I last reviewed Alimentation Couche-Tard (ATD.to) in this December 7, 2023 post. At the time, the most current financial information was for Q2 and YTD2024. We now have ATD’s Q4 and FY2024 results which has prompted me to revisit this company.

When I wrote my prior post, I held 1227 ATD shares in one of the ‘Side’ accounts within the FFJ Portfolio. It was not a top 30 holding when I complete my Mid 2023 Investment Holdings Review, nor was it a top 30 holding when I completed my 2023 Year End FFJ Portfolio Review.

In my June 11, 2024 post, I disclosed the liquidation of all holdings in the account that held 1231 ATD shares. The sale of all these holdings was not taken lightly but given the impending changes to the treatment of capital gains in Canada, our tax advisors presented us with various tax planning alternatives. The sale of these shares was the preferred strategy…even though we will incur a significant tax liability when our 2024 tax returns are filed.

I debated on whether to reinstate my exposure to ATD but opted to PASS since I think it is likely to continue to experience challenges.

Although ATD is an excellent operator, my rationale for not reinvesting in the company at this point is that I think we are experiencing a ‘suspension of disbelief’ period in which many investors are replacing reality for magic.

Historically, bull markets in the US have typically lasted 6 – 9 years. If we disregard the man-made two month 2020 COVID recession, we are now experiencing a 15 year bull market (market low of the last recession was March 9, 2009). This is the longest bull market in history.

The primary reason for this bull market it that the US government started to flood the economy with ~$27T of stimulus money starting in the 2008 downturn; approximately $15T has come in the last 5 years.

We have also had artificially low interest rates for roughly a decade which has helped fuel assets such as stocks.

Most of the current economic stimulus is slated to finish at the end of the current US federal government’s September 30, 2024 year end. Regardless who wins the upcoming US Presidential election, I think control of the House and the Senate will be so slim that the stalemates we have witnessed in recent years will continue. In essence, nothing meaningful is likely to be accomplished. The Trump Tax Cuts will end on January 1, 2025 and the country will revert to the Obama Tax Program; if Trump wins, he most likely will have an insufficient number of votes in Congress to reinstate any tax cuts.

If my thought process is correct, interest rates will remain elevated to combat inflation much longer than many anticipate. Rather than continuing to ‘kick the can down the road’, something needs to be done to address the US’s budget deficit…and soon! How is this likely to be achieved? Higher taxes and/or higher tariffs on imports? Same effect. ATD’s average consumer is likely to have their budget squeezed further. IF this happens, the headwinds ATD’s management discussed on the recent Q4 earnings call is likely to persist for the next few quarters.

NOTE:

- ATD’s shares trade on the TSX in Canada and over the counter in the US.

- Operating results are in USD. I use a USD $1 = CDN $1.3696 conversion rate for this post, USD $1 = CDN $1.3583 conversion rate for my December 7, 2023 post, and USD $1 = CDN $1.3289 for my July 10, 2023 post.

Business Overview

Please review ATD’s website if you are unfamiliar with the company.

The most recent analyst and investor presentation which provides a good overview of the company is accessible here.

