Contents

Investing in a company that develops the most successful drug to combat COVID and its variants or a company that will provide people with a means to travel into space might be exciting. Not all investors, however, seek that level of risk and excitement.

In my case, I have dialled back my risk and excitement by investing in Tyson Foods (TSN).

These are TSN's existing brands.

In this December 17, 2020 post, I disclosed the initiation of a position in TSN in a retirement account for which I do not divulge details. I made this investment decision following the December 16th Press Release in which the company announced the completion of an independent investigation into wagering allegations at TSN's pork plant in Waterloo, Iowa; the outcome of this investigation led to the termination of seven plant management employees who bet on how many workers would become infected with COVID-19.

I purposely waited to learn the outcome of the investigation to ensure this type of activity was not more widespread.

What I did not anticipate was another legal issue!

On December 21, TSN announced the launch of an internal review relating to one of its cattle suppliers. The internal review determined this supplier made misrepresentations regarding the number of cattle purchased on behalf of the TSN’s Beef segment. Based upon investigations and procedures performed with the assistance of outside advisors, TSN’s management estimated that the misappropriation of TSN funds by the supplier caused TSN to overstate live cattle inventory as of the TSN's October 3, 2020 fiscal year-end by an estimated $0.285B!

I followed up my December 17 post with a December 24 post stating that I still view the company to be an attractive long-term investment.

With the August 9, 2021 release of Q3 and YTD results, I now revisit results and guidance.

Tyson Foods - Stock Analysis - Business Overview

TSN is a global food company with operations in 10 countries serving consumers and customers on 5 continents. This brief What is Tyson? video provides a very high-level overview of the company.

Although TSN's FY2020 Form 10-K issued November 16, 2020, provides a comprehensive overview of the company in Part 1, investors should rely on financial information reflected in TSN's FY2020 Amended Form 10-K. This amendment arose as a result of the outcome of the company's investigation in the cattle supplier matter.

TSN determined the materiality of the misstatements in live cattle inventory did not, individually or in the aggregate, result in a material misstatement of the consolidated financial statements issued in November. However, TSN determined it would revise its consolidated financial statements to correct the recording of live cattle inventory in the periods impacted.

Cattle Supplier Incident

Details of the cattle supplier incident are found in the company's December 21, 2020 Form 8-K.

TSN issued the following statement:

'As stated in our 8-K, we expect that general trends in growth and operating profit metrics will remain unaltered, operating cash flow will be largely unaffected, liquidity will not change, and the company will remain in compliance with all debt covenants.

Tyson also initiated an investigation by outside advisors to review the facts and circumstances surrounding the misappropriation of company funds. That investigation has found no evidence that Tyson benefited from the supplier’s unlawful conduct or that anyone at Tyson took steps to alter financial statements to hide the transactions resulting from the supplier’s unlawful acts.

Tyson has begun to implement certain enhancements and remedial measures to our internal control over financial reporting to ensure the existence and accuracy of the recording of live cattle inventory.'

In the release of Q1 2021 results on February 11, 2021, TSN indicated:

'Sales volume increased primarily due to strong domestic and export demand as well as the prior year impact of a fire which caused the temporary closure of a production facility for the majority of the first quarter of fiscal 2020. Average sales price decreased primarily due to the increased availability of market-ready live cattle. Operating income increased due to strong demand as we continued to optimize revenues relative to live cattle supply, partially offset by production inefficiencies and direct incremental expenses related to COVID-19. Additionally, operating income in the first quarter of fiscal 2021 was impacted by a cattle supplier's misappropriation of Company funds, which resulted in a $55 million gain related to the recovery of cattle inventory as compared to a $68 million loss recognized in the first quarter of fiscal 2020.'

Sale of Pet Foods Business

In Q3, TSN agreed to sell its Pet Treats business for $1.2B to General Mills, Inc. (GIS). This business was included in TSN's Prepared Foods segment.

The business had a net carrying value of ~$0.411B as of July 3, 2021, which included $0.35B of goodwill. The goodwill is not deductible for tax purposes.

TSN reclassified the assets and liabilities held for sale related to this business to Other current assets and Other current liabilities in its Q3 Consolidated Condensed Balance Sheet. Since the sale closed on July 6, TSN anticipates recognizing a gain from the sale of this business in Q4.

The sale is not a significant disposal and does not represent a strategic shift. It has not, therefore, been classified as a discontinued operation.

Chicken Segment Challenges

TSN's Chicken segment has experienced challenges due to limited capacity and persistent labour challenges that impact customer fill rates.

The new plant in Humboldt, Tennessee continues to ramp up production, including harvest capacity. This ramp-up is helping improve customer fill rates.

