I do not know when it will happen. I just know it will happen. That is why we must prepare for a stock market correction.

I have only been an equity investor since the late 1980s so I certainly do not have the experience and expertise of the world’s super investors. I have, however, witnessed many unfortunate investors in the early 1980s in Western Canada, October 1987, the early 1990s recession in Canada, the bursting of the .com bubble in 2000, and the Financial Crisis.

What I witnessed happen to many investors during these time periods serves as a constant reminder that:

- equity values are unpredictable;

- stock market corrections do not care if you are a ‘nice’ person or not.

October 1987 Market Crash

The mid-October 1987 market crash occurred seven months after I returned to the workforce after having completed my MBA. I distinctly remember one wealthy client heavily exposed to the equity markets. He was employing the use of debt and had pledged tens of millions of dollars of highly liquid securities to support his credit facilities.

At the time, we did not have the sophisticated technology to value his exposure and his collateral at the press of a button. Two senior lenders at the Commercial Banking Centre where I was stationed holed up in the board room for several days trying to determine the security shortfall. The rapid decline in the value of the securities pledged as collateral made this a very difficult exercise.

I do not remember exact figures but I know this client had to pledge tens of millions of additional collateral or risk the immediate liquidation of existing collateral at the most inopportune time.

Bursting of the .com Bubble

How do you explain to your spouse that you borrowed $40,000 to invest in Commerce One and your investment is now worth nothing? That is the predicament a former co-worker faced.

Financial Crisis

I distinctly recollect a Morningstar analyst recommending Wachovia, Bank of America, BB&T, and US Bank as good investments shortly before the Financial Crisis hit. That certainly was an untimely call.

Gauge Your Exposure

Looking at the following table it is clear not every Bear Market is alike. The duration, the percentage of recovery, and the number of months required for recovery differ all the time. We also see a recession did not accompany every bear market.

I do not know if we will experience another Financial Crisis. A stock market crash that could temporarily erase 20%-40% of the value of your equity portfolio, however, does not strike me as unreasonable. This might seem extreme but a pullback of this magnitude would not be an anomaly. Look at the Bear Market Recoveries table. There are 12 pullbacks of this magnitude since August 1956. Think it can’t happen again?

Amazingly, our perception changes when times are good versus when times are ‘not so good’. Envision a sizable market correction when your personal financial situation is less than ideal.

If you have a significant other and/or other family members depending on you, how would they feel if your equity portfolio experiences a significant correction?

I am not suggesting you rush out to recalibrate your holdings. Be methodical when you review your entire financial situation to determine if anything needs to be done to achieve greater peace of mind for when a stock market correction does occur.

Correlations Exist

A stock market correction typically does not occur in isolation. An exogenous factor (pandemic) often causes a broad market decline and price declines across a range of other assets (real estate, equity derivatives, and commodities).

Canada experienced recessions in the early 1980s and early 1990s. I witnessed the failure of many highly successful businesses because of a sharp decline in client activity and revenues.

I also know many people who lost employment because their employer fell on hard times. The worst case is where couples employed by the same company lost their employment…..at the same time (eg. Nortel)!

Control Your Expenses

Expense reduction is one of the biggest levers you can pull to keep your finances on track during challenging times. This immediately:

- increases the duration in which your emergency fund will last;

- helps offset any reduction in your pay; and

- enables you to take advantage of depressed asset prices.

I think people look to control their expenses far too late. The time to start expense control is when times are good….not when you are behind the ‘8 ball’.

Some people generate significant income but their lifestyle chews up all their income. They have very limited flexibility because a significant percentage of their expenses are ‘fixed’ (eg. mortgage payments, vehicle leases, memberships, alimony payments, etc.)

Everyone should keep a monthly budget/cashflow forecast to identify the top several discretionary expenses to immediately eliminate.

Perhaps the fancy coffees, drinks with co-workers after work, and frequent tanning sessions are really not necessary?

