Contents

This Lockheed Martin (LMT) stock analysis is based on Q3 and YTD2021 results and FY2021 guidance released October 26, 2021.

On August 3, 2021, LMT shocked the investment community when it disclosed that LMT's Chief Financial Officer (CFO) decided to retire immediately due to personal reasons. In conjunction with this announcement, we learned LMT:

- had purchased group annuity contracts from Athene Holding Ltd., a leading financial services company specializing in retirement solutions, to transfer approximately $4.9B of LMT's pension obligations and related plan assets for ~18,000 U.S. retirees and beneficiaries to Athene. The contracts were purchased using assets from LMT's master retirement trust and no additional funding contribution was required as part of this transaction. In connection with this transaction, LMT has recognized a non-cash, non-operating settlement charge of ~$1.665B ($4.72/share) in Q3 2021. This charge is primarily related to the accelerated recognition of actuarial losses for the affected plans.

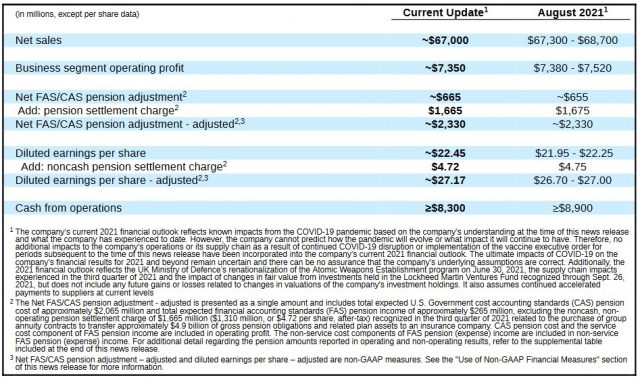

- FY2021 adjusted diluted EPS guidance was lowered from $26.70 - $27.00 to $21.95 - $22.25.

Following these announcements, LMT's share price trended lower until it reached ~$336 on September 21. The share price subsequently rebounded to ~$377 but upon the release of Q3 and YTD2021 results, the share price plunged to ~$332.

My underlying rationale for investing in LMT remains unchanged and I view the ~$44 drop in the share price on October 26, 2021 as an opportunity to acquire additional shares in this high-quality company that is facing short-term headwinds.

Lockheed Martin - Stock Analysis - Financials

Aerojet Rocketdyne Acquisition

On December 20, 2020, LMT announced it had entered into a definitive agreement to acquire Aerojet Rocketdyne Holdings, Inc. (AJRD) for $4.4B including the assumption of net cash. The transaction continues to move through the regulatory approval process and a Q1 2022 close is now anticipated.

Pension Trends

Following the surprise pension-related announcement in early August, LMT has included information on this topic in its Q3 Earnings Presentation (refer pages 17 - 20).

Interest rates have increased since FYE2020 and YTD2021 actual returns have been higher than previously expected. The trends include no required pension contributions through 2025 based on current assumptions.

Q3 and YTD Results

LMT's Q3 and YTD2021 results and FY2021 guidance are reflected in the October 26 Form 8-K and Earnings Presentation.

Q3 revenue of $16B was below expectation. This weaker than expected performance is attributed to larger-than-anticipated supply chain impacts across Aeronautics, Missiles and Fire Control and Space. These impacts span multiple suppliers and the expectation is for a gradual recovery from these disruptions over the next 12 - 18 months.

The supply chain disruptions experienced in Q3 underscore the fact many of LMT's suppliers are still dealing with the financial stress caused by the global COVID-19 pandemic. LMT's ability to generate strong cash from operations (it generated $1.9B) enabled it to continue its practice of accelerating payments to its supply chain; it disbursed $1.5B in accelerated payments at quarter-end. LMT expects to continue to experience impacts across its supply chain and now anticipates maintaining accelerated payments at the current $1.5B/quarter level through FYE2022.

In Q3, EPS included a non-cash charge of $4.72 related to the previously announced pension transaction (see above).

Outlook

Management has recently undertaken a reassessment of the company's 5-year business plan and has updated 2021 guidance and subsequent trend information. Strong cash flow generation is expected to continue but the forecast calls for a decline in sales in FY2022 relative to expected FY2021 sales. However, sales are projected to increase slightly in FY2023 with steadily increasing sales growth through 2026.

