A good time to initiate a BlackRock, Inc. (BLK) position would have been in late September/early October. However, due to an unexpected opportunity disclosed in my FFJ Portfolio – September 2022 Report, I regretfully had to remain on the sidelines. By the time my liquidity had improved, BLK’s share price had rocketed higher and its valuation was no longer appealing.

In mid-January 2023, however, BLK reported FY2022 results that fell short of earnings expectations and FY2021 results. This led to BLK falling out of favour with many investors; the share price has fallen from ~$770 in early February 2023 to $651.28 at the March 9 market close.

In several previous articles, I mention my desire to invest in great companies experiencing short-term headwinds. BLK, in my opinion, is such a company. On March 9 I initiated a BLK position by acquiring 60 shares at ~$658.47 in one of the ‘Core’ accounts within the FFJ Portfolio.

Overview

BLK, founded in 1988, is a leading publicly traded investment management firm with ~$8.6T of assets under management (‘AUM’) on December 31, 2022. This is a ~6% CAGR over the last 5 years.

It has established leadership positions in high-growth areas such as ETFs, private markets, outsourced solutions and technology.

Asset managers are compensated based on a percentage of the assets they manage. As a result, they can be expected to perform well in bull markets because bull markets are characterized by business growth, which typically translates into higher share prices.

A comprehensive overview of BLK is provided in Part 1 Item 1 in BLK’s FY2022 Form 10-K.

Financials

Q4 and FY2022 Results

An overview of BLK’s Q4 and FY2022 results is found in this earnings release and earnings presentation.

BLK generated ~$307B in net new assets and positive organic base fees in FY2022. In Q4 it generated ~$114B of total net inflows representing 3% annualized organic base fee growth.

In the US, BLK generated $230B of long-term net inflows, and flows were positive across all regions throughout the world.

On the January 13 Q4 earnings call, management indicated that BLK generated ~$114B of Q4 net inflows representing 3% annualized organic growth-based fees. It is also estimated that BLK captured over 33% of the long-term industry flows in 2022.

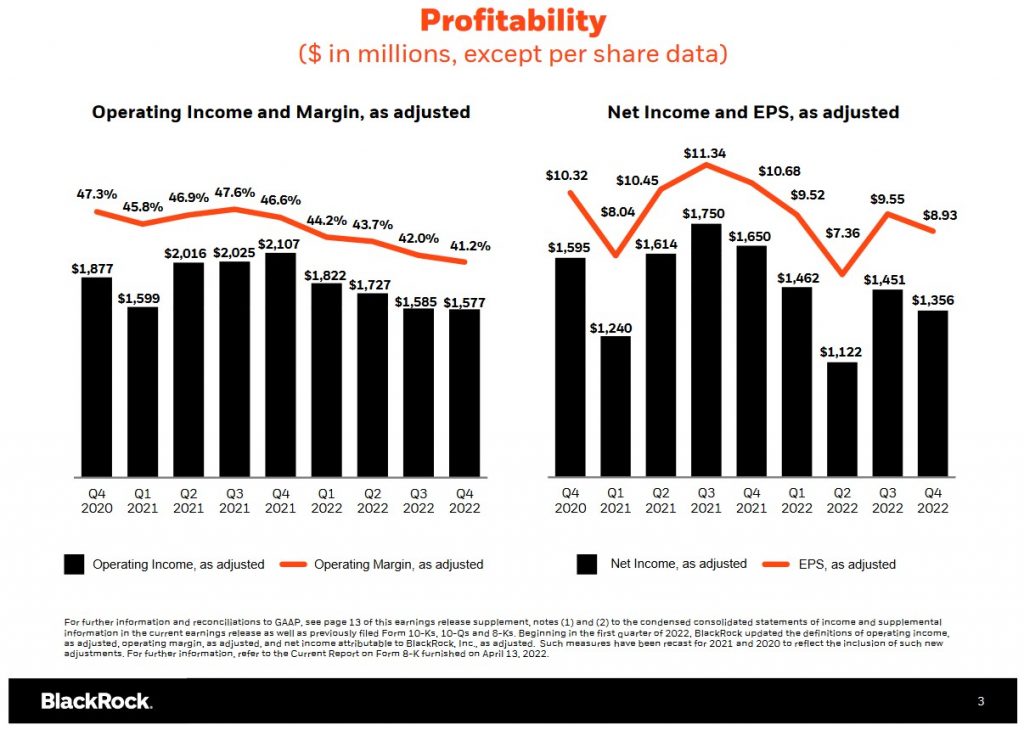

Despite this impressive performance, FY2022 results were weaker than those of FY2021. The FY2022 adjusted operating margin of 42.8%, for example, was down 400 bps from a year ago. This was primarily because of:

