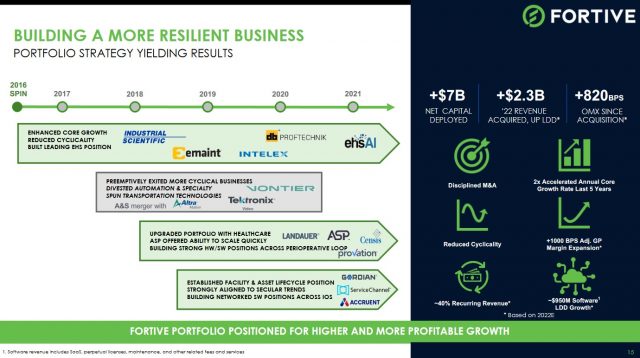

Fortive (FTV) was spun-off from Danaher in July 2016 at which time it had reported FY2015 annual revenue of ~$6.2B. After FTV became a separate publicly traded entity, it has undergone a significant transformation.

Segments of its business have been divested and on October 9, 2020, it completed the spin-off of Vontier (VNT); in FY2020 VNT generated ~$2.7B in annual revenue.

FTV has also completed a series of acquisitions to strengthen its presence in its 3 business segments.

- Intelligent Operating Solutions

- Precision Technologies

- Advanced Healthcare Solutions

The entities within each segment are reflected in the Business Directory.

Merely looking at FTV’s annual revenue (~$5.25B in FY2021) suggests deteriorating business conditions. Investors, however, must account for FTV’s divestitures and acquisitions.

Furthermore, this series of acquisitions and divestitures makes it difficult to draw any comparison between historical and current performance relative to potential future performance. FTV is, essentially, a completely different business from a few years ago.

I initiated a 300 share position on September 4, 2019 in one of the ‘Side’ accounts within the FFJ Portfolio. I last reviewed FTV in this February 19, 2021 post shortly after it released FY2020 results and FY2021 guidance. At the time, I considered its valuation to be high.

On April 28, 2002, FTV released Q1 2022 results and raised its FY2022 guidance. I now revisit this holding.

Business Overview

The following are great sources of information to learn about FTV.

Acquisitions and Divestitures

In FY2021, FTV completed the acquisition of ServiceChannel for ~$1.2B and the acquisition of Provation for ~$1.425B.

Details of FTV’s acquisitions and divestitures in FY2019 – FY2021 are found in Notes 3 and 4 in the FY2021 Form 10-K.

Financials

Q1 2022 Results

Links to FTV’s Q1 Earnings Release, the accompanying earnings presentation, and the Q1 10-Q are accessible here.

Source: FTV – Q1 2022 Earnings Presentation – April 28, 2022

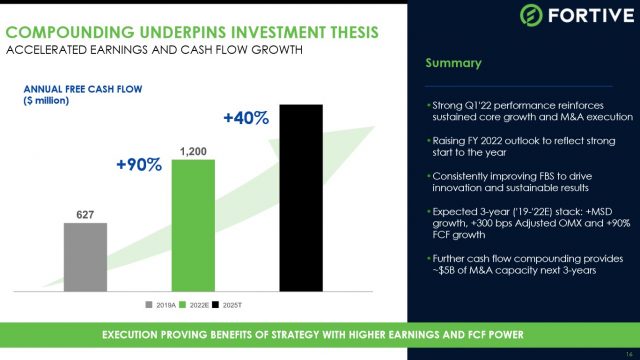

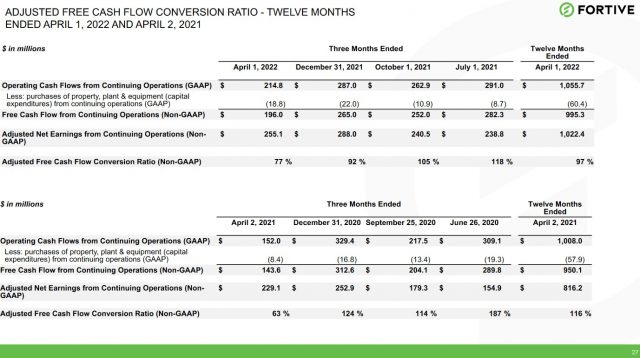

Free Cash Flow (FCF)

FTV’s FY2017 – FY2021 FCF (in millions of $) is: $1.065, $1.275, $1.197, $1.361, and $0.911.

Management’s definition of FCF is defined as cash provided by operating activities calculated according to GAAP minus payments for additions to property, plant, and equipment.

FCF projections call for a ~90% increase from FY2019 and another ~40% increase between FY2022 and FYE2025.

