In my January 30, 2025 post, I recommended buying undervalued Danaher (DHR) shares amid market challenges. Following that post, shares were caught in the recent broad market pullback.

In early April, DHR’s share price fell as low as ~$172. Despite a mild recovery to ~$196.50 as I compose this post on April 24, I still think DHR’s attractive valuation presents a buying opportunity.

Business Overview

I reference my December 19 post in which I provide a brief business overview. The best way to learn about DHR, however, is to read its Form 10-K that is accessible through the SEC Filings section of the company’s website.

Financials

Q1 2025 Results

Refer to the material available in the Quarterly Earnings section of DHR’s website.

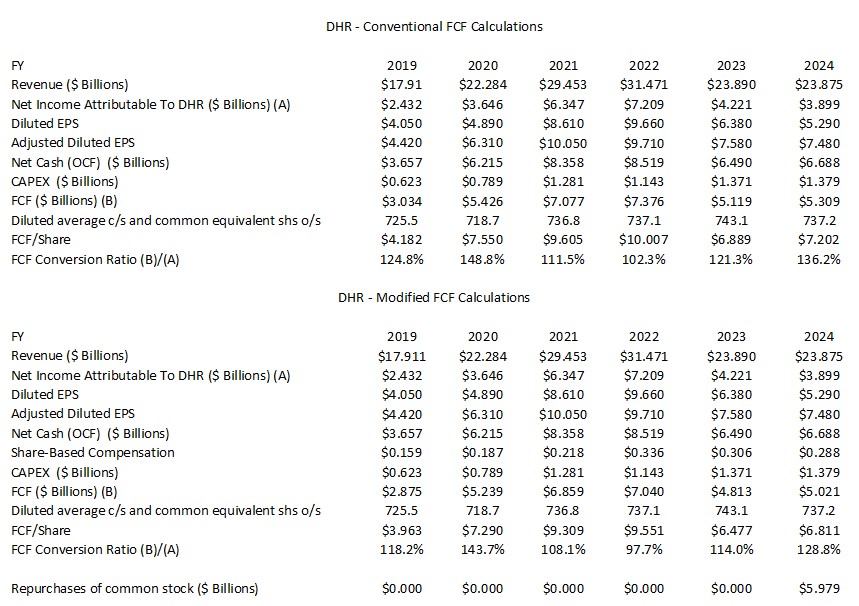

Conventional And Modified Free Cash Flow (FCF) Calculations (FY2019 – FY2024)

In several posts I express my thoughts about the way many companies calculate Free Cash Flow (FCF). Since FCF is a non-GAAP metric, there is no standardization in its calculation.

In most cases, companies merely deduct net CAPEX from net cash flows from operating activities. I think it is also necessary to deduct share based compensation (SBC).

Many companies employ SBC as part of their employee compensation plans and reflect this cost within the Income Statement. Because SBC involves no cash outlay, however, companies add back SBC to determine net cash flows from operating activities in the Condensed Consolidated Statement of Cash Flows.

Suppose, however, that DHR were to compensate employees 100% by way of SBC. Since there is no cash outlay, the full amount of its employee compensation is added back in the Condensed Consolidated Statement of Cash Flows to determine net cash flows from operating activities.

If, on the other hand, DHR were to have no SBC and were to actually disburse funds to pay its employees, nothing would be added back in the Condensed Consolidated Statement of Cash Flows.

By merely changing the manner in which it compensates its employees we get very different net cash flows from operating activities! How does this make any sense? Is the use of SBC not a form of ‘financing’? Would it be more proper to reflect SBC within the Cash Flows From Financing Activities section of the Condensed Consolidated Statement of Cash Flows? This way, we would arrive at similar FCF results no matter how a company chooses to compensate its employees.

The following table reflects data extracted from the FY2019 – FY2024 reconciliation of GAAP and non-GAAP financial measures and supplemental forward-looking information documents that are accessible here. The section with the modified FCF calculations deducts share based compensation (SBC) from total operating cash provided by continuing operations.

Strong free cash flow generation is one of the most important metrics at DHR. FY2024 marked the 33rd consecutive year of FCF to net income conversion which exceeded 100%. If we deduct SBC to determine FCF, however, DHR just fell short of 100% in FY2022.

In Q1 2025, net cash provided by operating activities was ~$1.299B. If we deduct net CAPEX of ~$0.239B and SBC of $0.061B, FCF amounts to ~$0.999B. Net earnings, on the other hand, was ~$0.954B for a FCF conversion ratio of ~104.7%.

FY2025 Outlook

DHR provides forecasted sales only on a non-GAAP core revenue basis. This is because of the difficulty in estimating the other components of GAAP revenue (eg. currency translation, acquisitions, and divested product lines).