- the negative impact of markets and foreign exchange movements on revenue; and

- BLK’s ongoing longer-term strategic investments in technology and its employees.

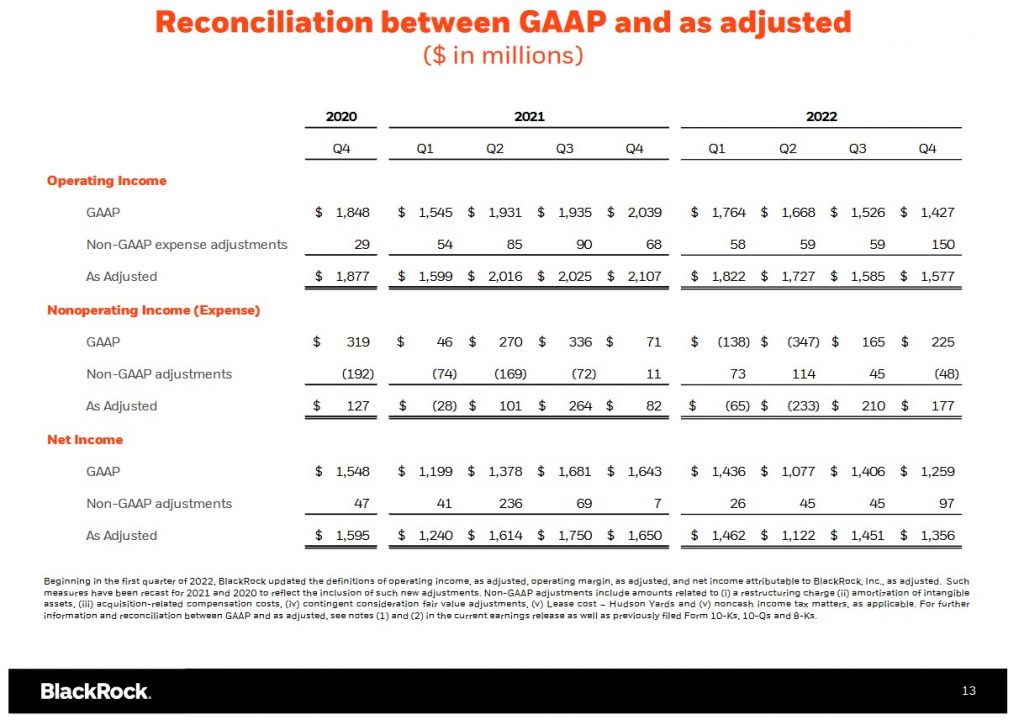

Source: BLK – Q4 2022 Earnings Presentation – January 13, 2023

In recognition of the strong probability of a challenging environment, in July 2022 BLK began to aggressively manage the pace of its discretionary spend to be better prepared for FY2023. This includes the recent restructuring of the size and shape of its workforce to free up investment capacity for the most important growth initiatives. This resulted in a ~$91 million Q4 restructuring charge primarily comprised of severance and accelerated amortization of previously granted deferred compensation awards for ~500 impacted employees (~2.5% of BLK’s global workforce); this charge appears as a single line expense item on the 2022 GAAP income statement (page 70 in the FY2022 Form 10-K) and is excluded from BLK’s adjusted results to enhance comparison to prior periods.

FY2023 Guidance

BLK does not issue guidance.

Operating Cash Flow (OCF) Free Cash Flow (FCF)

In FY2017 – FY2022, BLK generated OCF of (in $B) 3.950, 3.075, 2.884, 3.743, 4.944 and 4.956 and FCF of (in $B) 3.795, 2.871, 2.630, 3.549, 4.603, and 4.423.

