Contents

Unfortunately, the number of bargains presented to investors from mid-September through mid-October has diminished of late. However, CME Group (CME) is low-risk and attractively valued. This makes it an attractive investment at a time when investors should reduce risk.

In addition to this piece of good news, CME is scheduled to declare its 'special annual variable dividend' within the first 2 weeks of December.

Although I strongly encourage investors not to fixate on dividend metrics, many investors focus heavily on such metrics. You may wish to take a close look at CME should you be such an investor.

I last reviewed CME in my July 28, 2022 'CME Group – The Risk Of Relying On Stock Screeners' post. Given that we now have Q3 and YTD2022 results, I revisit CME.

Overview

A high-level overview of the company is provided in previous posts that are accessible in the FFJ Archives. I encourage you, however, to read Part 1 in CME's 2021 Form 10-K if you wish to gain a good understanding of the business.

Financials

Q3 and YTD2022 Results

CME's Q3 and YTD2022 results are reflected in Form 8-K, Earnings Commentary, and Income Statement Trends released on October 26, 2022.

Investors are reminded that the migration of EBS to CME Globex technology was completed in Q2 2022. This explains the reason for the shift in the revenue mix reflected on page 2 of 8 in the Earnings Commentary.

Google Partnership

In my February 9, 2022 post, I touch upon CME's 10-year strategic partnership deal with Google Cloud. This strategic partnership will allow CME to transform derivative markets to cloud adoption and co-innovation to deliver expanded access, new products and more efficiencies for more market participants. In conjunction with this new strategic partnership, Google has made a $1B equity investment in a new series of non-voting convertible preferred stock of CME.

The issuance of Class G non-voting shares in November in conjunction with CME's partnership with Google impacts the calculation of EPS attributable to common shares. These Class G non-voting shares have similar rights to common stock except for voting rights. Management, however, expects the EPS for the Class G non-voting shares and common shareholders to be the same going forward.

In Q1, Q2, and Q3, CME incurred ~$6 million, ~$8 million, and ~$7 million of cash expenses toward its cloud migration to Google. CME continues to progress with its Google partnership and is tracking to its internal objectives to build the foundation for its move to the cloud.

Guidance

FY2022 guidance, for the most part, is unchanged from that provided when FY2021 results were released in early February 2022.

- Total adjusted operating expenses excluding license fees of ~$1.45B.

- FY2022 cash costs associated with the Google Cloud partnership are expected to be ~$30 M which is revised upwards from prior $25M - $30M guidance; CME has spent ~$21 M YTD. A portion of these costs may be capitalized.

- CapEx, net of leasehold improvement allowances, is expected to be ~$0.1B versus prior guidance of ~$0.15B.

- The adjusted effective tax rate projection remains at 22.5% - 23.5% versus ~22% in FY2021.

Credit Ratings

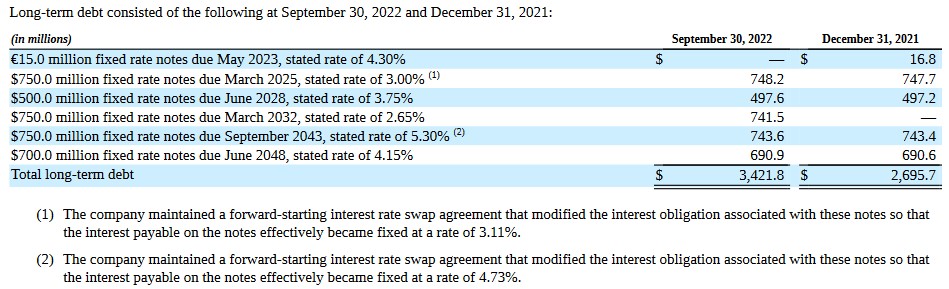

Details of CME's Debt are found in Note 7 (pages 18-19 of 39) in Q3 2022 Form 10-Q.

We see from the following schedule that there is no long-term debt maturing over the next couple of years. The €15.0 million fixed rate notes due May 2023 are classified as short-term debt and CME should have no difficulty in retiring this facility.

