Stryker Corporation (SYK) has disclosed its intent to acquire Wright Medical Group Inc. (WMGI) with a closing schedule for September 30, 2020. Although this acquisition is larger than the several acquisitions SYK has successfully completed in recent years, I fully expect SYK will achieve the targets it expects to achieve with the acquisition.

I expect the acquisition of WMGI will better position SYK to serve surgeons and patients in the trauma and extremities markets and especially in the ‘shoulder market’ where SYK has been subscale for years.

Summary

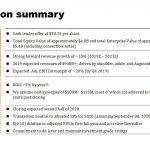

- Stryker has recently announced its intent to acquire Wright Medical Group N.V. to bolster its capabilities in the $3B upper extremity market.

- SYK has a successful integration track record having made several acquisitions within the last decade.

- The two major credit ratings agencies have placed SYK’s long-term debt under review with negative implications but management has committed to de-lever and maintain investment grade ratings.

Introduction

Following my most review of the holdings in accounts for which I disclose and do not disclose details, I have identified the Healthcare sector as one in which I need to increase exposure; I currently have exposure to Johnson & Johnson (JNJ) and Becton, Dickinson and Company (BDX). In fact, I recently disclosed that I had added to my BDX position through the purchase of 200 shares for the FFJ Portfolio.

With Stryker Corporation (SYK) having announced on November 4th its intent to acquire Wright Medical Group N.V. (WMGI) with a closing scheduled for the 2nd half of 2020 and a 10%+ pullback from SYK’s recent 52 week high share price, my interest in initiating a very long-term position in SYK has been piqued; shares will be acquired in one of our daughter’s investment accounts.

Business Overview

A comprehensive overview of SYK and its Risk Factors can be found in Part 1 of its FY2018 10-K.

A comprehensive overview of WMGI and its Risk Factors can be found in Part 1 of its FY2018 10-K.

WMGI is a company in which I would have never considered investing given its size (~$3.8B market cap) and its track record of negative earnings and negative Free Cash Flow. SYK, however, has identified WMGI as an ideal bolt-on acquisition to improve its capabilities in the $3B upper extremity market. With SYK’s successful track record of integrating acquired companies and enhancing shareholder value, my interest in investing in SYK has been piqued.

Rationale for Acquisition

The following images reflect high level details of the proposed acquisition and the strategic rationale for same.

Source: SYK – Acquisition of Wright Medical Presentation – November 4 2019

Source: SYK – Acquisition of Wright Medical Presentation – November 4 2019

On the November 4th call with analysts, SYK’s senior management indicated that the acquisition of WMGI will better position SYK to serve surgeons and patients in the trauma and extremities markets and especially in the ‘shoulder market’ where SYK has been subscale for years.

While acquisitions carry an element of risk in that not everything always proceeds as planned, I am encouraged by SYK’s successful M&A track record over the past several years (page 6 of Acquisition of Wright Medical Presentation); on the November 4th call with analysts management made a point of referring to its successful track record of being able to acquire and integrate acquisitions so as to enhance long-term shareholder returns.

After listening to the November 4th call, I am confident SYK will be able to integrate WMGI into the fold in a reasonable length of time thus allowing it to participate in the fast growing orthopedic segments (page 9 of presentation).

FY2019 Guidance

On the October 29, 2019 Q3 earnings call (Q3 Earnings Release), management indicated that based on YTD and anticipated strength in Q4, full year sales growth should come in toward the higher end of the sales growth range of 7.5% – 8%.

Given YTD performance, management expects adjusted diluted EPS will be $2.43 – $2.48 for Q4 2019 and $8.20 – $8.25 for FY2019.

On November 4th when SYK announced the proposed acquisition of WMGI with an expected closing of September 30th, management indicated the WMGI transaction would be neutral to FY2020 adjusted EPS and there would be a ($0.10) dilution to adjusted EPS in FY2021 after which time the acquisition would become accretive.

Credit Ratings

The following schedule of SYK’s total debt has been extracted from its Q3 2019 10-Q.

While the long-term debt maturity schedule is well balanced, I am of the opinion SYK will have a significant amount of long-term debt once it completes the financing arrangements for the WMGI acquisition. As a result, I am not surprised Moody’s and S&P Global have placed SYK’s credit ratings under review with negative implications.

Looking at SYK’s ratings history I see that Moody’s downgrade SYK from A3 (lowest tier of the upper medium grade) to Baa1 (upper tier of the lower medium grade) in February 2016.