On the Q1 2025 earnings call with analysts, management states:

We expect end market demand remains relatively consistent with the first quarter for the remainder of 2025.

Regarding tariffs, based on what is currently implemented, we believe we can largely offset the impact from these tariffs through a combination of supply chain adjustments, surcharges, manufacturing footprint changes and other cost actions.

Now for the full year 2025, there is essentially no change to our previous expectations.

We continue to expect core revenue growth of approximately 3%, which assumes better performance in our bioprocessing business will be offset by slightly more modest expectations for Life Sciences.

Additionally, we’re initiating full year adjusted diluted EPS guidance in the range of $7.60 to $7.75.

Given the current environment, we believe providing adjusted EPS guidance offers the best anchor point for assessing business performance and will provide better clarity for our investors. In the second quarter, we expect core revenue to grow in the low single-digit percent range.

And additionally, we expect a second quarter adjusted operating profit margin of approximately 25.5%, reflecting normal seasonality in Cepheid’s respiratory business and continued productivity investments.

Risk Assessment

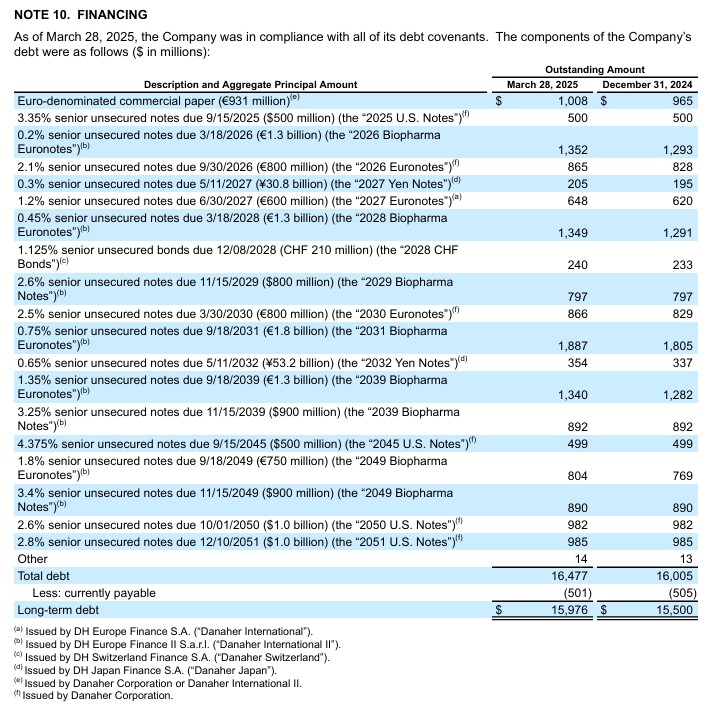

The following schedule reflects DHR’s long term debt at the end of Q1 2025 and FYE2024.

DHR borrows at very attractive rates and the scheduled maturity dates are well staggered.

DHR’s credit ratings remain the same from my last review.

- Moody’s: Upgraded to A3 from Baa1 on October 10, 2022. This rating was last reviewed on June 18, 2024 and the outlook remains stable.

- S&P Global: Upgraded to A- from BBB+ on June 11, 2022. This rating was last reviewed on June 11, 2024 and the outlook remains stable.

Both ratings are at the bottom tier of the upper-medium investment-grade tier and define DHR as having a STRONG capacity to meet its financial commitments. However, DHR is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

These ratings satisfy my conservative investment profile.

Dividend and Dividend Yield

DHR’s quarterly dividend is likely to remain a negligible portion of the total investment return. Do not, however, fixate on dividend metrics. Focus on total potential long-term investment returns!

DHR distributed its first $0.32/share quarterly dividend on April 25, 2025.

When it declared its quarterly dividend in December 2023 for distribution at the end of January 2024, it lowered the quarterly dividend to $0.24. This arose because of the Veralto spin-off. The $0.27/share quarterly dividend, however, was restored with the declaration of the dividend payable on April 26, 2024.

There were 710.2, 725.2, 718.7, 736.8, 737.1, 743.1, and 737.2 million diluted average common stock and common equivalent shares outstanding in FY2018 – FY2024. In Q1 2025, the diluted weighted average shares outstanding was 720.8 million.

The share increase in recent years is primarily the result of the conversion of On April 15, 2022, all outstanding shares of the 4.75% MCPS Series A converted and on April 15, 2023, the 5% MCPS Series B converted.

On July 22, 2024, DHR’s Board approved a new repurchase program authorizing the repurchase of up to an additional 20 million shares of common stock from time to time on the open market or in privately negotiated transactions.

In several recent years, DHR has repurchased no shares. In FY2024 and in Q1 2025, however, it repurchased $5.979B and $1.078B of its shares.