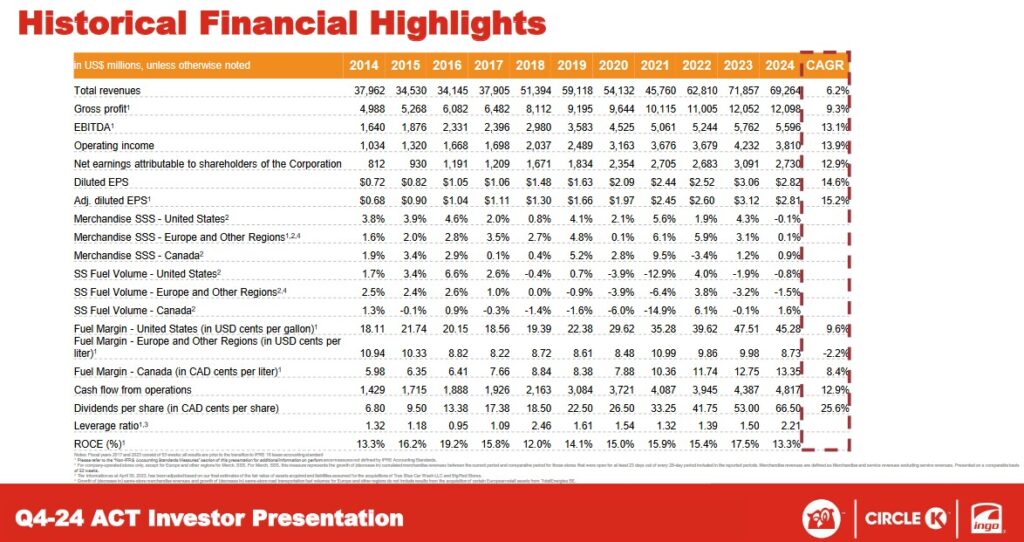

This is a high volume/low margin business. In FY2014 – FY2024, ATD generated revenue of (in billions of $ rounded) 38, 35, 34, 38, 51, 59, 54, 46, 63, 72, and 69. Its operating margin during the same time frame is (%) 2.6, 3.93, 4.8, 4.53, 4.04, 4.19, 5.65, 7.85, 5.67, 5.77, and 5.5.

The convenience store industry is highly fragmented and is undergoing consolidation. For example, in the US where ATD has its largest presence, we see an extensive list of industry participants.

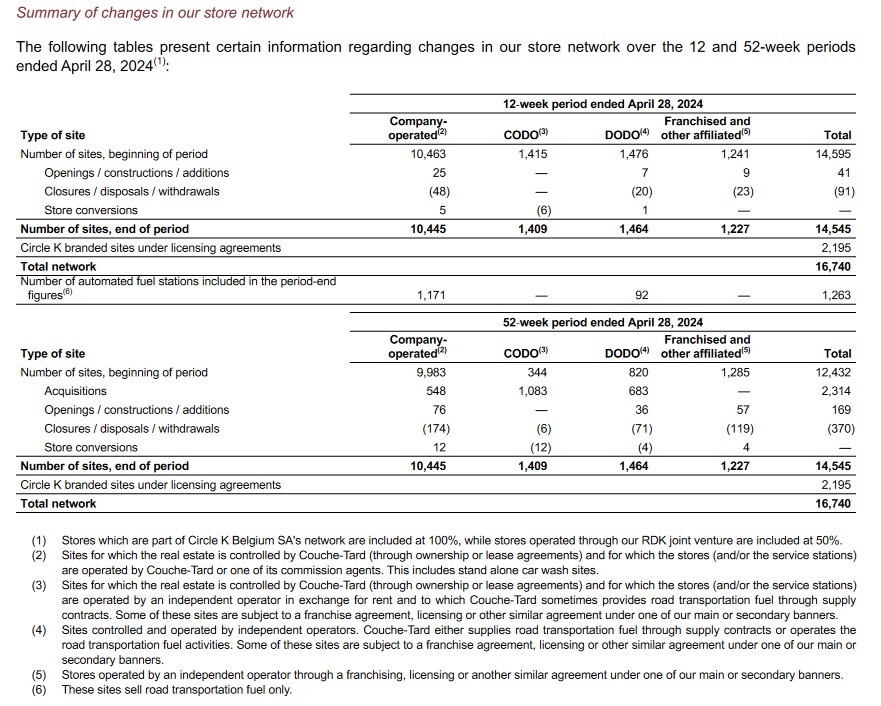

While the barriers to entry are low, ATD’s global network of 16,740 stores enables it to compete on a much different scale than most other convenience store industry participants.

The only other comparable industry participant is Seven & i Holdings Co., Ltd., a Japanese diversified retail holdings company, which owns 7-11.

