The degree of irrational exuberance we are witnessing suggests many investors are focusing on the ‘hype’ and are paying little heed to reality. The ‘fear of missing out’ is what is likely driving many investors to ‘invest’ in companies or instruments which they do not fully understand.

The valuation of many companies with no proven ability to generate a profit has been bid up to the extent where their market value equals, or exceeds, that of companies which have greatly rewarded investors over the long-term.

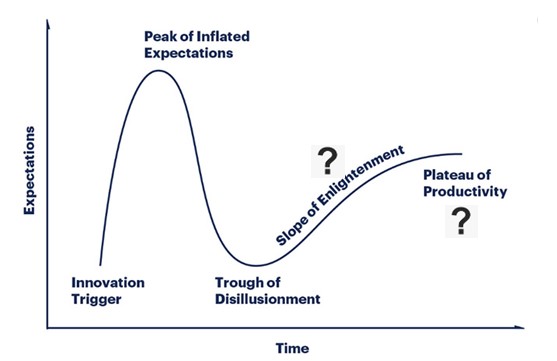

Looking at the ‘Hype Cycle’ graph, we now appear to be at, or close to, the stage where investors’ inflated expectations are at their peak. What typically follows this point is a trough of disillusionment, a slope of enlightenment, and a plateau of productivity. Many of today’s ‘high flyers’ will likely disappoint their shareholders and in all likelihood shareholders may never reach the stage of enlightenment. In essence, these companies will ‘crash and burn’ and permanently destroy shareholder value.

Investors would be wise to dial back risk and to invest in companies that have demonstrated an ability to create long-term shareholder value.

In recent weeks, stories have appeared in the media about retail investors who have ‘hit a grand slam’ by having invested in highly speculative companies whose share price has been bid up to values that are not supported by the underlying fundamentals or the profitability outlook. I am happy for these individuals but wonder how their ‘success’ (luck?) can be consistently replicated. Should such a fortunate investor cash out with absolutely no intention of ever ‘speculating’ again then it really does not matter whether they can replicate their success. My concern, however, is for the ‘investors’ who ‘lucked out’ and think their good fortune can be consistently replicated.

In my opinion, many ‘retail’ investors now have the means (no fee/low fee online trading accounts) and the time (downsized or ‘working from home’) to try their luck at ‘investing’. The term ‘investing’ is used loosely since a significant segment of these investors is gambling/speculating. Investments might be made with no intention of ever holding shares for the long-term, without ever having read any financial statements, or without ever having analyzed the company and the industry in which the company competes.

Using this IPO calendar, I sorted the list of companies on a monthly basis over the last 6 months by ‘offer amount’. Looking at some of those which had the largest ‘offer amount’, I reviewed what I could about the following:

- Airbnb ($111.4B)

- Snowflake ($81B)

- Palantir ($66B)

- DoorDash ($63.5B)

- Lufax ($41.5B)

- Contextlogic ($18.6B)

- Playtika ($12.4B)

NOTE: The current approximate USD market value as at January 26, 2021 is reflected in brackets.

All of these companies had either generated marginal or no profit so trying to determine their valuation was next to impossible.

After analyzing each company I came to the conclusion that each company was far too speculative an investment for me. I strongly suspect the speculative nature of these companies is far too great for many existing shareholders but until such time as the share price experiences a sudden and deep pullback, many existing investors may give little thought as to how risky their investment happens to be. This is quite concerning since some existing investors can likely least afford to lose their ‘investment’.

At the other end of the spectrum we have a short list of profitable companies which generate significant Free Cash Flow which can be used for whatever purposes the Board and senior management think will provide the best return to shareholders.

- Berkshire Hathaway ($546B)

- Johnson & Johnson ($447B)

- Visa ($446B)

- Raytheon Technologies ($104B)

- 3M ($101.6B)

- Lockheed Martin ($93B)

- Canadian National Railway ($77B)

- FedEx ($67B)

- Brookfield Asset Management ($59B)

NOTE: The current approximate USD market value as at January 26, 2021 is reflected in brackets.

Now, let’s think about this for a moment. These are companies with a proven track record of:

- profitability;

- generating tons of free cash flow;

- share buybacks;

- increasing dividends (except Berkshire Hathaway which does not distribute a dividend)

and they are equally or less valuable than companies with no track record of profitability?

Look at, for example, DoorDash. The company’s market cap is reasonably similar to that of FedEx! That makes perfect sense since FedEx has over 650 cargo planes that deliver anything to anywhere in the world and DoorDash subcontracts pizza delivery to a guy with a 2006 Honda Civic.

