Contents

Following a recent return to a reasonable valuation, investors should consider Automatic Data Processing (ADP) for its attractive long-term investment return potential.

I have covered ADP in various previous posts which are accessible through the Archives; my last ADP post was on July 29, 2020, at which time I indicated I had added to my position on weakness.

Having closely followed ADP for many years, I pretty much know when I am prepared to add to my exposure.

At the January 26, 2022 market close, ADP's share price had dropped to ~$197.50. This is a welcome decline from the ~$249 52 week high set in late December 2021!

I am optimistic about ADP's long-term outlook and initiated a 100 share position in one of the 'Side' accounts in the FFJ Portfolio; the ADP position I have held for over 2 decades is in a retirement account for which I do not disclose details.

In this post, I look at ADP given that it released Q2 and YTD results and its 2nd half of FY2022 outlook on January 26, 2022.

Business Overview

ADP is one of the world’s leading providers of cloud-based human capital management (HCM) solutions to employers; it offers solutions to businesses of all sizes.

ADP boats impressive statistics. It:

- serves over 920,000 clients;

- pays over 38 million workers across 140 countries and territories;

- paid 1 of 6 workers in the US in FY2021;

- paid $2.3 Trillion in annual payroll/tax processed in FY2021.

- recently reached a new milestone by running 1 million payslips for a single client on a single day for the first time in ADP's history.

- the ADP mobile app had over 1 billion log-ins in calendar 2021

Its 2 reportable business segments are:

- Employer Services

- Professional Employer Organization

The Staffing & Employment Services industry is becoming increasingly competitive and the business is subject to a wide range of complex U.S. and foreign laws and regulations.

The best way to learn about ADP is to:

- review its website;

- read Part 1, Item 1 in its 2021 10-K;

- review the November 2021 Investor Presentation.

Clients Funds Investment Strategy

The purpose of ADP’s Client Funds Extended Investment Strategy is to generate income from the significant client fund balance; on December 31, 2021, ADP had $45,890.4B held for clients.

In the first half of FY2022, ADP generated $207.1 million of 'Interest on funds held for clients'.

When deemed prudent, ADP will further enhance its investment returns by investing long and borrowing short to take advantage of the yield spread.

This strategy is structured to allow ADP to average its way through an interest rate cycle by laddering the maturities of investments out to 5 years (in the case of the extended portfolio) and out to 10 years (in the case of the long portfolio). This investment strategy is supported by ADP's short-term financing arrangements necessary to satisfy short-term funding requirements relating to client funds obligations.

The Q2 2022 Form 10-Q is not yet available. Note 4 - Corporate Investments and Funds Held for Clients in the FY2021 Form 10-K starting of page 61 of 93, however, provides a comprehensive overview of this investment strategy.

The purpose of these funds is such that ADP is very conservative with its investments.

Financial Review

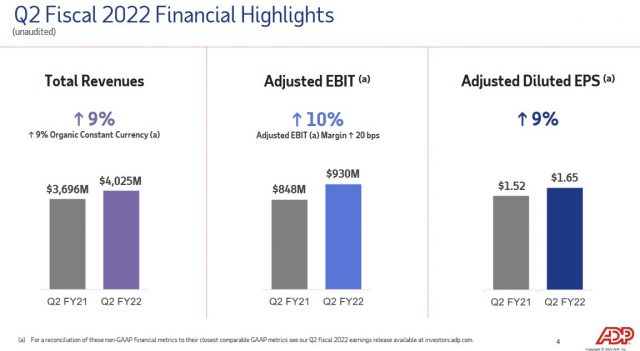

Q2 and YTD2022 Results

ADP's Q2 and YTD2022 results are reflected in Form 8-K and the accompanying earnings presentation.

ADP's CAPEX requirements are well below those of capital-intensive industries. This is a strong advantage when it comes to generating Free Cash Flow (FCF).

ADP's FY2012 - FY2021 FCF (in Billions of $) is $1.661, $1.342, $1.518, $1.639, $1.511, $1.655, $2.044, $2.122, $2.410, and $2.587. In the first half of FY2022, ADP generated ~$1.14B of FCF.

