I view the Canadian National Railway Company (CNR) as a core long-term holding.

CNR’s current valuation relative to 2011 – 2018 levels, however, suggests that shares are currently richly valued. If you are in agreement then the two conservative option trades presented in this article might be of interest to you.

Summary

- The number of Class A North American railroads is unlikely to increase which bodes well for CNR over the long-term.

- Current market conditions remind me of 1999 – 2000 before the bursting of the dot.com bubble.

- Rather than employ a host of complex valuation models in which multiple assumptions are required I use a couple of reasonably straightforward valuation models.

- CNR is core holding but I am not opposed to taking a bearish position in the short-term if I think shares are richly valued.

NOTE: All figures are expressed in Canadian dollars.

Introduction

Canadian National Railway Company (TSX: CNR) is a core holding within the FFJ Portfolio and it is not my intent to part with these shares. If my analysis leads me to the conclusion that shares are richly valued, however, I am receptive to employing low risk option strategies to generate additional income. These option strategies will not always pan out as intended but I can still come out ahead or my losses will be capped and negligible.

In my most recent CNR article of January 31, 2019 I looked at CNR’s valuation and felt shares were fully valued; I have not employed the use of options on CNR nor have I acquired additional shares (other than through dividend reinvestment) subsequent to that article.

I now take the opportunity to revisit CNR since the company released its Q1 2019 results following the April 29, 2019 market close. As I compose this article I see that CNR’s share price has pulled back somewhat and shares are hovering around the ~$124.44 level; $127.38 is the recent 52 week high and that was set April 26th.

Results were negatively impacted by one of the harshest winters the company has experienced in recent history; the company’s Q1 operating ratio was 69.5% (67.2% on an adjusted basis) versus 63.5%, 62.9%, 63.4%, 61.9%, 58.2%, 55.9%, 59.8% and 61.6% for FY2011 – 2018.

The Operating ratio is a company’s operating expenses as a percentage of revenue and is most commonly used for industries which require a large percentage of revenues to maintain operations (eg. railroads).

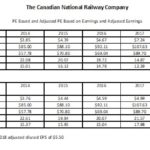

In my opinion, using Q1 results to try and determine FY2019 EPS is too difficult. I have, therefore, used management’s FY2019 adjusted EPS guidance to compare CNR’s current valuation with results dating back to 2011; management expects to deliver adjusted diluted EPS growth in the low double-digits range versus 2018 adjusted diluted EPS of $5.50.

Based on my analysis I have placed two relatively conservative option trades.

Q1 2019 Results

CNR’s Q1 Earnings Release, Earnings Presentation, and non-GAAP Measures can be accessed here.

Credit Ratings

I view my tolerance for risk as being relatively low. To put this in context, I have been retired for almost 3 years and have zero desire of ever returning to the workforce. I am not, therefore, about to take risks that could put me in a position where I experience a permanent impairment to my capital because I chose to invest in a company of inferior credit quality. This is why I pay attention to a company’s credit ratings from the major ratings agencies!

Moody’s continues to rate CNR’s senior unsecured long-term debt A2 which is the middle tier of the ‘upper medium grade’ rating.

S&P Global rates CNR’s senior unsecured long-term debt A which is the middle tier of the ‘upper medium grade’ rating.

Neither rating is under ‘review’.

These ratings are equivalent and I view them as attractive.

Valuation

Management has indicated that it expects to deliver adjusted diluted EPS growth in the low double-digits range versus 2018 adjusted diluted EPS of $5.50; I have increased FY2018’s adjusted EPS by 10% – 13% to arrive at a diluted EPS range for FY2019.

If we look at CNR’s current adjusted PE using management’s adjusted EPS guidance and the current ~$124.44 stock price it would appear that CNR’s valuation is closer to the high valuation levels exhibited in previous fiscal years.

We can see that CNR’s share price exhibits wild swings. Given that CNR’s share price has appreciated so rapidly in such a short timeframe and is close to a multi-year high, I am leaning toward CNR’s share price pulling back before rising further.

A $120 share price and $6.05 adjusted EPS for FY2019 would give us an adjusted PE of ~19.8.

A $120 share price and $6.22 adjusted EPS for FY2019 would give us an adjusted PE of ~19.3.

Both these levels are well in excess of CNR’s adjusted PE using the low stock price for the past several years.

If we were to proceed on the basis that CNR’s share price were to retrace to a level where the adjusted PE for FY2019 were 18, we would get a share price of ~$109 using a $6.05 adjusted EPS and a share price of ~$112 using a $6.22 adjusted EPS.

Given current market conditions I don’t think CNR share price will drop to these levels but I think ~$120 is not totally unreasonable.

Dividend and Dividend Yield

CNR’s dividend history can be found here.

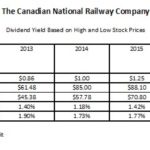

Here is CNR’s current valuation on the basis dividend yield.

As you can see from above, CNR’s current ~1.46% dividend yield is pretty close to the dividend yield exhibited when CNR’s share price was at a high in each of the past several years.

