Contents

On January 17, 2023, Goldman Sachs (GS) reported weaker-than-anticipated Q4 and FY2022 results because of high expenses and weak Investment Banking revenue. Despite measures having been implemented to improve results, I am cautiously optimistic GS will experience further short-term share price weakness.

I last reviewed this holding in my July 8, 2022 post at which time I disclosed the purchase of additional GS shares in one of the 'Side' accounts within the FFJ Portfolio at ~$296 on July 7. Rather than wait for the release of Q2 and YTD2022 results on July 18, my decision to acquire additional shares was partially based on the June 2 presentation by GS's President & Chief Operating Officer at the Bernstein 38th Annual Strategic Decisions Conference.

Following that post, GS's share price has experienced considerable volatility. This includes an unjustified rapid appreciation in the share price in October and November; GS's share price reached a 52-week high of ~$390 in late November. I did not think this was justified because I anticipated GS to report weak Q4 2022 results.

Downsizing

GS has made the headlines over the last several weeks given its intent to reduce headcount by ~3,200; this represents ~6.5% of GS's ~49,000 employees. In addition to this planned reduction, more bankers will likely depart over the coming weeks after managers disclose the size of 2022 year-end bonuses. Sources indicate that investment bankers are braced for a ~40% reduction in bonuses. Traders have been told to expect flat or lower bonuses even after a strong performance in 2022 owing to volatile financial markets.

The disappointing bonuses are likely to lead to a wave of resignations which will help GS reduce costs without having to pay severance. The risk, however, is that GS faces the prospect of losing some strong performers.

Managers tasked with giving staff the bad news described the process as 'brutal' and morale as 'horrendous'. Thousands of employees turned up to work the second week of January unaware of their fate. Some employees were given their marching orders and sources indicate no bonuses were paid for work performed in FY2022.

Many managing directors, the second most senior rank behind partner status, are to be paid until the end of January 2023 and will receive three months' severance. However, more junior employees, those at or below the vice-president level, will receive 2 months of severance pay. In addition, many junior bankers received 30 minutes' notice to gather their belongings and leave before their building access cards were deactivated.

While these job cuts may raise eyebrows, the Capital Markets industry is notoriously brutal when cost-cutting is required.