Despite a challenging environment, ATD is in an enviable position relative to many other industry participants. It has the ability to make acquisitions AND the valuation of acquisition opportunities may, in some cases, be more reasonable than a year or two ago.

On the recent Q4 earnings call, management stated:

In the last couple of months, we’ve seen quite a few deals come across our desk. We’d like to think we can land a few opportunities over the coming quarters.

The opportunities are both in Europe and North America and range in size from tuck-in acquisitions to acquisitions almost as large as the company’s purchase of European retail assets from TotalEnergies SE for 3.1B euros.

Financial Review

Q4 and FY2024 Results

Material related to the June 26 is financial release is accessible here.

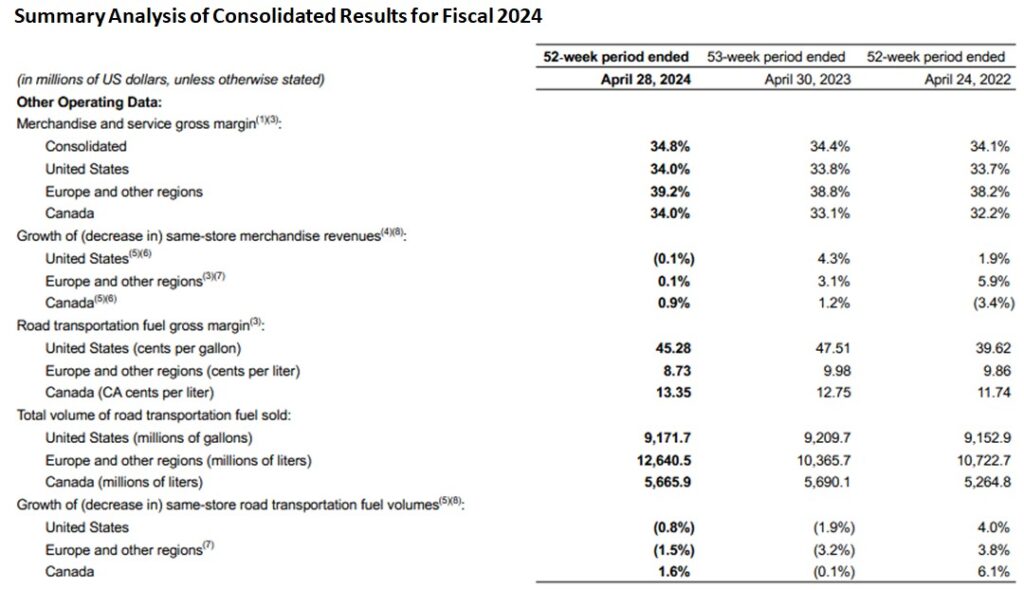

In ATD’s Q4 2024 Management Discussion and Analysis for the 52-week period ended April 28, 2024, we see weakness in same store sales (SSS).

In my previous ATD post, I referenced an interview on CNBC with Walmart’s CEO in which he stated that consumer spending in 2024 is tougher to predict because of rising credit card balances and dwindling household bank accounts.

Fast forward to June 2024 and ATD’s management is voicing a similar observation. Q4 2024 was another challenging quarter with persistent inflation and continued pressure on consumers who are carefully watching their spending. In addition, it states that customers are:

- purchasing less fuel per visit;

- gravitating toward private label products; and

- trading down from premium to lower tier brands in categories like alcohol.

Cigarette sales also continue to decline driven by global efforts to curb smoking and it harmful effects. Other contributing factors for soft tobacco sales in Canada are the increasing taxes placed on tobacco and other tobacco-related products and the growth of channels selling contraband tobacco products.

Canada is not the only country in which ATD faces headwinds.

