Before initiating a position in Lockheed Martin (LMT), I had exposure to the aerospace and defence industry through share ownership in Raytheon Technologies (RTX) and Heico Corporation (HEI-a). However, I expected the number of global ‘hot spots’ to increase and wanted more exposure to this industry.

Looking at The Council on Foreign Relations website’s Global Conflict Tracker, we see several current conflicts are in regions where conflicts have been ongoing for years; resolution to these most (all?) conflicts in the foreseeable future is highly unlikely. Given this, I expected a steady supply of growth opportunities for industry participants.

As a testament to ‘growth opportunities’, the US administration released preliminary details of the FY2024 President’s Budget Request (PBR) in early March. This budget proposal reflects a heightened emphasis on defence and security cooperation with allies. The FY2024 Department of Defense budget request is $842B – an increase of $25B or 3% over the FY2023 enacted funding.

The PBR includes continued investments in key technology development efforts such as conventional prompt strike, long range Hypersonic weapon, next generation interceptor, Hypersonic defense, bomb defense system and other space programs. Furthermore, key technology areas aligned with LMT investment priorities received increased funding to include microelectronics, 5G technologies and joint all-domain operations.

What is also appealing is that:

- the United States is the world’s largest ‘customer’; and

- ‘product development’ costs are primarily funded by governments.

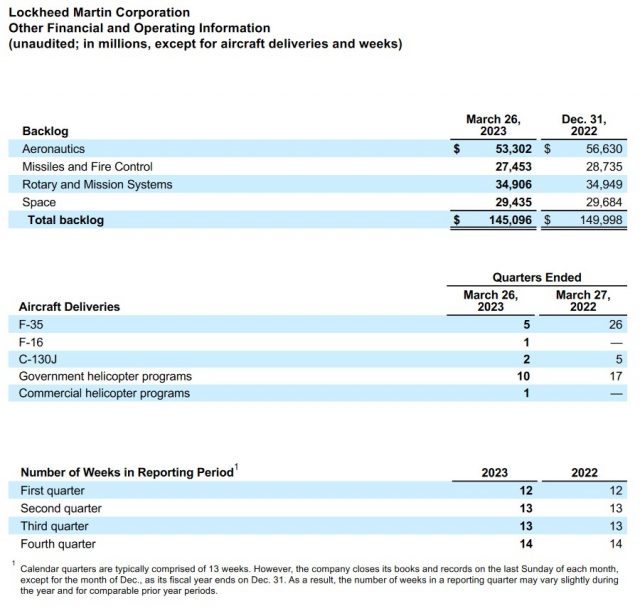

I also reviewed the order backlog over several years and concluded the probability of business ‘drying up’ to be remote.

After looking at various industry participants, I settled on LMT and initiated a 200-share position in November 2020.

I subsequently wrote various LMT-related posts that are accessible through the Archives section of this site. In some of these posts, I disclose the purchase of additional shares; my LMT exposure now stands at 459 shares in a ‘Core’ account within the FFJ Portfolio.

Unfortunately, LMT’s valuation at the time of my more recent posts has led me to refrain from acquiring additional shares; my most recent LMT post was on January 25, 2023.

With the April 18 release of Q1 2023 results and reaffirmed FY2023 outlook I revisit this holding to determine if I should acquire additional shares.

Business Overview

Investors unfamiliar with LMT should review its website, Part 1 of the 2022 Form 10-K, and the 2023 Proxy Statement.

The Risk Factors section within LMT’s Form 10-K provides a good overview of various risks that could impact its business, financial condition, operating results and cash flows.

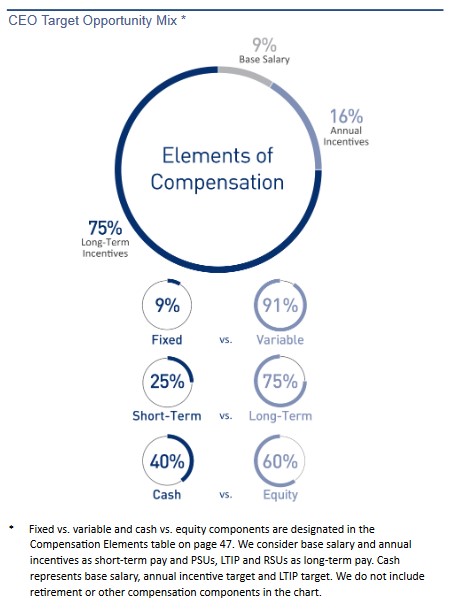

CEO Compensation

Of particular interest to me is a CEO’s compensation structure. I favour a structure where the compensation structure is aligned with the interests of long-term shareholders.