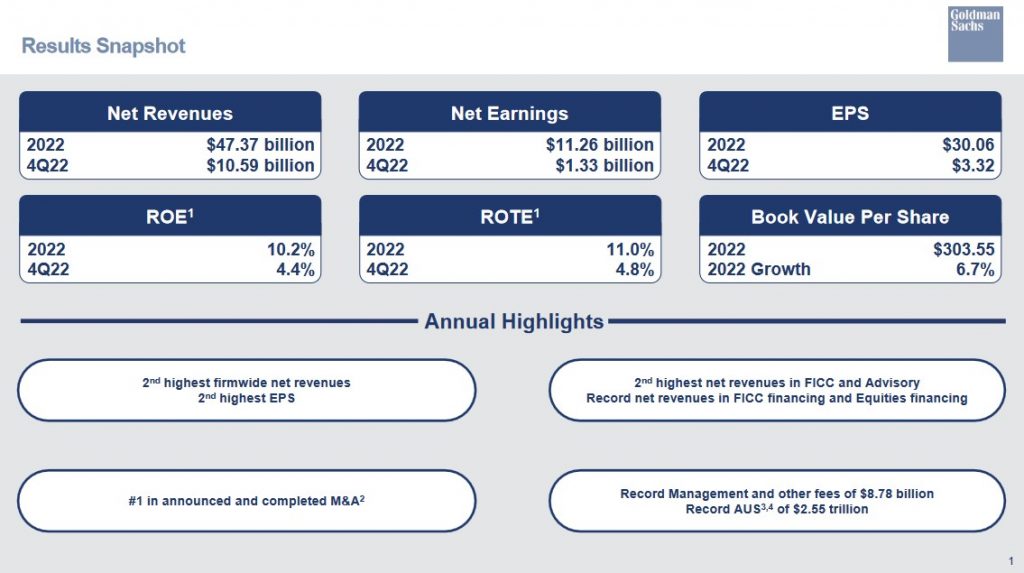

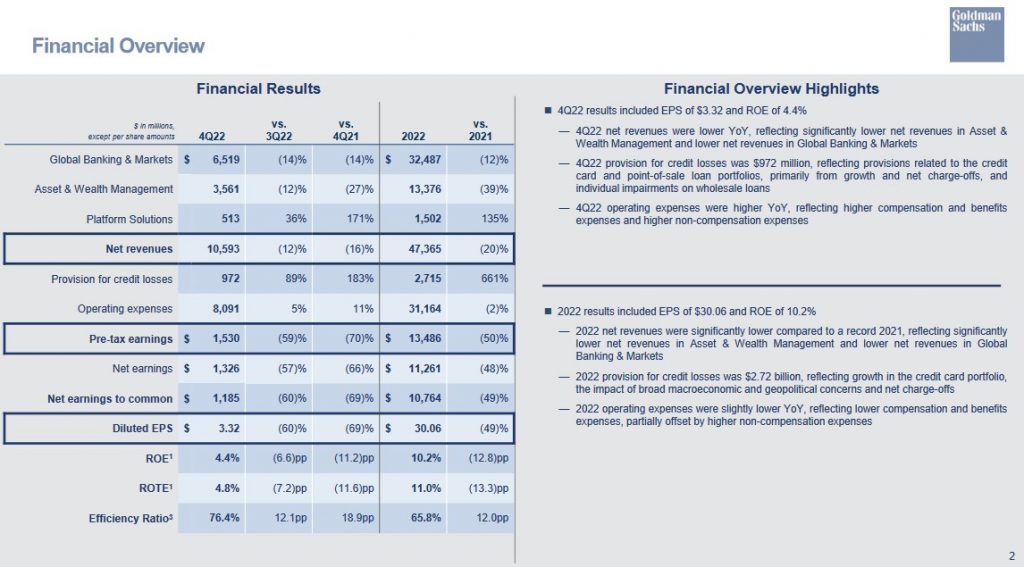

GS's business can be extremely volatile as borne out by FY2022 Net Revenues of $47.37B which is ~20% lower than a strong 2021. This decline is primarily attributed to significantly lower net revenues in Asset & Wealth Management and Global Banking & Markets. Given the challenges in these two lines of business, it only seems reasonable that steps would be taken to right-size the headcount.

While my thoughts go out to the impacted employees, we need to put these layoffs in perspective. We must remember that GS paused its regular performance management-related reductions during the pandemic and increased its headcount by ~12,400 over the past several years. The following is the approximate total number of GS employees in December in recent years:

- 2018: 36,600

- 2019: 38,300

- 2020: 40,500

- 2021: 43,900

- 2022: 49,000

Despite the recent layoffs, there are currently 9,200 more employees at GS than at the end of 2018!

Financial Review

Q4 and FY2022 Results

The following images provide a high-level overview of GS's results. However, more detail is provided in the January 17 Earnings Release and Earnings Presentation.

Source: GS Q4 and FY2022 Earnings Presentation - January 17, 2023

After 9 straight quarters of double-digit returns, high expenses and weak Investment Banking revenue contributed to disappointing Q4 results.

On the prior quarter's earnings call, management spoke about the challenging operating environment and the proactive measures being taken on expenses; I thought GS would have announced layoffs much sooner. Since this was not done and GS can not go back in time, it is somewhat reassuring to see that downsizing measures have now kicked in along with a reduction in certain components of the firm's non-compensation costs; this includes targeted reductions across communications and technology spend, professional fees and advertising costs.

