCF (in billions of $) is $0.665, $1.117, $0.217, $1.445, $1.893, $1.951, $2.661, $3.491, $3.563, $2.514, and $4.057. The FCF reported by SPGI, however, is more conservative than that reported elsewhere in that SPGI deducts the distributions made to noncontrolling interest holders.

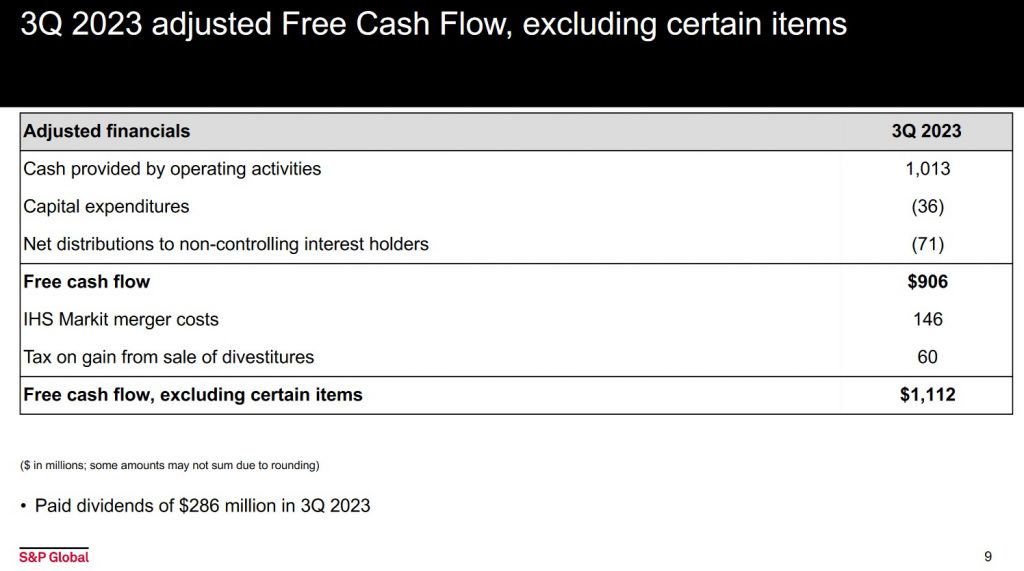

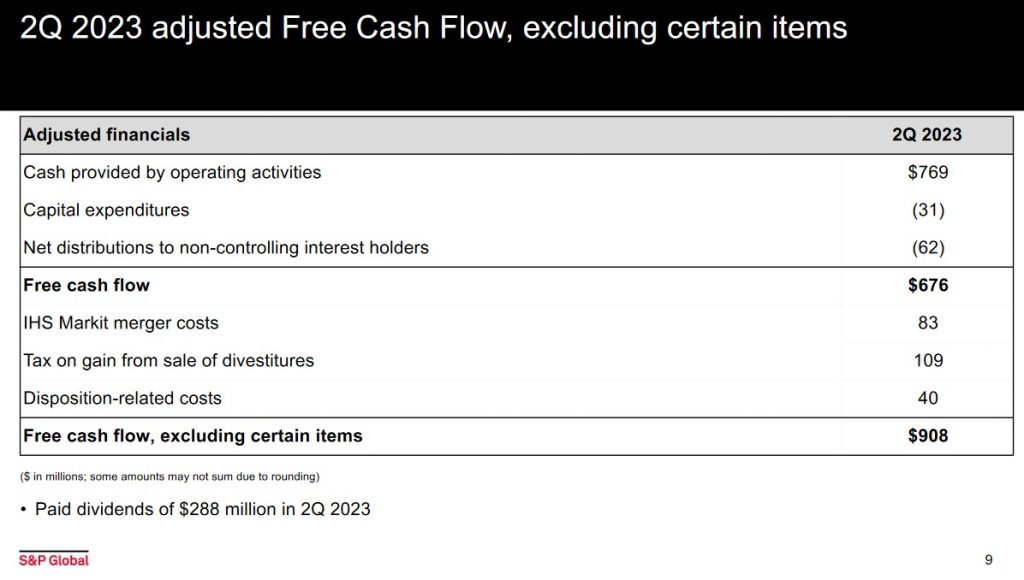

Adjusted FCF in Q2 – Q4 2023 is provided below.