Credit Ratings

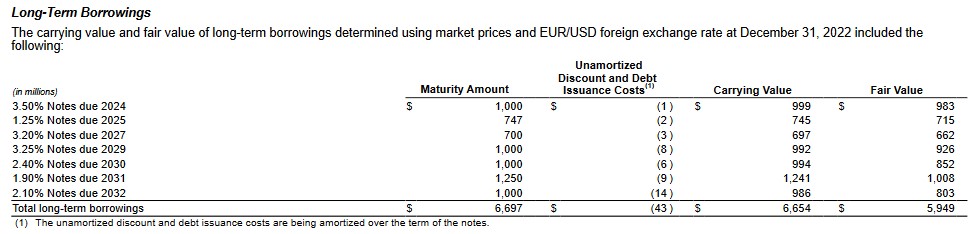

The interest rates associated with BLK’s long-term borrowings at December 31, 2022 are attractive. The maturity schedule is such that I do not envision BLK will experience any difficulty in repaying these obligations.

Source: BLK – FY2022 Form 10-K

In June 2018, Moody’s upgraded BLK’s domestic senior unsecured credit rating to Aa3 from A1. This Aa3 rating has been in effect since this upgrade and Moody’s assigns a stable outlook.

In May 2014, S&P Global upgraded BLK’s domestic senior unsecured credit rating to AA- from A+. This AA- rating has been in effect since this upgrade and S&P Global assigns a stable outlook.

Both ratings are the bottom tier in the high-grade investment-grade category. These ratings define BLK as having a very strong capacity to meet its financial commitments. The ratings differ from the highest-rated obligors only to a small degree.

These investment-grade ratings are acceptable for my purposes.

Dividends and Share Repurchases

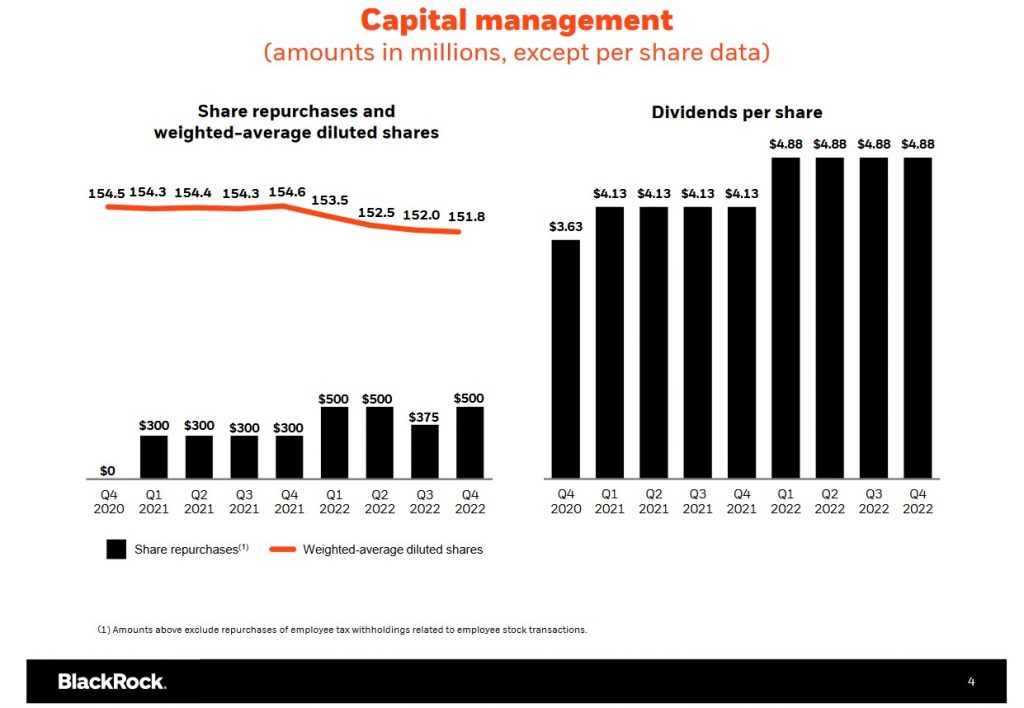

The following reflects BLK’s quarterly capital management allocation for the past 2 fiscal years.

