In my December 19, 2023 post, I touched upon why I think investors can create wealth with a HEICO (HEI and HEI-a) investment. I subsequently covered HEI in a January 8, 2024 guest post at Dividend Power.

When I reviewed HEI in my January 8, 2024 guest post, the most currently available financial information was for Q4 and FYE2023. With the release of Q3 and YTD2024 results on August 26, I revisit this existing holding.

For the sake of full disclosure, the following reflects my HEI-a purchases:

- 300 shares @ ~$99 on September 16, 2019

- 100 shares @ ~$130.85 on June 14, 2021

- 200 shares @ ~$132.10 on May 23, 2023

- 100 shares @ ~$127.02 on May 26, 2023

- 100 shares @ ~$127.75 on August 29, 2023

After another mental ‘tug of war’ I have acquired another 100 shares @ ~$189.47 on August 27 in a ‘Core’ account within the FFJ Portfolio.

In addition, two young investors I am helping on their journey to financial freedom also have HEI-a exposure through their Tax Free Savings Accounts (TFSA) and First Homeowner Savings Accounts (FHSA).

IMPORTANT:

- HEICO Corporation has two classes of common stock (HEI and HEI.a). Both classes of shares are virtually identical in all economic respects except voting rights. The difference is that each HEI share is entitled to one vote per share while each HEI.a share is entitled to a 1/10 vote per share. This post focuses on the HEI.a shares (non-voting) since these are the shares I own.

- Do not confuse HEICO Corporation with privately owned The Heico Companies.

In each prior HEI post (see FFJ Archives), I have concluded that shares are richly valued. When I did decide to acquire shares, I played a mental ‘tug of war’ (as I did again today). One one hand, the valuation is rich. On the other hand, this is a company that has a proven formula by which it has been able to make many of its rank and file employees multi-millionaires.

The mental trick I have used to ‘pull the trigger’ is that I am investing for the VERY long term…longer than my lifespan. Even if a reasonable price based on current results and outlook happens to be ~$150ish (for the HEI-a shares), will my beneficiaries really care decades from now if I bought a few shares and overpaid by ~$30 – ~$40/share?

I do not typically approach every investment with this mindset but do so in the case of HEI. If I did not, I would likely NEVER own shares; the probability of shares being undervalued or fairly valued is so remote. It also doesn’t help that Berkshire Hathaway has stepped in with the acquisition of a ‘boatload’ of shares within the past few months!

Berkshire Hathaway Initiates A Position In HEICO

Recently, Berkshire Hathaway (BRK-a and BRK-b) disclosed a $185,373,840/1,044,242 share stake in HEI which works out to be ~$177.52/share; BRK undoubtedly acquired HEI and not the HEI-a shares. This is likely a contributing factor to the share price having risen by ~$64 to the ~$241.50 level at the time I compose this post on August 27.

Some investors eagerly await the release of SEC Form 13-F Information from Warren Buffett and Berkshire Hathaway to help with their investment decision making process. This is somewhat foolish since Buffett and Berkshire Hathaway make Confidential Treatment Requests with the SEC; Buffett has long taken advantage of an obscure rule to avoid disclosing his investments to the public.

The rule states that the SEC:

may prevent or delay public disclosure of form 13F information for public interest reasons or the protection of investors.

The rule, in this case, is clearly meant to protect the Buffett and Berkshire Hathaway and not the public. In rendering its decision to grant ‘confidentiality’, the SEC tries to balance the benefits of transparency of how large managers invest with the need to temporarily protect the legitimate confidentiality interests of managers in limited circumstances.

Buffett’s case for making the ‘confidentiality’ requests is that public investors should not always be allowed to piggyback on investment ideas made by professional investors, especially before they are finished buying. In many cases, it takes more than 3 months to build a period hence the need to delay disclosure by one quarter.

Business Overview

Acquisitions have been an important element of HEI’s growth strategy over the past thirty-three years, supplementing organic growth. Since 1990, HEI has completed ~100 acquisitions complementing the niche segments of the aviation, defense, space, medical, telecommunications and electronics industries in which HEI operates. Fortunately, HEI has a a much improved website that includes a section with links to the websites of most subsidiaries. This enables us to learn about the respective operations of HEI’s subsidiaries.

Naturally, HEI’s 2023 Annual Report/Form 10-K is a must read if there is any thought of investing in the company.

Ownership Control

As of December 18, 2023, HEI’s executive officers and entities controlled by them, the HEICO Savings and Investment Plan (401(k) Plan) and members of the Board collectively beneficially owned ~19% of the outstanding Common Stock and ~3% of the outstanding Class A Common Stock. Accordingly, they are able to substantially influence the election of the Board and control the business, policies and affairs, including HEI’s position with respect to proposed business combinations and attempted takeovers.

