Brookfield Asset Management (BAM) released its Q2 2024 results on August 7 and I covered this entity in this post.

In late 2022, Brookfield’s reorganization resulted in the spin off of a minority stake in the asset management unit. The purpose of this transaction was to appeal to investors wanting to benefit from Brookfield’s growth without substantial exposure to its direct holdings which include one of the world’s largest office real estate portfolios.

The real estate sector has faced huge difficulties because of higher interest rates and fewer workers returning to the office relative to pre-pandemic levels. In BN’s core office portfolio, which includes 16 complexes in major cities including New York and London, occupancy fell to 94.5%, from 95% a year earlier. Including retail, however, occupancy in its core properties was 95.6% – relatively stable from a year earlier.

With Brookfield Corporation’s (BN) release of its Q2 and YTD2024 results on August 8, I now provide this very brief review.

Business Overview

Brookfield is one of the world’s largest asset managers in what is a highly competitive and highly fragmented industry.

Many asset managers will likely fall by the wayside over the coming years. The larger industry participants such as Brookfield, Blackstone, BlackRock, KKR, Apollo Global Management, however, should continue to thrive. These firms have the reputation and track record of success that enable them to raise funds from sophisticated investors to engage in transactions the smaller industry participants are unable to handle.

I can not give justice to explaining BN in this post. It is preferable you read BN’s FY2023 Annual Report. The BN website also provides a good overview of this conglomerate.

I also highly recommend reading the Q2 2024 the Brookfield Corporation Letter to Shareholders.

Financials

Q2 and YTD2024 Results

Refer to the August 8, 2024 earnings release and supporting material.

In Q2, BN reported strong results in its wealth and insurance business. This helped offset a ~12% drop in Distributable Earnings (DE) from its real estate business; BN has agreed to sell several assets in its real estate portfolio, including an office building in Washington and a US manufactured housing portfolio.

Profits from wealth and insurance business rose more than 80% after BN closed its acquisition of American Equity Investment Life Holding Company on May 2.

Cash flows across BN’s wealth and operating businesses continue to grow with capital markets improving. Management’s expectations are for transaction activity to continue to increase over the coming quarters.

Risk Assessment

BN’s current domestic long-term debt ratings are:

- Moody’s: A3 with a stable outlook and rating affirmed on April 10, 2024

- S&P Global: A- with a stable outlook and rating affirmed on April 16, 2024

- Fitch: A- with a stable outlook and rating affirmed on October 27, 2023

All 3 ratings are the lowest tier of the of the upper medium grade investment grade category. These ratings define BN as having a strong capacity to meet its financial commitments. It is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

Dividends and Share Repurchases

Dividend and Dividend Yield

BN’s dividend history is accessible here.

BAM aims to return 90% – 100% of its DE to its shareholders in the form of a dividend or share repurchases. BN, however, is the ‘dividend light’ company of the two. If you seek returns predominantly in the form of capital gains, BN is your best option.

Share Repurchases

BAM opportunistically increases shareholder returns with share repurchases. I can not add any value to what BN’s CEO states in his Q2 2024 Letter to Shareholders:

As important as investing well is the allocation of the capital that is generated in a business. Sometimes this goes to expansion, sometimes to debt repayment, and where a business is undervalued, to share repurchases. Since the start of this year, we repurchased over $800 million of shares of the Corporation in the open market. We acquired these shares at an average Price of $40 per share and, as a result, reduced the number of shares outstanding by approximately 20 million. This represented over 1% of the shares of the company and, while that does not sound like much, this added very meaningfully to the Value of our company.

The Value of our business based on our estimates is currently $84 per share, and this Value does not take into account the franchise we have, which generates transactions year in and year out by allocating capital effectively. For example, it does not take into account any Value for new businesses we are building, or the option we have to repurchase further shares at a discount to their intrinsic value, thereby adding further Value to each share.

Stepping back, the act of repurchasing shares is often misunderstood by investors, and even some management teams. It is not, as some think, a method to “boost the share price.” In fact, one should hope to make these purchases at a lower price as repurchases made at lower prices incrementally and very meaningfully add Value to the remaining shares outstanding.

In simple terms, we acquired 20 million shares this year, and the Value of those shares was $1.68 billion. Due to market trading conditions, we were able to acquire them for $800 million. This means that the selling shareholders left behind $880 million of excess Value. Said another way, for the ability to get liquidity of $800 million, the selling shareholders turned over $1.68 billion of Value to the remaining shareholders, reallocating $880 million of Value to the remaining shareholders. Even on this relatively modest amount of share repurchases, this added approximately $0.55 to each remaining share of the company. That is a lot of Value added for not a lot of work.

Share repurchases at too high a price can equally destroy enormous Value in a business, as the above calculation can work in reverse. This is why ensuring management is aware of the Value of their company and is completing share repurchases for the right reason is extremely important. Of course, also important is ensuring that at all times cash remains available to take advantage of opportunities to allocate capital to growing the business.

We intend to continue to allocate capital to share repurchases when the share price is meaningfully below our estimated Value, as these repurchases will be highly productive for the remaining shareholders. Of course, from time to time we have significant demands on our capital, so we are always prudent in terms of when and how we make these purchases. However, rest assured we will continue to allocate a portion of our available cash in this manner to enhance the underlying value of the business for each share you own.

Valuation

I typically look at:

- diluted EPS – P/E;

- adjusted diluted EPS – adjusted P/E; and

- Free Cash Flow (FCF) – P/FCF

metrics to gauge the valuation of most companies I analyze. These metrics, however, are of little relevance when trying to assess the performance and outlook of asset managers.

BAM uses non-GAAP measures such as DE, Fee-Bearing Capital, Fee-Related Earnings (FRE), Liquidity, and Capital Resources, to more accurately measure its performance. A Glossary of Terms is found on pages 37 – 39 in the Q2 2024 Supplemental Information.