CNR’s average dividend yield over the 2011 – 2018 timeframe is closer to ~1.70%. If you take the current $1.82 annual dividend and ~$107 share price you get a dividend yield of 1.7%. I don’t think CNR’s share price will drop this low but a $120 share price and a $1.82 annual dividend would give us a dividend yield of ~1.51%. This is lower than CNR’s dividend yield over the past several years when we use the low share price for each fiscal year.

Option Strategies

Based on the above, I am of the opinion that CNR’s share price is more likely to pullback as opposed to setting new highs. Given this, I have elected to place a couple of bearish option trades even though I am of the opinion CNR’s share price will increase over the long-term.

Covered Call Option Strategy

I am reluctant to write covered calls on 100% of my underlying CNR shares and have restricted the number of September 20, 2019 $125 covered calls to 3 contracts; I have received $4.30/share (before nominal fees). If you choose to place a similar trade the breakeven is when CNR is trading at $129.40/share ($125 strike price + $4.30 premium).

I expect CNR’s share price to drift lower prior to the release of Q2 results toward the end of July. When those results are released I expect the market to react positively and for CNR’s share price to tick up. At the same time, I am also of the opinion that there will be a market pullback between now and September 20, 2019 which is why I think CNR’s share price will remain below $125.

If CNR’s share price rises above $125, I will most likely close my position and issue new covered calls with a higher strike price for a future expiry date.

NOTE: This trade does NOT protect me if CNR’s share price plunges!

Bear Call Spread Option Strategy

In addition to writing covered calls you could place a Bear Call Spread; this strategy is used to profit from a neutral to bearish price action in the underlying stock.

This strategy results in you collecting an upfront premium. A comparable strategy would be to use the Bear Put Spread but then you would have to lay out money at the time of the trades.

These are the trades I have placed:

- Sold 2 $120 June 21, 2019 Call and generated $5.55/share

- Bought 2 $125 June 21, 2019 Call and paid $2.41/share

- Net credit of $3.14/share (excludes nominal commission)

If shares close below $120 at expiry, the holder of the right to buy CNR shares at $120 would let their options expire since they can acquire shares on the open market at a better price. In addition, I will let my right to buy CNR shares at $125 expire. My maximum profit potential is, therefore, the $3.14/share I collected at the time of the trade.

On the maximum risk front, I stand to lose the most if CNR is trading above $120 at expiry. If CNR is trading at $140, for example, the holder of the Call would have the right to acquire shares from me at $120 meaning I am down $20/share. I, however, have the right to acquire shares at $125 so I am ahead $15/share on these options resulting in a net loss of $5/share. This loss is partially offset by the $3.14/share in premiums I collected at the time of the option trades so my maximum loss is $1.86/share.

There will be no other earnings release before the expiry of these June contracts and I think CNR’s share price will continue drift lower over the next 1.5 months. This is why I decided to go with a June expiry for this Spread trade.

Combine the Covered Call AND Bear Call Spread Option Strategies

If you own the underlying CNR shares you may wish to combine both option strategies.

The strategies I employed above are separate and distinct but both are predicated on CNR’s share price staging a pullback from the current ~$124.50. As you can see from above, I maximize my profits if CNR closes below $125 come September 20, 2019 and below $120 come June 21, 2019.

I generated ~$1900 (excludes nominal commission) from the above noted trades but will not know my ultimate profit/loss until I close these positions or the options expire.

Risks

As always, I encourage you to remember that you can employ options to reduce risk. Some option strategies, however, will increase your risk.

There are 34 different option strategies which can be employed including variations of condors, butterflies, Christmas trees, strangles, straddles, and spreads, etc.. I will readily admit that these are far too complex and risky for my conservative nature and I stay as far away from them as possible. Furthermore, it is not my intent to be spending an inordinate amount of time monitoring my investments which is what I envision I would have to do if I employed some of these more exotic option strategies.

If you wish to employ the conservative option strategies presented in this article I highly encourage you to review this explanation of Covered Calls and this explanation of Bear Call Spreads.

Final Thoughts

CNR is one of the best Class A railroads in North America and this is why I intend to hold shares in the FFJ Portfolio for the long-term. At the same time, I am open to employing the use of option strategies if I think shares are richly valued.

I am of the opinion CNR’s shares are currently richly valued and a pullback in the very short-term is not out of the realm of possibility. This is why I am employing a Bear Call Spread where I maximize my profit if CNR’s share price closes below $120 at the June expiry.

I think CNR will generate strong results in Q2 and its share price will rise following the short-term pullback; CNR will not have to contend with harsh weather conditions as it did in Q1. This why I am writing September 2019 covered calls wherein my breakeven is $129.40/share (a little over $5/share higher than CNR’s current market price).

I am also of the opinion that a broad market pullback in the short-term should not be ruled out. This is why I am not employing a bullish option strategy even though I think CNR’s share price will increase over the long-term.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long CNR.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.