Management is keenly aware that the investment community is closely watching how GS will improve bottom-line results given that 2023 is expected to be a challenging year; on the Q4 earnings call, Mr. Solomon states that CEOs and Boards are telling him that they are cautious, particularly for the near term.

To reach financial targets and create shareholder value, several strategic actions have been taken. These include:

- a recently completed reorganization to strengthen the core businesses and help scale growth platforms and improve efficiency;

- Key decisions regarding the firm's ambitions in its consumer strategy. GS has started a process to cease offering new loans on the Marcus platform and it is likely the book of business will be allowed to roll down naturally. However, GS is also considering other alternatives; and

- the postponement of the launch of its chequing product. At the right time in the future, the intent is to offer chequing accounts to GS's wealth management clients. For now, the priority is to strengthen the deposit franchise, card partnerships and GreenSky. The reasoning for these decisions is to allow GS to reduce forward investment spend and rationalize expenses.

Risk Assessment

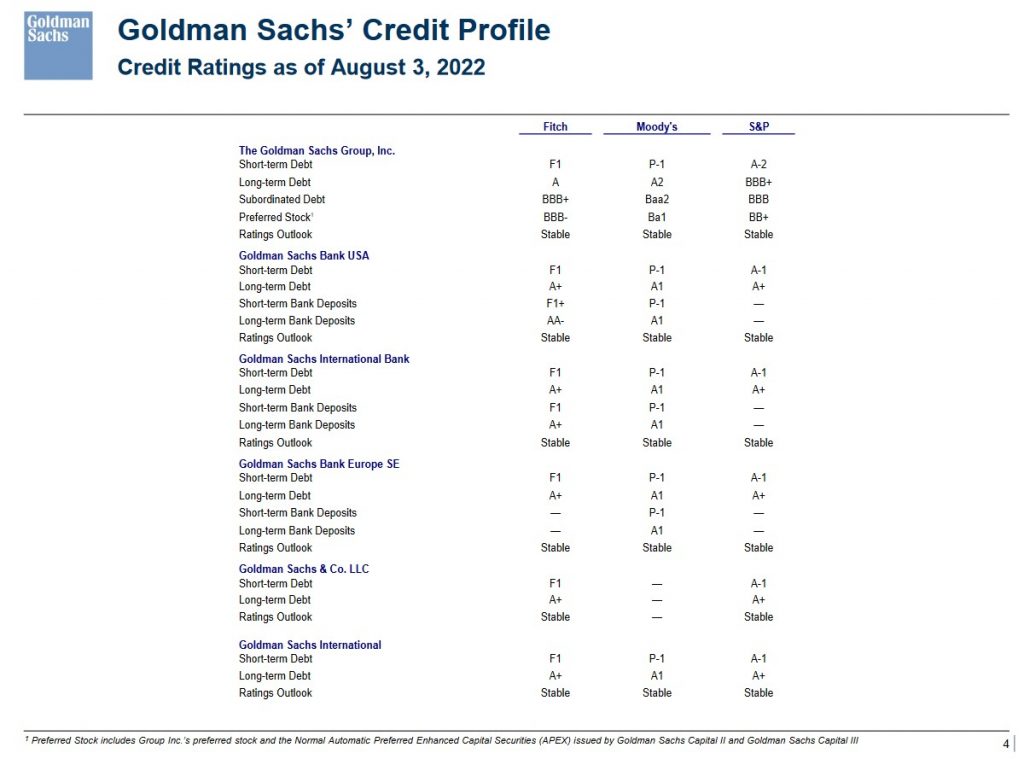

The most current credit profile is found in GS's August 2022 Overview Presentation.

GS - August 2022 Overview Presentation

As a Goldman Sachs Group, Inc. shareholder, my interest lies in this entity's risk.

In prior GS posts, I looked at the long-term debt ratings. In hindsight, I should have looked at GS's subordinated debt ratings because this is the riskiest form of debt; my risk is even greater as a common shareholder.

