Some investors think the demise of oil and gas producers is on the horizon as the transition toward more environmentally friendly forms of energy gathers momentum. I completely disagree.

The future supply of several metals and minerals is critical for the success of the energy transition. Any transition depends on the sustainable supply of metals and minerals such as lithium, copper, cobalt, nickel, and rare earths. The supply, however, is primarily concentrated in jurisdictions such as the Democratic Republic of the Congo. In addition, China controls most of the supply chains for these minerals. This is a major source of concern for European and North American countries.

Furthermore, forecasts call for a surge in the demand for metals and minerals required in the production of batteries to power electric vehicles. There is, however, insufficient availability and accessibility of these essential minerals.

Even mining and commodity trading majors have warned about the prospect of shortages in some key transition metals such as copper.

Jeremy Weir, CEO of metals trader Trafigura AG, said at the World Copper Conference, ‘If we don’t have enough copper, it could seriously short-circuit the energy transition’.

In addition, Goldman Sachs has indicated that regulatory approval for new copper mines has fallen to the lowest in a decade. This is alarming given that mines often take 10 – 20 years to permit and build. Goldman Sachs’ outlook is that surging copper demand will push prices to $15,000 a tonne by 2025 which is 67% above current levels.

Given the above, I think there will be an ongoing need for oil and gas. Chevron (CVX) and Exxon (XOM), therefore, are two of my largest holdings.

I last analyzed CVX in my January 28, 2023 post at which time I wrote that I was not adding to my exposure. While I was bullish on CVX, I was not currently looking to significantly increase my exposure because CVX was not out of favour. When I wrote that post, shares were trading at $179.60 and I considered the valuation to be unreasonable.

On July 23, CVX released its Q2 2023 performance highlights in advance of the July 28 earnings release. The share price rocketed to ~$164 before retracing to ~$159 at the time I compose this post on July 29.

Now that we have Q2 and YTD2023 results, I revisit CVX and disclose the purchase of 100 additional shares @ ~$153.69 in a ‘Core’ account within the FFJ Portfolio on July 14.

Business Overview

You are undoubtedly familiar with CVX. If not, the 2002 Annual Report contains a wealth of information from which you can familiarize yourself with the company.

PDC Acquisition

On May 22, CVX announced that it had entered into a definitive agreement with PDC Energy, Inc. (PDCE) to acquire all of the outstanding shares in an all-stock transaction valued at $6.3B, or $72/share. The total enterprise value of the transaction, including debt, is $7.6B. The benefits of the acquisition are reflected in this Press Release and the Announcement Presentation (with prepared remarks).

PDCE’s Q1 2022 Earnings Presentation includes maps showing where its operations are located.

The Wattenberg field is located in the Denver-Julesburg (DJ) Basin in northeast Colorado. It covers ~81 townships (1.9 million acres). PDC is one of the top-producing companies in that Basin.

The Delaware Basin is a geologic depositional and structural basin in West Texas and southern New Mexico. It holds large oil fields and a fossilized reef is exposed at the surface. Guadalupe Mountains National Park and Carlsbad Caverns National Park protect part of the basin.

Once the acquisition closes, CVX’s proven reserves will increase by ~10% and its Colorado business will be one of its top-five assets in terms of production and free cash flow. Expectations are for the addition of PDC’s assets and leading capabilities to further lower CVX’s carbon intensity.

Financials

Q2 and YTD2023 Results

Material related to CVX’s Q2 and YTD2023 earnings release is accessible here.

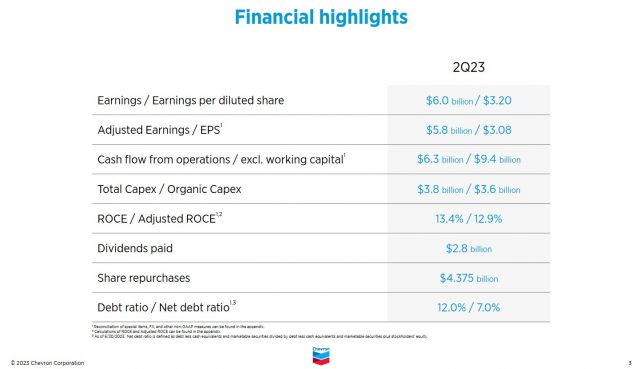

The financial highlights reflect continued improvement in overall performance.

