This company is currently fairly valued and I view it as an attractive investment for disciplined investors with a long-term investment horizon. It is a member of the exclusive Dividend Kings group of companies. These are companies which have a 50+ year of uninterrupted dividend increases.

Summary

- Strong Q2 results recently reported and projected earnings for FY2018 reaffirmed.

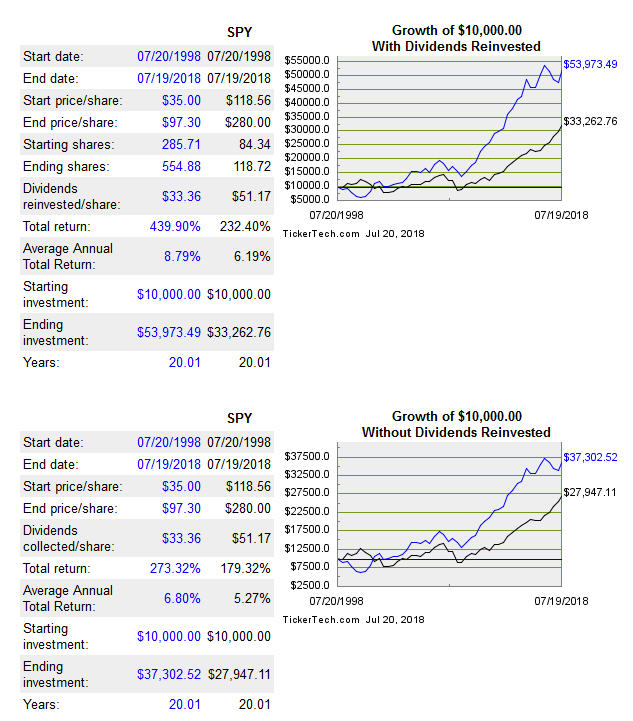

- Shareholder returns on the basis of dividends reinvested over the past 20 years are almost double that of the S&P500.

- Share price has risen ~10% from the level at which my previous article indicated shares were attractively valued. Despite this increase, shares are still attractively valued.

Introduction

On April 19th I wrote that the ~18% pullback in this company’s stock price subsequent to its late January 2018 high should be viewed as an opportunity to acquire shares in this company at a more reasonable valuation.

Subsequent to that article, this company’s stock price has risen ~10%. While this company is no longer as attractively valued as 3 months ago, shares are still reasonably valued based on the company’s growth opportunities.

This company will likely appeal to investors desiring a steadily increasing dividend income stream. The annual dividend has been increased for more than 60 consecutive years (qualifies as a Dividend King which is a company with 50+ consecutive years of dividend increases) and the dividend’s compound annual growth rate over the past 10 years is in excess of 6%.

In addition to dividend increases, this company has repurchased in excess of 57.5 million shares for a total of ~$2.6B since 1994. These shares have been repurchased primarily with earnings generated through normal business operations versus other companies which have loaded up their balance sheet with debt for the purpose of repurchasing shares.

The company prudently manages its working capital and its after-tax return on invested capital exceeds its weighted average cost of capital by 7%.

I have written a few articles about this company with the most recent two articles here and here being accessible to Financial Freedom is a Journey subscribers.

Please click here to read the complete version of this article.

Members of the FFJ community can access reports I generate on high quality companies which add long-term shareholder value. In an effort to help you determine whether my offering is of any value to you I am pleased to offer 30 days' free access to all sections of my site. No commitments. No obligations. That's 30 days from the time you register at absolutely no cost to you!