Summary

Summary

- This Colgate-Palmolive stock analysis is based on Q4 and FY2016 results and outlook for fiscal 2017 reported on January 27, 2017.

- Colgate reported its third year in a row of declining global sales.

- Diluted EPS, FCF, and NI increased relative to FY2015. Positive results are attributed to company initiatives and because FY2015 results were negatively impacted by the write-off of Venezuelan operations.

- Colgate is a Dividend King. I anticipate a $0.01/quarter dividend increase to be announced within 2 months to keep this string of increases intact.

Introduction

Colgate-Palmolive Company (NYSE:CL) released its Q4 and FY 2016 financial results on January 27, 2017.

In today’s post I assess CL’s FY2016 results and FY2017 projections to determine whether CL should be retained in our FFJ Portfolio.

I acquired shares in September 2015 knowing full well that CL faced class action lawsuits alleging CL misled consumers with false claims about its Optic White toothpaste. The lawsuits were filed following an investigation by the FTC into the toothpaste ads for Optic White and Optic White Platinum brands of toothpaste. Consumers in both lawsuits allege they did not get the tooth–whitening results promised in the advertisements.

I was also aware of its decision to extricate itself from Venezuela. I knew full well that management would likely be spending an inordinate amount of time and energy on this initiative at the expense of growing its business.

Business Overview

CL was founded in the early 1800s. It is a global consumer products company that operates in the oral, personal and household care and pet food markets. It markets its products in more than 200 countries and territories. The following is a snapshot of some of its most recognizable brands.

According to CL’s Corporate Overview presentation, the percentage of sales from each of its 4 segments is as follows:

- Oral Care: 46%

- Personal Care: 21%

- Home Care: 20%

- Pet Nutrition: 13%

CL is organized along geographic lines, with specific regional management teams having responsibility for the financial results in each region. Management focuses on a variety of key indicators to monitor business health and performance, including: market share, sales (including volume, pricing and foreign exchange components), gross profit margins, operating profits, net income and EPS. CL also focuses on measures to optimize the management of working capital, capital expenditures, cash flow, and return on capital.

In October 2012, CL announced a 4 year “Global Growth and Efficiency Program”. The purpose of this program is to ensure CL’s continued growth in unit volume, organic sales, EPS, and the enhancement of its leadership position within its core business.

Cumulative pre-tax charges as a result of the implementation of this program were expected to result in cumulative pre-tax charges of $1.3B – $1.45B. Annual savings of $0.35B – $0.45B, however, were expected to be realized by year 4 of the program.

In late October, 2014, CL’s Board approved the expansion of this 2012 Program to take advantage of additional savings opportunities. In late October 2015, the Board approved the reinvestment of the funds from the sale of the Company’s laundry detergent business in the South Pacific to expand the 2012 Program and the extension of the program until the end of 2017.

As previously noted, CL continues to face 2 class action lawsuits and as recently as January 2017, CL has sought to dismiss the proposed class action lawsuits.

Q4 and FY2016 Financial Results

Colgate-Palmolive Q4 and FY2016 results can be found in the January 27, 2017 Earnings release.

- FY 2016 marked CL’s third year in a row where global sales declined ($17.420B in 2013, $17.277B in FY2014, $16.034B in FY2015, and $15.195B in FY2016).

- Global unit volume decreased 3.0%, pricing increased 2.5% and foreign exchange was negative 4.5%.

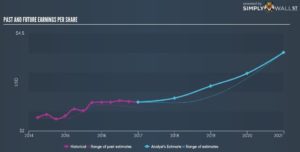

- Diluted EPS results for FY2012 – FY2016 were $2.58, $2.38, $2.36, $1.52, and $2.72 respectively.

- FCF results for the same period were $2.631B, $2.534B, $2.541B, $2.258B, and $2.548B.

- Net Income results for FY2012 – FY2016 were $2.472B, $2.241B, $2.180B, $1.384B, and $2.441B.

