Contents

With the release of Q2 results and FY2019 guidance I provide my opinion on SWK's current valuation.

Summary

- On July 23rd SWK reported Q2 2019 results in which $2.66 in Non-GAAP EPS beat estimates by $0.11 and GAAP EPS of $2.37 missed by $0.03. Revenue of $3.76B (+3.3% Y/Y) missed by $50M.

- Adjusted EPS results achieved through extreme focus on cost control and price execution which offset ~$110 million of pre-tax currency commodity and tariff headwinds.

- SWK expects that in FY2019 it will absorb ~$0.39B in combined tariff currency cost inflation.

- Despite recent quarterly dividend increase, dividend yield is now ~1.78% versus ~2.32% when I acquired additional shares for the FFJ Portfolio in January 2019.

Introduction

I am always interested in acquiring shares in great companies…especially when a company is a Dividend King; this is a very small subset of companies which has increased its dividend for at least 50 consecutive years.

When I published my previous Stanley Black & Decker’s (SWK) article I viewed shares as being attractively valued and disclosed that I had just acquired another 150 shares for the ‘Side Accounts’ within the FFJ Portfolio at $116.99/share.

Market conditions have certainly changed since January 2019. Back in December/January it looked like investors were throwing the ‘baby out with the bathwater’. Now….investors seem to be tripping over themselves to snap up shares in companies even when valuations appear to be somewhat stretched. This gives me cause for concern and as a result I have not been deploying much money in recent months.

My concern becomes greater when I read that investors appear to have reacted to the U.S. stock market’s strong rebound in June by employing a greater use of leverage (borrowing money to invest).

I fully appreciate not every investor shares my outlook on elevated (in general) equity valuations. I, however, prefer to err on the side of caution and think a broad market pullback of 10%+ is not out of the realm of possibility; I notice an increasing number of companies are reporting results wherein commodity inflation, foreign exchange and tariffs are greater than increases in volume, productivity and price.

In fact, on SWK’s July 23rd Q2 earnings call, the very first comment SWK’s President/CEO made was:

‘We continued to generate above market organic growth, achieved operating margin rate expansion and delivered adjusted EPS growth overcoming a $110 million of pre-tax currency commodity and tariff headwinds.’

Despite these headwinds I see that SWK’s share price jumped ~$10 jump to $151.66 following the release of Q2 and YTD results on July 23rd.

With Mr. Market reacting so positively to SWK’s results I have decided to look at management’s guidance to determine whether SWK shares are reasonably valued.

Q2 2019 and YTD Results

SWK’s most recent quarterly and semi-annual results can be accessed here.

Source: SWK – Q2 2019 Earnings Presentation – July 23 2019

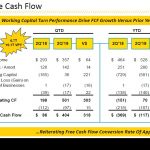

On the Q2 earnings call, SWK’s EVP/CFO reiterated the company’s commitment to deliver a Free Cash Flow (FCF) conversion rate of approximately 85% - 90% despite YTD FCF being ($0.117B).

Source: SWK – Q2 2019 Earnings Presentation – July 23 2019

Although SWK increased its operating margin by ~60 bps and increased its adjusted EPS growth by ~4% from Q2 2018, management indicated this was ‘achieved with a laser focus on cost control and price execution with our business teams overcoming ~$110 million of pre-tax currency commodity and tariff headwinds in Q2.’

SWK also indicated it expects it will absorb ~$0.39B in combined tariff currency cost inflation in FY2019.

At SWK’s May Investor Day, management discussed the launch of its margin resiliency program. The effort is centered on creating benefits across the entire value chain by applying the latest digital technologies and techniques such as artificial intelligence and advanced analytics to optimize performance to create incremental margin. Management expects this program will deliver $0.3B - $0.5B of annualized operating margin benefit over a multi-year period.

2019 Guidance

SWK has reiterated its 2019 adjusted EPS guidance, which calls for ~4% organic growth and adjusted EPS of $8.50 - $8.70. On a GAAP basis, the EPS range remains unchanged at $7.50 - $7.70.

Management estimates an incremental $50 million in external headwinds primarily related to List 3 China tariffs; List 3 products with a total import value of $200B were subject to an additional 10% tariff as of September 24, 2018. Following a breakdown in trade talks in May 2019, the tariff was increased to 25%.

On the July 23rd analysts call, SWK indicated this increase will be partially offset by slightly lower second half expectations.