A high degree of ownership concentration would be of concern if the controlling parties were acting with little regard for the long-term prosperity of the company or other shareholders. Based on my analysis, however, this does not appear to be the case. I see no ‘red flags’ in how the controlling shareholders manage HEI.

I encourage you to review the 2024 Notice of Annual Meeting and Proxy Statement (Form DEF 14A) that was filed on February 2, 2024. This document is accessible through the SEC Filings section of the company’s website. This document includes considerable information about Executive Compensation.

After reviewing this document, I am satisfied that HEI’s executive compensation program is properly structured to:

- align the interests of the executive officers with those of other shareholders; and

- fairly reward them for creating shareholder value and for achieving HEI’s business objectives.

HEICO’s Acquisition Strategy

As noted earlier, HEI has made multiple acquisitions over the years. It makes conservative use of debt and uses its strong cash flow to reduce its debt thus enabling it to borrow to make further acquisitions.

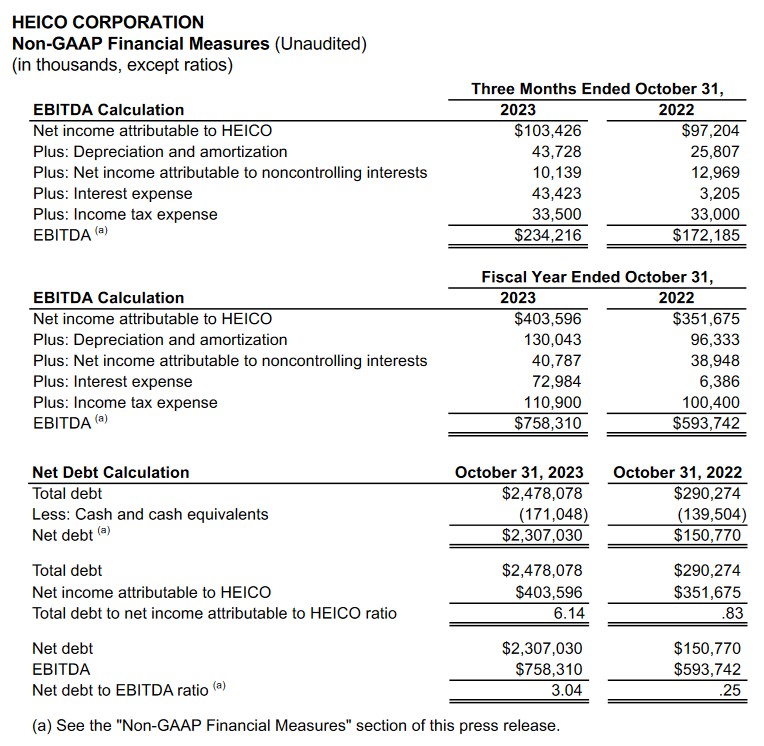

The following shows how HEI’s debt surged at FYE2023 following the completion of the Exxelia International acquisition on January 5, 2023. In addition, it completed the acquisition of the Wencor Group, the largest acquisition in the company’s history, on August 4, 2023.

The total debt and net debt ratios at FYE2023 raises eyebrows. However, HEI’s EBITDA and Net income attributed to HEICO reflect just one quarter of income generated from the Wencor acquisition. In addition, the FY2023 results reflect the benefit of just 3 quarters of income generated from the Exxelia acquisition. These events have the effect of distorting HEI’s FY2023 net debt calculations.

Management articulated that both highly synergistic acquisitions were expected to be accretive to earnings within the year following closing. In addition, HEI anticipated that it would continue to achieve its often articulated growth objective in the years after the closing.

One of management’s priorities was to restore the total debt to net income attributable to HEI ratio to historically low levels within the next two fiscal years. Investors should, therefore, expect no major acquisitions in the foreseeable future. HEI, however, will continue to actively pursue smaller bolt-on acquisitions from its robust pipeline of acquisition opportunities.

On August 22, 2024, HEI announced its intent to acquire the Aerial Delivery and Descent Devices divisions of Capewell Aerial Systems for an undisclosed amount.

Financials

Q3 and FY2024 Results

HEI’s most recently released financial results are accessible in Form 8-K; the Form 10-Q has yet to be released.

