Contents

The risks some investors take never cease to amaze me. They will invest in highly speculative unprofitable companies that consistently generate negative Free Cash Flow (FCF) but will overlook Intuitive Surgical (ISRG) with its impeccable Balance Sheet. Just because ISRG is a high-quality company, however, does not mean investors should overlook valuation!

I last reviewed ISRG in this July 22, 2023 post at which time I concluded shares were overvalued. With the release of Q3 and YTD2023 results on October 19, I revisit this existing holding and come to the same conclusion.

Business Overview

Refer to the company's website and 'Item 1 - Business' in the FY2022 Form 10-K for a good overview of the company.

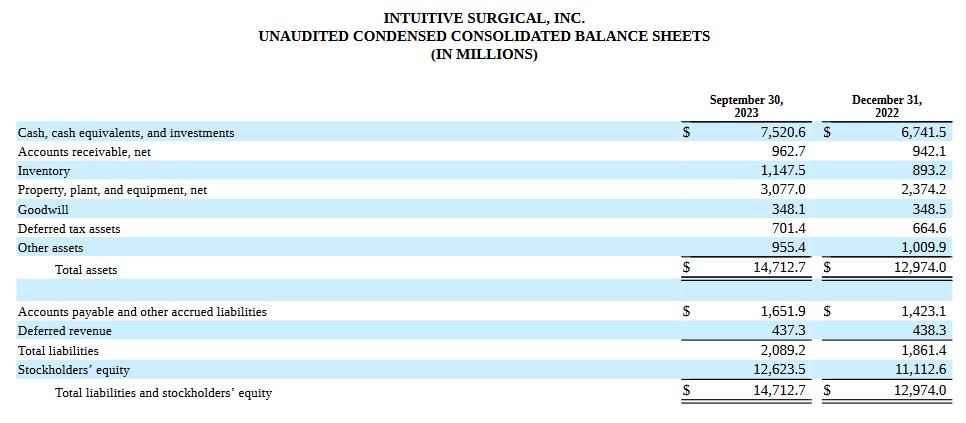

An immediate observation I made when looking at ISRG as a potential investment was how little leverage the company employs. Looking at ISRG's Q3 numbers, we see $7.521B in cash, cash equivalents, and investments; details are found in Note 3 - Financial Instruments starting on page 8 of 61 in the Q3 Form 10-Q.

Its total liabilities, however, are ~$2.089B.

ISRG could eliminate 100% of its liabilities and still have ~$5.432B in cash, cash equivalents, and investments.

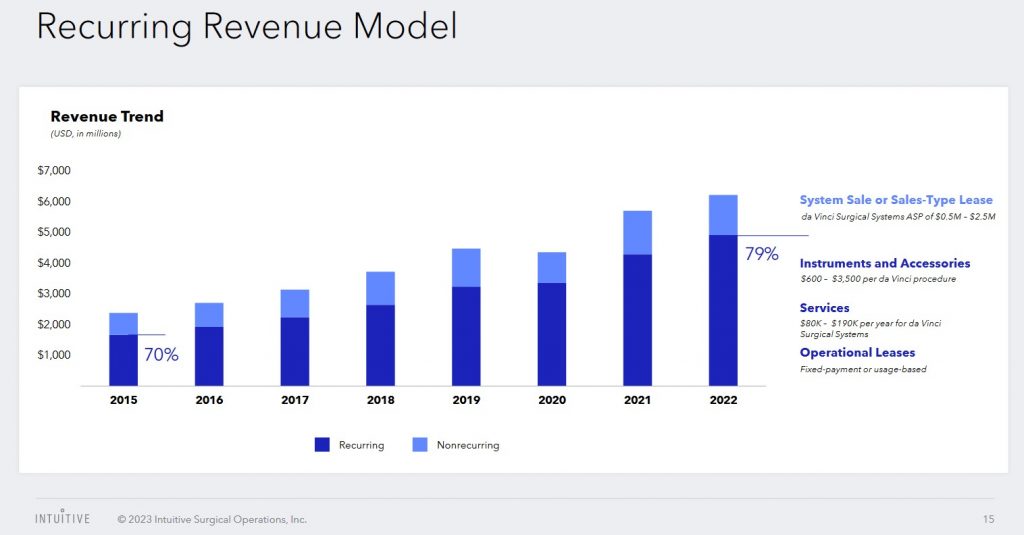

A second observation I immediately made was the extent to which ISRG's revenue is recurring. A high degree of recurring revenue reduces earnings volatility. Furthermore, it creates a stronger relationship between ISRG and its customers thus leading to a reduction in time and money to acquire new customers.

