The Bank of Montreal’s (BMO) Bank of the West acquisition from BNP Paribas was announced on December 20, 2021.

The last time I reviewed BMO was in my BMO – High Dividend Yield and Safety from Canada’s Oldest Bank guest post at Dividend Power. I concluded that post stating that I view The Royal Bank of Canada (RY) and The Toronto-Dominion Bank (TD) to be superior banks and that I had recently added to my RY and TD positions.

While I continue to view RY and TD as superior banks, I have recently executed BMO trades. Given my time constraints, the purpose of this brief post is merely to disclose the BMO trades I have recently placed that are a component of our Registered Retirement Savings Plan (RRSP) meltdown strategy.

BMO – Recent Events

Subsequent to my July 21, 2021 guest post, BMO:

- released its Q4 and FY2021 results on December 3rd;

- increased its quarterly dividend by CAD$0.27, or 25%, to CAD$1.33 with the first dividend at this level payable February 28, 2022 to shareholders of record as of February 1; and

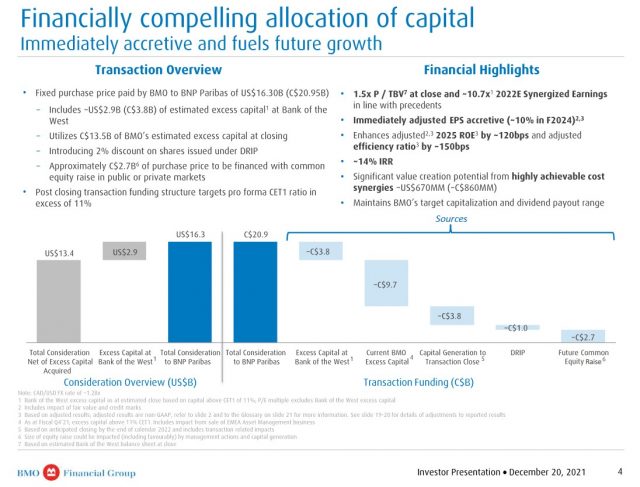

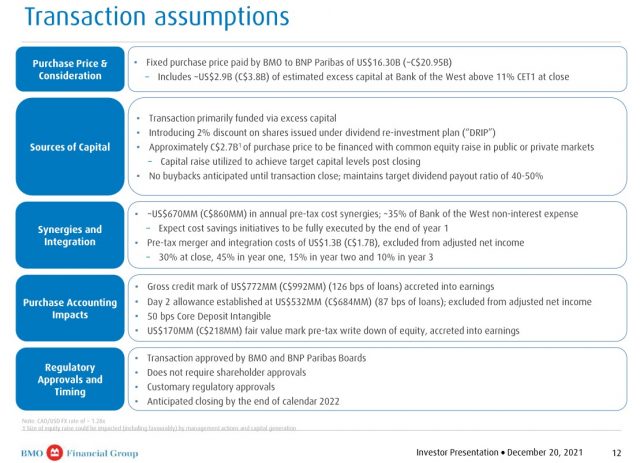

- announced its intent to acquire Bank of the West from BNP Paribas for US$16.3B (CAD $20.95B); details of this acquisition are found in the December 20 News Release and accompanying Presentation.

Source: BMO – Bank of the West Acquisition Presentation – December 20, 2021

RRSP Meltdown Strategy

In various previous posts, I have discussed my wife’s/my need to implement an RRSP meltdown strategy to minimize future tax liabilities. This strategy entails withdrawing funds from our RRSPs and paying a 30% withholding tax upon withdrawal. Despite the immediate tax hit, discussions with our tax accountant have led to our decision to significantly reduce the RRSP balances over the next decade.

The net proceeds withdrawn from our RRSPs will:

- cover expenses in the upcoming calendar year;

- allow us to maximize our annual Tax-Free Savings Account (TFSA) contributions; and

- be reinvested in taxable accounts to generate additional income.