This sales trajectory reflects the following factors:

- the continuing effects of the ongoing COVID-19 pandemic and extended delivery timelines across LMT's supply chain;

- moderating growth rates in the U.S. defense budget;

- shifts in customer priorities driven by recent events such as the withdrawal of U.S. forces from Afghanistan;

- the renationalization of the Atomic Weapons Establishment program in the U.K.; and

- LMT's recently completed agreement with the F-35 joint program office on a rebaselining of aircraft deliveries under the production program.

LMT anticipates a ~$0.9B headwind from the renationalization of its work in support of the United Kingdom's Atomic Weapons Establishment program.

Looking ahead, management has identified the following 4 primary areas that underpin the longer-term growth forecast.

- the future growth areas within LMT's hypersonics portfolio. LMT is currently performing on 6 hypersonic programs and following the successful completion of ongoing testing and evaluation activity, multiple programs are expected to enter production between 2023 and 2026.

- growth within LMT's classified activity. Three of the 4 business areas are engaged in significant classified development programs. Pending the achievement of the objectives within those programs, LMT expects to begin the transition from development to production between 2023 and 2026.

- expected growth in the current programs of record. Multiple programs from each business area are entering growth stages. This includes the CH-53K heavy-lift helicopter, F-35 sustainment activity, increased PAC-3 production rates and the modernization and enhancements to the fleet ballistic missile.

- LMT is also in competition for several significant new business awards. These include the future vertical lift, Future Long-Range Assault Aircraft (FLRAA) and Future Attack Reconnaissance Aircraft (FARA) competitions, the next-generation interceptor program, and the KC-Y tanker program. These all represent meaningful opportunities to accelerate LMT's projected top-line growth with new long-term projects that are critical to the US's national defense.

The FLRAA program was initiated by the US Army in 2019 to develop a successor to the Sikorsky UH-60 Black Hawk utility helicopter as part of the Future Vertical Lift program. The UH-60, developed in the early 1970s, has been in service since June 1979.

The FARA program was initiated by the US Army in 2018 to develop a successor to the Bell OH-58 Kiowa scout helicopter as part of the Future Vertical Lift program. The OH-58 was retired in 2014; three prior programs for a successor were cancelled before reaching production.

Source: LMT - Q3 2021 Earnings Presentation - October 26, 2021

Despite the downward revision of some FY2021 metrics, LMT remains committed to driving strong shareholder returns in the short term and is adjusting its capital allocation strategy with two major objectives.

- expand reinvestment through capital projects and independent research and development for mid- to long-term enhanced growth performance.

- reward shareholders with continued dividend growth and meaningful increases in the share repurchase program.

To drive sustainable organic growth, LMT will continue making significant investments that include ~$2B of annual capital expenditures and ~$1.5B in annual independent R&D. LMT is also transforming its internal operations with a model-based engineering and enterprise architecture and is building digital factories of the future.

After making these significant investments, LMT expects to have substantial free cash flow (FCF) available to return to shareholders through dividends and share repurchases.

Lockheed Martin - Stock Analysis - Credit Ratings

LMT's senior unsecured domestic currency debt ratings are the lowest tier of the upper-medium investment-grade level.

- Moody's: A3

- S&P Global: A-

- Fitch: A-

These ratings define LMT as having a STRONG capacity to meet its financial commitments. It is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

Dividend and Dividend Yield

LMT's dividend history is accessible here.

In the 3 months ending September 26, LMT distributed cash dividends of $0.718B compared to $0.672B in Q3 2020 and distributed $2.178B in the first 3 quarters of 2021 versus $2.036B in the same timeframe of FY2020.

LMT is committed to rewarding shareholders by way of dividend increases. On September 23, 2021, LMT announced an increase in its quarterly dividend from $2.60 to $2.80 effective December 27, 2021. This dividend is payable to holders of record as of the close of business on December 1, 2021.

With shares trading at ~$332, the $2.80 quarterly dividend yields ~3.4%.