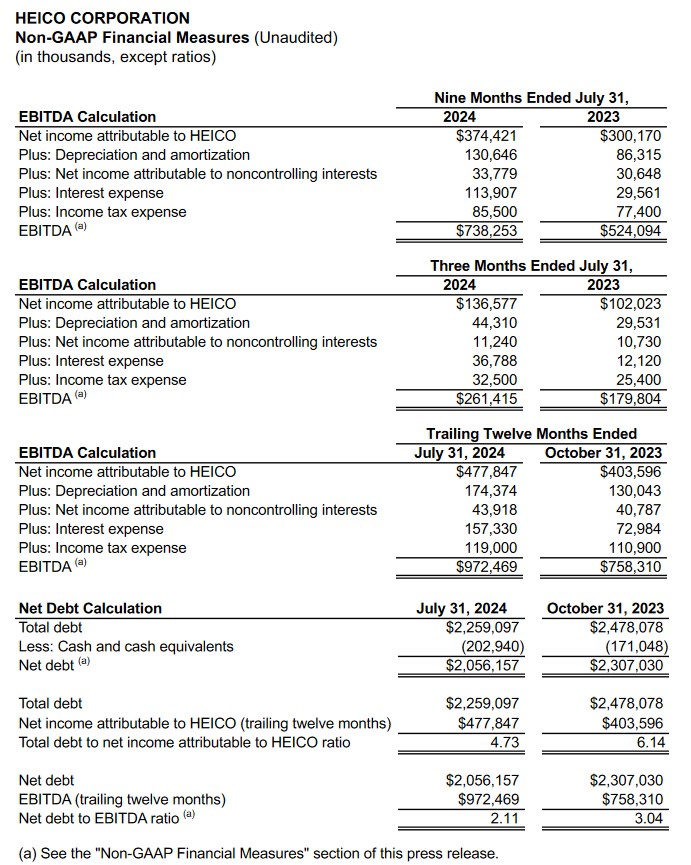

We see that at the end of Q3 2024 (July 31, 2024), HEI’s non-GAAP Financial Measures had improved substantially from those reported at FYE2023 (October 31, 2023).

Operating Cash Flow (OCF), Free Cash Flow (FCF), and CAPEX

In FY2014 – FY2023 and the first 3 quarters of FY2024

- OCF was (in million of $ approx.) 190.7, 172.9, 249.2, 274.9, 328.5, 437.4, 409.1, 444.1, 467.9, 448.7, and 466.7.

- CAPEX was (in million of $ approx.) 16.4, 18.3, 30.9, 26.0, 41.9, 28.9, 22.9, 26.2, 32.0, 49.4, and 42.2.

- FCF was (in million of $ approx.) 174.3, 154.6, 218.3, 248.9, 286.6, 408.5, 386.2, 407.9, 435.9, 399.3, and 424.5.

FY2024 Outlook

HEI typically does not provide net sales and earnings guidance. Management continually states, however, that the company will continue to invest in research and development and execute its successful acquisition program.

Risk Assessment

HEI’s domestic senior unsecured long-term debt ratings are:

- Moody’s: Baa2 with a stable outlook (newly rated as of June 20, 2023)

- Fitch: BBB with a stable outlook (last reviewed on January 25, 2024 and newly rated as of June 14, 2023)

Both ratings are in the middle tier of the lower medium-grade investment-grade category. These ratings define HEI as having an adequate capacity to meet its financial commitments. Adverse economic conditions or changing circumstances, however, are more likely to lead to a weakened capacity of the obligor to meet its financial commitments.

*S&P Global does not rate HEI’s debt.*

Dividends and Share Repurchases

Dividend and Dividend Yield

On June 20, 2024, HEI declared its 92nd consecutive semi-annual cash dividend since 1979; the dividend history is accessible here.

Warren Buffett and Charlie Munger used one key test to determine whether it makes sense for a company to distribute a dividend or not. The test is whether a company can continue to create more than $1 of value for every dollar retained. In essence, a company should probably not distribute a dividend (or distribute a very small dividend) when it has the opportunity to reinvest retained earnings profitably.

HEI’s exemplary track record demonstrates that reinvesting in the business is the most optimal means of allocating capital.

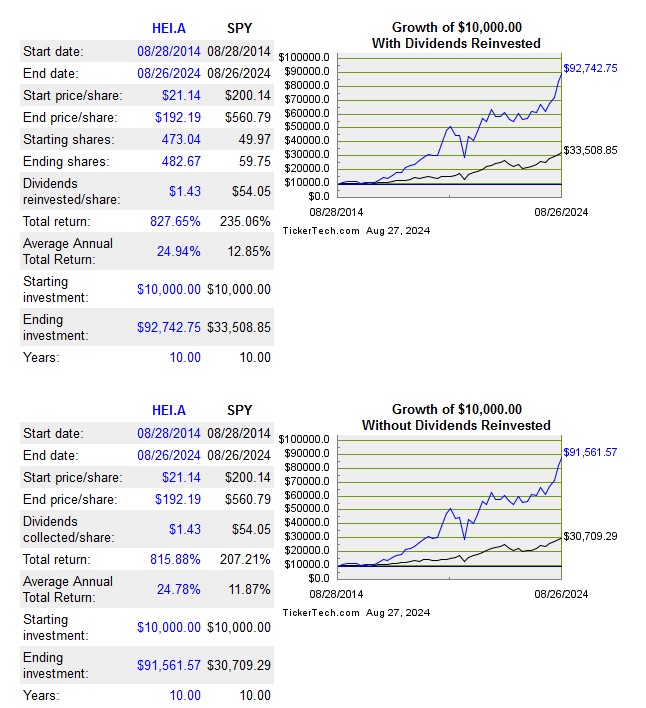

If you are remotely interested in seeing how a HEI investment has fared over various timeframes, you may wish to plug various start and end dates into this site. For current purposes, I have selected a 10 year timeframe for the HEI-a shares so you get an idea of why some long-term HEI investors have become wealthy.