FY2022 Outlook

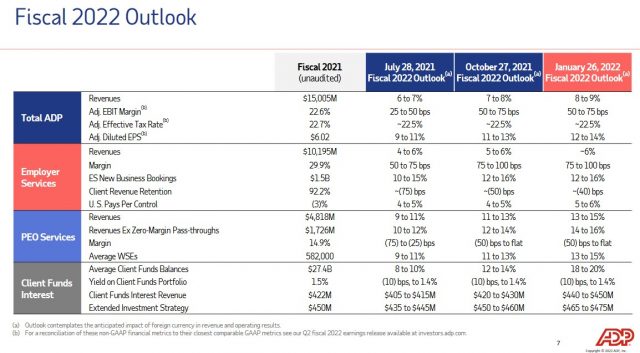

With the January 26, 2022 release of Q2 and YTD results, we see that ADP is increasing its guidance for certain metrics for the 2nd time this year.

Source: ADP - Q2 2022 Earnings Presentation

ADP has updated its Employer Services revenue outlook. The primary drivers for a higher outlook are the stronger Q2 performance, higher client funds interest outlook for the year and higher pays per control growth. These are partially offset by an expectation from incremental FX headwind in the 2nd half of FY2022 on the recent strengthening of the U.S. dollar.

Improved guidance is also based on management's expectation that a gradual ongoing recovery in the labour force participation will support job growth; the first half of the year was a bit ahead of expectations.

ADP's client funds interest grew for the first time since the pandemic started as the lower average yield was offset by a 28% balance growth. Based on YTD results, management is raising its client funds' interest revenue outlook by $20 million to $0.44B - $0.45B.

As in Q1 2022, ADP is raising its balance growth assumption to now expect 18% - 20% growth.

ADP now expects 8% - 9% revenue to growth.

The adjusted EBIT margin is still expected to increase 50 to 75 bps.

Margin improvement is expected to be concentrated in Q4 and margin is forecast to be lower in Q3 given ADP's recent personnel growth and wage increases.

Risk Assessment

ADP's domestic unsecured credit ratings all have a stable outlook and are:

- Moody's: Aa3

- S&P Global: AA-

- Fitch: AA-

All ratings are the bottom tier of the upper medium-grade investment-grade category.

These ratings define ADP as having a very strong capacity to meet its financial commitments. They differ from the highest-rated obligors only to a small degree.

These ratings satisfy my conservative investment preferences.

Dividends and Dividend Yield

ADP's dividend history on its website is currently outdated; the last dividend reflected is the $0.93 dividend payable on April 1, 2021. This dividend history is more current.

On January 12, 2022, ADP declared a regular quarterly dividend of $1.04/share payable on April 1, 2022 to shareholders of record on March 11, 2022. This will be the 2nd quarterly dividend at this level.

Using the current ~$197.50 share price, the forward dividend yield is ~2.1% assuming the next 4 quarterly dividend payments remain at $1.04/share. This is unlikely and I envision a dividend increase will be announced in early December 2022; the historical dividend increases have fluctuated wildly. I am not prepared to speculate the extent to which ADP's dividend will increase.

The FY2012 - FY2021 weighted average share outstanding (in millions) is 492, 487, 483, 476, 459, 450, 443, 438, 433, and 428. This was 422.9 for the 6 months ending December 31, 2021.

- FY2019 - ADP purchased ~6.5 million shares at an average price per share of $143.02.

- FY2020 - ADP purchased ~6.2 million shares at an average price per share of $160.61.

- FY2021 - ADP purchased ~8.2 million shares at an average price per share of $170.04.

- In the first 6 months of FY2022, ADP purchased $990.5 million of shares.