LMT generates ample Operating Cash Flow and Free Cash Flow so the dividend is well covered.

Any time I read that a company intends to repurchase shares I hope the share buybacks occur when the company's share price is depressed. I, therefore, view LMT's depressed share price as a 'plus'.

LMT has been a prolific buyer of its issued and outstanding shares. The weighted average number of issued and outstanding shares in FY2011 - FY2020 (in millions) is 340, 328, 327, 322, 315, 303, 291, 287, 284, and 281. In Q3 2021 this has been reduced to 278.5 and 274 at the end of the quarter.

In conjunction with the September 23, 2021 dividend increase announcement, LMT announced that its board authorized the purchase of up to an additional $5B of LMT common stock under its share repurchase program. With this increase, the total authorization for future repurchases under the share repurchase program is ~$6B; these share repurchases are expected to occur over the next 12 - 18 months.

Lockheed Martin - Stock Analysis - Valuation

When I wrote my July 26, 2021 post, LMT was trading at ~$368. Using the $26.85 mid-point of management's FY2021 guidance I arrived at a ~13.71 forward adjusted diluted PE.

In FY2013 - 2020, LMT's diluted PE levels were 16.02, 19.47, 19.27, 18.81, 26.04, 24.80, 18.51, and 15.16.

In addition, FY2021 and FY2022 guidance from 24 brokers at the time of my prior post was:

- FY2021 - mean of $26.68 and low/high of $26.46 - $27.25. Using the current share price and the mean, the forward adjusted diluted PE is ~13.8.

- FY2022 - mean of $27.89 and low/high of $26 - $29.77. Using the current share price and the mean, the forward adjusted diluted PE is ~13.2.

With shares currently trading at ~$332 and FY2021 diluted EPS guidance of ~$22.45, the forward diluted PE is ~14.8. Adjusted diluted EPS guidance is ~$27.17 thus giving us a forward adjusted diluted PE of ~12.2.

Although some brokers may not have yet amended their guidance to reflect the most recently released financial results, the two discount brokerage platforms I use currently reflect the following broker guidance:

- FY2021 - 17 brokers - mean of $22.78 and low/high of $21.88 - $27.17. Using the current share price and the mean, the forward adjusted diluted PE is ~14.6.

- FY2022 - 20 brokers - mean of $27.19 and low/high of $25.02 - $29.15. Using the current share price and the mean, the forward adjusted diluted PE is ~12.2.

- FY2023 - 14 brokers - mean of $28.52 and low/high of $26.88 - $30.05. Using the current share price and the mean, the forward adjusted diluted PE is ~11.64.

I am reluctant to place much reliance on earnings estimates the further out we go on the calendar, and therefore, the FY2023 earnings estimates are not factored into my investment decisions process.

Lockheed Martin - Stock Analysis - Final Thoughts

LMT is a play on the defense budgets of the US and its allies which is a function of each nation's wealth and perception of danger.

The allocation of these budgets is a political process and is difficult to predict. Investors should, therefore, favour companies like LMT which historically win a steady stream of contracts that are fulfilled over decades. For example, LMT's F-35 accounts for ~30% of its revenue and this contract will be sustained through 2070.

This is not a high-growth business in that margins are regulated, markets are mature, and customers pay for research and development. With long-term revenue visibility, the likes of LMT generate significant free cash flow which can be returned to shareholders.

On the Q3 earnings call, management indicated its stock is trading at levels well below the company's intrinsic value. Given this, the $6B planned share buybacks will be executed as conditions warrant.

Capital will be allocated to the highest return opportunities with investments being prioritized based on FCF per share. This includes opportunistic accretive bolt-on acquisitions, additional increases to LMT's current share repurchase authorization, and the continued reinvestment in the business to drive long-term growth.

I remain confident in LMT's long-term outlook and with the ~$44 decline in LMT's share price following the release of Q3 and YTD results, I have acquired additional shares in the 'Core' account in the FFJ Portfolio.

Stay safe. Stay focused.

I wish you much success on your journey to financial freedom!

Note: Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long LMT.

Disclaimer: I do not know your circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decisions without conducting your research and due diligence. You should also consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.