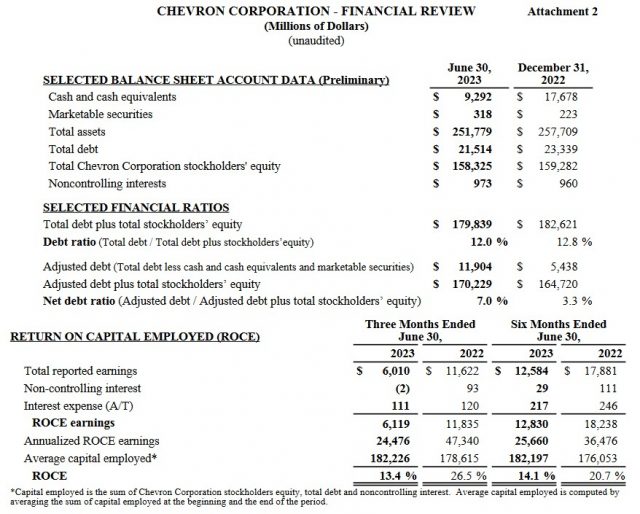

The company’s net debt ratio at the end of Q2 was 7%. Although CVX’s 7% Net Debt Ratio is higher than the 3.3% recorded at FYE2022, it is significantly below the low end of CVX’s guidance range.

Surplus cash on the balance sheet was reduced during Q2, with cash balances ending at $9.6B which is well above the cash required to run the company.

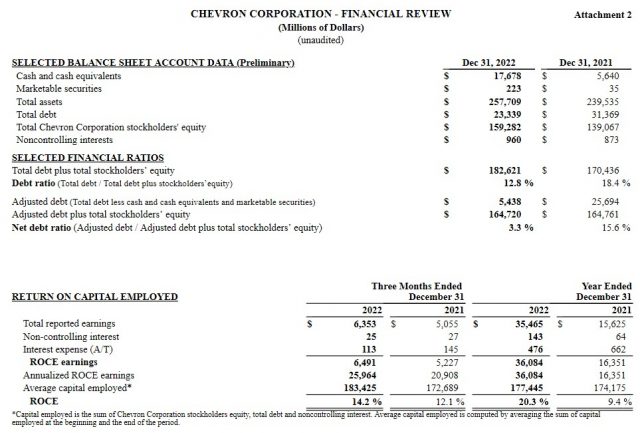

The Return on Capital Employed (ROCE) has deteriorated relative to FYE2022. Investors, however, must remember that FY2022 was an immensely successful year making for a difficult YoY comparison.

Source: CVX Form 8-K – January 27, 2023

Credit Ratings

The outlook for CVX’s senior unsecured domestic currency debt ratings is stable; the ratings are the same as in my last post.

- Moody’s: Aa2 (this is the middle tier of the high-grade investment-grade category).

- S&P Global: AA- (this is the bottom tier of the high-grade investment-grade category).

Both ratings define CVX as having a VERY STRONG capacity to meet its financial commitments. It differs from the highest-rated obligors only to a small degree.

Dividend and Dividend Yield

CVX’s dividend history is accessible here.

On July 28, CVX declared its 3rd consecutive $1.51/share quarterly dividend. It is payable on September 11 to all holders of common stock as shown on the transfer records at the close of business on August 18.

When I wrote my January 28 post, shares were trading at ~$179.60 and the dividend yield was ~3.36%.

Using my recent $153.69 purchase price, the dividend yield is ~3.9%.

I think there is a reasonable probability CVX will increase the quarterly dividend to $1.60 when it declares its dividend in January 2024. Investors can likely expect the next 4 dividends to total $6.22 ((2 x $1.51) + (2 x $1.60)). Using this total and my recent purchase price, the forward dividend yield is ~4%.

In my previous post, I indicate that CVX has returned $65B+ to shareholders in the form of share repurchases over the past 2 decades.

On January 25, CVX announced that its Board authorized a new $75B share repurchase program with no fixed expiration; the previous authorization was $25B. The plan is to steadily repurchase shares across commodity cycles. With a breakeven Brent price of around $50/barrel to cover CapEx and the dividend and with excess balance sheet capacity, CVX is positioned to return more cash to shareholders in any reasonable oil price scenario. Rather than the Board having to revisit the share repurchase authorization every few years, the repurchase authorization has been set where this matter does not need to be revisited as frequently.

On May 22, 2023, however, CVX announced that it entered into a definitive agreement with PDC Energy, Inc. (PDCE) to acquire all of the outstanding shares of PDCE in an all-stock transaction valued at $6.3B, or $72/share. Since PDC’s proxy solicitation on July 7, CVX has not been permitted to buy back its shares. After closing the acquisition in August, the plan is to resume buybacks at the $17.5B annual rate.

