Summary

- A comparison of the 5, 10, 15, and 20 year returns for the Big 5 Canadian banks shows a clear winner.

- The banks which have had significant US exposure for several years have fared much better than those which do not or which have only recently entered the US market.

- Despite the various headwinds/uncertainties which make me reluctant to acquire further shares in the Big 5, my Canadian bank holdings are a core component of my investment portfolio.

- All are exceptionally well managed banks and are far more conservative than their much larger US peers.

Introduction

While the largest 6 Canadian banks have collectively reported record Q3 earnings of ~$11.7B, Canada’s S&P/TSX Commercial Banks Index has only gained ~12.5% in the past 12 months versus the ~24% increase in the U.S. KBW Bank Index. This lagging performance comes about even though they are beating big U.S. lenders on profitability, productivity and dividend yields. Much of this underperformance has to do with a more robust US economy and investors being optimistic that the US banks are in a more favorable position given that the millennial generation is approaching their home buying years.

The lower tax rates are also definitely fuelling significant annual profit gains at Wall Street’s biggest banks; the Canadian banks with US operations are benefiting from U.S. tax cuts signed into law in December 2017.

Furthermore, the U.S. economy is expected to expand 2.9% in 2018 and 2.5% in 2019 while economic forecasts for Canada call for 2% expansion in 2018 and 1.9% in 2019.

The uncertainty surrounding the renegotiation of the North American Free Trade Agreement (NAFTA), lingering fears about Canada’s housing market and over-indebted consumers are likely also having a negative impact on Canadian bank stock prices.

The rapid growth of mortgages and loans at the major Canadian banks that have fuelled overheated housing markets and contributed to near record levels of household debt are undoubtedly making many US investors a little apprehensive about investing in Canadian banks. Afterall, it was only a decade ago during the U.S. subprime debacle and Financial Crisis that many US banks required a bailout in order to remain solvent.

While Canadian banks are outperforming their US counterparts on measures such as return on equity and profit margins, they are more expensive than US banks; they have fetched a premium over their US counterparts for ~12 years. In fact, the Canadian banks index is trading at ~2.4 times tangible book value per share versus 2.0 times for the KBW Index of U.S. lenders.

Despite the above, I still view the Canadian banks as a solid long-term investment. In fact, shares in The Bank of Montreal (TSX: BMO), The Bank of Nova Scotia (TSX: BNS), The Canadian Imperial Bank of Commerce (TSX: CM), The Royal Bank of Canada (TSX: RY), and The Toronto-Dominion Bank (TSX: TD) are a core component of my family’s overall investment portfolio.

I am an investor with a long-term outlook so when I compare the long-term performance of the Canadian banks versus the US banks, I am of the opinion that Canadian bank executives are more focused on running their bank than the majority of their US counterparts who might be more focused on their bank’s stock performance.

Having said all this, I thought I would take a look at the Big 5 Canadian banks and to rank them from most to least attractive. I am purposely excluding National Bank of Canada (TSX: NA) in this analysis since I am of the opinion adequate exposure to the Canadian financial sector can be achieved through investments in the Big 5.

I also have absolutely no desire to invest in Laurentian Bank (TSX: LB) despite a dividend yield approaching 6%. This bank is extremely small (sub $2B market cap) and the fact it is the only North American bank with a labour union does not sit well with me. Quite frankly, LB was never a competitor I ever worried about during my entire banking career.

Overview

I spent my entire career employed in the Canadian banking industry before retiring in 2016.

Between my undergraduate and MBA degrees I was employed with BMO (4 years). Upon completion of my MBA I was employed with TD (~17 years) and then BNS (~13 years). My ~34 years in the Canadian banking industry provided me with an opportunity to witness the transformation of the Big 5 over time.

Interestingly, Wealth Management was never a core business for the Canadian banks when I started my banking career in 1980. How times have changed! Now all the Big 5 are beefing up their Wealth Management business with strategic acquisitions having been made by all the Big 5 over the past several years.

When I started my banking career in 1980, RY was by far the industry leader. As time progressed, each bank evolved and strategic acquisitions/decisions were made which resulted in a change in rankings amongst the Big 5.

RY is currently Canada’s #1 ranked bank from a market cap perspective. It was the industry leader in Canada when I started my banking career and it still is although TD has certainly closed the gap.