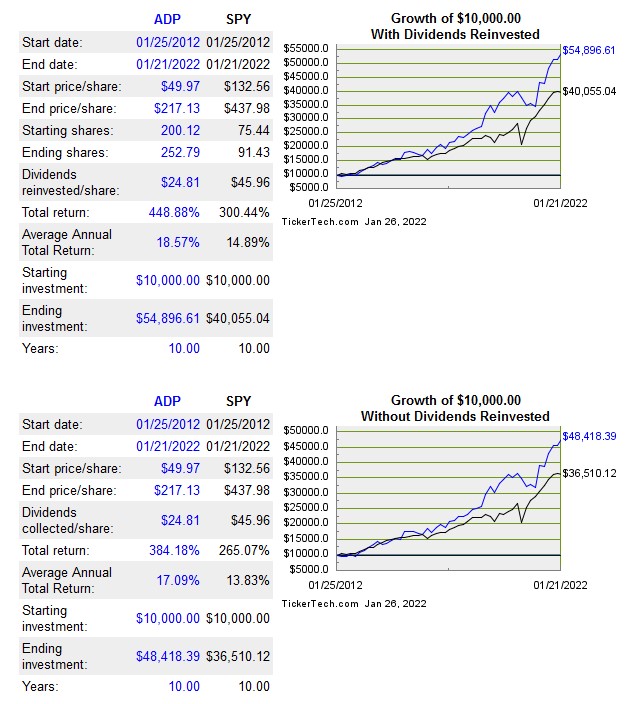

Historical performance does not influence future performance. However, we can use it as a guide. Looking at ADP's historical performance over a 10-year timeframe we see the dividend component of ADP's total shareholder return pales in comparison to that generated from capital gains. One can only wonder what the historical total investment return would be if ADP had solely repurchased shares and never distributed a dividend!

Valuation

ADP's diluted PE ratio in the FY2012 - FY2021 timeframe is 20.41, 28.25, 26.22, 28.33, 30.77, 29.74, 33.79, 31.40, 30.59, and 39.02.

When I wrote my July 29, 2020 post, ADP's diluted EPS forecast was $4.73 - $5.02. With shares trading at ~$137, the forward PE range was ~27.3 – ~29.

In addition, ADP’s adjusted diluted EPS is forecast was $4.85 - $5.15 giving us a forward adjusted PE of ~26.6 – ~28.3.

Management's FY2022 adjusted diluted EPS guidance now calls for a 12 - 14% increase from the $6.02 reported in FY2021. Using the current ~$197.50 share price and adjusted diluted EPS guidance of ~$6.74 - ~$6.86, we get a forward adjusted diluted PE range of ~28.8 - ~29.3.

I expect the brokers' forward-adjusted diluted PE levels reflected on the two online trading platforms I use will change over the next several days. Until such time, however, the forward valuations using the current data is:

- FY2022 - 19 brokers - mean of $6.81 and low/high of $6.72 - $6.91. Using the mean estimate, the forward adjusted diluted PE is ~29 and ~28.6 if I use $6.91.

- FY2023 - 19 brokers - mean of $7.55 and low/high of $7.25 - $7.85. Using the mean estimate, the forward adjusted diluted PE is ~26.2 and ~25.2 if I use $7.85.

- FY2024 - 10 brokers - mean of $8.43 and low/high of $8.11 - $8.60. Using the mean estimate, the forward adjusted diluted PE is ~23.4 and ~23 if I use $8.60.

Only 10 brokers have provided FY2024 estimates so I disregard this guidance.

ADP's forward-adjusted diluted PE is not as attractive as in July 2020. However, at that time, COVID had just brought several global economies almost to a screeching halt and unemployment levels had surged. While we must still contend with COVID-related challenges, the economic situation is not as dire.

ADP is not a capital-intensive business. I am, therefore, prepared to accept a slightly higher valuation than that for the North American railroads and Aerospace and Defense companies I have recently reviewed.

Final Thoughts

In my January 2022 Investment Holding Review, I reported that ADP is my 14th largest holding. It was my 20th largest holding in my 2021 review and it was my 19th largest holding in my 2020 review.

In July 2020, I took advantage of a ~$45 drop from the ~$182 52 week high to add to my ADP position.

ADP has now fallen ~$52 from the ~$249 52 week high set in late December 2021.

I also recently disclosed the purchase of more Paychex (PAYX) shares; PAYX is one of ADP's major competitors. Although I view PAYX's current valuation as also being slightly high, I am a long-time PAYX shareholder and like the company for its attractive long-term investment return potential.

Both ADP and PAYX have very low credit risk and they:

- do not require significant annual CAPEX;

- are consistently profitable;

- are the 2 largest participants within the Staffing and Employment Services industry.

I would very seriously consider adding to my exposure to both companies should their share price significantly pull back further.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long ADP and PAYX.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.