I like the target pay mix of LMT’s CEO because:

- it is predominantly variable;

- the variable elements of the compensation package tie into the company’s long-term success and sustainable long-term total shareholder returns.

A comprehensive compensation overview commences on page 49 of the 2023 Proxy Statement. We see from the following that 91% of the CEO’s compensation is variable and 75% is tied to LMT’s long-term performance.

Source: LMT – 2023 Proxy Statement

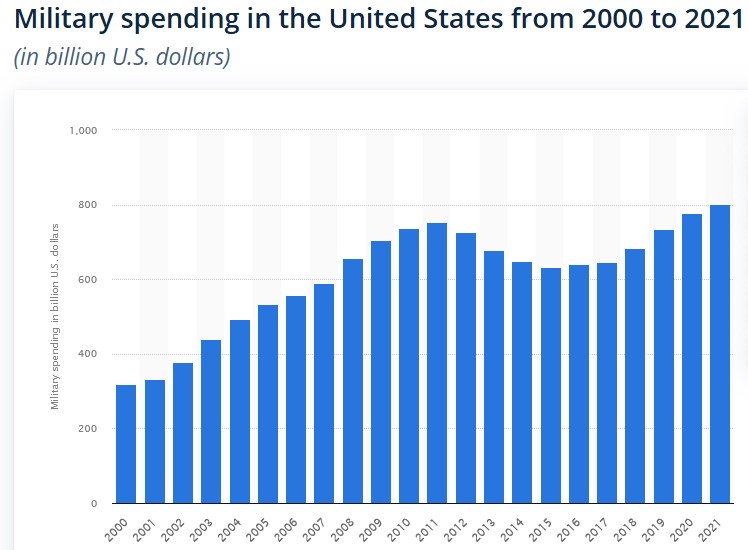

US Military Spending

The following reflects US military spending from 2000 to 2021.

Source: Statista Inc.

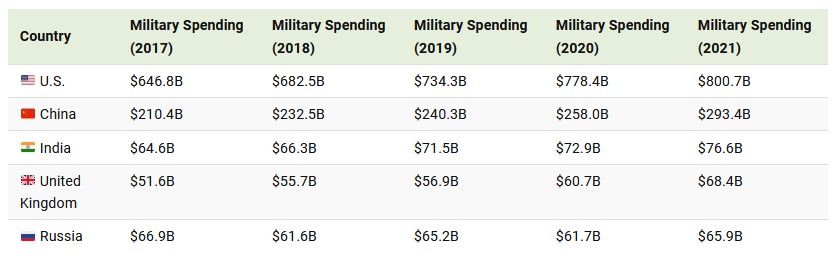

The following table reflects military-related spending from 2017 to 2021, and therefore, the data is slightly outdated. US military-related spending, however, most likely continues to exceed that of the next 4 largest military-spending countries.

In my January 25 post, I note that the National Defense Authorization Act (NDAA) supported a total of $857.9B for national defence in 2023 representing a ~8% increase relative to FY2022 levels; some analysts think this could surpass $1T in the coming years. This consists of ~$816.7B for the Department of Defense (DOD) and $30.3B for national security programs within the Department of Energy (DOE). (Summary of the Fiscal Year 2023 NDAA) As noted above, the FY2024 Department of Defense budget request is $842B so we are not far off from $1T.

Source: Visual Capitalist

Financials

Q1 2023 Results

LMT’s Q1 2023 results and FY2023 guidance are accessible in the Quarterly Results section of LMT’s website.

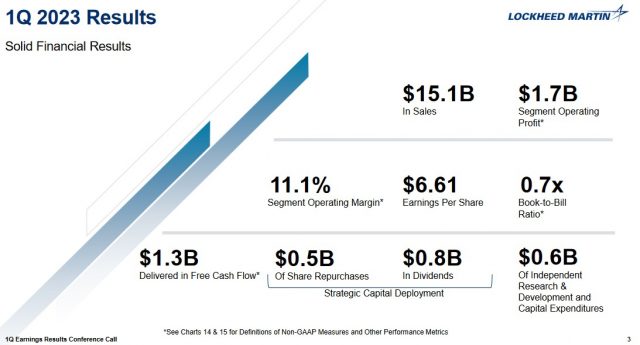

The following is a recap of LMT’s Q1 2023 results.

