Summary

Summary

- On February 1, 2018, V reported Q1 2018 results and indicated that factoring in tax reform benefits it expected earnings per share (EPS) growth in the high end of the mid-20s range versus its previous forecast in the mid-teens.

- V provided guidance for higher operating expenses in 2018 (high end of mid single-digits vs. mid-single digits).

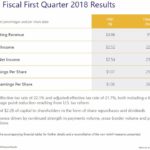

- Payments volume increased 10% in Q1 and cross-border volume increased 9%. Total processed transactions rose 12% to $30.5B.

- Despite the recent pullback in share price from the ~$126 level a week ago to the current ~$122 level, I will patiently wait for a drop to the ~$115 level before acquiring additional shares.

Introduction

A quick search on this site will reveal that I have written about VISA (NYSE: V) on a few occasions.

Despite the recent pullback in V’s stock price I see that the value of our V investment has increased almost 9 times; we acquired shares almost immediately after V’s initial public offering.

Unless I am extremely disciplined when it comes to investing it is possible my past experience with a particular investment will influence my investment decisions going forward. As a result, I need to temper my enthusiasm with a company and to be rational in my thought process as it relates to any possible further investment in a company.

Given that I have relatively recently written articles about V, this will be a short post wherein I will provide:

- links to V’s Q1 2018 results and projections;

- my opinion of V’s valuation;

- look at V’s Dividend, Dividend Yield, Dividend Payout Ratio, and Share Buybacks

Q1 2018 Financial Results

You are encouraged to read V’s Q1 2018 results which it reported on February 1, 2018.

Source: Visa Inc. Fiscal Q1 2018 Financial Results Presentation February 1 2018

Source: Visa Inc. Fiscal Q1 2018 Financial Results Presentation February 1 2018

2018 Forecast

V’s 2018 outlook for the remainder of FY2018 is as follows.

Source: Visa Inc. Fiscal Q1 2018 Financial Results Presentation February 1 2018

Source: Visa Inc. Fiscal Q1 2018 Financial Results Presentation February 1 2018

Valuation

At the time of my October 27 2017 article, V was trading ~$110 and had a PE in excess of 40 and a forward PE is in excess of 27.

When V released its Q1 results on February 1, 2018, the stock was trading ~$125.50 which was a slight pullback from the January 26 ~$126 level; it has subsequently pulled back to the ~122 level as I compose this article.

On the February 1, 2018 analyst call, V’s CFO indicated EPS growth for FY2018 was expected to be at the high end of the mid-20s range on an adjusted non-GAAP basis.

In FY2017, V reported adjusted full-year net income of $8.3B or $3.48/share so I estimate that V is expected to generate ~$4.35 on an adjusted basis if we increase the $3.48/share by 25%; this is extremely close to the mean estimate of $4.33 provided by 36 brokers.

Using my estimate and the current share price of ~$122 I get a forward adjusted PE of ~28.05. This is slightly more reasonable than the ~29 level using the January ~$126 stock price but I still view the current stock price as being on the high side. A level closer to ~$115 would give us a ~26.4 forward PE on an adjusted basis which is not cheap, but is reasonable for a company of V’s quality.

Dividend, Dividend Yield, and Dividend Payout Ratio

V’s dividend history can be found here and its stock split history can be found here.

V has just announced a ~7.7% dividend increase from $0.195/share/quarter to $0.21/share/quarter effective with the March 6th dividend payment.

The new annual $0.84 dividend only generates a yield of ~0.69% on the basis of a ~$122 stock price. V, however, is not the type of stock you acquire if your objective is to maximize your dividend income stream. V is the type of investment for investors seeking growth with a token stream of dividends as a reward for being patient.

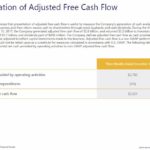

If you have any concern about V’s ability to service its dividend obligation, fear not. The annual dividend is only ~19% of its projected ~$4.35 EPS on an adjusted basis. In addition, V generates considerable free cash flow (FCF). In the 3 months ending December 31, 2017 V generated $2.621B in FCF.

Source: Visa Inc. Fiscal Q1 2018 Financial Results Presentation February 1 2018

Source: Visa Inc. Fiscal Q1 2018 Financial Results Presentation February 1 2018

Share Buybacks

As at FY2012 – 2017, V had the following number of diluted weighted-average shares outstanding (2.712B, 2.624B, 2.524B, 2.457B, 2.414B, 2.395B). The diluted weighted-average shares outstanding as at December 31, 2017 was 2.353B. As you can see, V is rewarding shareholders by way of a significant reduction in outstanding shares even though new shares are being issued as part of V’s employee compensation program.

In FY2017, V repurchased 77 million shares class A common stock in the open market using $6.9B of cash on hand; the net reduction in diluted weighted-average shares outstanding was 19 million shares. As at V’s FYE2017, it had authorized funds of $3.9B remaining under its previously authorized share buyback program; all share repurchase programs authorized prior to April 2017 had been completed.

In Q1, V repurchased another 15.5 million shares of class A common stock, at an average price of $110.67/share using $1.7B of cash on hand.

The Board of Directors has now authorized a new $7.5B repurchase program for class A common stock. V now has $9.1B of funds available for share repurchases if we include this recent additional authorization.

Final Thoughts

I like V in that it has a wide moat and significant growth potential. It is a core holding of my wife/mine although it is not held in the FFJ Portfolio. We acquired several hundred shares shortly after V’s initial public offering so taking into account the 4 for 1 stock split in February 2015 our average cost is sub $14….V has been a pretty darn good investment.

While some may argue that I should take some profit off the table, my train of thought is more along the line of Warren Buffett and Charlie Munger of Berkshire Hathaway. Buffett has indicated that “if you don’t feel comfortable owning a stock for 10 years, you shouldn’t own it for 10 minutes”. Given Buffett’s/Munger’s success at investing I am not about to argue with them.

I feel comfortable owning V much longer than 10 years so I have no intention of taking profit off the table. In fact, I VERY rarely sell shares!

I fully intend to acquire additional V shares but am prepared to patiently wait for a further retracement in its stock price. If V drops close to the $115 level I would be willing to acquire a few more hundred shares.

Thanks for reading!

Note: Thanks for reading this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long V.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.