Contents

I last reviewed Intercontinental Exchange (ICE) in my February 10, 2024 post at which time the Q4 and FY2023 results had just been released.

With the release of Q2 and YTD2024 results on August 1, 2024 I revisit this existing holding.

Business Overview

Part 1 of ICE’s FY2023 Form 10-K has a comprehensive overview of the company and various risk factors.

ICE’s revenue used to be heavily reliant on volatile trading revenue. This made ICE’s quarterly results susceptible to wild variances. Through a series of acquisitions, ICE has diversified its business into new lines of business that generate more reliable annual recurring revenue (ARR). ICE, however, still receives a significant amount of its revenue from its largely transactional ‘Exchanges’ business segment.

Financial Review

Q2 and YTD2024 Results

Material related to ICE’s August 1 earnings release is accessible here.

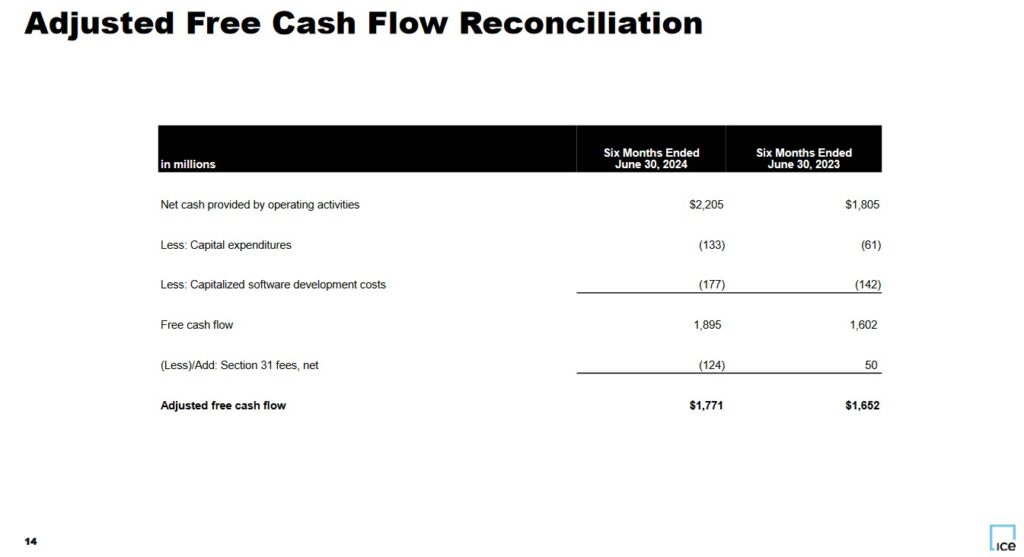

Operating Cash Flow (OCF), CAPEX, and Free Cash Flow (FCF)

In the FY2017 – FY2023 time frame, ICE’s:

- OCF was (in B$) 2.085, 2.533, 2.659, 2.881, 3.123, 3.554, and 3.542.

- CAPEX was (in B$) 0.357, 0.280, 0.305, 0.410, 0.452, 0.482, and 0.489.

- Adjusted FCF was (in B$) 1.730, 2.286, 2.320, 2.402, 2.821, 2.906, and 3.197

CAPEX includes capital expenditures and capitalized software development costs.

Adjusted FCF makes an adjustment (generally nominal) for net Section 31 fees. CME Group makes a similar adjustment.

Because the SEC fee is a provision under Section 31 of the Securities Exchange Act of 1934, it is often referred to as the Section 31 Transaction Fee. The fee is based on the volume of shares traded and applies to the sale of stocks, but not the purchase of stocks. The fee is 1% of one eight-hundredth of the dollar value of the equities sold.

ICE’s OCF, CAPEX, FCF, and Adjusted FCF in the first half of FY2023 and Fy2024 is reflected below.

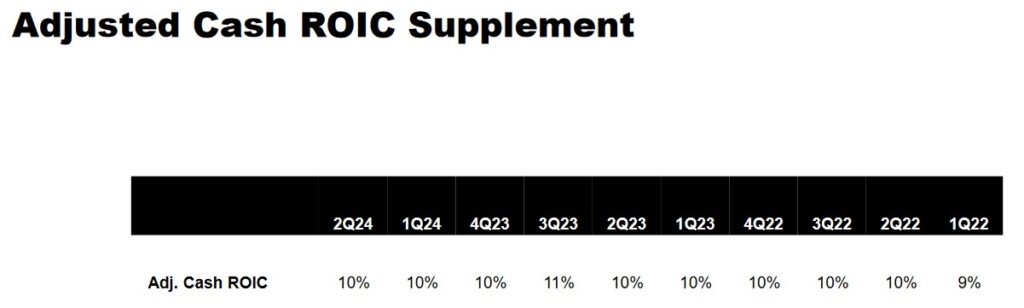

Return On Invested Capital (ROIC)

High quality companies often generate a high ROIC. If a company generates a high ROIC, it needs to invest less to achieve a certain growth rate thus reducing the need for external capital.