Earnings Security

Rarely is employment secure as it was a few decades ago.

You might work for an employer where turnover is common practice. Hiring ramps up when good times are anticipated but the ‘culling of the herd’ happens as soon as times get tough. Isn’t it interesting how stock market corrections coincide with tough times?

Anybody employed in an industry that is dying should be concerned. I certainly would not want to be employed in the coal mining sector!

Living in a community that relies heavily on few major employers is also extremely risky. The departure of a major employer in a small community wreaks havoc with the local employment market.

The time to reinvent yourself is not when there is a severe market dislocation. Continually upgrade your skill set or learn new transferable skills.

Invest Continually

The best time to invest is when everyone is panicking. So many people, however, do the exact opposite. The present is a perfect example. People who never invested in equities, or who had sworn off equity investing after suffering losses during The Financial Crisis, are now jumping into equities.

Take advantage of stock prices when valuations are depressed/reasonable. Stay away from the flavour of the day! Some people make tons of money with the flavour of the day. The retail investor is usually not part of the ‘money-making’ group.

Think the regulatory authorities are going to protect you? Not a chance. By the time they step into the equation, you have lost your money and you are lucky if you recover pennies on the dollar.

How will you react when the market crashes?

Your behaviour when times are terrible determines your success.

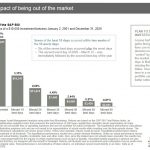

Source: J.P. Morgan Asset Management – Guide to Retirement – 2021 Edition

Implement and maintain a plan to stay the course even during a stock market correction. You may also want to make yourself accountable to someone who can encourage you when you feel like you want to ‘throw in the towel’.

Timing the Market Does Not Work

In my FFJ Portfolio – March 2021 Report I indicated ‘I have terminated the automatic dividend reinvestment for several of my holdings and am building my cash position.’

I also indicated in my Focus On Total Return To Better Manage Your Investments post that:

‘My wife and I need to start ‘melting down’ our Registered Retirement Savings Plan (RRSP) accounts. In a little over a decade, we must convert our RRSPs to Registered Retirement Income Funds (RRIFs); the mandatory conversion age is 71. If we fail to make RRSP withdrawals over the next several years, our mandatory minimum annual RRIF withdrawals will be taxed at the highest marginal tax rate.’

I am not timing the market because I decided to discontinue the automatic reinvestment of some of our quarterly dividends. I am merely building my cash position to fund the RRSP withdrawals which will be used to cover living expenses, taxes, and equity reinvestment in taxable accounts.

Nobody knows when the next stock market correction will occur so timing the market will not work. You just need to always be prepared for a stock market correction.

Things to Consider

Here are things to consider as you prepare for a stock market correction:

- The degree of risk you take with your investments. If you have a significant other you need to consider that person’s risk tolerance.

- If you employ risky or complex investment products, what happens if you ‘get hit by a bus’?

- Who will manage your financial affairs if a stock market correction occurs and you do not have the capacity to manage them?

- Create a budget based on your actual expenses and not just numbers ‘picked out of thin air’.

- Track actual versus forecast expenses to determine what to reduce/eliminate.

- Rank expenses by the degree of importance to aid in determining what to reduce/eliminate.

- Build an emergency fund based on budget results. I chose to have the liquidity to service at least 1 – 1.5 years of expenses.

- Create alternate sources of income.

- Are your skills transferrable? If not, upgrade your skills.

- Develop close friendships.

- Help those in need. Your time may come when you need support.

Final Thoughts

Proper planning is required to prepare for a stock market correction. Envisage scenarios in which various catastrophic events occur and the potential impact on your finances. This may be a difficult process but it is far better to plan for the worst when life is working in your favour rather than in times of stress.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclaimer: I do not know your circumstances and am not providing individualized advice or recommendations. You should not make any investment decision without conducting your research and due diligence.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with the company mentioned in this article.