Contents

In my July 29 post, I reviewed RTX Corporation (RTX) following the release of Q2 and YTD2023 results. In releasing Q2 results, RTX informed the investment community that its Pratt & Whitney (P&W) operating segment identified microscopic contaminants in a metal used in part of the Geared Turbofan (GTF) engines that power Airbus' popular A320neo jets.

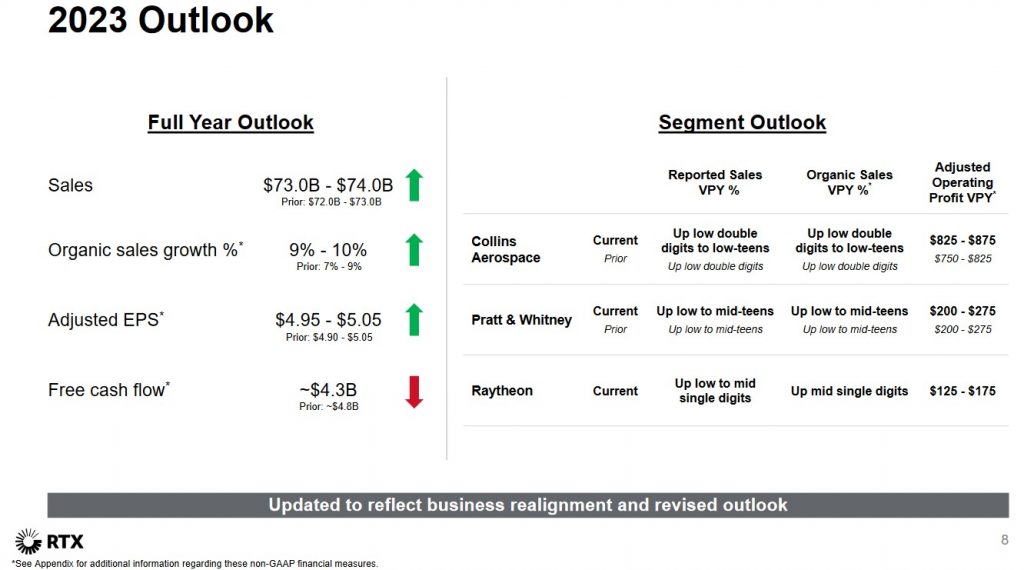

While RTX provided the following FY2023 Outlook, management indicated that the costs, work scope, and timing to rectify the GTF problem had yet to be determined. In the next 30 - 60 days, however, management anticipated being in a position to provide more details including the impact on cash flow.

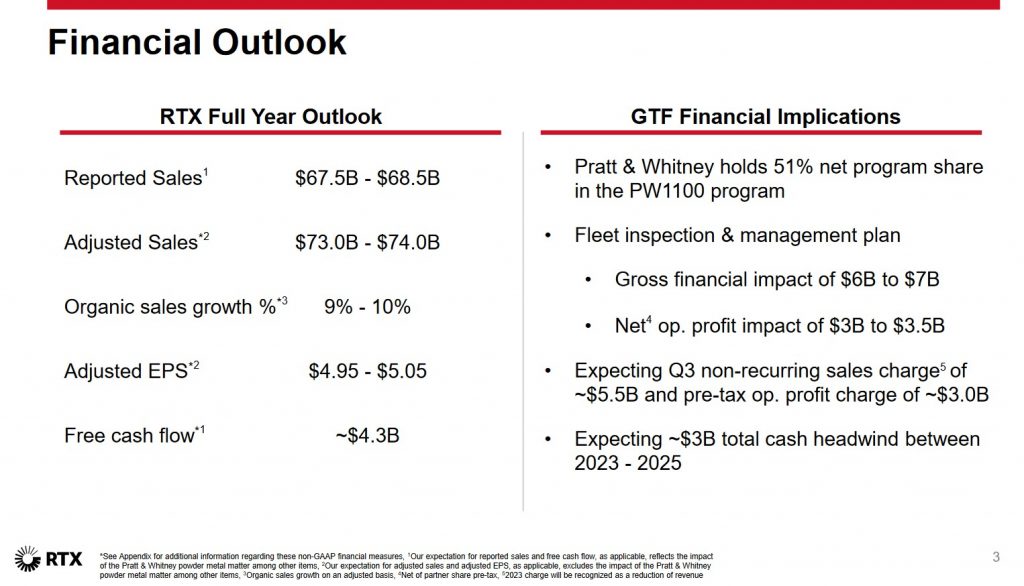

Fast forward to September 11 and RTX has provided an update on the GTF issue (see Press Release and Presentation).

RTX's pre-tax operating profit impact is estimated to be $3B - $3.5B over the next several years. This includes a ~ $3B pre-tax charge in Q3 2023, after the partners’ share of charges.