When a company consistently generates a high ROIC over the long term and it is growing its revenue, it can reinvest a portion of its profits under favorable conditions thereby leading to a compounding effect. I would much rather invest in a growing company that can reinvest to create greater shareholder value than to invest in a company that has limited growth opportunities and thus chooses to distribute a growing dividend.

A company that generates $0.15/profit for every $1 invested, for example, achieves a ROIC of 15%. I consider a ~15%+ ROIC to be a reasonable minimum threshold because most of the time, a company’s cost of capital will be lower than this level.

ICE’s FY2014 – FY2023 ROIC (%) was 6.13, 6.96, 7.01, 11.97, 9.09, 8.52, 7.63, 11.90, 4.79, and 6.19.

On an adjusted basis, however, ICE’s ROIC has been relatively consistent (9% – 11%) over the past several quarters.

Q3 and FY2024 Guidance

ICE’s current financial guidance is:

- FY2024 GAAP operating expenses: $4.90B -$4.93B;

- Adjusted operating expenses: $3.79B – $3.82B;

- Q3 2024 GAAP operating expenses: $1.22B – $1.23B;

- Adjusted operating expenses: $0.955B – $0.965B;

- Q3 2024 GAAP non-operating expense: $0.2B – $0.205B;

- Adjusted non-operating expense: $0.190B – $0.195B; and

- Diluted share count for Q3: 573 – 579 million weighted average shares outstanding.

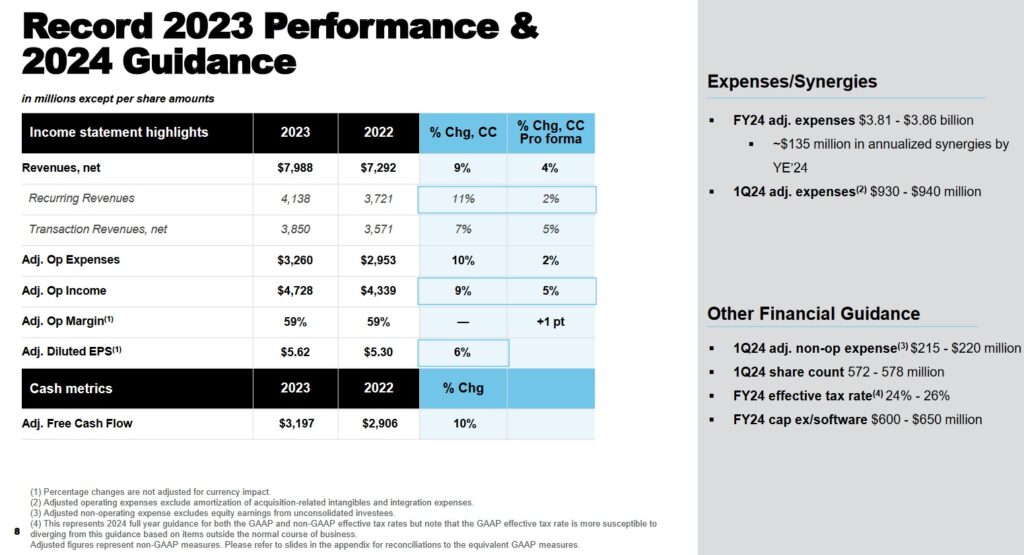

The following reflects ICE’s financial guidance when it released its FY2023 results in early February 2024.

Risk Assessment

Adjusted leverage at the end of Q2 2024 is ~3.7x pro forma EBITDA. This is a reduction from 3.9x at the end of Q1 2024 and 4.3x upon the completion of Black Knight in Q3 2023.

ICE continues to target 3.25X by 2025 and 3X as its normalized leverage level. Once the 3.25x level is attained, the plan is to resume share repurchases; share repurchases were suspended when ICE announced the BK acquisition.