CVX’s diluted weighted average shares outstanding in FY2011 – FY2022 (in millions) are 2,001, 1,965, 1,932, 1,884, 1,875, 1,873, 1,898, 1,914, 1,895, 1,870, 1,920, and 1,940. If we exclude 14 million shares outstanding that are associated with Chevron’s Benefit Plan Trust, there were 1,916 million and 1,901 million outstanding shares on December 31, 2021 and December 31, 2022, respectively.

In the first 6 months of FY2023, CVX has repurchased $8.1B of issued shares. The weighted average number of diluted shares outstanding in Q2 2023 was 1,875.5.

On the Q2 earnings call with analysts, management reiterated that it does not have a problem putting more debt on the balance sheet to repurchase shares.

Valuation

CVX’s FY2011 – FY2022 PE levels are 7.88, 8.12, 10.22, 10.33, 19.51, N/A, 36.50, 14.64, 17.29, N/A, 22.65, and 10.21. The years in which PE levels are N/A are when CVX reported a loss.

I am not reiterating CVX’s valuation at the time I wrote my June 22, 2021, November 1, 2021, January 29, 2022, May 3, 2022, and August 18, 2022 posts. This information is accessible in my January 28, 2023 post.

When I wrote my January 28, 2023 post, shares were trading at ~$179.60. Using the brokers’ adjusted earnings estimates, CVX’s forward adjusted diluted PE levels were:

- FY2023: mean of $15.96 and a low/high range of $12.53 – $20.94 from 28 brokers. The forward adjusted diluted PE using the mean estimate is ~11.3.

- FY2024: mean of $14.81 and a low/high range of $7.95 – $22.29 from 20 brokers. The forward adjusted diluted PE using the mean estimate is ~12.3.

- FY2025: mean of $12.18 and a low/high range of $9.28 – $13.54 from 7 brokers. The forward adjusted diluted PE using the mean estimate is ~14.7.

Using my recent $153.69 purchase price, the following are CVX’s forward-adjusted diluted PE levels based on the information currently available:

- FY2023: mean of $12.91 and a low/high range of $10.75 – $15.58 from 23 brokers. The forward adjusted diluted PE using the mean estimate is ~11.9.

- FY2024: mean of $13.74 and a low/high range of $10.90 – $18.95 from 23 brokers. The forward adjusted diluted PE using the mean estimate is ~11.2.

- FY2025: mean of $14.35 and a low/high range of $8.37 – $23.02 from 14 brokers. The forward adjusted diluted PE using the mean estimate is ~10.7.

The variance in broker estimates is considerable. In my opinion, the low range of analysts’ estimates is much too low.

Final Thoughts

CVX was my 3rd largest holding when I completed Mid 2023 Investment Holdings Review and my 2nd largest at the time of my January 2023 Investment Holdings Review.

Following my recent purchase, I hold 1,995 shares in ‘Core’ accounts and 330 shares in a ‘Side’ account within the FFJ Portfolio.

In prior posts, I have expressed my thoughts about the future of oil and gas. While there is a transition toward cleaner energy sources, the major oil and gas producers are positioning themselves to play an important role in a world of cleaner energy. This section of CVX’s website addresses how CVX plans to accomplish its energy transition goals.

Secondly, not every country shares the same sentiment when it comes to the future use of oil and gas. Countries, such as India, have little intention of scaling back their use of oil and gas.

Thirdly, at the beginning of this post, I pointed out that the future demand for metals and minerals such as lithium, copper, cobalt, nickel, and rare earths required to transition to cleaner sources of energy will very likely outstrip the supply. There is an insufficient number of mines to produce all the required minerals and there is an insufficient number of new mines coming into production in the foreseeable future.

Complicating matters further is that a significant percentage of the metals and minerals currently come from corrupt regions of the world. These countries are also more closely aligned with countries that are not on the best of terms with North American and European countries.

In essence, there are a host of reasons why the demise of major oil and gas producers appears to be exaggerated.

Given my opinion about future energy demand and supply, I choose to invest in CVX. It has a very low debt ratio/net debt ratio, is highly profitable, and generates very strong FCF. I envision CVX remaining within my top 10 holdings.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long CVX and XOM.

Disclaimer: I do not know your circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decisions without conducting your research and due diligence. You should also consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.