Full year expectations around organic volume growth have been modestly adjusted to reflect a slower market outlook for general industrial and emerging markets. Guidance also incorporates the deceleration SWK saw during Q2.

While the plan still calls for 4% organic growth SWK will need to offset headwinds through incremental pricing actions and operational outperformance.

Q3 EPS is expected to be ~23% of full year performance while Q4 will be closer to ~29%.These Q3 and Q4 estimates are slightly different from historical trends due to the timing of various brand transitions, impact to pricing in response to tariffs and the margin resiliency benefits. SWK also expects some variation in the effective tax rate for each quarter.

Credit Ratings

There has been no change to SWK’s credit ratings subsequent to my previous article.

SWK’s senior unsecured debt has been rated ‘Baa1’ by Moody’s since March 15, 2010. S&P Global’s ‘A’ rating has held steady since it was assigned in mid December 2010.

The Moody’s rating is the top tier of the lower medium grade category and S&P Global’s rating is the middle tier of the upper medium grade category.

Regardless of which ratings agency is more accurate, it does not make a difference from my perspective as I view both ratings as acceptable.

Valuation

At the time of my January 22nd article, SWK had projected FY2019 Diluted GAAP EPS of $7.45 - $7.65 and Adjusted Diluted EPS of $8.45 - $8.65. With the share price hovering around $116, I viewed SWK’s ~15.36 projected diluted PE and ~13.57 projected adjusted diluted PE as being attractive.

On April 24, 2019 when SWK released its Q1 2019 results, we saw that FY2019 adjusted EPS guidance had been raised to $8.50 - $8.70. With shares having closed at ~$146 following the Q1 earnings release, SWK’s projected adjusted PE range was ~16.78 - ~17.18.

SWK has now reiterated its FY2019 adjusted EPS guidance of $8.50 -$8.70 and with shares having closed at $151.66 on July 23rd, we arrive at a projected adjusted PE range of ~17.43 - ~17.84.

In Q1, SWK increased its FY2019 Diluted GAAP EPS guidance of $7.45 - $7.65 to $7.50 - $7.70 and this outlook remains unchanged. Using the ~$146 share price following the Q1 earnings release, SWK’s projected diluted EPS for FY2019 was ~18.96 - ~19.47.

Fast forward to the release of Q2 results and SWK has reported diluted EPS of $3.50 for the first half of the year. In my opinion, I think SWK will be hard pressed to achieve the upper end of its FY2019 diluted GAAP EPS guidance of $7.50 - $7.70 and reaching $7.50 appears to be more likely. On this basis and using the current $151.66 share price, SWK’s projected diluted PE is ~20.22. Should you think SWK can attain the $7.70 upper end of management’s guidance then the projected diluted PE is ~19.7.

Dividend, Dividend Yield, and Dividend Payout Ratio

Looking at SWK’s dividend history we see that SWK recently announced an increase in its quarterly dividend from $0.66 to $0.69 which is what I had anticipated in my previous article.

Management has indicated this increase is a reflection of:

- its confidence in SWK’s cash generation capability;

- SWK’s capital allocation strategy of returning ~50% of excess capital to shareholders through dividends and repurchases and ~50% towards M&A over the long-term.

In my January article I projected that SWK’s dividend would be increased to ~$2.70 thus giving us a forward dividend yield of ~2.32% on the basis of the ~$116 share price.

The new $2.70 annual dividend now provides investors with a ~1.78% dividend yield based on the current ~$151.66 share price.

As noted earlier, SWK’s diluted EPS guidance has been raised subsequent to my January article (increased from $7.45 - $7.65 to $7.50 - $7.70). The new $2.70 dividend now represents a dividend payout ratio of ~35% - ~36%; SWK’s target dividend payout ratio range of 30% – 35%.

As at the end of FY2011, SWK had 170,105 million in weighted average diluted shares outstanding. Fast forward to the end of FY2018 and this had been reduced to 151,643 million. This has subsequently been reduced to 150,139 million.

Final Thoughts

In January I viewed shares as attractively valued, and therefore, acquired more shares. I now view shares as being at the upper end of fair valuation and have no immediate intention of increasing my position.

If guidance were to remain unchanged and SWK were to retrace ~11% to the $135 level (not totally out of the realm of possibility) I would consider acquiring additional shares. Using FY2019 $7.50 - $7.70 EPS guidance this would give us a PE range of ~17.53 - ~18.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to [email protected].

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long SWK.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.