CEO and NEO Compensation

I touched upon this topic in my April 19 post.

Financials

Q3 and YTD2023 Results

I reference ISRG's Q3 2023 Form 8-K and Form 10-Q. In addition, I encourage you to review the supporting financial data that reflects quarterly data dating back to Q1 2021.

Q3 revenue of ~$1.744B was a ~12% YoY increase. This revenue growth was driven by procedure growth, partially offset by an 11% decline in systems revenue due to the significant increase in the mix of operating lease arrangements.

Recurring revenue in Q3 grew 21%, pro forma operating margin was 36%, and pro forma EPS increased 23% over Q3 2022.

In Q3, ISRG continued to see double-digit growth albeit at a modestly lower growth rate as compared to Q2.

In Q2, ISRG highlighted that the growth rate in bariatric procedures in the U.S. had slowed given patient interest in weight loss drugs. Bariatric procedures, however, represent ONLY 4% - 5% of total global procedures. Based on third-party data, ISRG believes it continues to gain market share in the bariatric surgical segment.

In typical fashion, many people turn to medication to address their health issues. Quite often these medications are not a permanent fix and they often lead to other complications.

In the case of people who have difficulty controlling their weight, many are turning to Ozempic and Wegovy. Unfortunately, drugs often have very unpleasant side effects such as nausea, stomach pain, constipation, diarrhea and vomiting. In some cases, these negative side effects are even worse according to a local registered dietician. This registered dietician has stated that some of her patients are experiencing pancreatitis and gallbladder issues which has led to hospitalization. In rare instances, some patients have reported severe gastrointestinal issues, including gastroparesis, which is a paralysis of the stomach. Furthermore, weight loss medication does not result in permanent weight loss. Unless a patient continues to take Ozempic and Wegovy and is willing to assume the risks that come with long-term use of this medication, it is likely they will eventually need to reconsider a bariatric procedure.

On the Q3 earnings call with analysts, ISRG's executive vice president and chief medical officer who is a bariatric surgeon, stated:

'We will see patients who are considering or are in the pipeline for bariatric surgery going to try the drug. However, given compliance issues, costs, side effects, we expect that many of them will not stay on the drug for longer than a year or 2. And at that time, we'll consider bariatric surgery. So I think overall, we'll see an increased interest in bariatric surgery, but that will get delayed in the short term.'

While bariatric procedures growth has decelerated as people resort to the use of medication, the adoption and market share of robotics are still growing. ISRG's Ion platform, a robotic-assisted bronchoscopy platform for minimally invasive peripheral lung biopsy, is experiencing rapid growth. In Q1 2021, its Ion Installed System Base was 50 units. At the end of Q3 2023 this had grown to 490.

In Q3, ISRG reported strong growth in procedures, new system placements and steady growth in utilization amid challenging market conditions that are largely consistent with those experienced in Q2.

ISRG reported 19% da Vinci procedure growth in Q3 with areas of strength being general surgery for benign conditions. The increase in procedures was particularly evident in the United States with broad regional growth in Germany, Japan, the U.K. and India; China procedure growth was in line with ISRG's global average in Q3. U.S. dermal surgery procedure growth was led by cholecystectomy and colon resection.

Ion procedures continue to strengthen with 125% growth in the quarter.

The total system units placed in Q3 was 312 compared with 305 systems in Q3 2022 and there were 69 Trade-Ins and Retirements versus 76 in Q3 2022.

ISRG's clinical installed base now stands at:

- 8,127 multiport da Vinci systems;

- 490 Ion systems; and

- 158 single-port da Vinci systems.

Trends reflect demand for additional capacity in multiport, growing interest in ISRG's Ion system and a modest acceleration for Single Console X Systems and Single Console Xi Systems placements.

The proportion of leases for new capital placements accelerated in the quarter with the U.S. using the highest leasing rates. Management is of the opinion the acceleration in leasing reflects the convenience of ISRG's leasing program. While leasing reduces quarterly revenue relative to capital purchase, the total economics are healthy for ISRG and its customers. This is because leasing allows customers to build clinical capacity as required and provides predefined pathways for ISRG's new technology as it enters the market.