If those are not good examples to support the fact hype currently appears to outweigh reality, look no further than Tesla. The mere fact the ‘Investor’ section of the company’s website is not readily apparent sets off a ‘red flag’. (BTW – you need to go to the bottom of the web page and to click on Tesla © 2021).

Tesla will be releasing FY2020 earnings on January 27, 2021 but for now, the most current financial information is the Q3 10-Q. A very quick review of this document raises concerns.

- Revenue of $20.792B but ‘Net income used in computing net income per share of common stock’ of only $420 million! The company is essentially trading dollars.

- Operating margin of 6.82% (Income from Operations: $1,419 vs Total Revenue of $20,792). The other major automotive companies also have a terrible Operating margin!

- Look at the Consolidated Statements of Cash Flows (page 9). The ‘depreciation, amortization and impairment’ and ‘stock-based compensation’ almost equal the Net cash provided by operating activities.

- Looking at the Consolidated Statements of Cash Flows we see sizable ‘Proceeds from issuances of common stock in public offerings, net of issuance costs’ and ‘Proceeds from issuances of convertible and other debt’. It is readily apparent that without these flows from financing activities, Tesla would have run out of cash; capital spending is significantly outstripping the cash generated from normal business operations.

- Diluted weighted average shares used in computing net income (loss) per share of common stock: 1,059 million in Q3 2020 versus 502, 537, 597, 623, 641, 721, 830, 855, and 885 (million) in FY2011 – 2019. The high quality companies I listed above are typically reducing share count.

- Valuation? Off the charts! With a PE of ~1689/1 you are essentially paying $1689 for $1 of earnings. It is very difficult to generate long-term attractive investment returns when you significantly overpay for an investment.

- Even after a ratings upgrade from Moody’s, we are looking at a company whose debt is rated ‘non-investment’ grade. If you are curious as to how speculative an equity investment in Tesla happens to be, look at this ratings chart and then take into consideration that as a shareholder your risk is greater than that of a debtholder. This has been extracted from Moody’s website:

New York, July 23, 2020 — Moody’s Investors Service (“Moody’s”) upgraded the ratings of Tesla, Inc., including the Corporate Family Rating to B2 from B3, and senior unsecured rating to B3 from Caa1, and the speculative grade liquidity rating to SGL-2 from SGL-3. The outlook is stable.

I can not fathom what makes Tesla so much different from other well established automotive companies which turn in superior results (even though these results are terrible in comparison to those of companies in less capital intensive industries).

If the examples I have provided do not convince you that we are at/near the peak of inflated expectations, look no further than cryptocurrencies. For readers somewhat unfamiliar with this form of ‘investment’, a comprehensive overview of ‘bitcoin’ (one of the cryptocurrencies) can be found here.

As much as I have tried to keep an open mind about this form of ‘investment’, I just can not determine how to value it. In my opinion, the current cryptocurrency environment is similar to the 17th-Century ‘Tulip Mania’.

I appreciate that not everyone will agree with my take on crytocurrencies. That is fine but I take comfort knowing that Warren Buffett and Charlie Munger have the same view on this form of ‘investment’ as me. During one of Berkshire Hathaway’s AGM shareholder Q&A sessions Warren Buffett explained why cryptocurrencies are not a good ‘investment’. Charlie Munger’s very blunt opinion commences at the 4:00 mark! This man gets his message across in very few words.

If the examples of the degree of hype I have provided are insufficient, I draw your attention to the extent in which investors have increased the use of debt to finance their investing activites. Look at the increase in Debit Balances in Customers’ Securities Margin Accounts. Never has the degree of leverage ever been this high!

So…we have investments being made in irrationally valued, highly speculative companies AND investors are making these investment with more debt than ever before. In essence, investors have magnified their risk with the use of debt because they have become caught up in the hype and have tuned out reality.

Final Thoughts

In my opinion, many U.S. (and Canadian) stocks have reached epic bubble territory and a collapse rivaling the crashes of 1929 and 2000 should not be ruled out. While a collapse in the share price of a great number of companies is very likely to happen, it is far too difficult to predict when this will occur. What you can do, however, is position yourself NOW to restrict your investments to high quality companies. It will be far too late to purge inferior investments when the collapse begins.

On a final note, I highly encourage you to listen to this Bloomberg Markets and Finance interview with Jeremy Grantham, co-founder and chief investment strategist of Boston’s GMO.

Stay safe. Stay focused.

I wish you much success on your journey to financial freedom!

Note: Thanks for reading this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long BRK-b, JNJ, V, RTX, MMM, LMT, CNR, FDX, and BAM-a.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.