The Moody's and S&P Global ratings are the middle tiers of the lower-medium grade investment-grade category. The rating assigned by Fitch is one tier higher and is the top tier of the lower-medium grade investment-grade category.

All 3 ratings define GS as having an adequate capacity to meet its financial commitments. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity for GS to meet its financial commitments.

All 3 ratings are satisfactory for my purposes.

Dividend and Dividend Yield

In FY2022, GS distributed $3.20B of common stock dividends. This includes $0.88 million distributed in Q4.

GS does not maintain a dividend history on its website. This history is accessible here.

At the time of my July 8, 2022 post, GS's $2.00 quarterly dividend yielded ~2.7% based on the current ~$296.50 share price.

On January 13, GS's Board declared its 3rd consecutive $2.50 quarterly dividend. It is to be paid on March 30 to common shareholders of record on March 2. With shares trading at ~$350, the dividend yield is ~2.86%.

As noted in several previous posts, focusing on dividend income and dividend yield metrics can lead to flawed investment decisions. Investors would be better served by focusing on an investment's TOTAL potential return.

Since March 2000, GS's Board has approved a repurchase program authorizing repurchases of up to 605 million common shares; it has no set expiration or termination date. The repurchase program is effected primarily through regular open-market purchases. The amounts and timing of these repurchases are determined primarily by GS's current and projected capital position, but may also be influenced by general market conditions and the prevailing price and trading volumes of GS's common stock.

In FY2021, repurchased $5.20B of common shares. In FY2022, GS repurchased $3.50B of common shares (10.1 million shares at an average cost of $346.07). This included $1.50B of share repurchases (4.2 million shares at an average cost of $358.48) in Q4.

GS has been a prolific buyer of its issued and outstanding shares over the years with the FY2009 - FY2022 weighted average number of diluted shares outstanding (in millions) being 550.9, 585.3, 556.9, 516.1, 499.6, 473.2, 458.6, 435.1, 409.1, 390.2, 375.5, 360.3, 355.8, and 358.1.

Valuation

At the time of my July 28, 2021 post, GS was trading at ~$375 and in the first half of FY2021, it had generated $33.64 in diluted EPS. Management does not provide guidance so using the forward-adjusted diluted PE guidance available from the 2 discount brokerage trading platforms I use, I arrived at the following:

- FY2021: 22 brokers, mean estimate $53.14, low/high range $48.39 - $60. Valuation using the mean estimate is ~7 and ~6.25 using the high end of the range.

- FY2022: 22 brokers, mean estimate $37.31, low/high range $32.98 - $41.50. Valuation using the mean estimate is ~10 and ~9 using the high end of the range.

- FY2023: 11 brokers, mean estimate $39.53, low/high range $34.37 - $43.70. Valuation using the mean estimate is ~9.5 and ~8.6 using the high end of the range.

When I wrote my October 15, 2021 post, GS had just released Q3 and YTD2021 results. Based on a ~$400 share price and adjusted diluted earnings estimates, GS's adjusted diluted PE levels were:

- FY2021: 28 brokers, mean estimate $53.59, low/high range $48.66 - $58.63. Valuation using the mean estimate is ~7.46 and ~6.82 using the high end of the range.

- FY2022: 28 brokers, mean estimate $38.04, low/high range $32.98 - $43.82. Valuation using the mean estimate is ~10.5 and ~9.1 using the high end of the range.

- FY2023: 15 brokers, mean estimate $40.79, low/high range $34.37 - $46.05. Valuation using the mean estimate is ~9.8 and ~8.7 using the high end of the range.

My valuation calculations when I wrote my January 19, 2022 post were based on a ~$347.50 share price and the following adjusted diluted earnings estimates:

- FY2022: 26 brokers, mean estimate $40.52, low/high range $34.58 - $45. Valuation using the mean estimate is ~8.6.

- FY2023: 24 brokers, mean estimate $42.23, low/high range $37.65 - $48. Valuation using the mean estimate is ~8.2.