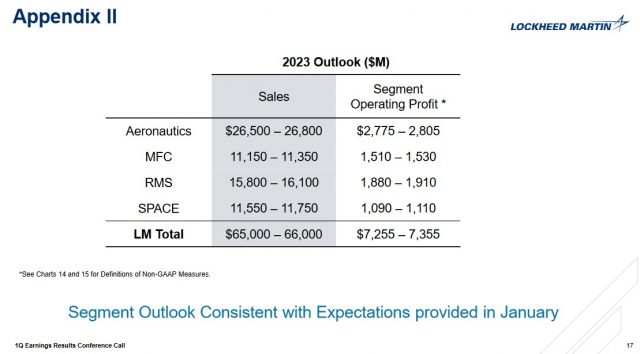

LMT’s Q1 2023 sales of $15.1B were led by ~15.6% YoY growth in the Space segment. Segment operating margin of 11.1% was led by Missiles and Fire Control at 15.8%.

Free cash flow (FCF) grew ~11% to $1.3B. This, combined with the lower share count, contributed to a strong YoY FCF per share growth.

On the capital deployment front, LMT returned $1.3B or 101% of its FCF to shareholders in Q1. On the earnings call, management stated that LMT remains focused on the long-term strategy of growing FCF per share; the plan is to deliver ~110% of FCF to shareholders in 2023 through dividends and buybacks.

LMT continues to report a strong backlog of orders and continues to be awarded significant contracts. One recently awarded contract is the multiple-year production contract for Joint-Air-to-Ground Missiles and HELLFIRE missiles that was announced on April 3. The Program Year 1 award total value is $0.439B. Because this is a multiple-year award, the contract offers 3 additional follow-on awards starting in late 2023, allowing for a total contract value of up to $4.5B over the next 4 years.

While aircraft deliveries in Q1 2023 were well below the Q1 2022 levels, LMT is confident that deliveries in the remaining 3 quarters will enable it to meet its FY2023 targets.

Free Cash Flow (FCF)

In Q1 2023, LMT continued to generate strong FCF thus enabling it to repurchase ~$0.5B of issued and outstanding shares and to distribute ~$0.784B in dividends.

Source: LMT – Q1 2023 Earnings Presentation – April 18, 2023

The $1.27B of FCF generated in Q1 is after LMT incurred ~$0.294B in capital expenditures AND more than $0.6B in accelerated payments to suppliers.

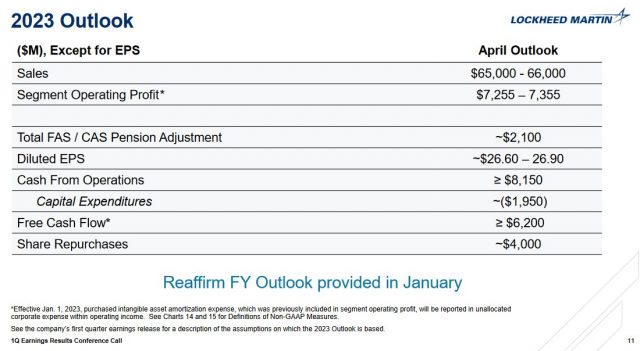

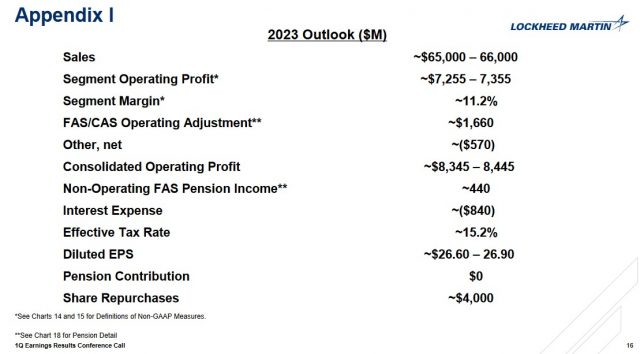

FY2023 Outlook

LMT’s FY2023 outlook is unchanged from that released on January 24, 2023. A commentary on LMT’s FY2023 Outlook is provided in my January 25, 2023 post.

Source: LMT – Q1 2023 Earnings Presentation – April 18, 2023

Source: LMT – Q1 2023 Earnings Presentation – April 18, 2023

Source: LMT – Q1 2023 Earnings Presentation – April 18, 2023

Credit Ratings

LMT’s senior unsecured domestic currency debt ratings are unchanged from those at the time of my January 25 post; all 3 rating agencies also continue to assign a stable outlook.

- Moody’s: A3

- S&P Global: A-

- Fitch: A-

These ratings are the lowest tier of the upper-medium investment-grade level. They define LMT as having a STRONG capacity to meet its financial commitments. LMT is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

Dividends and Share Repurchases

Dividend and Dividend Yield

LMT is committed to rewarding shareholders through dividend increases (see dividend history).

