Summary

- While MMM reported Q3 results on October 23rd and revised FY2018 earnings downward, the revised FY2018 EPS projections are 11 % – 13% higher than FY2017 results.

- MMM will be holding its Investor Day on November 15th at which time management will lay out its 5-year plan and the framework for that plan.

- View pullbacks in MMM’s share price as opportunities to acquire shares.

NOTE: This is a brief article given that MMM’s Investor Day is less than 1 month away.

Introduction

In October 2017 I wrote a 3M (NYSE: MMM) article in which I applauded JP Morgan’s analysts for downgrading MMM to ‘Underweight’. At the time of that analyst’s downgrade I viewed MMM as an excellent company but was in complete agreement that the company was grossly overvalued.

Fast forward to late July 2018 by which time MMM’s stock had come off ~$53 from its ~$260 high set in late January 2018.

In the Final Thoughts portion of my July 24th MMM article I indicated:

‘I would be an extremely happy investor if MMM were to SIGNIFICANTLY drop in value for a prolonged period as long as the drop was not attributed to a serious problem with the company.’

At the time of that article MMM had just released its Q2 results. MMM’s stock price had plunged to just under $191 from the previous day’s close of ~$199 but as I was composing my article the share price had bounced back to close at just above $200. Based on the 604.2 million weighted average diluted common shares outstanding for the 3 months ending June 30th, investors had suddenly viewed the company as being worth ~$4.83B less than at the close of the previous business day. This was despite an upward revision in 2018 Planning Estimates.

Source: MMM – Q2 2018 Earnings Presentation – July 24 2018

Here we are, one quarter later and MMM has released Q3 and YTD results and has reduced the EPS and Adjusted EPS values reflected in its 2018 Planning Estimates. On the date Q3 results were released (October 23rd) investors shaved ~$8.8/share from MMM’s share price.

It once again appears that many in the investment community are bailing on MMM!

I can fully appreciate that if you’re an investor with a short-term investment time horizon and you employ the use of leverage, then you seriously need to re-evaluate your MMM investment. If, however, you shun the use of leverage and invest in great companies on the basis of a long-term investment time horizon then MMM’s downward price fluctuation should be welcomed!

Q3 2018 Results and 2018 Outlook

MMM’s Q3 results released October 23, 2018 can be found here. You are also encouraged to review the Q3 2018 Presentation for which a link is provided below as the presentation provides some context as to the performance of each of MMM’s business segments: Industrial, Safety & Graphics, Health Care, Electronics & Energy, and Consumer.

Source: MMM – Q3 2018 Financial Results Presentation – October 23 2018

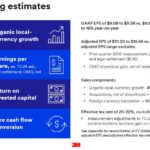

While MMM revised its Planning Estimates upward in Q2, estimates have now been revised downward.

Source: MMM – Q3 2018 Financial Results Presentation – October 23, 2018

Despite this downward revision in earnings estimates, MMM is still forecasting strong Free Cash Flow conversion. In the Q2 2018 presentation MMM forecast Free Cash Flow conversion of 90% – 100%. This has now been narrowed down to 90% – 95%.

For those unfamiliar with the term Free Cash Flow Conversion, it is a measure of the ability of a company to convert (in the same period) accrual-based accounting earnings that the business generates to actual cash that is available to:

- deploy in business acquisitions,

- reduce net debt (by increasing book cash or reducing actual gross debt),

- return to shareholders in the form of cash dividends or stock buybacks.

Free Cash Flow Conversion is equal to the Company’s free cash flow for a given period divided by net earnings for the same period, subject to adjustment for extraordinary items, non-operating items, discontinued operations, asset write-downs and impairments and other unusual and non-recurring items, currency fluctuations, financing activities, acquisitions and acquisition expenses, divestitures and divestiture expenses and the effects of tax or accounting changes.

Source: MMM – Q3 2018 Financial Results Presentation – October 23 2018

Credit Ratings

Moody’s continues to rate MMM’s senior unsecured debt A1 (upper tier of the ‘upper medium grade’ rating).

S&P Global continues to rate MMM’s senior unsecured debt AA- (lowest tier of the ‘high grade’ rating).

Neither agency has MMM’s credit ratings under review.

These attractive credit ratings confirm neither agency is of the opinion MMM will have difficulty in servicing its obligations.

Valuation

The most recent earnings estimates can be found above in the Q3 2018 Results and 2018 Outlook section of this article. A comparison with previous quarterly projections can be made by accessing my July 24th MMM article in which I include images of previous recent earnings projections.

- MMM has revised downward its GAAP EPS to $8.78 – $8.93 from $9.08 -$9.38. This lower forecast, however, is still up 11% – 13% YoY.

- On the Adjusted EPS front, MMM is now targeting $9.90 – $10.00 versus the previous $10.20 -$10.45.

With MMM having closed at $192.55 on April 23, the forward PE is ~21.56 – ~21.93. At the time of my July 24th article, MMM was trading at ~$200 and the forward PE range was ~21.3 – ~22.

MMM’s adjusted EPS is now ~19.26 – ~19.45. At the time of my July 24th article, the adjusted PE range was ~19 – ~19.6.

After today’s pullback in share price, MMM’s valuation is pretty much in line with that evidenced when Q2 results were released.

The current forward PE range of ~21.56 – ~21.93 is in line with the 2013 – 2017 PE levels which were 21.6, 22.5, 19.5, 22.5, and 26.2.

Dividend and Dividend Yield

MMM’s dividend history can be found here and its stock split history can be found here.

I anticipate another $1.36 quarterly dividend will be declared in mid-November 2018.

Final Thoughts

My Final Thoughts are much the same as in my July 24th article.

I have no intention of reducing my MMM exposure but since I am already overweight MMM, I will only be acquiring additional shares through the automatic reinvestment of the quarterly dividends.

I suspect that until such time as the following headwinds subside…

- U.S. – China trade tensions;

- Brexit;

- Major financial challenges in Italy;

- Worry about how higher interest rates could impact the US economy (the Federal Reserve has indicated a move to tighten up monetary policy by year’s end);

- Uncertainty surrounding US mid-term elections;

….we will evidence elevated levels of volatility. In this regard, if you wish to initiate a position or increase your position in MMM then I suggest you acquire shares in tranches when its share price experiences pullbacks.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long MMM.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.