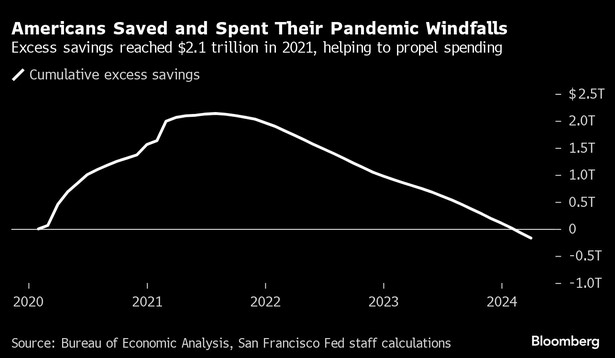

In the US, consumers have been resilient and have spent despite rising prices and high borrowing costs. During the COVID-19 pandemic, Americans accumulated ~$2T in excess savings. According to the U.S. Federal Reserve Bank of San Francisco, however, this excess savings was fully depleted as of March 2024.

In addition, employment/unemployment statistics may suggest that things are not as dire in the US as they appear. However, these statistics rarely (if ever) touch upon the quality of the jobs being lost/added. The loss of 6 figure jobs and the addition of minimum wage jobs is like comparing apples and oranges. I, therefore, take the weekly/monthly employment statistics with a grain of salt.

ATD’s typical customer might not make six figure salaries. However, the financial stress extends beyond ATD’s ‘typical’ consumer.

According to a new survey from the Federal Reserve Bank of Philadelphia, a little over 30% of Americans making six-figure salaries are worried about paying their bills. Several tables within the Federal Reserve Bank of Philadelphia’s April 2024 Labor, Income, Finances, and Expectations (LIFE) Survey point to a broad spectrum of American consumers who appear to be in a financial predicament.

One of the findings from this survey is a notable increase over the past year of consumers making $100,000+ a year expressing concern about financial pressure. In order to make ends meet, they are lowering spending on a variety of expenses (eg. restaurant visits and entertainment).