Source: CME - Q3 2022 Form 10-Q

There are no changes to CME's senior unsecured long-term debt ratings from those at the time of my July 28, 2022 post.

- Moody's: Aa3 with a stable outlook

- S&P Global: AA- with a stable outlook

- Fitch: AA- with a stable outlook

All are the lowest tier of the high-grade category and are investment grade. These ratings define CME as having a VERY STRONG capacity to meet its financial commitments. It differs from the highest-rated obligors only to a small degree.

CME's credit risk is acceptable for my purposes.

Dividend and Dividend Yield

CME's 4th quarterly $1.00/share dividend is to be distributed on December 28, 2022.

It distributed ~$0.363B of dividends during 3Q and ~$2.3B YTD.

CME's dividend policy targets a regular quarterly dividend of between 50% - 60% of the prior year's cash earnings. In addition, CME declares its 'special annual variable dividend' within the first 2 weeks of December for distribution in mid-January.

NOTE: Since the implementation of the special annual variable dividend policy in early 2012, CME has returned ~$18.8B to shareholders in the form of dividends.

This 'special annual variable dividend' increases or decreases from year to year based on operating results, capital expenditures, potential merger and acquisition activity and other forms of capital return, including regular dividends and share buybacks during the prior year.

Given how this 'special annual variable dividend' is determined, it is very difficult to predict the amount to be declared. I do, however, compare prior year results relative to the current fiscal year results at the end of Q3 to try and gauge the amount of this 'special annual variable dividend'.

After comparing CME's YTD2022 results against those for the first 9 months of the recent prior fiscal years, I envision the declaration of at least a $3/share 'special dividend'. Based on 4 quarterly $1/share dividends plus the $3/share 'special annual variable dividend' means investors who have held shares since at least the beginning of 2022 would receive $7/share in total annual dividend income.

With shares currently trading at ~$174, the dividend yield is ~4%. If you are a Canadian resident like me and hold shares in taxable accounts, however, you incur a 15% dividend withholding tax so the dividend yield drops to ~3.4%.

Investors can also expect CME to declare a dividend increase in February for distribution near the end of March. Once again, it is difficult to predict the value of this new dividend. Based on recent dividend history, however, an increase of at least $0.05/share/quarter is not unreasonable.

CME has not repurchased shares in recent years; the weighted average number of issued and outstanding shares in FY2011 - FY2021 (in millions) is 334, 332, 334, 336, 338, 339, 340, 344, 358, 359, and 359. The weighted average number of issued and outstanding shares for the first 9 months of FY2022 is still ~359.

Increases in outstanding common shares are related to shares issued under the following:

- CME Group Omnibus Stock Plan

- Director Stock Plan

- Employee Stock Purchase Plan

Details of CME's 'Capital Stock and Stock-Based Payments' commence on page 77 of 107 in the FY2021 10-K.

Valuation

CME's diluted PE in FY2011 - FY2021 is 12.92, 18.77, 27.53, 29.45, 24.22, 26.89, 33.12, 14.20, 35.28, 30.34, and 33.70.

When I wrote my October 2021 post, CME had generated $5.60 in diluted EPS in the first 3 quarters of FY2021 and I envisioned FY2021 EPS of $7.45 - $7.50. Using the $7.475 mid-point and a ~$217 share price, I estimated a forward diluted PE of ~29.

Using the broker guidance from the two online trading platforms I use, CME's forward adjusted diluted PE levels were:

- FY2021 - 17 brokers - mean of $6.63 and low/high of $6.20 - $7.07. Using the mean estimate, the forward adjusted diluted PE is ~32.7.

- FY2022 - 17 brokers - mean of $7.27 and low/high of $6.54 - $8.05. Using the mean estimate, the forward adjusted diluted PE is ~30.

- FY2023 - 15 brokers - mean of $7.89 and low/high of $6.80 - $9.14. Using the mean estimate, the forward adjusted diluted PE is ~27.5.