In Canada, the mandatory age by which RRSPs must be converted to Registered Retirement Income Funds (RRIFs) is the calendar year in which the RRSP holder turns 71 years of age; mandatory minimum RRIF withdrawals must commence in the following calendar year.

The balances in our RRSPs are such that we must withdraw a few hundred thousand dollars annually until we reach age 71. Failing this, we will find ourselves in a predicament where our minimum annual RRIF withdrawals and income generated from holdings within taxable accounts will be very heavily taxed.

As part of this strategy, we are also delaying the collection of Canada Pension Plan (CPP) and Old Age Security (OAS) payments from the Canadian Federal government until we each reach 70 years of age.

Another consideration in deciding to meltdown our RRSPs is that our OAS payments will be fully clawed back if our annual income is above a certain threshold.

In a nutshell, as much as it sounds crazy to incur a 30% withholding tax on RRSP withdrawals made each year for the next decade, this meltdown strategy makes perfect sense in our case. The success of this strategy, however, is heavily dependent on our life expectancy. The longer we live, the more successful this strategy will be.

BMO – Recent Trades

As part of our RRSP meltdown strategy, I liquidated 639 BMO shares @ ~CAD$139/share on December 14, 2021. It was never my intent to part with this portion of our BMO exposure and fortunately, BMO’s share price subsequently weakened thus enabling me to acquire 630 BMO shares at ~CAD$131/share on December 20th. These shares are now held in a taxable account that is included in the ‘Core’ account component of the FFJ Portfolio; another 658 BMO shares are held in one of the ‘Side’ accounts within the FFJ Portfolio.

The timing of the recent sale and purchase is such that I do not forego any quarterly dividend income; on November 26 I received CAD$677.34 and with the new higher quarterly dividend I shall receive CAD$837.90 on February 28.

Knowing that we would need to withdraw funds from our RRSPs, I had suspended the automatic dividend reinvestment. With the BMO shares now held in a taxable account and the introduction of a 2% discount on shares issued under the dividend reinvestment plan (‘DRIP’), I have reinstated the automatic reinvestment of our quarterly BMO dividends.

This 2% discount means that if BMO shares are trading at CAD$131 when the February dividend is distributed, 6 shares would be credited to our investment account (CAD$837.90/(CAD$131 * 0.98)). The CAD$67.62 difference between the CAD$837.90 dividend income and the 6 shares acquired for a total of CAD$770.28 would remain in the investment account as cash.

BMO – Final Thoughts

BMO has been improving its efficiency and technology over the past several years. It started implementing a digital strategy that has helped it gather deposits online from all 50 U.S. states. This efficiency and technology will be key in getting the most out of the Bank of the West acquisition.

The acquisition also bulks up BMO’s commercial-banking operations and gives it greater exposure to the technology and vendor leasing sectors. It also gives BMO a significant branch and lending operation in California, a state with 885,000 affluent households and a population similar to that of Canada but an economy that is almost twice as large.

BMO’s Bank of the West acquisition will essentially double its US retail presence and vault it to the 4th largest North American commercial bank.

The timing of this acquisition is fortuitous. Because of COVID-19, BMO and its Canadian peers were forced to stockpile capital. BMO now has a sizable war chest to buy Bank of the West.

Looking at the December 20 Press Release, we see that:

‘On closing, the acquisition will bring nearly 1.8 million customers to BMO and will further extend its banking presence through 514 additional branches and commercial and wealth offices in key U.S. growth markets. Post closing, BMO will have a strong position in 3 of the top 5 U.S. markets, a footprint in 32 states, expanded national specialty commercial businesses and a digital banking platform gathering deposits in all 50 states. With approximately 70% of Bank of the West’s deposits in California, BMO is making a scaled entry to a market with a population of approximately 40 million people producing US$3.1 trillion of GDP – which, if considered as a country, would rank as the world’s 5th largest economy.’

This is a very large acquisition so, naturally, it is imperative all go according to plan. I have no reason to expect otherwise. As a result, I did not hesitate to ‘pull the trigger’ to reacquire BMO shares….shares I intend to hold for the very long term.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long BMO, RY, and TD.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.