Source: FTV – Q1 2022 Earnings Presentation – April 28, 2022

I look closely at a company’s FCF and trend because it provides useful information in assessing a company’s ability to:

- generate cash without external financing;

- fund acquisitions and other investments; and

- in the absence of refinancing, repay debt obligations.

Source: FTV – Q1 2022 Earnings Presentation – April 28, 2022

FCF, however, is not without its drawbacks. As a liquidity measure, it has material limitations because it excludes certain expenditures that are required or to which a company is committed, such as debt service requirements and other non-discretionary expenditures.

This is why I look at the credit rating and outlook assigned by major rating agencies.

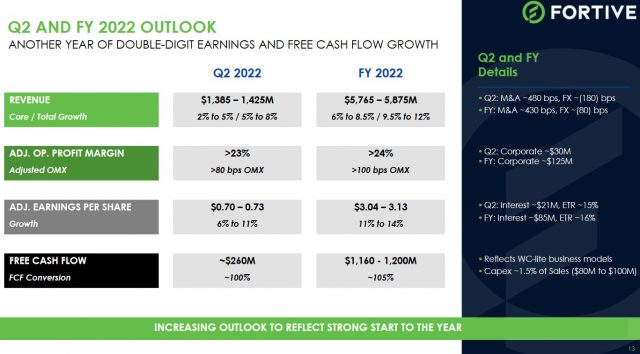

FY2022 Outlook

When FTV released its FY2022 outlook on February 3, 2022, management anticipated:

- revenue of $5.73B – $5.88B;

- diluted net EPS of $2.03 – $2.17 from continuing operations; and

- adjusted diluted net EPS from continuing operations of $3.00 – $3.13.

Despite various headwinds, the FY2022 outlook increases the lower end of previous guidance.

- revenue of $5.77B – $5.88B;

- diluted net EPS of $2.07 – $2.16 from continuing operations; and

- adjusted diluted net EPS from continuing operations of $3.04 – $3.13.

On the Q1 2022 earnings call, management indicated it expects low to mid-single-digit core revenue growth. This outlook includes a headwind of ~$40 million from the COVID-related government shutdowns in Shanghai which are expected to subside in mid-May.

The lost China volumes as a result of the government-mandated lockdowns in the first half are expected to shift to the second half of FY2022.

Adjusted operating profit margins are expected to be up at least 80 basis points year-over-year. Q2 2022 adjusted EPS of $0.70 – $0.73 assumes a 15% tax rate in the quarter and a ~100% FCF conversion rate.

Source: FTV – Q1 2022 Earnings Presentation – April 28, 2022

Source: FTV – Q1 2022 Earnings Presentation – April 28, 2022

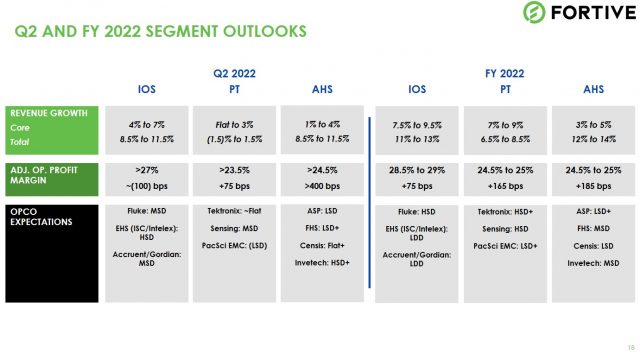

The following reflects management’s outlook for each of the 3 segments.

Source: FTV – Q1 2022 Earnings Presentation – April 28, 2022

- LSD: Low single-digit % growth

- MSD: Mid single-digit % growth

- HSD: High single-digit % growth

- LDD: Low double-digit % growth

Credit Ratings

Notes 4 and 5 that commence on page 13 of 40 in FTV’s Q1 2022 Form 10-Q provide a good overview of FTV’s financing.

FTV’s senior unsecured long-term debt credit ratings and outlook are:

- Moody’s: Baa1 and stable

- S&P: BBB and stable.

Moody’s rating is the top tier of the lower medium investment-grade category. S&P’s rating is 1 notch lower and is the middle tier of the lower medium investment-grade category.

These ratings define FTV as having an ADEQUATE capacity to meet its financial commitments. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity to meet financial commitments.

Both ratings are satisfactory for my conservative nature.

Dividend and Dividend Yield

The dividend history reflects no change to the $0.07/share quarterly dividend that was instituted in mid-2016. FTV is unlikely to appeal to investors who focus heavily on dividend income and dividend yield.

Based on the current $57.50 share price, the dividend yield is ~0.5%.

