Legendary investor Howard Marks, chairman and co-founder of Oaktree Capital Management, has published two books in which he explains the keys to successful investing, the pitfalls that can destroy capital, and the importance of having a keen understanding of the reasons behind the rhythm of cycles.

In my opinion, the current investment environment is such that both books should be on your list of books to read NOW.

In June 2019 I wrote the following articles (here and here) about legendary investor Howard Marks, chairman and co-founder of Oaktree Capital Management.

For over 2 decades Howard Marks would meet with clients and prospects and would find himself repeatedly saying 'The most important thing is X'. Later in the conversation Marks would find himself saying 'The most important thing is Y' and then 'The most important thing is Z'. In addition, he would write occasional memos to his clients in which he set forth his investment philosophy, explained the workings of finance, and provided his take on recent events. Eventually, Marks compiled a series of memos in which he discussed multiple 'most important things'!

I am of the opinion far too many investors in our current market environment have never invested during periods of heightened volatility and do not fully appreciate all the risks that come with investing. I suspect many think investing is easy but this could not be further from reality. I know you fully appreciate this but, nevertheless, encourage you to read Marks' teachings since I am confident they will set you even further apart from many, many investors.

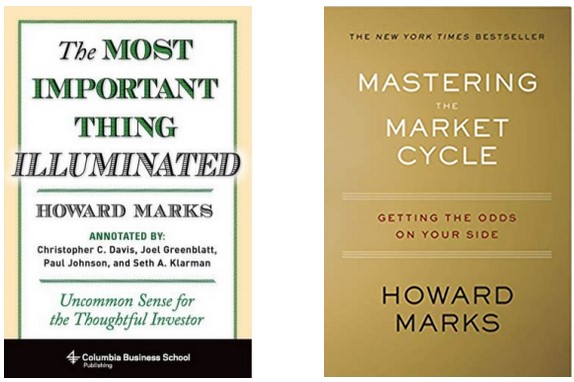

In 2013, Marks published 'The Most Important Thing Illuminated - Uncommon Sense for the Thoughtful Investor'. In this book he lays out the following 'Most Important Things':

- Second-Level Thinking

- Understanding Market Effeciency (and Its Limitation)

- Value

- The Relationship Between Price and Value

- Understanding Risk

- Reconginzing Risk

- Controlling Risk

- Being Attentive to Cycles

- Awareness of the Pendulum

- Combating Negative Influences

- Contrarianism

- Finding Bargains

- Patient Opportunism

- Knowing What You Don't Know

- Having a Sense for Where We stand

- Appreciating the Role of Luck

- Investing Defensively

- Avoiding Pitfalls

- Adding Value

- Reasonable Expectations

- Putting It All Together

In 2018, Marks followed up 'The Most Important Thing Illuminated - Uncommon Sense for the Thoughtful Investor' with 'Mastering the Market Cycle - Getting the Odds on Your Side'. In this book, Marks delves into the importance of having a keen understanding of the rhythm of cycles. He explains how learning the patterns of ups and downs that influence economics, markets and companies, human psychology, and the investing behaviors that result can help you become a more confident investor.

By understanding the origins of past cycles you can remain alert for the next cycle and prepare yourself for changes in the investment environment while other investors get blindsided by unexpected events or fall victim to emotions like fear and greed.

When you read these books I think you will find Marks takes the complicated and communicates his teachings so they are easy to read and understand.

On a personal note, I fully intend to read these two books at least once a year.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to [email protected].

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.