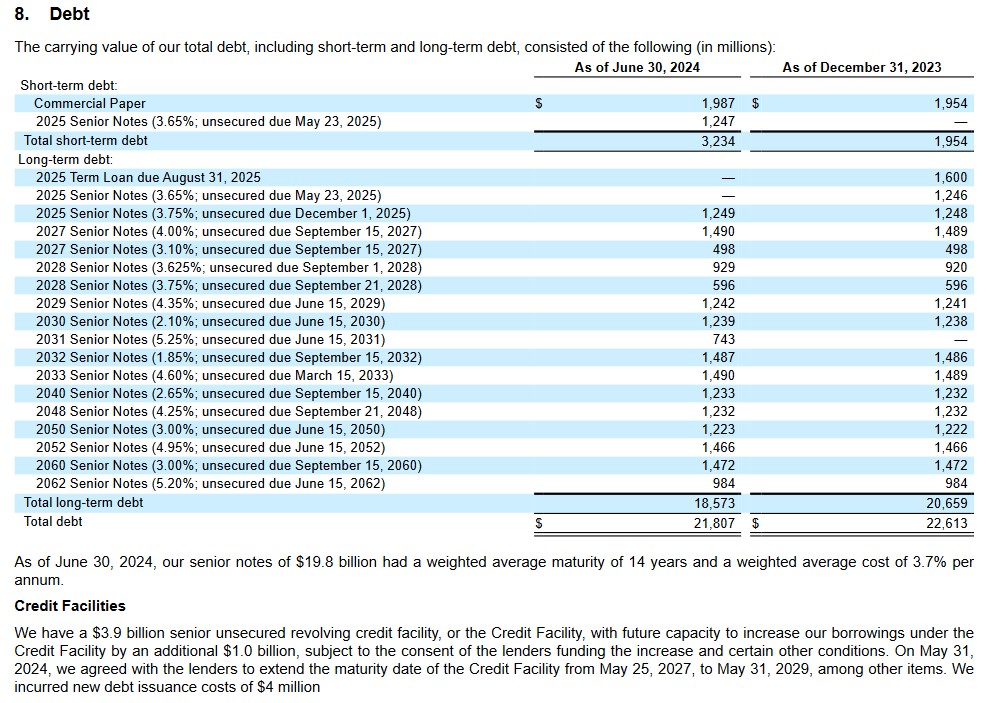

The following table reflects the fair value of ICE’s debt as of June 30, 2024 and December 31, 2023.

ICE’s current senior unsecured long-term debt credit ratings and outlook remain unchanged from my prior review.

- Moody’s: A3 (stable and affirmed on August 31, 2023)

- S&P Global: A- (stable and last reviewed on February 26, 2024)

Both ratings are at the bottom of the upper-medium grade investment-grade category. These ratings define ICE as having a strong capacity to meet its financial commitments. It is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

ICE’s ratings are acceptable for my purposes.

Dividend and Dividend Yield

ICE’s dividend history is accessible on the NASDAQ website; it does not maintain a dividend history on its website.

In FY2020 – FY2023, ICE distributed dividends of $0.669, $0.747, $0.853, and $0.955 (in billions). In the first half of Fy2024, ICE distributed ~$0.519B.

On August 2, ICE declared its 3rd consecutive $0.45/share quarterly dividend. In February 2025, I anticipate ICE will declare a $0.48/share quarterly dividend. If this happens, the next 4 quarterly dividend payments will total $1.86 ((2 x $0.45) + (2 x $0.48)). Using the current ~$150 share price, the dividend yield is ~1.24%.

Although some may perceive this dividend yield to be unsatisfactory, the focus should be on total potential shareholder return and not dividend metrics.

ICE’s weighted average diluted shares outstanding in FY2012 – FY2023 (in millions) are 365, 396, 573, 559, 599, 594, 579, 565, 555, 565, 561, and 565. In the first half of FY2024, this was 575.

In connection with the Black Knight acquisition, ICE terminated its Rule 10b5-1 trading plan and suspended share repurchases on May 4, 2022. The focus is on reducing its leverage below 3.25X.

As of June 30, 2024, the remaining balance of Board approved funds for future repurchases was $2.5B.

Valuation

ICE’s diluted PE in FY2011 – FY2023 is 18.52, 16.46, 29.52, 66.86, 24.08, 23.09, 25.62, 17.00, 25.15, 31.76, 25.23, 22.70, and 29.80.

The company has undergone a significant transformation over the years and the BKI acquisition will result in a vastly different ICE from several years ago. As a result, investors are cautioned not to compare historical PE levels to current and forward PE ratios.