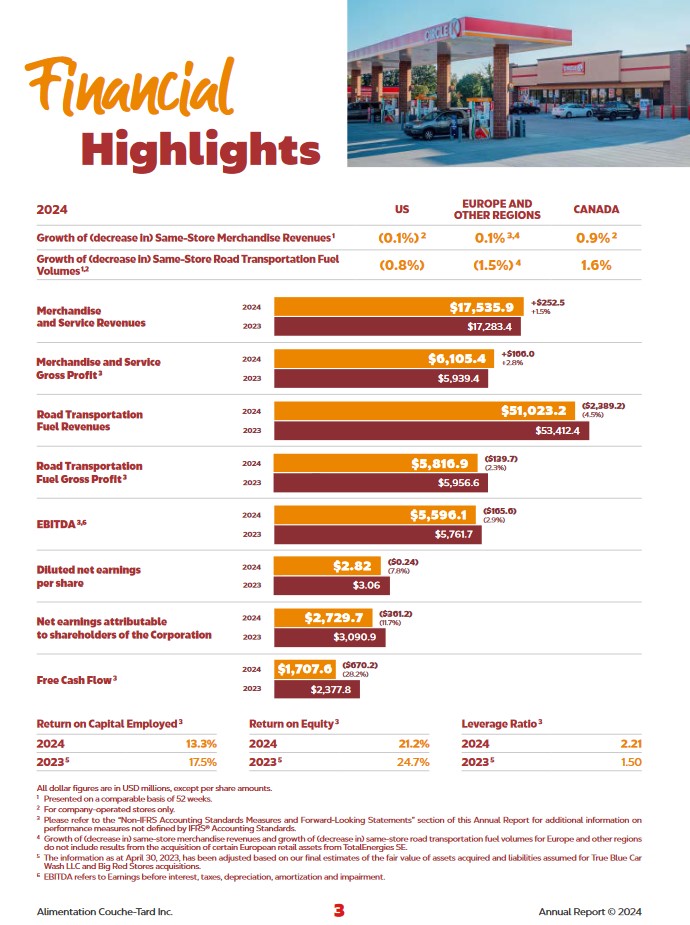

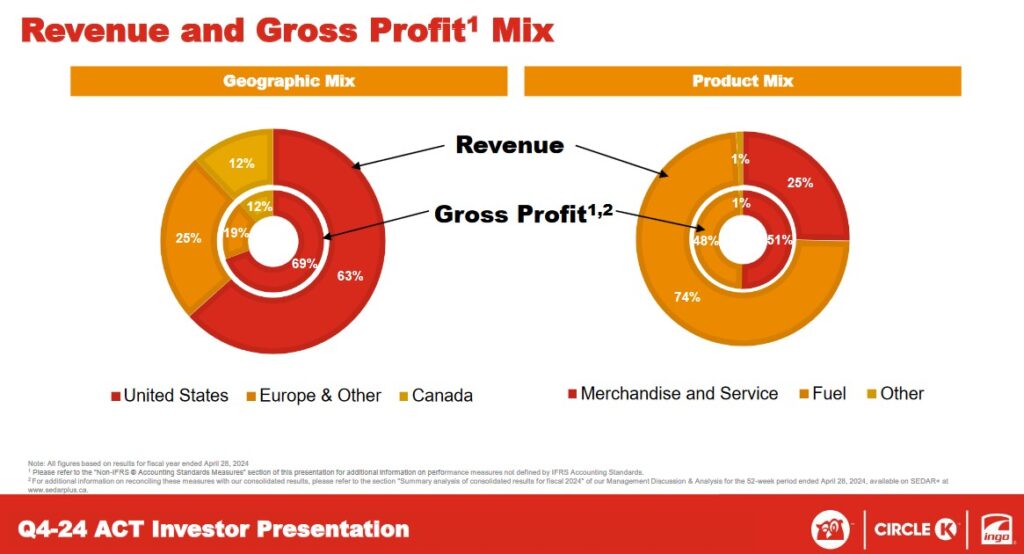

Revenue and Profit Mix

The following was ATD’s revenue and profit mix.

Historical Financial Highlights

ATD’s historical results are a testament to its financial discipline.

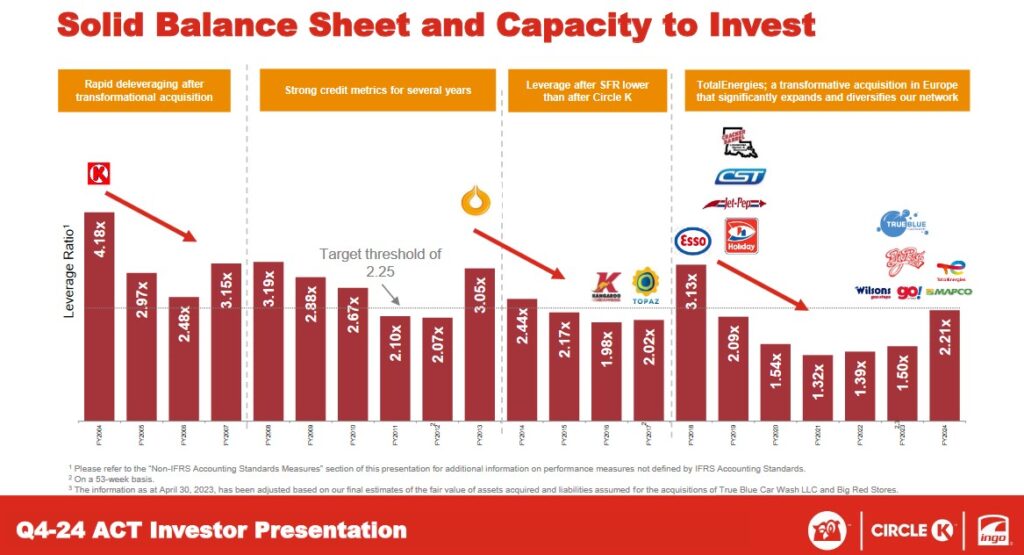

ATD has ~$10B of incremental Balance Sheet capacity which bodes well for additional potential acquisitions.