When I reviewed CME on February 9, 2022, it had recently reported $7.29 in FY2021 GAAP diluted EPS. With shares trading at ~$250, the diluted PE based on FY2021 results was ~34.3.

Using the current ~$250 share price and broker estimates, the forward adjusted diluted PE levels were:

- FY2022 - 19 brokers - mean of $7.34 and low/high of $6.83 - $7.89. Using the mean estimate, the forward adjusted diluted PE is ~34.

- FY2023 - 17 brokers - mean of $7.95 and low/high of $7.50 - $8.91. Using the mean estimate, the forward adjusted diluted PE is ~31.

- FY2024 - 3 brokers - mean of $8.34 and low/high of $7.86 - $8.85. Using the mean estimate, the forward adjusted diluted PE is ~30.

When I wrote my May 10, 2022 post, CME was trading at $201.60.Using the current broker estimates, the forward adjusted diluted PE levels are:

- FY2022 - 18 brokers - mean of $7.89 and low/high of $7.63 - $8.35. Using the mean estimate, the forward adjusted diluted PE is ~25.6.

- FY2023 - 18 brokers - mean of $8.44 and low/high of $7.84 - $9.33. Using the mean estimate, the forward adjusted diluted PE is ~24.

- FY2024 - 12 brokers - mean of $8.97 and low/high of $7.87 - $9.53. Using the mean estimate, the forward adjusted diluted PE is ~22.5.

On July 27, 2022, I acquired additional shares at $195.135. Using the current broker estimates, the forward adjusted diluted PE levels are:

- FY2022 - 17 brokers - mean of $7.91 and low/high of $7.33 - $8.23. Using the mean estimate, the forward adjusted diluted PE is ~24.7.

- FY2023 - 17 brokers - mean of $8.43 and low/high of $7.87 - $9.21. Using the mean estimate, the forward adjusted diluted PE is ~23.

- FY2024 - 12 brokers - mean of $8.88 and low/high of $8.14 - $9.94. Using the mean estimate, the forward adjusted diluted PE is ~22.

Shares now trade at ~$174 and the forward adjusted diluted PE levels using the current broker estimates are:

- FY2022 - 14 brokers - mean of $7.98 and low/high of $7.82 - $8.07. Using the mean estimate, the forward adjusted diluted PE is ~22.

- FY2023 - 15 brokers - mean of $8.36 and low/high of $7.73 - $8.70. Using the mean estimate, the forward adjusted diluted PE is ~21.

- FY2024 - 13 brokers - mean of $8.69 and low/high of $7.96 - $9.38. Using the mean estimate, the forward adjusted diluted PE is ~20.

CME's current valuation is attractive.

Final Thoughts

CME consistently generates very strong FCF. It also has no long-term debt maturing in the next couple of years (the €15.0 million fixed rate notes due May 2023 is a negligible amount and is now classified as short-term debt).

In my opinion, the increasing risk of a global economic pullback should incent investors to 'dial back risk'. This, however, does not mean sitting entirely in cash. Instead, investors should restrict equity purchases to attractively/reasonably valued shares in high-quality companies. CME meets this criterion.

Immediately following my August 5, 2018 post, I initiated a 300 share position on August 7 within a 'Side' account in the FFJ Portfolio. I subsequently acquired another 300 shares on June 29, 2020 within a 'Core' account in the FFJ Portfolio. Both purchases were at ~$162/share.

My CME exposure now consists of 382 CME shares in a 'Core' account and 321 shares in a 'Side' account within the FFJ Portfolio.

I had purposely set aside liquidy to take advantage of attractive investment opportunities. However, I recently applied the bulk of this liquidity toward the purchase of a second home. As a result, I am in no position to be adding to my CME exposure as much as I think this is the time to 'buy' CME.

I wish you much success on your journey to financial freedom!

Note: Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long CME.

Disclaimer: I do not know your circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decisions without conducting your research and due diligence. You should also consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.