Summary

- Prestige Brands is a small cap company engaged in the business of marketing, sales, manufacturing and distribution of well-recognized, brand name, over-the-counter (“OTC”) healthcare and household cleaning products.

- It crossed my radar in December 2011 when it acquired 17 over-the-counter medicine brands sold in North America from GlaxoSmithKline Plc for $660 million cash.

- I have regretted not investing in PBH given its appreciation in value since such time but the excessive leverage and pull back in stock price in recent months reaffirms that I made the right decision.

- PBH does not suit my reasonably conservative investor profile and I will not be taking a position despite the pullback in stock price over recent months.

Introduction

Prestige Brands Holdings, Inc. (NYSE: PBH) first raised my interest in December 2011 when it was announced that it had agreed to buy 17 over-the-counter medicine brands sold in North America from GlaxoSmithKline Plc for $660 million cash.

At the time I reviewed PBH’s most recent year-end financial statements (March 31, 2011) and most recent quarterly financial statements (September 30, 2011) and deemed PBH would be too highly leveraged and would not be suitable for my investor profile.

I will admit it has been extremely frustrating to watch PBH’s stock price appreciate from ~$12 in December 2011 to ~$56.75 in April 2016. I gained a bit of satisfaction when the stock price pulled back to ~$45 in October 2016 but then the stock ratcheted up to ~$57.40 in April 2017.

Despite the temptation to dip into PBH as a result of the meteoric rise in stock price from the time PBH first crossed my path, I never pulled the trigger.

I now see that PBH has retraced from the ~$57.40 level in April 2017 to ~$31.37 as I compose this post. This has prompted my curiosity and hence this article.

NOTE: PBH’s market cap is only ~$1.66B. This company is very different from the type of companies in which I invest but I am undertaking this review because some subscribers have asked that I periodically review smaller cap companies.

Business Analysis

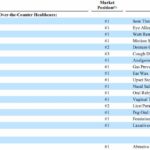

PBH is engaged in the business of marketing, sales, manufacturing and distribution of well-recognized, brand name, over-the-counter (“OTC”) healthcare and household cleaning products to mass merchandisers, drug, food, dollar, convenience, and club stores in North America (the United States and Canada) and in Australia and certain other international markets. It uses the strength of its brands, its established retail distribution network, a low-cost operating model and its experienced management team to its competitive advantage.

Source: PBH at Raymond James Institutional Investor Conference Presentation – March 6 2018

Further details on PBH’s brands can be found here.

The following schedule of PBH’s major brands as at FYE2017 reflects the brands which accounted for approximately 78.9%, 75.1%, and 70.8% of PBH’s net revenues for 2017, 2016, and 2015 during the period in which the respective brands were owned by PBH.

Source: PBH FY2017 10-K page 5 of 155

During 2017, Walmart Inc. (NYSE: WMT) accounted for ~21.1% of PBH’s gross sales and was the only customer that accounted for more than 10% of gross revenues.

PBH has indicated that in future periods its top 10 customers should continue to account for a large and potentially increasing portion of sales. As a result, the loss of one or more top customers, any significant decrease in sales to these customers based on changes in their strategies including a reduction in the number of brands they carry, the amount of shelf space they dedicate to store brand products, inventory management, or a significant decrease in PBH’s retail display space in any of these customers’ stores, could reduce PBH’s sales and have a material adverse effect on the financial condition and results of operations.

I encourage you to read the Risk Factors section within PBH’s FY2017 10K starting on page 18 of 155.

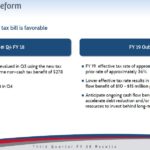

Impact of the Tax Cuts and Jobs Act (TCJ) on PBH

The permanent reduction to the federal corporate income tax rate resulted in a one-time gain related to the value of PBH’s deferred tax liabilities in Q3 2018, resulting in a net $278 million gain.

Source: PBH Q3 2018 Earnings Conference Call

Q3 2018 Results and FY2018 Outlook

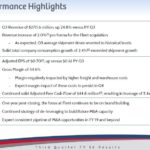

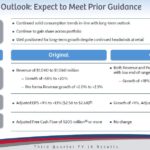

On February 1, 2018, PBH reported Q3 results and provided its outlook for the remainder of FY2018.

Source: PBH Q3 2018 Earnings Conference Call

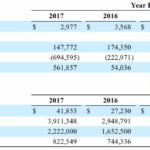

One of the metrics I closely look at is Gross Profit Margin (GPM). This metric indicates how good a company is at creating a product or providing a service compared to its competitors.

In Q3, PBH reported a 55.4% GPM (with adjusted GPM of 55.9% excluding adjustments related to the Fleet transition and integration) in the first 9 months of FY2018. This GPM falls short of that in the previous fiscal years. In fiscal 2014 – 2017 GPM was 56.5%, 56.84%, 57.95%, and 56.72%. Furthermore, if we look at the GPM solely for the first 9 months of FY2017, we see 57.7%.

Management has attributed the GPM year-over-year deterioration primarily to the addition of the high growth Fleet portfolio and the higher distribution costs realized in third quarter 2018.

PBH is scheduled to release its Q4 2018 results on May 10, 2018. I do not envision that within the last 3 months of FY2018 PBH will have been able to restore it GPM to the levels reported in the last few years.

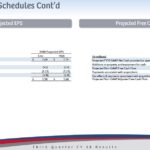

On May 11, 2017, PBH provided its outlook for FY2018. At the time it provided Fiscal 2018 GAAP EPS guidance of $2.50 – $2.60 and Non-GAAP Adjusted EPS guidance of $2.58 – 2.68.