Despite this impressive track record, some investors will still be reluctant to invest in the company because its dividend metrics are unattractive.

I can’t fix stupid.

Since all the HEI shares I own are held in taxable accounts and I am a Canadian resident, I incur a 15% dividend withholding tax. Furthermore, I am in a tax bracket where each additional dollar of dividend income is heavily taxed. I do not, therefore, favor investments with attractive dividend metrics.

Since I typically hold my investments for the very long-term, I defer any tax liability attributed to capital gains thus enabling my investments to grow uninterrupted.

HEI has generated an average annual total return above 20% over the past 10 years. Can it replicate this over the next couple of decades? I have no idea. Even if the average annual total return drops to 12%, however, I would double the value of my investment in 6 years.

‘Damn! I wish its dividend metrics were more attractive’….good grief!

Stock Splits and Share Repurchases

HEI has had six 5 for 4 stock splits over the years; twelve stock splits are reflected but investors must remember that HEI has 2 classes of common stock.

The weighted average number of common shares outstanding in the FY2023 – FY2016 timeframe is 138.905, 138.037, 137.854, 137.302, 137.350, 136.696, 135.588, and 133.145 (millions of shares). In Q3 2024, this had risen to 140,305.

Details of HEI’s share repurchases commence on page 106 of 150 in the FY2023 10-K.

Looking at HEI’s Condensed Consolidated Statements of Cash Flows over the past several years, we see that share repurchases are negligible. Share repurchases are generally for the redemption of common stock related to stock option exercises as opposed to share repurchases on the open market.

Furthermore, HEI issues shares as part of its employee compensation structure. It also issues HEI-a shares to the sellers of many of the companies it acquires thus permitting the sellers to participate in HEI’s wealth creation model.

Valuation

Trying to gauge HEI’s valuation based on GAAP earnings is a challenge because of the magnitude of its non-cash depreciation and amortization. I, therefore, prefer to gauge HEI’s valuation using non-GAAP earnings and Price/FCF.

HEI.a’s current share price is ~$188.34. Using the current broker-adjusted diluted EPS guidance, the forward adjusted diluted PE levels are:

- FY2024 – 10 brokers – mean of $3.62 and low/high of $3.50 – $3.72. Using the mean, the forward adjusted diluted PE is ~52.

- FY2025 – 10 brokers – mean of $4.24 and low/high of $4.00 – $4.49. Using the mean, the forward adjusted diluted PE is ~44.4.

- FY2026 – 5 brokers – mean of $4.87 and low/high of $4.50 – $5.08. Using the mean, the forward adjusted diluted PE is ~38.7.

HEI has generated $424.5 million of FCF in the first 3 quarters of FY2024. If HEI generates $140 million of FCF in Q4 (similar to the average $141.5 in the first 3 quarters), we can expect ~$564.5 million of FCF in FY2024.

The diluted weighted average shares outstanding in the first 3 quarters is 140.086 million. Let’s assume this increases to 140.2 million for all of FY2024. HEI’s FCF/share should be ~$4.03 ($564.5 million/140.2 million).

Using my recent $189.47 purchase price, I ended up acquiring shares with a P/FCF of ~47. Definitely not a ‘fire sale’ but I’ll look back at this purchase a decade from now and will probably tell myself ‘Big Deal!’

Final Thoughts

The fact HEI’s dividend metrics are unattractive is irrelevant to me. My focus is on total investment return.

HEI-a was my 25th largest holding when I completed my 2023 Year End FFJ Portfolio Review and my 16th largest holding when I completed my 2024 Mid Year FFJ Portfolio Review. Following my August 27 purchase, I own 500 HEI-a shares in a ‘Core’ account at an average cost of ~$141.77 and 400 shares in a ‘Side’ account at an average cost of ~$121 in the FFJ Portfolio.

All our HEI exposure is by way of HEI-a shares (solely because of its slightly lower valuation) for which we only receive one vote for each share owned as opposed to 10 votes for each HEI share; we own so few shares that our votes are irrelevant.

I fully recognize that current market conditions are susceptible to a broad market pullback. If HEI gets caught up in this pullback, the probability is high that I will add to my exposure.

For now, I know I added to my exposure when shares are expensive. In the grand scheme of things, however, these HEI shares will likely be worth a whole lot more in a few decades.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long HEI-a.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.