Hopefully DHR’s share price will remain depressed thus enabling it to continue to aggressively repurchase shares.

Valuation

DHR’s valuation using the current broker guidance and the April 24 closing share price of ~$196.50 is:

- FY2025 – 26 brokers – mean of $7.70 and low/high of $7.60 – $7.83. Using the mean, the forward adjusted diluted PE is ~25.5.

- FY2026 – 25 brokers – mean of $8.57 and low/high of $8.21 – $8.98. Using the mean, the forward adjusted diluted PE was ~23.

- FY2027 – 18 brokers – mean of $9.50 and low/high of $8.95 – $10.25. Using the mean, the forward adjusted diluted PE was ~20.7.

- FY2028 – 9 brokers – mean of $10.60 and low/high of $10.06 – $11.55. Using the mean, the forward adjusted diluted PE was ~18.5.

In Q1, DHR generated diluted EPS of $1.32 and the FCF conversion ratio was ~104.7% (see modified FCF calculation found earlier in this post); it generated $1.88 of adjusted diluted EPS in Q1 2025. Should DHR generate $6.00 of diluted EPS in FY2025 and the FCF conversion ratio calculated on a modified basis approaches 110%, we can expect DHR’s FY2025 FCF/share to be ~$6.60. Using the current ~$196.50 share price, the forward P/FCF is ~30.

For comparison, the following reflects my valuation estimates in my January 30, 2025 post.

DHR generated $6.38 and $7.38 of diluted EPS and adjusted diluted EPS in FY2024. Both are greater than what I anticipated when I wrote my December 8 post. Using my January 29 $226.47 purchase price, the diluted PE and adjusted diluted PE are ~35.5 and ~30.7.

DHR’s valuation using the current broker guidance is:

- FY2025 – 27 brokers – mean of $7.79 and low/high of $7.57 – $8.55. Using the mean, the forward adjusted diluted PE is ~29.1.

- FY2026 – 25 brokers – mean of $8.72 and low/high of $8.20 – $10.00. Using the mean, the forward adjusted diluted PE was ~26.

- FY2027 – 12 brokers – mean of $9.72 and low/high of $8.92 – $11.40. Using the mean, the forward adjusted diluted PE was ~23.3.

- FY2028 – 6 brokers – mean of $10.93 and low/high of $10.12 – $11.70. Using the mean, the forward adjusted diluted PE was ~20.7.

DHR typically reports significant depreciation and amortization expenses every year which depresses earnings; in FY2023 and FY2024, it reported ~$2.174B and ~$2.377, respectively. It also reported ~$0.265B in impairment charges related to an indefinite-lived trade name within the genomics consumable business included in the Life Sciences segment. This determination was primarily the result of softness in the genomics market, including but not limited to the discontinuation of drug development programs announced in the third quarter and weaker demand at some of the business’s larger customers as well as reduced demand due to the reprioritization of drug development programs at other customers.

DHR consistently reports significant non-cash items that depress earnings. Management also focuses very heavily on the FCF metrics. Investors would, therefore, be wise to look at DHR’s valuation based on FCF.

Using my January 29 $226.47 purchase price and $7.202 of FCF/share in FY2024 (conventional FCF calculation), the P/FCF is ~31.4. Using $6.811 of FCF/share in FY2024 (modified FCF calculation), the P/FCF is ~33.3.

Final Thoughts

I currently hold 800 DHR shares in a ‘Core’ account in the FFJ Portfolio.

DHR was my:

- 28th largest holding when I completed my 2023 Year End FFJ Portfolio Review;

- 22nd largest holding when I completed my 2024 Mid Year FFJ Portfolio Review; and

- 19th largest holding when I completed my 2024 Year End FFJ Portfolio Review.

My assessment of DHR is much the same as in January 2025 at which time I wrote:

DHR continues to experience short-term headwinds and management’s FY2025 outlook suggests investors should not expect much of a rebound.

On the bright side, DHR’s capital allocation is exemplary. While DHR’s share price is under pressure, the company is repurchasing a significant number of shares.

Once growth trends normalize, I think DHR will be able to generate low double-digit earnings growth; this is unlikely to begin until 2026 – 2027 at the earliest.

DHR’s share price could slip further from current levels. At $226.47, however, I stand to have capital appreciation of ~17% if DHR’s share price improves to ~$265 – a level I consider fair.

Should DHR’s share price improve from the current ~$196.50 to ~$230 – below the ~$265 I consider to be a fair value – investors would generate a ~17% return. If the share price appreciates to $245 or $265, the return rises to ~24.7% and ~34.9%, respectively. I am prepared to withstand DHR’s short-term headwinds for this potential return.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long DHR.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.