Source: BLK – Q4 2022 Earnings Presentation – January 13, 2023

Dividend and Dividend Yield

BLK initiated a quarterly dividend in 2003 (see dividend history).

On January 25, BLK announced that its Board had approved a 2.5% increase in the quarterly cash dividend to $5.00/share, payable on March 23 to shareholders of record at the close of business on March 7, 2023.

With shares having closed at $651.28 on March 9, the dividend yield is ~3.07%.

Share Repurchases

The diluted weighted average common shares outstanding in FY2017 – FY2022 (in millions) are 164.4, 162, 157.5, 154.8, 154.4, and 152.4; these are annual figures which is why they differ slightly from the image reflected above.

During FY2022, BLK repurchased 2.7 million common shares under its existing share repurchase program for ~$1.9B. On December 31, 2022, there were ~0.9 million shares still authorized to be repurchased under the program. In January 2023, BLK announced that its Board authorized the repurchase of an additional 7 million shares under the Company’s existing share repurchase program for a total of up to ~7.9 million shares of BLK common stock.

On a combined basis, BLK returned ~32% more to shareholders through dividends and share repurchases in FY2022 versus FY2021.

Since the inception of BLK’s current capital management strategy in 2013, it has repurchased over $13B of BLK stock. This has resulted in a ~13% reduction in total outstanding shares and an unlevered compound annual return of ~15% for shareholders.

Based on capital spending plans for FY2023 and subject to market conditions, including the relative valuation of BLK’s stock price, the target is to repurchase at least $1.5B of shares.

Valuation

BLK’s FY2013 – FY2022 PE levels based on diluted EPS are 19.93, 18.57, 17.58, 20.08, 24.16, 11.30, 19.47, 24.07, 24.45, and 19.60.

BLK’s forward valuation based on currently available adjusted earnings estimates and the current ~$651.28 share price is:

- FY2023 – 16 brokers – mean of $35.04 and low/high of $33.00 – $37.94. Using the mean estimate, the forward adjusted diluted PE is ~18.6.

- FY2024 – 16 brokers – mean of $39.90 and low/high of $36.15 – $42.23. Using the mean estimate, the forward adjusted diluted PE is ~16.3.

- FY2025 – 6 brokers – mean of $45.53 and low/high of $42.32 – $48.66. Using the mean estimate, the forward adjusted diluted PE is ~14.3.

Although BLK’s valuation could become slightly more attractive if we get a broad market pullback, I consider its current valuation to be sufficiently attractive for me to initiate a position.

Final Thoughts

BLK sources ~66% of its managed assets (and almost 50% of its revenue) from passive products (its iShares exchange-traded fund platform and institutional index fund offerings).

Over the past 5 years, BLK has delivered an aggregate of $1.8T in net inflows or 5% average organic asset growth compared to flat or negative industry flows.

BLK has been able to offset many of the secular headwinds facing traditional asset managers. In my opinion, BLK appears to be well-positioned for an environment in which clients seek out providers of passive products and active asset managers that have greater scale, established brands, solid long-term performance, and reasonable fees.

The transformation of the geopolitical world has rewired globalization and supply chains. Production constraints, labour shortages, energy and food price disruptions and price increases have led to inflation levels not witnessed in decades thereby sparking a cycle of rate hikes by central banks.

Inflation continues to be a top concern and in many parts of the world, there has been a decline in birth rates, an increase in aging populations, and a rise in nationalism and populism. This will likely lead to a period of economic malaise.

On the Q4 earnings call, Larry Fink (Chairman and CEO) stated:

‘Leaders must continue to invest in technology and research and development to improve long-term prospects and to provide a vision that offers hope about the future.

Fundamentally, investing is also an active hope, hope that the future will be better than the present. If people do not have hope, they will not take money out of the bank account and invest it in a 30-year retirement outcome. Today, the financial narrative is so often about the near-term market moves, the topic of the day, the latest meme stock or media headlines about political polarization.’

As a long-term investor, BLK’s long-term approach to investing appeals to me. It has, over the years, demonstrated that a balanced portfolio can deliver long-term financial security. In hindsight, I should have initiated a BLK position at the height of The Financial Crisis. Unfortunately, I did not. Now that I have BLK exposure I intend to follow it more closely.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long BLK.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.