FTV’s capital deployment is likely to remain very similar to that of DHR; DHR maintains a low dividend payout ratio and retains funds to grow the business. This strategy has proven to be highly successful and investors should not expect FTV to change its dividend policy.

The diluted weighted average shares outstanding (in millions) in FY2016 – FY2021 are 347, 353, 351, 340, 359, and 352.

On February 17, 2022, FTV’s announced that its Board of Directors authorized a share repurchase program under which up to 20 million shares can be purchased from time to time on the open market or in privately negotiated transactions. There is no expiration date for the repurchase program, and the timing and amount of repurchases under the program are determined by FTV’s management based on market conditions and other factors.

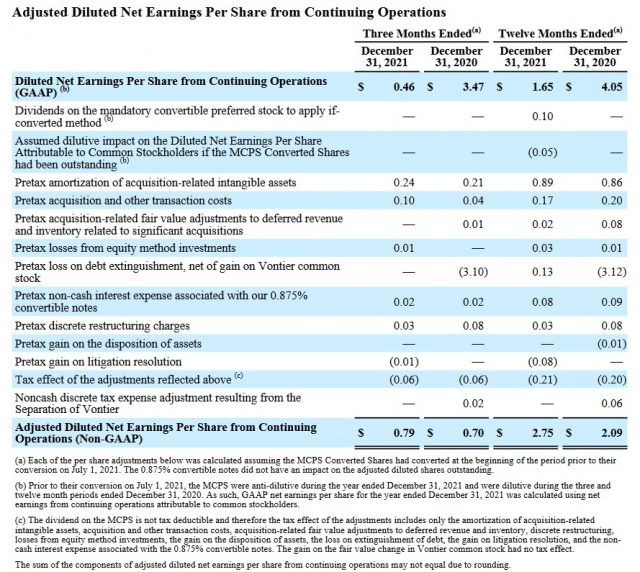

Valuation

When I wrote my February 19, 2021 post, management’s FY2021 Adjusted Diluted Net EPS from Continuing Operations guidance was $2.40 – $2.50. Using the $2.45 mid-point and the ~$67.20 share price, FY2021’s forward Adjusted Diluted PE was ~27.43.

FY2021 guidance from the 18 brokers which cover FTV was $2.27 – $2.58 with a mean of $2.50. Using the $2.50 mid-point and the ~$67.20 share price, FY2021’s forward Adjusted Diluted PE was ~26.9.

FTV ended up reporting $1.65 in FY2021 diluted EPS and $2.75 in FY2021 adjusted diluted EPS. Using the ~$67.20 share price, FTV’s diluted PE was ~40.1 and its adjusted diluted PE was ~24.4.

FTV is now trading at $57.50 and, as noted earlier, management’s revised FY2022 guidance is diluted net EPS of $2.07 – $2.16 from continuing operations and adjusted diluted net EPS from continuing operations of $3.04 – $3.13. Using the current share price and the ~$2.12 mid-point of diluted EPS guidance, the forward diluted PE is ~27. Using the ~$3.09 mid-point of adjusted diluted EPS guidance, the forward adjusted diluted PE is ~18.6.

FTV’s forward adjusted diluted EPS using broker guidance is:

- FY2022 – 22 brokers – mean of $3.10 and low/high of $3.06 – $3.16. Using the mean estimate, the forward adjusted diluted PE is ~18.6.

- FY2023 – 22 brokers – mean of $3.44 and low/high of $3.21 – $3.65. Using the mean estimate, the forward adjusted diluted PE is ~16.7.

- FY2024 – 9 brokers – mean of $3.79 and low/high of $3.46 – $4.25. Using the mean estimate, the forward adjusted diluted PE is ~15.2.

I am reluctant to rely on FY2024 data because only 9 brokers have provided estimates. Furthermore, much can happen in 2 years…especially since FTV has a history of acquisitions and divestitures which can significantly change results.

Final Thoughts

Over the last 6 years, FTV has modified its portfolio to become more resilient and less cyclical so that it can outperform even in a difficult environment.

Its acquisitions have added ~$2.3B of annual revenue and low-double-digit growth is projected in FY2022.

It has expanded its gross profit margin from 54.4% (2019) to 57.5% (Q1 2022) as it delivers on its commitment to deliver higher and more profitable growth. Furthermore, FTV has:

- more than doubled recurring revenue as a percentage of total revenue to ~40%;

- built a portfolio of software-enabled workflow solutions, which is approaching $1B of revenue and that continues to enhance the company’s long-term competitive advantage; and

- improved its ability to generate strong FCF.

FTV’s long-term outlook is attractive and I consider shares to be undervalued. I currently do not have the liquidity in the investment account which currently holds FTV shares otherwise I would be adding to my exposure.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long FTV.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.