In 1980, TD was the smallest of the Big 5. The acquisition of Canada Trust in early 2000 and additional strategic acquisitions in the US has resulted in TD being an extremely close second to RY from a market cap perspective. While no bank is perfect I will admit this is a very well run bank!

BNS, BMO, and CM were reasonably similar from a market cap perspective in 1980. Over the next few decades, however, BNS grew to be the third largest of the Big 5. Unlike TD, RY, and BMO, BNS made a strategic decision to focus on expansion in growing Latin American countries (it has had a significant presence in the Caribbean for over a century) with a growing middle class.

BNS’s expansion has not been without some hiccups as its foray into Argentina was a complete disaster. Other countries in which BNS has a presence (eg. Mexico and Colombia) are not nearly as stable as Canada and the US. As a result, BNS has assumed slightly more risk in exchange for greater long-term growth potential.

BMO expanded into the US market in the early 1980s through its acquisition of Harris Bank. While Harris has been part of the BMO family of companies for years, it never really seemed as if these banks operated seamlessly. In speaking with counterparts who worked at BMO in the 1990s and early 2000s it appeared that the cohesiveness one would have expected after having been part of the same organization for over a decade would have been superior to the level of cohesiveness which truly existed. Subsequent to the acquisition of Marshall & Ilsley, it appears a concerted effort has been made to give customers the feeling that they are dealing with the same bank whether north or south of the 49th parallel.

CM has floundered for years. Attempts to expand in the US were disastrous (eg. it took a $2.4B hit to settle a lawsuit over its dealings with failed energy trader Enron Corp and it sold off the bulk of its capital markets business to Oppenheimer Holdings Inc. after suffering deep losses from subprime lending during the U.S. credit crisis).

CM has made strategic acquisitions in 2017 and 2018 to reduce its reliance on the Canadian market and to beef up its exposure in the Wealth Management side of the business. In 2017 it acquired PrivateBancorp. This was shortly followed by the acquisition of Geneva Advisors. So far, results from the US operations seem to be generating positive results.

Historical Performance

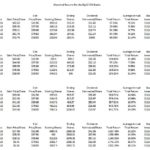

NOTE: The following graphs and chart are based on the US listed shares.

A comparison of how the Big 5 have performed over 1, 2, and 5 years is reflected in the following graphs.

The performance of the Big 5 over 5, 10, 15, and 20 year timeframes can be found below.

It is readily apparent that the absence of any significant US presence has negatively impacted BNS’s performance relative to its peers over the past 10 years. BNS has offices in New York and Houston but there is no retail branch network and the bank has no desire to compete in the US retail market. As a result, BNS has not benefited from the post Financial Crisis recovery to the same extent as TD, RY, and BMO.

CM has only recently entered the US market so the 5 and 10 year results are also weak when compared with TD, RY, and BMO which have had a strong US presence for several years.

TD, with its significant US presence, has posted strong results. In fact, TD has a larger branch presence in the US than in Canada.

As previously noted, BNS’s strategy is to grow its presence in the Caribbean and Central and South America. While this certainly is a sound strategy, investors have a right to be cautious when taking a position in BNS. Mexico, Chile, and Colombia are two countries in which BNS has a significant presence and these countries have combined budget and current-account gaps as a percentage of GDP that are rising.

In addition, they each have a reserve coverage of less than 2. Reserve coverage measures the capacity to meet immediate foreign-currency obligations and is calculated by taking the country’s foreign-exchange holdings and dividing same by 12-month funding needs for the current account, short-term debt maturities and amortization of long-term debt.

By way of comparison, Turkey and Argentina have a reserve coverage of 0.4 and 0.6 respectively. This means they are unable to cover their needs without new borrowings.

Pakistan, Ecuador, Poland, Indonesia, Malaysia and South Africa have reserve coverage of less than 1.

Hungary and India are two other countries with coverage of less than 2.

Brazil and China come in at 2.5 and 3.1 times, respectively.

While the Latin American region in which BNS has decided to focus its expansion has been relatively more stable in the past decade versus previous decades, there is always the risk this may not continue. This region has a higher likelihood of a return to political instability, higher credit losses, and inflation than for more mature markets. In my opinion, I don’t see how BNS could avoid any significant fall out in the event Mexico, Chile, or Colombia experience a further deterioration in their capacity to meet immediate foreign-currency obligations.