CAPEX, Operating Cash Flow (OCF), and Free Cash Flow (FCF)

Depreciation often serves as an rough indicator of how much needs to be invested to maintain assets in good operating condition.

Annual CAPEX was (in billions of $) 0.529, 0.635, 0.906, 0.994, 1.169, 1.145, 1.408, 1.189, 1.665, 1.804, and 1.943 during the same period. In comparison, FY2023 and FY2024 depreciation, amortization, impairment and amortization of financing costs was $1.534 and $1.765.

In FY2014 – FY2024, ATD generated:

- OCF of (in billions of $): 1.429, 1.715, 1.888, 1.926, 2.163, 3.084, 3.721, 4.087, 3.945, 4.345, and 4.817.

- FCF of (in billions of $): 0.900, 1.080, 0.982, 0.931, 0.994, 1.939, 2.313, 2.898, 2.280, 2.541, and 2.874.

Return On Invested Capital (ROIC)

High quality companies often generate a high ROIC. If a company generates a high ROIC, it needs to invest less to achieve a certain growth rate thus reducing the need for external capital.

A company that generates $0.15/profit for every $1 invested, for example, achieves a ROIC of 15%. I consider a ~15%+ ROIC to be a reasonable minimum threshold because most of the time, a company’s cost of capital will be lower than this level.

In FY2014 – FY2024, ATD’s ROIC (%) was 13.43, 14.72, 17.06, 15.09, 15.06, 12.93, 14.35, 13.85, 13.33, and 15.01.

Risk Assessment

ATD’s leverage has increased because of debt incurred to acquire retail sites in Germany, Netherlands, Belgium, and Luxembourg from TotalEnergies. The company, however, has a track record of deleveraging so it can raise debt for future acquisitions.

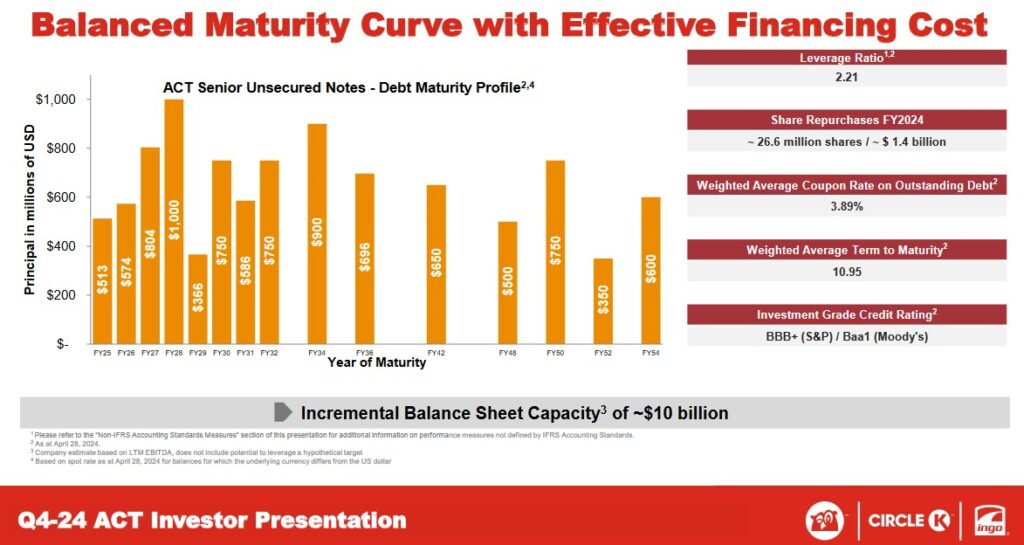

Looking at ATD’s debt maturity schedule, we see that ~$5.343B of debt matures in FY2025 – FY2032.