On the Q3 2021 earnings call, TSN's President and CEO indicated the Chicken segment remains a top priority and the company continues to strive to bring operating income margin to at least the 5% - 7% range by mid-FY2022.

The second imperative is to improve operational performance. In Q3, TSN highlighted the impact of lower hatch rates on the Chicken operations. TSN has begun to deploy new male parent stock. Hatch rates are improving where this stock has been deployed.

A full rollout of this breeder stock is expected to be completed in the Fall of 2021 with harvest capacity improvements occurring by mid-FY2022.

The rate of outside meat purchases has declined 25% versus Q2 and will continue to decline as hatch rates and utilization improve.

TSN continues to gain market share in its value-added products like Tyson Chicken Nuggets, Crispy Strips and Air Fried. Further growth is expected and as a result, TSN is investing in line upgrades and increased capacity to drive branded product growth.

Prices have been increased to help offset significant raw material and supply chain cost inflation. Pricing improved ~16% in Q3 versus Q3 2020.

Tyson Foods - Stock Analysis - Financials

Q3 2021 and YTD Results

On August 9, TSN released its Q3 and YTD results; the accompanying Earnings Presentation is accessible here. In addition, more comprehensive information is found in the Q3 2021 Form 10-Q.

TSN has now reported 12 consecutive quarters of retail share gains in its core business lines. Its Tyson, Jimmy Dean and Hillshire Farms $1B brands have driven strong share growth with consumers.

In Q3, its foodservice channel experienced growing volume as the economy slowing begins to reopen.

The diversity of TSN's portfolio demonstrated its value during Q3. Led by Beef, TSN delivered exceptional results as the strong US and export demand, coupled with ample cattle supply, supported elevated margins.

Operating Cash Flow (OCF) and Free Cash Flow (FCF)

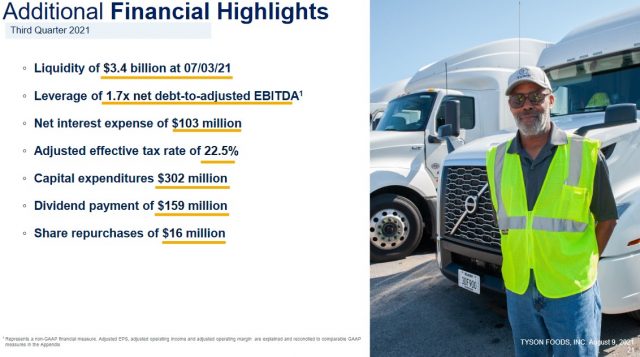

TSN continues to build financial strength and it has reduced total debt by ~$1B in the first 9 months of FY2021.

For the first 3 quarters of FY2021, it generated $2.656B of OCF and incurred $0.859B in additions to property, plant and equipment resulting in YTD FCF of ~$1.8B.

FY2021 Outlook

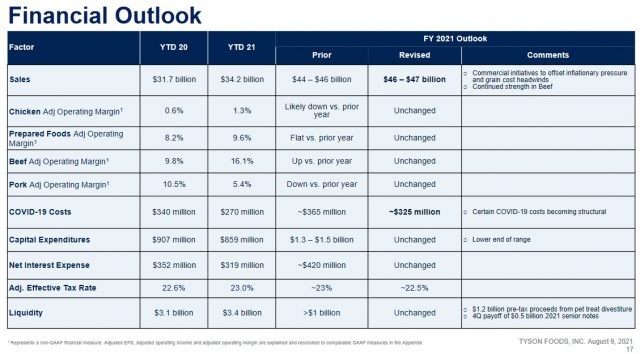

Full-year sales guidance is increased given the continued strength in TSN's Beef segment and ongoing inflationary pressures that are being partially recovered through price increases. TSN now expects to deliver annual revenues in the $46B - $47B range versus $43.185B in FY2020.

Key risks to this guidance include:

- freight rates;

- labour cost and availability;

- grain costs in the Chicken segment;

- raw material costs for each of the 4 reportable segments (Beef, Pork, Chicken, and Prepared Foods); and

- continued export market strength along with price volatility in commodity meats.

The outlook on the effective tax rate has been raised to ~22.5%. Management continues to monitor the potential implications of new legislation but does not currently expect to see impacts to the adjusted rate in FY2021.

In Q3, liquidity improved substantially to $3.4B and has subsequently benefited from $1.2B of pre-tax proceeds from the divestiture of the Pet Treats business in early July as noted above.

COVID-related costs of $0.055B in Q3 are forecast at ~$0.325B in FY2021. Some costs previously described as COVID-related have since evolved to become structural.

TSN continues to prioritize financial strength and flexibility; leverage in Q3 2021 is 1.7 times net debt to adjusted EBITDA versus 2.4 times as of FYE2020 (October 3, 2020). The target level is 2.0 times.