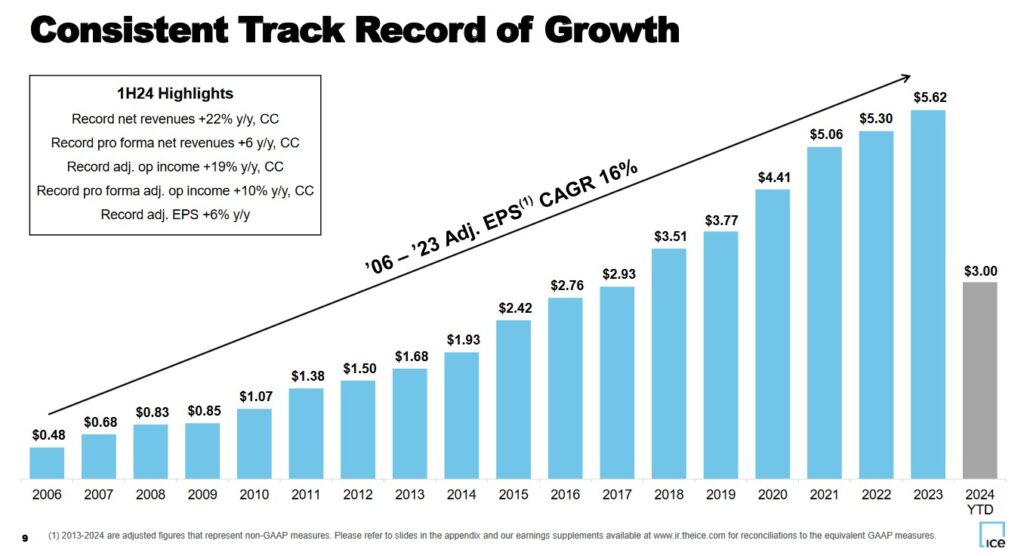

In FY2023, ICE generated diluted EPS and adjusted diluted EPS of $4.19 and $5.62, respectively. With shares trading at ~$135 when I wrote my prior post, the diluted PE and adjusted diluted PE were ~32.2 and ~24.

FY2023’s adjusted FCF that incorporates net Section 31 fees was $3.197B. The weighted average diluted shares outstanding in FY2023 was ~565 million thus giving us ~$5.69 FCF/share and a P/FCF/share of ~23.7.

ICE did not provide FY2024 adjusted diluted EPS guidance. Using broker estimates, however, the forward adjusted diluted PE levels were:

- FY2024 – 16 brokers – mean of $5.90 and low/high of $5.56 – $6.23. Using the mean estimate: ~22.9.

- FY2025 – 15 brokers – mean of $6.56 and low/high of $6.04 – $6.85. Using the mean estimate: ~20.6.

- FY2026 – 5 brokers – mean of $7.44 and low/high of $7.24 – $7.62. Using the mean estimate: ~18.1.

I envisioned ICE’s forward adjusted FCF would be somewhat similar to its forward adjusted diluted EPS, and therefore, the forward P/FCF would be similar to the forward adjusted diluted PE.

At the time of my prior review, I considered ICE to be fairly valued.

ICE share price is ~$150. Using the current broker estimates, the forward adjusted diluted PE levels are:

- FY2024 – 15 brokers – mean of $6.04 and low/high of $5.90 – $6.23. Using the mean estimate: ~24.8.

- FY2025 – 15 brokers – mean of $6.70 and low/high of $6.50 – $6.89. Using the mean estimate: ~22.4.

- FY2026 – 10 brokers – mean of $7.43 and low/high of $7.17 – $7.91. Using the mean estimate: ~20.2.

ICE’s YTD2024 Adjusted FCF is $1.771B. If it is able to generate this in the second half of FY2024, we should expect $3.542B.

ICE is not repurchasing shares and forecasts a diluted share count for Q3 of 573 – 579 million. I expect the weighted average shares outstanding to increase further in Q4 so for FY2024 a weighted average of 578 million shares seems reasonable. This gives us ~$6.13 adjusted FCF/share. Divide the ~$150 share price by ~$6.13 and the forward P/FCF is ~24.5.

Final Thoughts

I currently hold 200 shares in a ‘Core’ account and 200 shares in a ‘Side’ account the FFJ Portfolio and more shares in a retirement account.

In my 2023 Year End FFJ Portfolio Review, ICE was my 29th largest holding; shares were trading at ~$128. When I completed my 2024 Mid Year FFJ Portfolio Review, it was my 25th largest holding; shares were trading at ~$137.

ICE’s consistent track record has been made possible because it is diversified across asset classes and geographies. This means ICE is not restricted to any one cyclical trend or macroeconomic environment.

When I wrote my February 10, 2024 post, I concluded that ICE’s shares were fairly valued. Now, I consider shares to be slightly overvalued and a share price of ~$138 appears to be a fair value.

It would appear we are experiencing a period of irrational exuberance. There may be an opportunity to acquire additional shares at a more favorable valuation within the next few months.

I wish you much success on your journey to financial freedom!

Note: Thanks for reading this article. Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long ICE.

Disclaimer: I do not know your circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decisions without conducting your research and due diligence. You should also consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.