Having said this, I have no intention of exiting my BNS position and I will continue to automatically reinvest my dividends which is exactly what I am doing with the dividends generated from all my Big 5 holdings.

Q3 FY2018 Results and Outlook

In Q3, BNS recorded one-time charges which were largely related to its string of acquisitions. This has negatively impacted its results and share price. The bank is unlikely to gain much positive momentum over the short term given that management has indicated recent acquisitions are not expected to become accretive until 2020.

TD, on the other hand, has indicated its recent acquisition of alternative asset manager Greystone Managed Investments, will become accretive in year one based on adjusted results.

BMO’s Canadian banking unit consistently grows revenue while containing expenses and the U.S. banking unit continues to see outsized commercial loan growth.

CM has reported high growth in assets under management, solid capital markets revenue growth, and returns on equity exceeding 17%. Another plus is that its mortgage loan growth is moderating which is fortunate given that it has the most exposure to the Canadian real estate market.

RY has superior operating efficiency which is partially due to superior operational execution and partially due to the highest noninterest income proportion among the Canadian banks. It has a dominant market share in all key retail banking products and is one of the dominant investment banks in Canada and it ranks within the top 15 worldwide. In addition, having the largest amount of assets under management and assets under administration among the Canadian banks gives it the largest exposure to this higher-margin, fee-based business, and a larger share of clients’ overall wealth.

Risks

It is not my intent to delve into the list of top and emerging risks each bank must contend with. Anyone who is currently investing or looking to invest in any of the Big 5 Canadian banks is strongly encouraged to review the most recent Annual Report(s). There is an entire section within Management’s Discussion and Analysis that is devoted to the topic of Risk Management.

The very nature of the banking business involves risk. In this continuously changing world, each bank must adapt to ensure appropriate measures are in place so that the outcomes of their respective risk-taking activities are consistent with the strategies and risk appetite so as to provide an appropriate balance between risk and reward in order to maximize shareholder value.

In addition to reviewing Management’s Discussion and Analysis on the topic of Risk Management, I provide below the links to each bank’s website wherein you will find the most current credit ratings.

The Canadian Imperial Bank of Commerce

The ratings of all 5 banks are satisfactory for my purposes.

Valuation

While I am of the opinion the Big 5 are all fairly valued, I rank them as follows by order of attractiveness from a forward P/E perspective: CM, BNS, BMO, TD, and RY.

I would not hesitate to gradually acquire shares in all banks over time but would be inclined to give a greater weighting to TD and RY.

Dividends

The Big 5 have a history of rewarding shareholders from a dividend income perspective. Unlike many of their foreign peers which dramatically reduced their dividends during the Financial Crisis, the Big 5 merely froze their dividends, albeit for different time frames.

BNS, CM, and RY just recently announced dividend increases with the increases to take effect with the Q4 dividend payable in October (BNS and CM) and November (RY).

BMO left its quarterly dividend unchanged for the November 2018 payment given that it had announced a dividend increase in May 2018 re: August 2018 dividend payment.

TD increases its quarterly dividend on an annual basis with its 4th quarterly $0.67 dividend scheduled to be paid January 31, 2019. I anticipate a dividend increase to be declared very early in 2019.

Each bank’s common stock dividend history can be accessed from the links found below.

The Canadian Imperial Bank of Commerce

Final Thoughts

While the Big 5 have all rewarded shareholders over the last several years, I mentioned a few significant risks in this article that give me cause for concern. As a result, I am not about to rush out and make any significant additional investment in the Big 5 at this point in time. I will, however, continue to automatically reinvest my dividends but I am adopting a ‘wait and see’ attitude.

A negative outcome to the NAFTA negotiations, the heavily indebted Canadian consumer, the impact of tariffs (and retaliatory tariffs), the upcoming mid-term elections in the US, the lofty real estate valuations in some of the major urban areas in Canada…these are some of the things I think could potentially trigger a pullback in the equity markets.

As indicated in the ‘Introduction’ of this article, I am a long-term investor so despite my concerns I am not about to trim any of my Big 5 holdings.

If you do not currently hold any shares in the Big 5, you may wish to acquire shares over time. My order of preference would be RY, TD, BNS, BMO, and CM (although RY and TD are pretty much a ‘tie’).

I hope you enjoyed this post and I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long BMO, BNS, CM, RY, and TD.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.