This Automatic Data Processing, Inc. (ADP) article analyses Q4 and FY2019 results, FY2020 guidance, and amended FY2021 targets which were released July 31, 2019.

Summary

- ADP should benefit from the evolving and increasingly complex relationship between businesses and their employees, changes in the US tax code, labor regulation and benefit compliance.

- Investors with a low tolerance for risk will appreciate ADP’s high credit ratings accorded by the major ratings agencies.

- ADP’s current dividend yield is low relative to recent historical levels. It has, however, increased its dividend for over 4 decades.

- Current market conditions as extremely unpredictable and a ‘tweet’ within the very near future could result in a broad market pullback with ADP becoming more attractively valued.

Introduction

Automatic Data Processing, Inc. (ADP) continues to be North America’s largest provider of payroll services. It stands to benefit from the evolving and increasingly complex relationship between businesses and their employees, changes in the US tax code, labor regulation, and benefit compliance. This is because a significant number of businesses do not have the expertise to adapt to these constantly shifting compliance requirements.

One of ADP’s challenges, however, is that payroll is slowly becoming commoditized. In order to remain at the forefront of the industry, ADP will need to continue to increase its value proposition and to introduce new offerings that maintain high switching costs.

One of ADP’s biggest risks is that there are several competitors with highly user friendly technology platforms that are less expensive and easier to maintain than ADP’s legacy technology platform. ADP’s technology platform is partially the result of several years of acquisitions that were less than effectively integrated.

In August 2017, hedge fund management company Pershing Square Holdings announced that it started to acquire a stake in ADP beginning in late 2016; Pershing is led by activist investor Bill Ackman, founder and CEO.

At the time Pershing initiated a position in ADP, ADP was trailing several of its competitors from a Gross Margin, Net Operational Revenue per Employee (this excludes float income (“Funds Held for Clients”) and Professional Employer Organization (PEO) Services pass-through costs). More details on this subject matter can be found here.

Subsequent to initiating a position in ADP, Pershing was actively engaged with ADP in an effort to increase long-term shareholder value. A proxy contest was launched which resulted in ADP making commitments to shareholders to accelerate revenue growth, bolster its competitive position in its Enterprise segment, and improve efficiency and margins.

Fast forward to 2019 and ADP is one of Pershing Square Holdings’ largest positions at ~4%. In Pershing Square Holdings’ May 17, 2019 Letter to Shareholders, Ackman states that he and his team continue to believe ADP has a significant opportunity to accelerate top-line revenue growth and expand margins which should allow ADP to compound earnings at a mid-to-high-teens growth rate for several more years.

Although I have held shares in ADP for several years and view ADP as a long-term investment I indicated in my May 2nd article that I was of the opinion ADP shares were richly valued. I, therefore, wrote May 17, 2019 $155 covered calls.

ADP’s share price rose above my strike price so I closed these positions at a loss and wrote August 16, 2019 $165 covered calls which generated almost sufficient premium to cover my cost of closing the May contracts.

As I compose this article ADP is trading at $164.27 and I am cautiously optimistic ADP will remain below my $165 strike price come expiry. I will be monitoring this position closely since it is not my intent to part with any ADP shares.

With ADP having released Q4 and FY2019 results, FY2020 guidance, and amended FY2021 targets on July 31st I take this opportunity to revisit ADP.

Q4 and FY2019 Financial Results

ADP most recent results found here and here.

Over the past three years, ADP has been working to improve service levels by migrating clients to its strategic cloud-based software solutions and by simplifying the service experience. It has also closed sub-scale locations and transformed its client service model. These initiatives have contributed to improvements in client satisfaction scores and in overall service costs.

In Q4 2019, ADP implemented its Workforce Optimization initiative to reduce management layers and increase spans of controls which should lead to further improvement in ADP’s results.

Contributing toward margin expansion was the execution of transformation initiatives, the voluntary early retirement program, and increased operating efficiencies; the voluntary early retirement program is projected to have an annualized recurring cost saving of $0.15B which is in line with original expectations.

In FY2019, ADP exited the remainder of its previously identified 68 subscale service locations for an annualized recurring cost saving of ~$60 million.

Combined with share buybacks and a lower adjusted effective tax rate, ADP delivered 20% adjusted EPS growth in FY2019.

Employer Services new business bookings grew 11% in Q4 and 8% for the year and ~$1.6B of new annualized recurring revenue was generated.