Source: SPGI Q4 Earnings Presentation – February 8 2024

Source: SPGI – Q3 2023 Earnings Supplemental Disclosure – November 2, 2023

Source: SPGI – Q2 2023 Earnings Supplemental Disclosure – July 27 2023

FY2024 Guidance

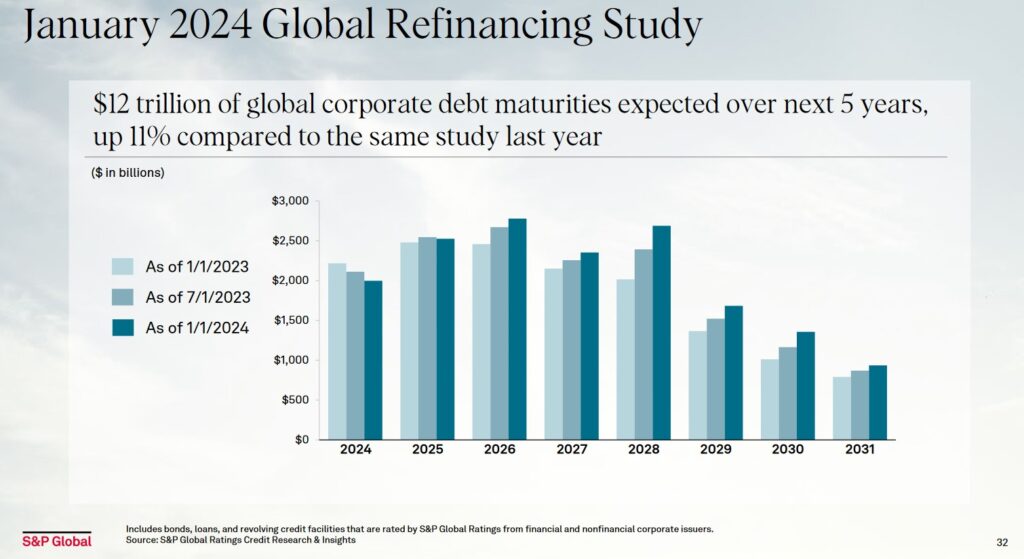

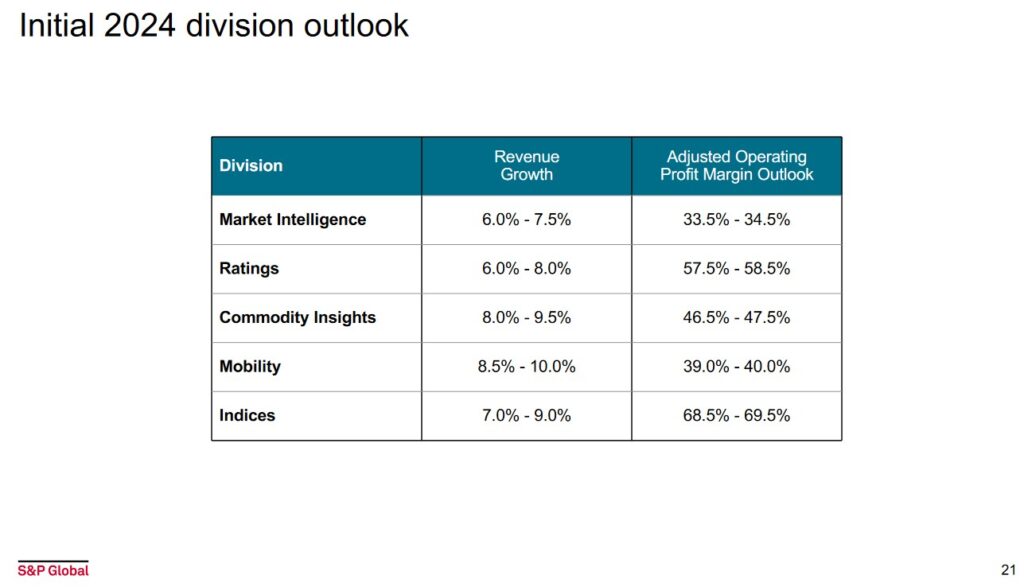

The Ratings segment typically generates ~33% of SPGI’s adjusted operating income. How this segment performs, therefore, has a significant impact on overall results. Over the long term, mid-single-digit revenue growth that is driven by GDP growth and pricing appears to be a reasonable expectation for this business segment.

Based on the results of its January 2024 global refinancing study, SPGI is forecasting 7% revenue growth and adjusted operating margins of 58% at the midpoint. In addition, billed issuance is expected to grow 3%-7%. Stronger growth is anticipated in the first half of FY2024.

