Periodically I will skim through other blogs in search of companies which may warrant further investigation. Occasionally, however, I will stumble across an article in which a company’s common stock is recommended and I just have to shake my head as to what would possess someone to recommend to readers such a company as a potential investment. Case in point….Pitney Bowes Inc. (NYSE: PBI).

This is the final sentence of the article I just read.

‘With a tremendous dividend yield that is extremely safe, investors have an intriguing opportunity here. I think the recent pullback is extremely overdone, so Pitney Bowes looks like a top pick moving forward.’

Clearly, this individual is not alone in his thinking that PBI is a worthwhile investment since ~2 million shares on average trade hands daily.

Readers unfamiliar with PBI can find an overview of the business at the beginning of the FY2017 10-K.

PBI is a company that, at one time, created shareholder value. The challenge PBI has faced over the last couple of decades, however, is that the world has evolved and PBI has been unable to adapt.

This is a company that once traded at ~$63/share (December 1998). Today, PBI languishes around $9/share. This significant drop in share price is not because of any stock splits as PBI has had four 2 for 1 stock splits in its history but the most recent occurred January 20, 1998.

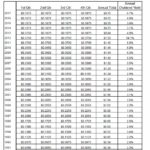

At one time PBI used to shower investors with double digit annual dividend growth. Between 1988 – 2000 shareholders were receiving ~13% - 15% annual dividend increases. In 2001, however, dividend growth dropped to ~1.8% when PBI increased its annual dividend from $1.14 to $1.16.

Dividend growth remained anemic until 2013 at which time PBI cut its annual dividend 50% from $1.50 to $0.75; the dividend was cut after the Q1 dividend payment which explains why the annual dividend in 2013 is $0.94 versus $0.75. As you can see from the following chart, PBI has frozen its annual dividend at $0.75 subsequent to this dividend cut.

Source: PBI Website

Source: PBI Website

Another warning sign that all has not been well with PBI for the past several years is the dividend yield. If we look at the annual dividend yield for PBI in 2008, we see a jump from 3.5% to 5.5%. The dividend yield continued its ascent until 2012 at which time it peaked at 14.1%. Whenever you see a dividend yield at such a level you can bet your bottom dollar there is a serious problem.

I recognize the low interest rate environment in recent years has been incentive for many investors to shift to high dividend yield stocks. Many investors who rely on investment income to service their ongoing obligations were accustomed to receiving an income stream from lower risk investments that met their income requirements. When these low risk investments matured, however, the interest rate environment had changed considerably from the time of the original investment. Instruments were maturing in a low interest rate environment which resulted in investors having to take on additional risk in order to receive comparable income.

While the 50% dividend cut in 2013 restored the annual dividend yield to a more realistic level, you can see that the dividend yield has subsequently crept up. The chart above reflects a 6.7% dividend yield for 2017 but that yield has risen even further and currently stands at ~8.4% based on the May 18, 2018 $9.14 closing stock price!

Risk adverse equity investors should pay close attention to credit ratings assigned by the major ratings agencies. The rationale for doing so is that an equity investor ranks very low from an investment recovery perspective in the event of default. If a company’s debt is rated ‘highly speculative’ then your equity investment is ‘very highly speculative’.

Moody’s initiated coverage September 2017 and has rated PBI’s long-term debt Ba1 since such time. This rating is the upper tier of the ‘non-investment grade speculative’ category.

S&P Global rates PBI’s short-term debt B and long-term debt BB+; the long-term debt rating was downgraded from BBB- on May 4 2018.

The B rating is the middle tier of the ‘highly speculative’ category and BB+ is the top tier of the ‘non-investment grade speculative’ category.

On occasion, I will invest in a company with a Ba1 Moody’s rating. An example of such an investment is Becton Dickinson (NYSE: BDX). In the case of BDX, I see a far greater likelihood of this credit rating improving over the next 2 -3 years than I do with PBI.

If you are an investor desiring to create long-term wealth while minimizing the effort required to maintain your investment holdings, you should seek to invest in companies which are growing revenue, profits, and free cash flow.

When I look at PBI I see that in FY1998 it generated ~$3.5B in Revenue, $0.576B in Net Income, $2.06 in Diluted EPS (includes $0.48 from discontinued operations), and $0.474B in free cash flow. The weighted average common shares outstanding amounted to ~279.7 million.

Ten years later (FY2008), PBI generated ~$6.26B in Revenue, $0.42B in Net Income, $2.13 in Diluted EPS (includes $0.13 from discontinued operations), and $0.753B in free cash flow. The weighted average common shares outstanding amounted to ~206.2 million.

Fast forward to FY2017 and you have a company which generated $3.55B in Revenue, $0.261B in Net Income, $1.39 in Diluted EPS (includes $0.00 from discontinued operations), and $0.325B in free cash flow. The weighted average common shares outstanding amounted to ~187.4 million.

The Balance Sheet certainly does not paint a rosy picture either!

- In FY1998, PBI had $1.713B in long-term debt versus $7.661B in Total Assets.

- In FY2008, PBI had $3.935B in long-term debt versus $8.736B in Total Assets.

- In FY2017, PBI had $3.559B in long-term debt versus $6.679B in Total Assets.

PBI has essentially ratcheted up its debt to repurchase shares.

While the historical data suggests PBI is a toxic investment, the recent data suggests PBI remains toxic. In the Q1 2018 10-Q, management indicated:

‘In the first quarter of 2018, total revenue increased 18% and our gross margin declined to 46.8% from 56.8% as compared to the prior year. We continued to see a shift in our overall portfolio to higher growth, digital and shipping solutions. The margins from these higher growth areas are lower than in our traditional markets, which are experiencing secular declines.’

Look at the following schedule of PBI’s long-term debt as at Q1 2018 and please pay special note to the comments just below the listing of PBI’s long-term debt!

Source: PBI Q1 2018 10-Q

We are now in a rising interest rate environment and PBI has debt maturing every year for the next 6 years. It remains to be seen at what interest rates PBI will be able to renegotiate whatever debt it does not retire prior to maturity. In my opinion, I strongly suspect interest rates will be higher than those on the table reflected above.

I recognize many investors will find PBI’s lofty 8.4% dividend yield far too appealing to pass up. In my opinion, however, another dividend cut within the next 2 – 3 years should not come as a surprise.

As I indicated in my recent Berkshire Hathaway article, if you are a risk adverse investor you should be concerned about investing in a company that relies heavily on debt; PBI is a minimally profitable company with a heavy debt load.

I am not nearly as optimistic as the blogger to whom I referred at the beginning of this article. In the entire universe of publicly listed North American companies there are certainly many that are far more appealing from a long-term wealth creation aspect. PBI might be a ‘dividend stock’ but it possesses many character traits that are the exact opposite of what you should seek from a long-term investment. Take a pass on PBI!

I hope you enjoyed this post and I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to [email protected]

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I do not hold a position in PBI nor do I intend to initiate a position within the next 72 hours.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.

Members of the FFJ community can access reports I generate on high quality companies which add long-term shareholder value. In an effort to help you determine whether my offering is of any value to you I am pleased to offer 30 days' free access to all sections of my site. No commitments. No obligations. That's 30 days from the time you register at absolutely no cost to you!