ADP has benefitted from the tight labor market as this has increased the importance of recruiting. Organizations are increasingly looking to utilize technology to provide a more seamless and effective recruitment process. Employers are increasingly looking for an integrated offering that equips recruiters with tools that effectively identify and connect with top talent. In this regard, ADP recently integrated ADP recruiting management, its all-in-one automated recruiting platform with LinkedIn recruiter system connect. This integration allows recruiters to easily export basic profile data into ADP recruiting management while servicing critical candidate information in real-time into Linkedln recruiter.

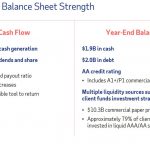

Looking at ADP’s balance sheet, cash flow and financial liquidity we see a strong balance sheet with multiple sources of liquidity and solid credit ratings. This helps support ADP with ~$2.2T in global client money movement operations and with its investment strategy for the client fund’s portfolio.

Source: ADP Q4 and FY2019 Earnings Presentation – July 31 2019

Source: ADP Q4 and FY2019 Earnings Presentation – July 31 2019

FY2020 Outlook and FY2021 Targets

On June 12, 2018 ADP held its Investor Day at which time it provided its Financial Outlook through 2021. When FY2021 targets were provided in 2018 they were baselined off FY2018 guidance as at Q3 2018 and were under ASC 605, Revenue Recognition. ADP has now recast the original FY2018 baseline and FY2021 targets to reflect actual FY2018 results and the adoption of the ASC 606 basis of accounting.

ADP’s FY2020 outlook and FY2021 targets can be found on pages 8 and 9 of ADPs’ July 31, 2019 Q4 and FY2019 Earnings Presentation for which a link is provided above.

Clients Funds Investment Strategy

The purpose of ADP’s Client Funds Portfolio Extended Investment Strategy is to generate income from the significant client fund balances. When deemed prudent, ADP will further enhance its investment returns by investing long and borrowing short to take advantage of the yield spread.

Details on this subject matter can be found on pages 10 and 11 of ADPs’ July 31, 2019 Q4 and FY2019 Earnings Presentation for which a link is provided above.

Credit Ratings

We are certainly living in interesting times and in my opinion investors would be well served by dialing back risk.

Prior to April 10, 2014, ADP’s long-term debt credit rating was AAA. Following a couple of downgrades, ADP is now rated Aa3 (as of August 28, 2015). This is the lowest tier of the High Grade category.

S&P Global has rated ADP AA since April 10, 2014. This rating is one notch higher than that accorded by Moody’s.

I have no issues with ADP’s credit ratings.

Valuation

At the time of my May 2nd article ADP was trading at $158.40. On May 1st ADP had just released Q3 2019 results and the outlook for FY2019 was a 19% – 20% increase from $4.53 in FY2018 adjusted diluted EPS giving us a range of $5.39 – $5.44. This gave us an adjusted diluted PE level of ~29.1 – 29.4.

We now know that ADP generated $5.45 in adjusted diluted EPS in FY2019 and we see that ADP’s FY2020 guidance is a 12% – 14% increase. This gives us a range of $6.10 – $6.21. With ADP currently trading at $164.27 we get a forward adjusted diluted PE range of ~26.45 – ~26.93.

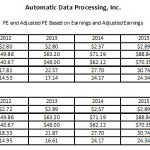

The following table reflects ADP’s forward adjusted diluted PE range relative to historical levels and its current diluted PE relative to historical levels; ADP provides guidance solely on an adjusted basis.

Even though ADP has increased its guidance and its share price had just recently retraced from its recent 52 week high I am still of the opinion shares are somewhat expensive.

Dividend and Dividend Yield

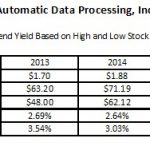

ADP’s dividend history can be found here.

ADP has one more dividend payment of $0.79 which will be distributed at the beginning of October.

I anticipate a dividend increase of at least $0.08 to $0.87 commencing with the January 2020 dividend. On this basis, I am projecting an annual dividend of $3.40 ($0.79 in October followed by $$0.87 in January, April, and July). With ADP trading at $164.27 this gives us a forward estimated dividend yield of ~2.07%. This is low relative to historical levels.

Final Thoughts

Final Thoughts

I view current market conditions as extremely unpredictable and am cautiously optimistic that some ‘tweet’ within the very near future will result in a broad market pullback.

I fully intend to increase my ADP exposure and would be receptive to acquiring shares at $155 or lower. Using a forward adjusted diluted EPS range of $6.10 – $6.21 we would have a forward adjusted diluted PE range of ~25 – ~25.4. This is certainly not a ‘bargain’ but is acceptable for my purposes.

I intend to post a brief article mid-August to provide the status of the ADP August 16th covered call.

I hope you enjoyed this post and I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long ADP.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.