Source: SPGI Q4 Earnings Presentation – February 8 2024

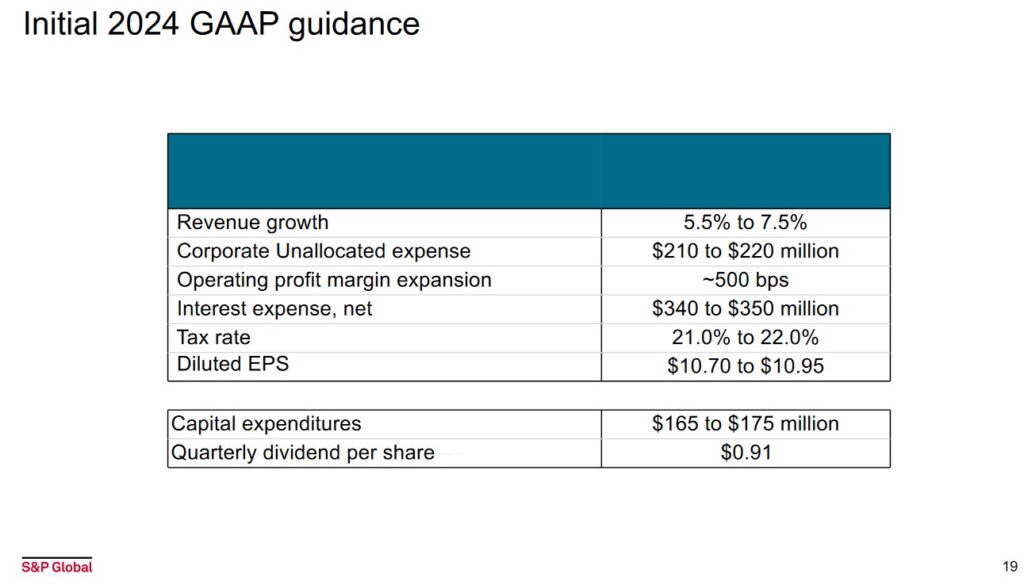

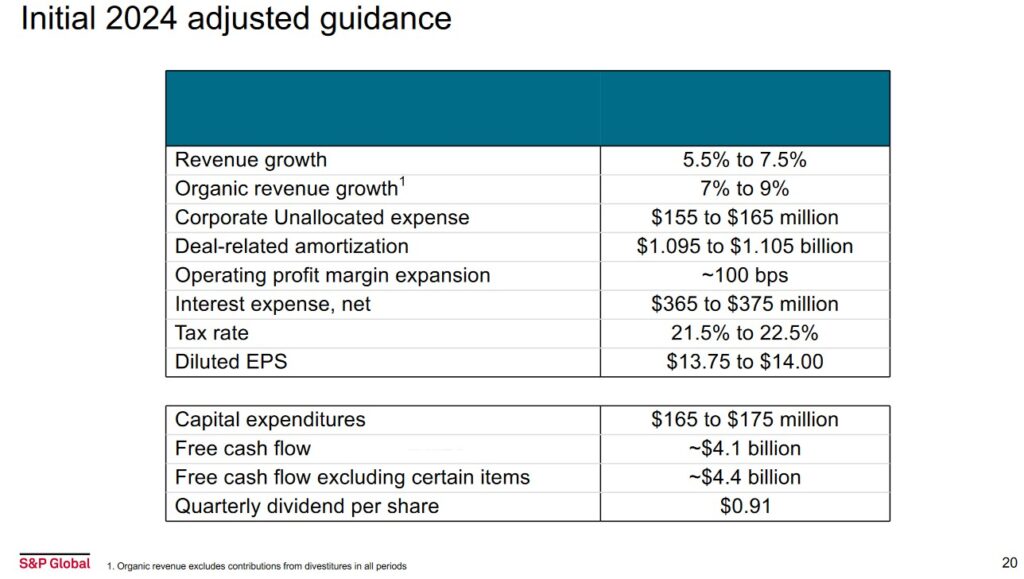

SPGI’s initial GAAP and Adjusted FY2024 guidance are reflected below. Despite synergy realization from the IHS Markit merger, SPGI only expects ~100 bps of margin expansion in 2024. This is attributed to higher compensation and investment spending.

Source: SPGI Q4 Earnings Presentation – February 8 2024

Source: SPGI Q4 Earnings Presentation – February 8 2024

Source: SPGI Q4 Earnings Presentation – February 8 2024

Credit Ratings

The ratings assigned to SPGI’s senior domestic unsecured debt are the same as in my last review. They are stable and are the lowest tier of the upper-medium grade investment-grade category.

- Moody’s: A3

- Fitch: A-

The ratings define SPGI as having a VERY STRONG capacity to meet its financial commitments. It differs from the highest-rated obligors only to a small degree.

Both ratings satisfy my risk profile.

Dividend and Dividend Yield

SPGI’s dividend history is accessible here. On January 31, it declared a $0.01/share increase in its quarterly dividend to $0.91 thus marking the 51st consecutive year of dividend increases.