Unless business conditions deteriorate dramatically, I see no reason why ATD can not repay its debt in a timely manner.

On May 18, 2023, Moody’s upgraded ATD’s domestic senior unsecured debt from Baa2 to Baa1. On September 18, 2023, S&P Global, upgraded ATD’s domestic senior unsecured debt from BBB to BBB+. Both ratings, the top tier of the lower medium-grade investment-grade category, define ATD as having an ADEQUATE capacity to meet its financial commitments. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity in which ATD can meet its financial commitments.

These ratings are satisfactory for my purposes.

Dividends and Dividend Yield

ATD’s dividend history dating back to September 2014 is accessible here.

With shares trading at ~$77, the new $0.175/share quarterly dividend results in a sub 1% dividend yield. This dividend yield is likely to dissuade dividend-focused investors from considering ATD as a potential investment. The bulk of ATD’s total shareholder return, however, is likely to continue to be in the form of share price appreciation. This is unlikely to change as ATD’s capital allocation priorities favor the retention of funds for growth.

Share Repurchases

In FY2011 – FY2023, there were 1,129, 1,101, 1,121, 1,136, 1,137, 1,138, 1,139, 1,134, 1,130, 1,125, 1,107, 1,064, and 1,009.5 million shares outstanding. In the 12-week period ended April 28, 2024, the weighted average number of diluted shares outstanding was 961.5. For FY2024, the weighted average number of diluted shares outstanding was 968.2.

During FY2024, ATD repurchased 26,618,337 shares (52,024,694 shares for FY2023). These repurchases were settled for an amount of ~$1.374B USD (~$2.336B USD for FY2023) of which $24.6 million USD is recorded in Accounts payable and accrued liabilities as at April 28, 2024. This is related to 433,300 shares which were repurchased in the last two business days prior to April 28, 2024 and cancelled subsequent to FYE2024.

On April 26, 2024, the Toronto Stock Exchange approved another renewal of the Corporation’s share repurchase program, which took effect on May 1, 2024. The renewed share repurchase program allows ATD to repurchase up to 78,083,521 shares, representing 10.0% of the shares outstanding as at April 18, 2024; the share repurchase period will end no later than April 30, 2025.

Valuation

ATD’s FY2013 – FY2023 diluted PE is 18.48, 27.74, 23.25, 23.36, 21.89, 15.64, 17.65, 13.76, 17.18, 15.68, and 18.53.

When I wrote my July 10, 2023 post, ATD had recently reported FY2023 $3.06 diluted EPS and $3.12 in adjusted diluted EPS. Using a $1.3289 conversion rate, I arrived at ~$4.07 in diluted EPS and ~$4.15 in adjusted diluted EPS. Using my recent $65.38 purchase price, the diluted PE was ~16 and the adjusted diluted PE was ~15.8.

The forward valuations using adjusted diluted EPS estimates from the brokers which cover ATD and my $65.38 purchase price were:

- FY2024 – 14 brokers – mean of $2.86 and low/high of $2.65 – $3.05. Converting the mean value using the conversion rate reflected at the outset of this post, I arrived at ~$3.80 CDN. The forward adjusted diluted PE was ~17.2.

- FY2025 – 13 brokers – mean of $3.21 and low/high of $2.80 – $3.48. Converting the mean value using the conversion rate reflected at the outset of this post, I arrived at ~$4.27 CDN. The forward adjusted diluted PE was ~15.3.

At the time of my December 7, 2023 post, ATD’s forward valuations using brokers’ adjusted diluted EPS estimates and the current ~$77.50 share price were:

- FY2024 – 15 brokers – mean of $3.20 and low/high of $2.96 – $3.55. Converting the mean value using the conversion rate reflected at the outset of this post, we get ~$4.35 CDN. The forward adjusted diluted PE was ~17.8.