On February 1, 2018, PBH reported GAAP Diluted EPS, Including Gain from Recent Tax Legislation, of $5.88 for Q3 Fiscal 2018 and Adjusted EPS of $0.70.

As noted in the previous section of this article, PBH revalued its net deferred tax liability Q3 using the new tax rates which resulted in a one-time non-cash tax benefit of $278 million. This has grossly distorted PBH’s Q3 results.

I encourage you to review the Appendix Schedule of the Q3 2018 PBH presentation which accompanied the Q3 2018 earnings conference call. The Reconciliation Schedules provide detail on PBH’s organic revenue growth, gross margin, and various other key metrics in addition to the following projected FY2018 EPS and Free Cash Flow.

Source: PBH Q3 2018 Earnings Conference Call

PBH expects an immaterial impact to its tax rate in Q4 2018. Going forward, however, PBH expects the impact of the TCJ to result in a reduction of its effective tax rate beginning in FY2019 to ~26% and a cash tax savings of approximately $10 – 15 million in FY2019 versus the prior year; PBH has indicated it expects to provide a finalized FY2019 estimated tax rate outlook when it reports its Q4 FY2018 results on May 10, 2018.

When PBH released its Q3 2018 results, it indicated that in the near-term it expects to continue to experience retailer inventory reduction headwinds. In addition, it expects increased freight and warehousing expenses experienced in Q3 to persist into Q4. As a result, PBH advised the investment community that it expects FY2018 results to be at the low end of its key FY2018 outlook metrics.

Source: PBH Q3 2018 Earnings Conference Call

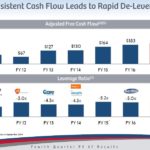

Leverage

Given that PBH employs a considerable amount of leverage to finance its growth, I am devoting a section of this article on this very topic.

I draw to your attention PBH’s historical leverage levels.

Source: PBH FY2017 10-K page 33 of 155

Details of the terms and conditions surrounding leverage can be found on page 63 of 155 of PBH’s FY2017 Annual Report wherein it is indicated that PBH is to have a leverage ratio of less than 7.75 to 1.0 for the quarter ended March 31, 2017. PBH’s leverage ratio requirement then decreases over time to 7.50 to 1.0 on September 30, 2017, 7.25 to 1 on March 31, 2018 and 0.25 to 1.0 per quarter until December 31, 2018 and 6.50 to 1 thereafter.

PBH continues to generate a reasonable amount of free cash flow which can be deployed toward debt repayment, servicing costs, and acquisitions.

Source: PBH Q4 2017 Earnings Conference Call

Credit Ratings

Moody’s currently rates PBH B2 which is the middle tier of the Highly Speculative rating description. In fact, this rating was downgraded in August 2014 from B1.

S&P Global rates PBH B+ which is the upper tier of the Highly Speculative rating description.

A company with these credit ratings is far too risky for me.

Valuation

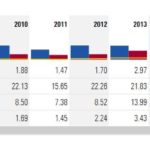

PBH has historically reported an elevated PE ratio (20s, 30s, and 40s). The current 4.3 PE ratio reported on various sites is misleading because these sites include the one-time $278 million TCJ gain in the earnings portion of the PE metric.

Source: Morningstar

If we exclude this extraordinary item, PBH’s projected Non-GAAP Adjusted EPS is ~$2.58 for FY2018. With PBH trading at $31.37, we get an adjusted PE ratio of 12.16. This is well below historical levels but given the other concerns I have addressed in this article, the low PE level is insufficient reason for me to initiate a position in PBH.

Dividend, Dividend Yield, Dividend Payout Ratio, Stock Splits, and Share Repurchases

PBH does not pay a dividend, has never split its stock, and it does it repurchase shares.

Insider Trading

I periodically check to see whether any insiders are making significant ‘Direct Purchases’ of their company’s stock. ‘Direct, Non Open Market’ transactions are not that important from my perspective since, in many cases, shares are being acquired through the exercise of stock options issued as part of an insider’s compensation package.

I note that in February 2018, the CEO, 3 Directors, and the Secretary acquired additional shares on the open market at prices slightly higher that the April 13, 2018 $31.37 closing stock price.

Although this is a positive sign it is insufficient for me to initiate a position in PBH.

Final Thoughts

I have little interest in investing in a company which is leveraged to the extent PBH is leveraged. While PBH is in compliance with the terms and conditions of its credit facilities, my investor profile is such that I prefer to invest in companies with strong free cash flow and leverage in the range of ‘No Leverage’ to ‘Moderate Leverage’.

I am also concerned about the weakened GPM. This might be an aberration and might be the result of the high growth Fleet portfolio and the higher distribution costs but I am not prepared to stick around to see whether PBH restores its GPM to higher levels.

While I was frustrated at having passed on PBH as a potential investment in late 2011/early 2012, PBH’s recent performance now reaffirms that I likely made a good decision to pass on investing in this company. The companies in which I invest are typically companies where I do not need to monitor their financial performance on a quarterly basis.

In the vast universe of possible companies in which to invest, I just do not see PBH as ranking in the top 100 attractive companies.

PBH is scheduled to release its FY2018 financial results on May 10, 2018. I will likely look at these results but am unlikely do write a follow up analysis.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I do not currently hold a position in PBH and do not intend to initiate a position within the next 72 hours.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.