On the Q3 earnings call, management indicated investing organically in the business will continue to be an important priority. The company will also continue to explore portfolio optimization efforts through M&A.

Management has also reiterated its commitment to return cash to shareholders through dividends and share buybacks.

TSN - Q3 Earnings Presentation - August 9, 2021

Tyson Foods - Stock Analysis - Credit Ratings

The senior unsecured domestic long-term debt ratings assigned by the major rating agencies remain unchanged from those reflected in my previous post.

- Moody's assigns Baa2 long-term debt credit rating with a stable outlook;

- S&P Global assigns BBB+ long-term debt credit rating with a stable outlook; and

- Fitch assigns a BBB rating with a stable outlook.

Moody's and Fitch's ratings are the middle tier in the lower-medium-grade investment-grade tier. S&P Global's rating is one notch higher.

All three ratings define TSN as having the ADEQUATE capacity to meet its financial commitments. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity to meet its financial commitments.

These ratings satisfy my conservative investment preferences.

Dividend and Dividend Yield

The consolidated condensed statement of cash flows (page 7 of 51 in the Q3 Form 10-Q) reflects the distribution of $0.477B in dividends for the first 9 months of FY2021 versus $0.451B for the same timeframe in FY2020.

In my December 17, 2020 post I state the dividend history section of the company's website is not current; the most current dividend is the 3rd quarterly $0.42/share distribution on June 15, 2020.

Investors looking for more current information should look here where we see that TSN will be distributing its 4th quarterly $0.445/share dividend on September 15, 2021.

The dividend yield using the current ~$79.50 share price is ~2.2%.

TSN is committed to returning cash to shareholders through dividends. Within the next month, I anticipate a dividend increase announcement in the range of 4% - 6%. This will bring the new quarterly dividend to ~$0.47. On this basis, and using the current share price, the dividend yield would be ~2.4%.

TSN is also committed to returning cash to shareholders through share repurchases.

The consolidated condensed statement of cash flows (page 7 of 51 in the Q3 Form 10-Q) reflects the repurchase of $50 million of TSN's Class A stock in the first 9 months of FY2021 versus $0.2B for the same timeframe in FY2020.

The weighted average Class A shares outstanding, which is the class of publicly traded shares, is 335, 315, 296, 295, 293, and 293 (in millions) in FY2015 - FY2020. The weighted average Class A shares outstanding in Q3 2021 is also 293.

TSN's Class B stock is owned by insiders and is not listed for trading on any exchange or market system. However, Class B stock is convertible into Class A stock on a share-for-share basis. The weighted average Class B shares outstanding remains constant at ~70 million shares.

Tyson Foods - Stock Analysis - Valuation

Based on FY2021 adjusted diluted EPS estimates from 15 analysts ($5.35 - $6.37/share with a mean of $5.70), I purchased shares at $64.96. Using the mean estimate, the forward adjusted diluted PE was ~11.4. Even if TSN had a dismal FY2021 and only generated $5.35, the forward adjusted diluted PE was ~12.

I considered these valuation levels to be attractive. Hence the reason for my purchase.

Shares are now trading at ~$79.50 and the current FY2021 - FY2023 adjusted diluted EPS analyst estimates are fairly wide-ranging:

- FY2021 - 12 brokers - mean of $6.93 and low/high of $5.31 - $7.90. Using the mean estimate, the forward adjusted diluted PE is ~11.5.

- FY2022 - 13 brokers - mean of $6.65 and low/high of $5.73 - $7.45. Using the mean estimate, the forward adjusted diluted PE is ~12.

- FY2023 - 3 brokers - mean of $7.47 and low/high of $6.93 - $8.13. Using the mean estimate, the forward adjusted diluted PE is ~10.6.

The valuation using the mean value for FY2021 and FY2022 is similar to when I completed my December analysis.

I place no reliance on the FY2023 earnings estimates because much can happen within two years thereby rendering these estimates meaningless. Furthermore, FY2023 guidance is based on input from only 3 brokers.

I continue to view TSN's valuation as attractive.

Tyson Foods - Stock Analysis - Final Thoughts

TSN is not a company from which investors can expect high growth. As a result, it would be unwise to acquire shares if the forward adjusted diluted PE was above the mid-teens.

My rationale for investing in TSN was partly driven by its attractive valuation and the relatively steady nature of the business.

I think many grossly overvalued companies will experience a sharp pullback if we get a long-overdue broad market correction. TSN's valuation, however, is so low that any pullback in its share price is likely to be less pronounced than that which richly valued companies will experience.

Despite its current attractive valuation, I do not intend to add to my position.

Stay safe. Stay focused.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long TSN.

Disclaimer: I do not know your individual circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.