The pro forma gross margin in Q3 was 68.8% versus 68.5% in Q2 and 69.8% in Q3 2022. The pro forma gross margin in Q3 2022, however, included a one-time benefit of ~50 bps related to the favourable conclusion of certain indirect tax matters.

Inventory increased to approximately 180 days in Q3. This is higher than historical averages and is driven by:

- a modest increase in inventory targets given supply chain stress over the last couple of years; and

- because significant capital investments are being made in manufacturing facilities and capacity. ISRG is building bridge inventory to facilitate an elevated number of line transfers to new locations.

The plan is to have inventory levels of inventory into 2025 relative to historical norms.

The pro forma operating expenses in Q3 increased 8% YoY primarily due to higher headcount-related costs. In Q3, headcount increased by 489 employees of which ~275 were for ISRG's manufacturing operations in support of revenue growth.

Pro forma other income in Q3 was $58 million compared to $42 million in Q2 2023 and $7 million in Q3 2022. This other income primarily consists of interest income. The increase as compared to prior periods is attributed to higher interest rates and higher average cash and investment balances. Pro forma other income in Q3 2022 also reflected higher than typical foreign exchange losses resulting from remeasurement of the balance sheet as a result of the strengthening U.S. dollar.

Capital expenditures in Q3 were $0.256. This was primarily comprised of infrastructure investments to expand ISRG's facilities footprint and increase manufacturing capacity.

The pro forma effective tax rate in Q3 was 22.5%.

Free Cash Flow (FCF)

In FY2011 - FY2022, ISRG generated FCF (in millions of $) of 595, 700, 775, 560, 725, 1033, 953, 982, 1173, 1143, 1736, and 958. In the first half of FY2023, it generated ~$0.665B and by the end of Q3, this had risen to ~$0.957B. I expect ISRG will generate ~$1.1B - $1.3B of FCF in FY2023.

Outlook

Given the timing of the completion of new facilities, manufacturing efficiency improvements for new products and other complex projects, investors can expect variability in gross margin over the coming quarters as ISRG works through these programs.

On ISRG's Q2 earnings call, management forecasted FY2023 procedure growth of 20% - 22%. This is now amended to 21% - 22%.

The low end of the range reflects uncertainty around the duration of elevated procedure volumes with patients returning to health care, a continued slowing of bariatric growth rates in the U.S. and macroeconomic challenges that could impact hospitals and patient spending. At the high end of the range, ISRG assumes macroeconomic challenges do not have a significant impact on hospital procedure volumes, and bariatric growth rates in the U.S. continue at the Q3 rate. The range does not reflect significant material supply chain disruptions or hospital capacity constraints.

The previous FY2023 pro forma gross profit margin forecast was 68% - 69%. This is now amended to 68% - 68.5%. Actual gross profit margin varies quarterly depending largely on product, regional and trade-in mix and the impact of new product introductions.

The prior FY2023 pro forma operating expense growth forecast was 12% - 15%. This is now amended to 12% - 14%.

The prior FY2023 noncash stock compensation expense range of $0.6B - $0.62B is now $0.6B - $0.61B.

The estimate for other income, which is comprised mostly of interest income, is now expected to be $0.19B - $0.2B in FY2023. The previous estimate was $0.16B - $0.18B and the estimate before that was $0.14B - $0.16B. The increase primarily reflects the rise in interest rates.

ISRG previously forecast ~$0.8B - ~$1B in CAPEX for planned facility construction activities. This range is now $0.9B - $1B.

The FY 2023 pro forma tax rate is now 22% - 23% versus the prior 22% - 24% estimate.

to be between 22% and 23% of pretax income, reducing the previous estimate of the upper end of the range from 24% to 23%.

Credit Ratings

No rating agency rates ISRG because it has no debt.

Dividend and Dividend Yield

ISRG does not distribute a dividend.

In FY2011 - FY2022, ISRG's weighted average number of outstanding shares (millions rounded) was 362, 370, 361, 339, 341, 354, 349, 356, 359, 361, 366, and 362. The weighted average number of outstanding shares in Q1 - Q3 2023 was 356, 357.3 and 358.2.