In April 2016, S&P Global assigned a long-term rating of A which is the lowest tier of the upper medium grade; this rating is 2 notches higher than that assigned by Moody’s. S&P Global has also placed SYK’s rating under review with the view of a potential downgrade.

Even if Moody’s and S&P Global were to lower their respective ratings by two notches, SYK’s long-term credit rating would still be investment grade although a Baa3 rating by Moody’s would be at the lowest level of the investment grade ratings.

Naturally, a downgrade in SYK’s credit rating is not encouraging but I am confident management will make the appropriate efforts to ensure that the company’s credit rating remains at the investment grade level. In fact, SYK has demonstrated its ability to improve its credit rating in reasonably short order; Moody’s increased SYK’s rating from Ba3 in October 1999 to A3 in mid-July 2005…a rating it held until February 2016.

Despite what will likely be a downgrade by both ratings agencies I am prepared to accept the higher level of risk since I am of the opinion there is a reasonable probability that SYK’s long-term debt ratings will be increased within the next few years.

Valuation

On the basis of $8.20 – $8.25 adjusted diluted EPS for FY2019 and the current ~$200 share price we get a forward adjusted diluted PE of ~24.32 (using the $8.225 mid-point).

As at the end of Q3, SYK had generated $3.58 in diluted EPS. If SYK generates ~$1.20 (~1/3 of YTD diluted EPS) in diluted EPS in Q4 then we can expect SYK to generate ~$4.78 in diluted EPS for FY2019. Using the current ~$200 share price we get a forward diluted PE of ~41.84.

Despite the elevated valuation, I view SYK as a high growth business and am prepared to pay up to acquire shares for one of our daughter’s investment accounts. Her investment time horizon is far lengthier than mine and I am reasonably confident that SYK will be far more valuable 50+ years from now; I acquire shares from a business owner’s perspective so it is not my intent to be ‘flipping’ shares in high quality companies.

Dividend and Dividend Yield and Share Repurchases

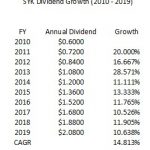

Looking at SYK’s dividend history we see that a quarterly dividend policy was instituted in 2010. I envision this dividend policy will remain in effect, and therefore, have calculated the compound annual growth rate of SYK’s dividend starting from 2010.

NOTE: The above calculations are based on the dividend payable date and not the record date.

In late December I expect SYK will declare its Q1 dividend for distribution in late January 2020. I prefer to err on the side of caution and expect SYK’s quarterly dividend will be increased ~10% to $0.57/quarter for an annual payout of $2.28. On the basis of the current ~$200 share price this would provide investors with a ~1.14% dividend yield. The dividends will incur a 15% withholding tax given that shares will be held in a ‘non-registered’ account so the anticipated quarterly dividend will be ~$0.4845 thus resulting in an estimated dividend yield closer to ~1%. I am not investing in SYK, however, for dividend income purposes.

Before you exclude SYK as a potential investment because of its low dividend yield, I encourage you to look at SYK’s performance relative to the S&P500 over the past decade.

Source: TickerTech.com

Granted, there are no assurances SYK’s return over the next 10 years will replicate that of the past 10 years. I am, however, prepared to take a calculated risk that an average annual total return of at least 12 – 13% is not out of the realm of possibility. Using the rule of 72 I think it is reasonable to expect the value of a SYK investment to double in 10 years.

Looking at SYK’s FY2010 10-K we see there were 391,246,163 shares outstanding as at January 31, 2011. Fast forward to SYK’s FY2018 10-K and we see that there were 372,664,636 shares outstanding as at January 31, 2019.

While SYK has made multiple acquisitions over the past several years, the WMGI impending acquisition is the largest to date. I think SYK’s management anticipates a ratings downgrade from both Moody’s and S&P Global which is likely why they have expressed a commitment to de-lever and to retain investment grade ratings. If your intention is to retain your SYK investment, or to initiate a position, I suggest you do not factor into your analysis any material reduction in the share count over the next few years.

Final Thoughts

SYK’s valuation certainly appears to be elevated and a further pullback in SYK’s share price is not out of the realm of possibility. I do, however, like SYK’s extensive breadth of products and expect this will benefit SYK as hospital customers seek to consolidate suppliers in order to take advantage of volume discounts. I am, therefore, prepared to initiate a position at the current valuation. I will continue to closely monitor SYK’s progress and fully intend to add to my position over time.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I do not currently hold a position in SYK but intend to initiate a position within the next 72 hours.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.