When I wrote my April 15, 2022 post, GS traded at ~$321.60. Its valuation based on current adjusted diluted earnings estimates was:

- FY2022: 27 brokers, mean estimate $37.92, low/high range $31.04 - $44.68. Valuation using the mean estimate is ~8.5.

- FY2023: 28 brokers, mean estimate $40.48, low/high range $34 - $45.30. Valuation using the mean estimate is ~8.

- FY2024: 14 brokers, mean estimate $43.88, low/high range $34.71 - $50.17. Valuation using the mean estimate is ~7.3.

When I wrote my July 8, 2022 post, shares were trading at ~$296.50. Its valuation based on current adjusted diluted earnings estimates were:

- FY2022: 25 brokers, mean estimate $35.19, low/high range $28.70 - $41.25. Valuation using the mean estimate is ~8.4.

- FY2023: 26 brokers, mean estimate $38.70, low/high range $26.10 - $45.30. Valuation using the mean estimate is ~7.7.

- FY2024: 16 brokers, mean estimate $42.72, low/high range $32.56 - $48.50. Valuation using the mean estimate is ~6.9.

There is a significant variance in forward-adjusted diluted earnings estimates from the brokers which cover GS. These estimates are starting to be lowered following GS's earnings release and I envision further downward revisions over the coming days. However, based on the currently available estimates and the current ~$350 share price, GS's valuation is:

- FY2023: 25 brokers, mean estimate $35.28, low/high range $27.01 - $41.95. Valuation using the mean estimate is ~9.92.

- FY2024: 20 brokers, mean estimate $41.21, low/high range $33.29 - $48.00. Valuation using the mean estimate is ~8.49.

In my opinion, GS is currently too richly valued. At least the first half of FY2023 is expected to be a challenge according to what CEOs and Boards are telling Mr. Solomon. Given this, I envision GS will also be challenged.

If further revisions to broker estimates lower the FY2023 and FY2024 mean adjusted diluted EPS estimates to ~$35 and $40.5 and we use a forward adjusted diluted PE of 8.5 and 8.2 for FY2023 and FY2024, then a more reasonable share price would be ~$300 - ~$330. This range might seem unrealistic but we need to remember that GS's share price can experience considerable short-term volatility. A further ~$20 - ~$50 decline in GS's share price within the first half of 2023 is not a stretch.

Final Thoughts

On the Q4 earnings call, David Solomon (GS's Chairman and CEO) stated that the backdrop over the last year has been incredibly dynamic. There were the expected headwinds such as high inflation. However, GS never expected the war in Ukraine to last as long as it has.

While there are not many signs of widespread distress (balance sheets and company fundamentals are relatively healthy), the outlook for 2023 remains uncertain.

The US Central Bank's rate increases have started to have an impact on inflation, but they are also lowering the growth trajectory of the economy. Furthermore, the labour market remains remarkably tight with an estimated 1.7 job openings available for every unemployed American.

Mr. Solomon also stated that CEOs and Boards are telling him that they are cautious, particularly for the near term. They are rethinking business opportunities and would like to see more stability before committing to longer-term plans. Many firms have started preparing for tougher times by focusing on factors within their control.

Despite several challenges, GS continues to execute its 3 key priorities:

- grow management fees in the asset and wealth management business;

- maximize wallet share and growing financing activities and the global banking and markets business; and

- scaling platform solutions to deliver profitability.

Nevertheless, in response to these challenges, GS has had to implement measures to more closely align expenses with projected earnings. In typical fashion, measures that involve employee downsizing make headlines that attract eyeballs. Investors would be wise to disregard this 'noise' and focus on GS's long-term prospects.

GS's business is cyclical so wild swings in quarterly earnings should come as no surprise. It is likely GS will continue to experience challenges over the coming quarters. Hopefully, this will lead to GS falling further out of favour with the investment community and more downward pressure on its share price. I will bide my time before acquiring additional shares.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long GS.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.