The percentage of sales generated from each region in FY2016 was:

- North America: 21%

- Latin America: 24%

- Europe: 16%

- Asia Pacific: 18% (this is a 1% reduction from the 19% reflected in the October 2016 presentation)

- Africa/Eurasia: 6%

- Hill’s Pet Nutrition (globally): 15% (this is a 1% increase from the 14% reflected in the October 2016 presentation)

While CL continues to face:

- continued challenging macroeconomic conditions worldwide

- the acceleration of foreign currency headwinds relative to expectations

- slowing category growth in several key markets and India’s demonetization

it did achieve positive results on various fronts including organic sales growth, increased gross profit margin, and market share. Please refer to CL’s Earnings release for more details.

Outlook for Fiscal 2017

Operating a global business is definitely a challenge. It becomes increasingly complicated when management has to divert its attention and to allocate resources toward the extrication of its business from a geographic region (Venezuela). With much of the Venezuelan issues out of the way, management should now be able to allocate more time and attention to the growth of its business.

Having said this, management expects FY2017 to be challenging. It has noted that it faces increased uncertainty in global markets and that foreign exchange volatility remains challenging. Based on current foreign exchange spot rates, management anticipates a low-single-digit net sales increase for 2017.

Gross margin is expected to expand, operating cash flow is expected to be strong, but EPS should remain flat. This is all based on expectations of another year of solid organic sales growth driven by a full new product pipeline, engaging marketing programs, and increased advertising investment.

Valuation

CL’s diluted EPS in FY2016 was $2.72. While the FY2017 mean EPS derived from earnings estimates from 22 brokers is $2.91, I will go with CL’s $2.72 FY2017 projected diluted EPS.

As I compose this post, CL is trading at roughly $64.27 and its PE is 23.63. While CL continues to generate strong FCF, sales growth has been stagnant. I would suggest that CL is somewhat overpriced at the moment and suggest you patiently wait for a pullback to roughly $55. Using the forecast EPS of $2.72, this would give you a PE of roughly 20.

CL pays a quarterly dividend of $0.39 or $1.56/year. CL is a Dividend King which means it has increased its annual dividend for at least 5 consecutive decades. While a Board does not set its dividend solely on the basis of investor expectations, there is a track record of annual dividend increases which investors are likely pricing into the stock’s price. I doubt CL’s Board wishes to deviate from its practice of increasing its dividend annually, and therefore, expect a $0.01/share/quarter dividend increase to be announced within the next 2 months. This is certainly not an impressive increase but given all the headwinds CL faces, I am not optimistic a larger increase is forthcoming.

If we use a new quarterly/annual dividend of $0.40 and $1.60, we get a dividend yield of 2.50% based on the current market price (increases to 2.90% if price drops to $55). This low dividend yield may be enough to dissuade some investors from initiating a position in CL. If you have a long term investment horizon, however, you may be willing to put up with a low dividend yield on the expectation that management will be able to restore CL to its glory days where meaningful growth was evidenced on a consistent basis.

Colgate-Palmolive Stock Analysis – Final Thoughts

CL is currently a member of the FFJ Portfolio and shall remain so despite the absence of any meaningful top line/bottom line growth over the last few years. My rationale for continuing to hold CL is that:

- I purchased CL as a long-term hold knowing full well that it was experiencing challenges in its business

- it continues to generate strong FCF that is more than ample to meets its dividend obligations.

- I am cautiously optimistic that with the Venezuelan issue out of the way, management will be able to focus its time and attention on growing the business as opposed to fighting fires.

I expect a dividend increase to be announced shortly but have no expectations that it will be greater than $0.01/quarter. If you are a US based readers, stop griping about the low yield. I am a Canadian based investor and hold these shares in a non-registered account. This means I suffer a 15% haircut on all dividends paid by US companies listed on US exchanges; we only hold a little over 400 CL shares so in the great scheme of things, it doesn’t cause me to lose sleep.

CL is not an overnight sensation. It has been around for over 200 years. It is not going away but it has hit some bumps along its journey. I am cautiously optimistic CL will once again return to growth mode.

Having said this, I would encourage you to be patient if you are contemplating initiating a position in CL, or increasing your exposure to CL (refer my comments under “Valuation”) since I think it is just a bit expensive at the moment (like many, many other stocks).

Disclaimer: I have no knowledge of your circumstances and am not providing individualized advice or recommendations. I encourage you to conduct your own research and due diligence and to consult your financial advisor about your situation.

Disclosure: I am long CL.

I wrote this article myself and it expresses my opinions. I am not receiving compensation for it and have no business relationship with any company mentioned.