- FY2025 – 15 brokers – mean of $3.39 and low/high of $2.80 – $3.67. Converting the mean value using the conversion rate reflected at the outset of this post, we get ~$4.60 CDN. The forward adjusted diluted PE was ~16.8.

ATD has now reported $2.82 and $2.81 of diluted EPS and adjusted diluted EPS for FY2024. Using a $1.3696 fx rate, we get ~$3.85 of diluted and adjusted diluted EPS. Shares closed at $77.12 on June 26 thus giving us a ~20 diluted and adjusted diluted PE.

ATD does not provide guidance but using brokers’ adjusted diluted EPS estimates and the current ~$77 share price we get the following:

- FY2025 – 15 brokers – mean of $3.07 and low/high of $2.58 – $3.34. Converting the mean value using a $1.3696 conversion rate, we get ~$4.23 CDN thus giving us a ~18.2 forward adjusted diluted PE.

- FY2026 – 13 brokers – mean of $3.45 and low/high of $2.74 – $3.97. Converting the mean value using a $1.3696 conversion rate, we get ~$4.78 CDN thus giving us a ~16 forward adjusted diluted PE.

ATD has just released its earnings on June 26 so several brokers have yet to update their earnings estimates. I expect some brokers will be lowering their earnings estimates in the coming days.

ATD generated ~$2.874B USD of FCF in FY2024 and the weighted average number of diluted shares outstanding was 968.2 million resulting in ~$2.97 USD FCF/share. Convert ~$2.97 USD using a $1.3696 conversion rate and we get ~$4.07 CDN FCF/share. Divide ~$77 by $4.07 and we get a P/FCF of ~19.

ATD’s renewed share repurchase program allows it to repurchase up to 10.0% of the shares outstanding as at April 18, 2024. In Q4, the weighted average number of diluted shares outstanding was 961.5. The weighted average number of shares outstanding in FY2025 depends on several factors. Let’s suppose, however, that the weighted average in FY2025 ends up being ~930 million.

If its FY2025 FCF ends up being roughly comparable to FY2024 or ~$2.875B USD, we get ~$3.09 USD FCF/share. Convert ~$3.09 USD using a $1.3696 conversion rate and we get ~$4.23 CDN FCF/share. Divide ~$77 by $4.23 and we get a P/FCF of ~18.2.

Final Thoughts

I do not dispute that ATD is arguably the best large operator in its industry.

My concern with ATD at this point is that its customer base is comprised heavily of ‘financially challenged consumers’. ATD could certainly make fortuitous additional acquisitions that will lead to FY2025 results being somewhat similar to FY2024 results. I do not, however, see economic conditions improving any time soon and think ATD’s SSS will remain weak in FY2025.

Every country in which ATD has operations appears to be experiencing its share of ‘headwinds’ and an increasing number of consumers are struggling financially. Worsening housing affordability, debatable employment statistics (quantity versus quality), and increases in credit card delinquencies and car repossessions do not pain a rosy picture.

In recent posts I have disclosed that I:

- am trying to acquire shares in great companies experiencing temporary headwinds that have fallen out of favor with investors; and

- have made a conscious decision to dramatically reduce my exposure to Canadian companies. I currently have exposure to very few Canadian companies.

ATD is certainly experiencing temporary headwinds which makes it an ‘investment opportunity’. It also generates ~88% of its revenue and gross profit from outside Canada so I am prepared to consider it as a potential investment.

Unless ATD’s valuation significantly improves, however, I do not intend to repurchase shares. This is because I have identified other great companies I think can generate superior long term total returns. These companies are all less capital intensive than ATD and they generate superior operating margins, OCF, and FCF on a fraction of ATD’s annual revenue.

I wish you much success on your journey to financial freedom.

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I have no exposure to ATD.to. The only ATD exposure my family has is a ’rounding error’ and is in an account for a young shareholder I am helping on their journey to financial freedom.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.