There are several reasons to like Lockheed Martin Corporation (LMT) as a long-term investment. The company is growing, it is consistently profitable, it generates strong free cash flow, it is aggressively repurchasing shares, it has an attractive dividend yield, and it is attractively valued.

As a long-term investor I see much to like about LMT and have acquired additional shares for one of the ‘Core’ accounts within the FFJ Portfolio.

In the current environment there are few fairly valued high quality companies which have the potential to generate attractive long-term investment returns. While there are many high quality companies in which to invest, investing in a great company when its valuation has become detached from the underlying fundamentals is likely to result in sub-standard investment returns over the long-term.

For example, yesterday I wrote an article disclosing that I had written short-term out-of-the-money covered calls on Nike, Inc. (NKE). There is no disputing that NKE is a great company but paying ~40 times a $1’s worth of earnings on a company which generates just under $40B in annual sales (ie. this is NOT a micro cap or small cap company) seems like a stretch if you want to generate attractive long-term investment returns.

You then have other companies which have never generated free cash flow or a profit from normal business operations yet investors have bid up the share price to ridiculous levels. In some cases, you can not even determine the company’s valuation because there are no ‘earnings’. There are countless companies that fall in this bucket but one of the worst offenders has to be Nikola Corporation (NKLA). This company is such a toxic waste that it rolled its electric truck down a hill to give the investment community the impression it had a functioning prototype. The company is worthless but investors have bid up the share price to the point where the market value is in excess of $9B. This goes to show that what investors are prepared to pay for a share of a company can have to bearing on how profitable the company truly is.

Then you have companies which were once ‘okay’ companies but the world changed and they did not adapt. A good example of this is Pitney Bowes (PBI). Although this company is a ‘financial basket case’, investors continue to invest in this company. This is likely because of the lofty dividend yield (see here too) but delve into the numbers and we see that PBI has cut its quarterly dividend twice within the past decade. In fact, the company does not reflect its dividend history on its website because it is probably so embarassed about its dismal dividend track record.

We also have companies with very attractive valuations but they are ‘value traps’. Their valuation is so low because the company is not growing and is likely to continue to just ‘plod along’.

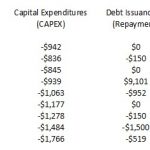

On the other hand, we have Lockheed Martin Corporation (LMT). In LMT we have a company generating strong free cash flow (FCF) for equity shareholders which can be used to repurchase shares, increase the dividend, retire debt, and/or grow the company…and this is after CAPEX required to keep the business operational!

Looking at share count we see the following weighted average number of diluted outstanding shares (in millions) for 2012 – 2020: 328, 327, 322, 315, 303, 291, 287, 284, and 281.

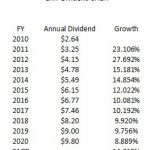

We can also see how the dividend has grown over the years.

After the March 26th $2.60 dividend distribution there will be 2 more quarterly dividends at the $2.60 level. It would not surprise me if LMT were to declare a $2.80 quarterly dividend in late September.

On the debt front, we also see from above how LMT has been reducing its debt. The ~$9B in new net debt in 2015 is when LMT acquired Sikorsky from United Technologies (now Raytheon Technologies).

Furthermore, we have a company which is very attractively valued. During the 2012 – 2020 timeframe, LMT generated diluted EPS of $8.36, $9.13, $11.21, $11.46, $17.07, $6.75, $17.59, $21.95, and $24.30. With shares having closed at ~$337.23 on February 4th, LMT’s valuation based on FY2020 results is ~13.9.

Looking forward, we see that LMT provided adjusted diluted EPS guidance for FY2021 in the $26 – $26.30 range. If we use the midpoint of $26.15 and the current share price we get a forward adjusted diluted PE of ~12.89. When we compare this valuation with LMT’s PE for the 2011 – 2020 timeframe (10.04, 11.04, 16.02, 19.47, 19.27, 18.81, 26.04, 24.80, 18.51, and 15.16) we see that an uptick in LMT’s PE to 14 is not a remote possibility; I touched upon LMT’s valuation in this previous article.

Final Thoughts

I like LMT as a long-term investment and on February 4th acquired additional shares at $333.48. With today’s purchase I now hold 321 LMT shares in one of the ‘Core’ accounts. With a March 1st date of record to be eligible to receive the March 26th $2.60 quarterly dividend payment, I will receive dividend income of $709.41 which is after a 15% withholding tax is deducted from my $834.60 dividend payment.

I fully expect LMT to appreciate significantly in value over the next several years and encourage you to conduct your own analysis to determine whether LMT would be a worthwhile long-term investment for you.

Stay safe. Stay focused.

I wish you much success on your journey to financial freedom!

Note: Thanks for reading this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long LMT.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.