With shares currently trading at ~$436.60 as I compose this post, the forward dividend yield is less than 1%. I expect capital gains will continue to constitute the majority of SPGI’s total future investment return.

SPGI’s weighted average number of shares outstanding over the FY2011 – FY2023 timeframe (in millions of shares) is 304, 285, 280, 272, 275, 265, 259, 253, 247, 242, 241, 322, and 318.9. At FYE2023, this had been reduced to 314.1. The increase in FY2022 is attributed primarily to the shares issued to finance the merger with IHS Markit that was completed on February 28, 2022.

In FY2023, SPGI repurchased $3.301B of its outstanding shares. It also issued ~$171 million of shares as part of its stock-based compensation program.

SPGI’s Board has authorized the repurchase of shares totaling up to $2.4B. In the coming weeks, the company expects to launch an initial $0.5B Accelerated Share Repurchase (ASR).

Valuation

SPGI’s valuation at the time of my prior post is found in my November 2, 2023 post.

When the Q3 and YTD2023 results were released, SPGI’s revised FY2023 guidance was $8.75 – $8.90 in diluted EPS. Using the current ~$376 share price, the forward diluted PE range was ~42.2 – ~43.

Management’s revised FY2023 forward adjusted diluted EPS guidance was $12.50 – $12.60 thus resulting in a forward adjusted diluted PE range of ~30 – ~30.1.

Using the current forward-adjusted diluted EPS broker estimates, the forward-adjusted diluted PE levels were:

- FY2023 – 21 brokers – ~30 using a mean of $12.54 and low/high of $12.39 – $12.62.

- FY2024 – 22 brokers – ~26.1 using a mean of $14.39 and low/high of $13.96 – $14.82.

- FY2025 – 18 brokers – ~23.1 using a mean of $16.33 and low/high of $15.71 – $17.00.

SPGI has just reported FY2023 GAAP diluted EPS of $8.23 and adjusted diluted EPS of $12.60. Shares currently trade ~$436.60 thus resulting in a diluted PE of ~53 and an adjusted diluted PE of ~34.7.

It generated $4.057B of FCF in FY2023 and the weighted-average number of diluted common shares was 315.9 million thus giving us a FCF/share value of ~$12.84. The Price/FCF per share is ~34.

Management’s FY2024 diluted EPS guidance is $10.70 – $10.95. Using the ~$436.60 share price, the forward diluted PE range is ~40 – ~41.

Management’s adjusted diluted EPS guidance is $13.75 – $14.00. Using the ~$436.60 share price, the forward adjusted diluted PE range is ~31 – ~31.8.

Using the current forward-adjusted diluted EPS broker estimates, the forward adjusted diluted PE levels are:

- FY2024 – 22 brokers – ~31 using a mean of $14.11 and low/high of $13.85 – $14.60.

- FY2025 – 20 brokers – ~27.3 using a mean of $16.00 and low/high of $15.49 – $16.50.

- FY2026 – 9 brokers – ~24.4 using a mean of $17.89 and low/high of $16.71 – $18.60.

The FY2024 adjusted FCF guidance is ~$4.1B and ~$4.4B when certain items are excluded. If SPGI reduces the weighted average number of shares outstanding in FY2024 to ~312 million, the FCF/share is ~$13.1 and ~$14.1 when certain items are excluded. Using the current ~$436.60 share price, the forward P/FCF is ~33.3 and ~31 when certain items are excluded.

Final Thoughts

Despite a healthy drop in the share price following the release of FY2023 results, SPGI was significantly overvalued prior to February 8 and shares remain richly valued. Fair value, in my opinion, is ~$390 – ~$400.

If we use the ~$395 mid point, the ~$10.83 mid point of management’s FY2024 diluted EPS guidance, and the ~$13.88 mid point of management’s FY2024 forward adjusted diluted EPS guidance, we get:

- a forward diluted PE of ~36.5; and

- a forward adjusted diluted PE of ~28.5.

I currently hold 350 shares in a ‘Core’ account and 200 shares in a ‘Side’ account within the FFJ Portfolio; SPGI was my 8th largest holding when I completed my 2023 Year End FFJ Portfolio Review.

While SPGI is a great long-term investment, we appear to be experiencing another period of irrational exuberance. I am in no rush to add to my SPGI exposure and will patiently wait in the hope that its valuation becomes more attractive.

I wish you much success on your journey to financial freedom!

Note: Thanks for reading this article. Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long SPGI.

Disclaimer: I do not know your circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decisions without conducting your research and due diligence. You should also consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.