ISRG's capital allocation is as follows:

- Invest in the business, both in capital expenditures and in organically investing in operating expenses;

- Acquire technology externally that gives the company differentiated capability or accelerates ISRG in the marketplace. This generally consists of license arrangements, Intellectual Property or tuck-in acquisitions.

- Opportunistically returning cash to shareholders.

In the first half of FY2023, ISRG repurchased 1.5 million shares at an average price of $238.10 for a total of $0.350B. It repurchased no shares in Q3.

Valuation

FY2011 - FY2022 PE ratios are 40.02, 30.69, 22.97, 46.20, 37.72, 34.17, 47.07, 72.02, 53.69, 93.18, 77.44, and 70.38.

Refer to my October 19, 2022 post in which I provided ISRG's valuation at the time I wrote previous posts. The following valuation levels at the time of my more recent ISRG posts are provided below for ease of comparison.

When I wrote my April 19, 2023 post, shares were trading at ~$298.60 and the forward-adjusted diluted PE levels were:

- FY2023 - 23 brokers - ~55 based on a mean of $5.42 and low/high of $5.03 - $5.60.

- FY2024 - 23 brokers - ~47 based on a mean of $6.37 and low/high of $5.93 - $6.88.

- FY2025 - 16 brokers - ~40 based on a mean of $7.43 and low/high of $6.87 - $8.29.

When I wrote my July 22 post, ISRG's share price had closed at $335.83 on July 21. ISRG had generated $2.18 and $2.65 in diluted EPS and adjusted diluted EPS in the first half of FY2023 and I envisioned ~$4.50 and ~$5.45 in diluted EPS and adjusted diluted EPS. Using my FY2023 earnings estimates, the forward diluted PE and forward adjusted diluted PE were ~74.6 and ~61.6.

The forward-adjusted diluted PE levels using broker estimates were:

- FY2023 - 26 brokers - ~60.7 based on a mean of $5.53 and low/high of $4.70 - $5.76.

- FY2024 - 27 brokers - ~52 based on a mean of $6.46 and low/high of $5.56 - $7.08.

- FY2025 - 19 brokers - ~45 based on a mean of $7.47 and low/high of $6.56 - $8.60.

Shares closed at ~$267 on October 20. ISRG had generated $3.34 and $4.11 in diluted EPS and adjusted diluted EPS in the first 9 months of FY2023. In my July 22 post, I wrote that I envisioned FY2023 diluted EPS and adjusted diluted EPS of ~$4.50 and ~$5.45; I see no reason to change my estimates. Using my FY2023 earnings estimates, the forward diluted PE and forward adjusted diluted PE are ~59.3 and ~49.

The forward-adjusted diluted PE levels using broker estimates are:

- FY2023 - 26 brokers - ~47.8 based on a mean of $5.59 and low/high of $5.50 - $5.82.

- FY2024 - 26 brokers - ~41.4 based on a mean of $6.45 and low/high of $6.15 - $6.76.

- FY2025 - 20 brokers - ~35.7 based on a mean of $7.48 and low/high of $7.07 - $8.03.

Despite a significant pullback in ISRG's share price subsequent to my July 22 post, I still consider shares to be overvalued.

Final Thoughts

My final thoughts are the same as those in my July 22 post.

With industry conditions now returning to normal following the COVID pandemic, ISRG should benefit from the global adoption of robotic surgery despite the entry of new rivals in the area of robot-assisted surgery that ISRG has dominated.

I also think the slower growth rate in bariatric procedures in the U.S. given the increased interest in weight loss drugs is a non-issue. Bariatric procedures represent only 4% - 5% of total global procedures. Furthermore, patients taking weight loss drugs will likely find that they are not effective and the negative side effects far outweigh any benefits.

ISRG's procedure volume is likely to exceed 2 million in 2023. However, the total addressable global is several times this level. There are ample growth opportunities, particularly in overseas developed countries, where robotic surgery's acceptance is generally significantly lower than in the US.

In a world where companies feasted on debt thus leading to Balance Sheets that are bloated with debt, ISRG is at the other end of the spectrum.

In hindsight, I overpaid (just above $300) when I made my first few ISRG share purchases. Fortunately, I have been able to 'average down' and my average cost is now ~$279.

I currently hold 450 shares in a 'Core' account in the FFJ Portfolio. Since I deem shares to be currently overvalued, I do not intend to add to my exposure at this stage.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long ISRG.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.