NOTE: The development of new engines and improvements to current production engines present important growth opportunities for Pratt & Whitney. In view of the risks and costs associated with developing new engines, Pratt & Whitney has entered into collaboration arrangements in which revenues, costs and risks are shared with third parties. On December 31, 2022, the interests of third-party collaboration participants in Pratt & Whitney-directed jet engine programs ranged, in the aggregate per program, from 13% - 49%.

The impact of the powder metal matter is not currently expected to have a significant impact on sales and margins in 2023. Pratt & Whitney’s FY2023 free cash flow (FCF), however, will be negatively impacted by ~$1.5B. I do not deny this is significant. We should not, however, lose sight that RTX still expects to generate substantial FCF including ~$7.5B in FY2025! The company should still be able to adequately reinvest in the company, increase its dividend, and repurchase shares.

In addition, RTX remains confident in its ability to return $33B - $35B in capital to its shareowners from the United Technologies and Raytheon merger through 2025 despite this recent setback.

Dividend and Dividend Yield

When I wrote my July 29 post, I disclosed the purchase of an additional 100 shares at $85.67. Using this purchase price and the $0.59 quarterly dividend (see dividend history), the dividend yield was ~2.75%.

I further noted that if RTX's historical dividend increases are an indication of what to expect in April, an increase in the quarterly dividend to $0.63 is not unreasonable. On this basis, the next 4 quarterly dividend payments will likely total $2.44 ((2 x $0.59) + (2 x $0.63)) thus resulting in a ~2.8% forward dividend yield.

Following the September 11 Press Release, RTX's share price dropped further. I, therefore, acquired an additional 100 shares @ $78/share. Using my $2.44 dividend projection and my recent purchase price, the forward dividend yield is ~3.1%.

Dividend metrics, however, are relatively insignificant in my decision-making process. My primary focus is total investment return.

Valuation

On July 25, I acquired 100 additional RTX shares @ $85.67/share. Using the $5 mid-point of management's revised FY2023 adjusted diluted EPS guidance of $4.95 - $5.05 (previously $4.90 - $5.05), the forward adjusted diluted PE was ~17.1.

The valuation using broker estimates and my $85.67 purchase price was:

- FY2023: 23 brokers, mean estimate $5.01, low/high range $4.95 – $5.05. The valuation using the mean estimate is ~17.

- FY2024: 23 brokers, mean estimate $5.67, low/high range $5.10 – $5.89. The valuation using the mean estimate is ~15.

- FY2025: 16 brokers, mean estimate $6.68, low/high range $6.31 – $7.20. The valuation using the mean estimate is ~12.8.

I also indicated that should RTX determine the GTF problem is more severe than anticipated and the FY2024 forward-adjusted diluted mean EPS is closer to $5.25, then the forward-adjusted diluted PE is ~16.3. This is still a reasonable valuation for a company that plays a critical role in the aerospace and defence sectors.

RTX has not amended its FY2023 adjusted diluted EPS guidance of $4.95 - $5.05. Using my recent $78 purchase price and the $5 mid-point of management's guidance, the forward adjusted diluted PE is ~15.6.

The valuation using broker estimates and my $78 purchase price is:

- FY2023: 19 brokers, mean estimate $5.01, low/high range $4.95 – $5.05. The valuation using the mean estimate is ~15.6.

- FY2024: 21 brokers, mean estimate $5.57, low/high range $4.70 – $5.87. The valuation using the mean estimate is ~14.

- FY2025: 16 brokers, mean estimate $6.65, low/high range $6.25 – $7.20. The valuation using the mean estimate is ~11.7.

Final Thoughts

I currently hold 508 shares and 425 shares in a 'Core' account and a 'Side' account in the FFJ Portfolio.

When I completed my January 2023 Investment Holdings Review and Mid 2023 Investment Holdings Review, RTX was not a top 30 holding; it was my 24th largest holding when I completed my Mid 2022 Investment Holdings Review. Despite my recent purchases, RTX very likely is still not a top 30 holding.

In multiple posts, I state my intention to increase my exposure to great companies that are experiencing what I consider to be short-term headwinds. RTX is such a company.

The impact on RTX's FCF resulting from the GTF issues is material. This, however, is already baked into RTX's current valuation.

Although RTX's share price can certainly drift lower from the current level, I know I can not perfectly 'time' my purchases. In the grand scheme of things, my purchases are relatively insignificant so even if RTX's share price were to decline further, I wouldn't lose sleep. Furthermore, I am not investing to make a 'quick buck'. My investment time horizon is decades (much longer than I anticipate I will be around).

In my opinion, investors need to step back and look at the big picture. RTX is a critical aerospace and defence company that provides advanced systems and services for commercial, military and government customers worldwide. It is highly unlikely this will come to a sudden end as evidenced by the recently awarded contracts and the record backlog.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long RTX.

Disclaimer: I do not know your circumstances and am not providing individualized advice or recommendations. I encourage you not to make investment decisions without conducting your research and due diligence. You should also consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.