BAM is not easy to value although management assigns a conservative ~$84/share value of its business based on its estimates. It raises large pools of capital from clients for deployment and several multi-billion-dollar acquisitions are generally made annually. In addition, BAM is in no hurry to sell assets and will refrain from selling during unfavorable conditions. A quarter in which asset sales are low following the same quarter in the prior year when asset sales were high can result in a significant YoY variance. It is, therefore, of utmost importance to analyze BAM’s long term performance.

Over the long-term, the non-GAAP metrics reflected above have improved.

Given that growth in Assets Under Management (AUM) is more than likely to lead to higher DE and FRE, it is encouraging to see the growth in AUM:

- August 13, 2020 : ~$550B; and

- Q2 2024: ~$995B.

Final Thoughts

The Brookfield conglomerate is far too complex to cover in a brief post; I recommend you read the material for which I have provided links earlier in this post.

If you do not have the bandwidth to review all this information, consider that Brookfield’s expertise and a track record of success is leading sophisticated investors to commit to it more money for investment purposes.

Brookfield’s mandate is to generate attractive returns for its sophisticated investor while controlling risk. In addition to earning fees for its efforts, the Brookfield entities stands to participate further when target returns are achieved. In essence, the compensation structure provides the necessary incentive for the Brookfield entities to perform exceptionally well.

Naturally, not every investment will be a success. Brookfield’s investment portfolio, however, is so diversified that the occasional setback is not a death knell.

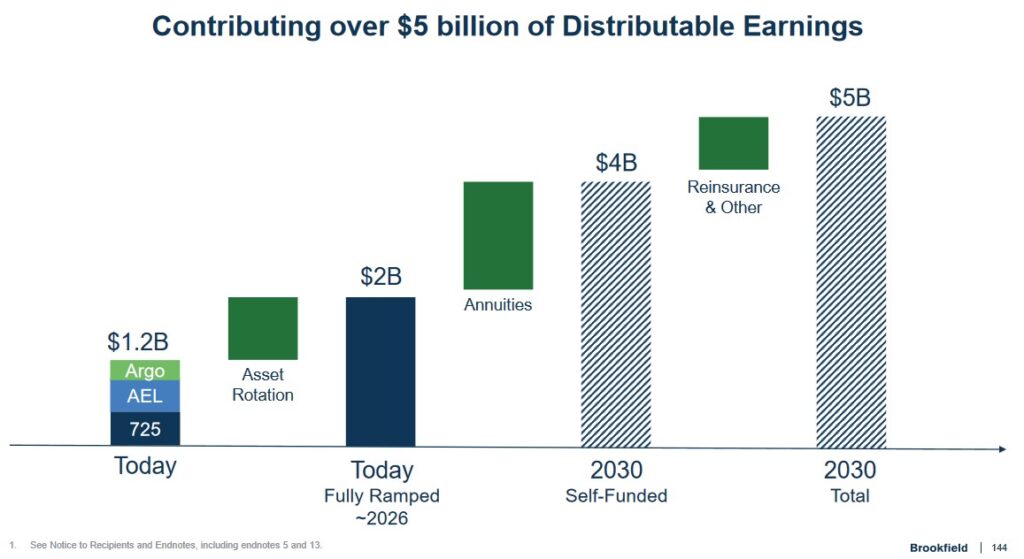

At the September 12, 2023 Investor Day, management set a 5-year growth target to more than double DE to $5B by 2030. This growth will come from increasing Fee-Bearing Capital, which is expected to reach $1T over the next few years.

Source: BN – 2023 Investor Day Presentation – September 12, 2023

My decision making process when it comes to investing in BAM, Blackstone (BX), and BlackRock (BLK) is fairly simplistic. I want private equity exposure, however, require the expertise of asset managers with a proven track record of success.

When I completed my 2023 Year End FFJ Portfolio Review, I had exposure to various Brookfield entities. My aggregate exposure to these entities resulted in ‘Brookfield’ being my 11th largest holding.

On June 5, 2024, however, I was ‘forced’ to sell 100% of my ‘Brookfield’ exposure in a particular ‘Side’ account within the FFJ Portfolio for tax planning purposes; I disclosed this in my June 11 post. I never intended to sell ‘Brookfield’ shares but the Canadian government’s decision to change the tax treatment of capital gains forced my hand.

These sales resulted in ‘Brookfield’ dropping to my 23rd largest holding when I completed my 2024 Mid Year FFJ Portfolio Review.

In my August 8 Brookfield Asset Management Exposure Increased post, I disclosed the purchase of 500 BAM shares @ CDN$53.814 through a ‘Side’ account in the FFJ Portfolio. My BAM exposure now consists of 541 shares in various ‘Core’ accounts and 500 shares in a ‘Side’ account within the FFJ Portfolio; I also hold BAM shares in accounts for which I do not disclose details.

The sale of 612 Brookfield Corporation shares (the TSX listed shares) on June 5 generated @ CDN$58.8567/share which now sits in ‘cash’ awaiting redeployment. However, I now only have 1,521 BN shares in various ‘Core’ accounts within the FFJ Portfolio and shares in accounts for which I do not disclose details.

I have made a deliberate decision to limit my exposure to just 6 Canadian companies with BAM and BN being two of these 6 companies; it is not my intention to invest in the other ‘Brookfield’ entities. I can participate in their successes through my BAM and BN investments.

My plan is to opportunistically acquire additional shares to replace, at the very least, the 612 BN shares I had to sell in early June.

NOTE: BAM and BN will hold their Investor Day on September 10. All BAM/BN affiliates will hold their Investor Day on September 24.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long BAM, BN, BX, and BLK.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.