Contents

Summary

- Broadridge is actively pursuing new markets to help bolster future earnings.

- Its business model helps shield earnings during periods of economic weakness; recurring fee revenue accounts for 60%+ of overall revenue.

- At the time of my February 7, 2019 article when shares had retraced to ~$94 I viewed shares as attractively valued.

- Valuation has subsequently risen to the extent where I suggest you patiently wait for BR’s share price to retrace to $105 or lower (based on FY2019 guidance).

Introduction

Following the release of Q2 2019 results I wrote this article in which I stated that the pullback in Broadridge Financial Solutions’ (BR) share price to ~$94 from the previous business day’s $103.54 presented investors with an opportunity to snap up attractively valued shares in this high quality company.

In keeping with my recommendation I acquired an additional 100 shares for the ‘side accounts’ within the FFJ Portfolio; I also acquired additional shares for an account in which I do not disclose details.

Subsequent to that article, BR’s share price has been caught in the broad market updraft; shares recently touched ~$118 but have retraced to $115.23 as at the May 7th close of business; BR released Q3 results and adjusted guidance on May 7th which coincides with the day’s broad market pullback.

In several of my recent articles I have come to the conclusion that shares are richly valued. Where I own the underlying shares of the company being analyzed I have recommended the use of covered calls to generate additional income. Depending on the outcome of my analysis I have also recommended bull or bear call option spreads.

At this juncture I do not intend to employ the use of options on BR and will increase my BR exposure through the outright purchase of shares. My reasoning is that:

- there is a sizable gap between the bid and ask option prices;

- there is not much selection as to option expiry dates;

- volatility is low;

- daily volume is negligible.

BR holds a dominant position in certain areas of its business and a significant percentage of its revenue is of a recurring nature. Should you be unfamiliar with BR but you hold self directed brokerage accounts, you may be receiving emails with a subject line similar to this:

Vote now! COMPANY NAME Annual Meeting

At the bottom of such an email you will likely see:

Look closely at the fine print within this image and you will see that BR manages the proxy votes; this is just one component of its business.

BR continues to expand its product offering. A recent expansion announcement can be found here.

In previous articles I have mentioned that M&A is an important part of BR’s long-term investment strategy; it is investing ~$0.1B in tuck-in acquisitions that will strengthen existing mutual fund business and broaden the wealth management product line.

BR’s growth has been propelled through a series of acquisitions; details of very recent acquisitions can be found here and here.

BR has recently acquired TD Ameritrade's retirement custody and trust assets. This business provides mutual fund and ETF trading and cut fee services to record-keepers and third-party administrators.

The recent acquisition of Rockall Technologies, a SaaS-based provider of securities based lending and collateral management solutions for wealth management firms, extends BR’s product line in wealth management and gives it new front office capabilities which can eventually be incorporated into its broader wealth platform.

I encourage you to read Item 1 in the 2018 10-K in which a comprehensive overview of the company is provided.

Q3 2019 Results

BR’s Q3 Earnings Release can be accessed here and the Earnings Presentation can be accessed here.

On the Q3 Earnings Call, management indicated the ongoing implementation of the new ASC 606 accounting standard has had the effect of shifting a large chunk of recurring fee proxy associated distribution revenues into Q3 that, previously under ASC 605, would have been recorded in Q4. Reported Q3 2018 (under ASC 605) and Q3 2019 (under ASC 606) growth rates are not indicative of the underlying performance of the business.

While the impact of the accounting change is material to Q3 and Q4 growth rates, on a reported basis, the expected full-year impact on results and growth rates is immaterial.

FY2019 Guidance

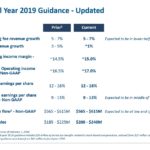

BR has reaffirmed or raised FY19 guidance for the following:

- recurring fee revenue growth – REAFFIRMED;

- adjusted EPS growth guidance range – REAFFIRMED;

- closed sales guidance - RAISED.

Growth guidance for total revenue has been lowered based on BR’s outlook for reduced low to no margin distribution revenue and FX headwinds. On a positive note, this has resulted in the raising of BR’s operating margin guidance.

Credit Ratings

There has been no change to BR’s credit ratings from Moody’s and S&P Global subsequent to my last article and the credit ratings are not under review.

Moody’s continues to rate BR’s long-term debt as Baa1 which is classified as lower medium grade. Standard & Poor’s continues to rate the debt BBB+ which is also lower medium grade.

These ratings are satisfactory for my purposes.

Valuation

At the time of my August 7th article, I indicated that on the basis of FY2018 Diluted EPS (GAAP) and adjusted Diluted EPS (Non GAAP) of $3.56 and $4.19, investors could expect Diluted EPS (GAAP) of ~$3.99 - ~$4.13 and adjusted Diluted EPS (Non GAAP) of ~$4.57 - ~$4.73.

Using the August 7th $129.17 closing stock price I arrived at a forward diluted PE range of ~30.8 – ~36.3 and a forward adjusted diluted PE of ~27.3 - ~28.3. I viewed these levels as lofty and indicated I would refrain from acquiring additional shares until such time as BR’s valuation retraced to the low – mid 20s (based on Diluted EPS (GAAP) results).

When I wrote my November 6th article, BR’s shares had retraced to ~$105. Using this share price and the reaffirmed guidance, BR’s forward PE was ~25.4 - ~26.3 while its forward adjusted PE was ~22.2 - ~22.98.

In my February 7, 2019 article, guidance had once again been reaffirmed. Using the then current ~$95.80 share price I arrived at a forward PE range of ~23.2 - ~24 and a forward adjusted PE range of ~20.3 - ~20.96; I recommended shares be purchased and disclosed that I had acquired additional shares.

On May 7, 2019, BR’s FY2019 guidance calls for diluted EPS growth of 12% - 16%; adjusted diluted EPS growth of 9% - 13% is now expected with ~11% being the expected level.

FY2018 diluted EPS was $3.56 so 12% - 16% growth gives us a FY2019 range of $3.99 - $4.13 and $4.06 based on 14%.

FY2018 adjusted diluted EPS was $4.19 so 11% growth gives us ~$4.65 for FY2019.

With BR trading at $115.23 we get a forward diluted PE of ~28.38 and a forward adjusted diluted PE of ~24.78.

Once again I view BR as richly valued.

Dividend and Dividend Yield

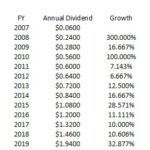

On April 30, 2019, BR's Board of Directors declared a quarterly dividend of $0.485/share ($1.94/year) payable July 3, 2019 to shareholders of record on June 14, 2019; BR does not keep the dividend history segment of its website current.

I do not envision a ~30+% dividend increase to be announced in early August and have calculated BR’s new dividend on the basis of ~12% growth. I arrive at a projected annual dividend of $2.17 which would provide investors with a ~1.9% dividend yield based on the current ~$115.23 share price.

I continue to be confident that BR will have no difficulty in servicing its dividend.

The Diluted Weighted-average shares outstanding as at FYE 2014 – 2018 amounted to (in millions of shares) 124.1, 124, 121.6, 120.8, and 120.4. As at March 31, 2019 this had been reduced to 115.8.

Final Thoughts

In my opinion, BR’s valuation once again appears to be elevated.

My intent is to acquire additional BR shares when the share price retraces $105/share or less. Even at this level the diluted PE of ~25.9 ($105/$4.06 diluted EPS) is not a bargain. I, however, have utmost confidence that BR will continue to add shareholder value over the long-term. I am, therefore, prepared to acquire additional shares at a slightly less attractive valuation than that at which I acquired shares in February.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to [email protected].

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long BR.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.