Investors can expect LMT to declare its 3rd consecutive $3.00/share quarterly dividend within the next few days.

The following reflect the dividend yields at the time of prior reviews.

- January 25, 2022: shares were trading at ~$380 and the $2.80 quarterly dividend yielded ~3%.

- April 19, 2022: shares were trading at ~$460 and the $2.80 quarterly dividend yielded ~2.4%.

- July 19, 2022: shares were trading at ~$390 and the $2.80 quarterly dividend yielded ~2.9%.

- October 18, 2022: shares were trading at ~$432 and the $3.00 quarterly dividend yielded ~2.78%.

- January 25, 2023: shares were trading at ~$452.50 and the $3.00 quarterly dividend yielded ~2.65%.

LMT’s ~$501.50 share price as I compose this post is close to the 52-week high and the $3.00 quarterly dividend yields ~2.4%.

Share Repurchases

LMT is a prolific acquirer of its shares. The weighted average number of issued and outstanding shares in FY2011 – FY2022 (in millions rounded) is 340, 328, 327, 322, 315, 303, 291, 287, 284, 281, 277.4, and 264.6. On December 31, 2022 (FYE2022), this had been reduced to 254. In Q1 2023, the weighted average was 255.7 and at the end of the quarter, this had been further reduced to 254.

While LMT repurchased ~$0.5B of its shares in Q1 2023, it also issued ~$0.057B of shares as part of its stock-based compensation package.

On October 17, 2022, LMT’s board authorized the purchase of up to an additional $14B of LMT common stock under its share repurchase program. This multi-year share repurchase program follows the substantial completion of purchases of common stock under the prior repurchase authorization.

In Q4, LMT entered into a $4B accelerated share repurchase program, bringing the total share repurchases for the year to ~$7.9B. LMT plans to complete the remaining ~$10B repurchase authorization over the next few years with funding of the repurchases coming through a combination of cash on hand and debt.

Valuation

In FY2013 – FY2022, LMT’s diluted PE levels were 16.02, 19.47, 19.27, 18.81, 26.04, 24.80, 18.51, 15.16, 16.38, and 22.37.

When I wrote my January 25 post, LMT’s share price was ~$452.50 and management’s FY2023 adjusted diluted EPS forecast was ~$26.60 – ~$26.90. This gave us a forward-adjusted diluted PE of ~17 based on the mid-point of guidance.

I expected broker guidance to change over the coming days. However, using the current forward-adjusted earnings estimates from the two discount brokerage platforms I use, LMT’s forward-adjusted diluted PE levels were:

- FY2023 – 24 brokers – mean of $26.77 and low/high of $22.72 – $27.64. Using the current share price and the mean, the forward adjusted diluted PE is ~16.84.

- FY2024 – 23 brokers – mean of $28.05 and low/high of $24.32 – $29.52. Using the current share price and the mean, the forward adjusted diluted PE is ~16.1.

- FY2025 – 13 brokers – mean of $28.60 and low/high of $25.61 – $32.05. Using the current share price and the mean, the forward adjusted diluted PE is ~15.8.

Management’s current FY2023 guidance is unchanged from ~$26.60 – ~$26.90 yet the share price has surged to ~$501.50. This gives us a forward-adjusted diluted PE of ~18.75 based on the $26.75 mid-point of guidance.

Using the current forward-adjusted earnings estimates from the two discount brokerage platforms I use, LMT’s forward-adjusted diluted PE levels are:

- FY2023 – 23 brokers – mean of $26.78 and low/high of $25.47 – $27.20. Using the current share price and the mean, the forward adjusted diluted PE is ~18.7.

- FY2024 – 22 brokers – mean of $27.97 and low/high of $26.17 – $28.89. Using the current share price and the mean, the forward adjusted diluted PE is ~17.9.

- FY2025 – 17 brokers – mean of $28.81 and low/high of $25.63 – $32.05. Using the current share price and the mean, the forward adjusted diluted PE is ~17.4.

I considered LMT to be overvalued when the share price was ~$50 lower than the current share price. The share price increase coupled with no changes to LMT’s FY2023 earnings outlook means shares are even more overvalued than before.

Final Thoughts

LMT was my 7th largest holding when I completed my January 2023 Investment Holdings Review; it remains a top 10 holding.

As much as I like LMT’s long-term outlook and wish to increase my exposure, I can not justify the current valuation. Using management’s FY2023 guidance, a share price below ~$430 is when I would consider acquiring additional shares.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long LMT.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.