Summary

Summary

- Coca-Cola is facing declining sales and FCF due to changing consumer preferences.

- A turnaround plan has been implemented but I suspect positive results will take time to be evidenced.

- The Tax Cuts and Jobs Act (TCJ) will positively impact KO but there will be no positive net cash impact for several years.

- The days of high single digit / low double digit annual dividend growth are likely a thing of the past. KO investors should expect 4% – 6% dividend growth in the foreseeable future.

Introduction

The Coca-Cola Company (NYSE: KO) released its Q4 and FY2017 results on February 16, 2018 and also provided guidance for FY2018.

KO is the world’s largest beverage company with a portfolio of more than 500 sparkling and still brands and nearly 3,900 beverage choices. Its portfolio features 21 billion-dollar brands, 19 of which are available in reduced-, low- or no-calorie options. Further details can be found here.

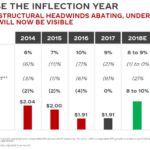

Source: KO’s 2018 CAGNY 2018 Presentation – February 20, 2018

KO acquired a ~17% equity stake in Monster Beverage in 2015 which allowed it to gain exposure to the fast-growing energy drink category in which its own product, NOS, had had little commercial success. This acquisition further enabled KO to reduce the risk of potentially eroding the KO brand equity that could arise from the risks and regulatory scrutiny surrounding the energy drink market.

Management recognizes that changing consumer tastes requires KO to evolve its business strategy to become a total beverage company. This means giving people more of the drinks they want in more packages sold in more locations. In order to build this portfolio of ‘consumer-centric brands’, KO must shift its focus from what the company wants to sell to what consumers want to buy purchase.

This evolving business strategy includes:

- reducing the level of sugar in more than 500 of KO’s drinks around the globe. It is adding to the 30% of more than 3,900 beverages that already fall into the low or no-sugar category;

- investing more marketing dollars to build awareness of the low- and no-sugar drinks;

- evolving to smaller and more convenient packaging. Currently, ~40% of KO’s sparkling brands are available in 250 ml (8.5 oz.) or smaller packages. Mini cans and other smaller packs now account for ~15% of KO’s sparkling transactions in North America.

Impact of the Tax Cuts and Jobs Act (TCJ) on KO

While the U.S. corporate tax rate of 35% was the highest among the 35 countries that are members of the Organization for Economic Co-operation and Development (OECD), KO’s effective tax rate was much lower since a significant proportion of its business was outside the U.S.; KO’s tax rate was closer to 24% globally. The new TCJ lowers the U.S. tax rate to 21% thus putting rates in the U.S. more in line with other nations.

The TCJ eliminates the worldwide system and puts the U.S. on a modified territorial system; US companies are now on more equal footing with global competition.

The U.S. was one of a handful of OECD members that featured a worldwide tax system. This meant that if KO repatriated funds to the US (ie. the transfer of money earned by foreign subsidiary operations to the US), it would have been required to pay the difference between the tax imposed at the 35% U.S. tax rate and the taxes already paid in the foreign country in which the income was earned. In general, the foreign taxes were much lower than in the US.

US companies which operated under the worldwide system were at a disadvantage relative to companies in the vast majority of countries which operate under a territorial tax system. The territorial tax system allows companies to pay taxes on income where it is generated and to repatriate those earnings without incurring further tax. This is far more efficient and provides greater cash management flexibility since business decisions are less impacted by tax considerations.

Under the TCJ, KO will incur a repatriation tax on historical foreign earnings which was being reinvested or held for overseas investment. In Q4, KO recorded a one-time, non-cash charge of $3.61B. While this charge is recognized from an accounting standpoint, the TCJ stipulates this amount only needs to be paid over an 8 year period.

Since it will take 8 years to pay the $3.61B tax bill faced on the repatriation of overseas cash and investments, KO will not see a positive net cash impact for several years. KO, however, has indicated that over the long-term the net outcome or the new TCJ will have a positive impact on the company.

Q4 and FY2017 Financial Results

KO’s February 16, 2018 Earnings Release can be found here and its Reconciliation of GAAP and Non-GAAP Financial Measures (Unaudited) can be found here.

Source: KO’s 2018 CAGNY 2018 Presentation – February 20, 2018

Source: KO’s 2018 CAGNY 2018 Presentation – February 20, 2018

As previously noted, KO will incur a repatriation tax on historical foreign earnings consisting of a repatriation charge of $4.61B and a deferred tax benefit of $1.0B (net $3.61B tax bill).

KO plans to reduce its gross debt level by approximately $7B using the cash currently held overseas. The plan is to continue to maintain a net debt leverage ratio (non-GAAP) that is within the targeted 2.0 – 2.5 times net debt to earnings before interest, taxes, depreciation, and amortization.

FY2018 Outlook

KO’s outlook for FY2018 calls for:

- ~4% growth in organic revenues (non-GAAP);

- 8% to 9% growth in comparable currency neutral operating income (structurally adjusted) (non-GAAP);

- ~$8.5B in cash from operations;

- ~$1.9B in capital expenditures (excluding discontinued operations);

- ~$1B in net share repurchases (non-GAAP);

- Full year EPS from continuing operations (non-GAAP): 8% to 10% growth versus $1.91 in 2017.

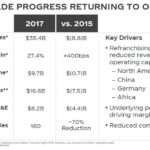

Source: KO’s 2018 CAGNY 2018 Presentation – February 20, 2018

Source: KO’s 2018 CAGNY 2018 Presentation – February 20, 2018

In January 2018, KO announced plans to rejuvenate Diet Coke in North America with an updated look, new packaging, and the debut of four new flavors.

KO has recently expanded its Venturing & Emerging Brands (“VEB”) model to Central & Eastern Europe in partnership with Coca-Cola HBCAG. This includes the launch of smartwater, ZICO coconut water, and Appletiser.

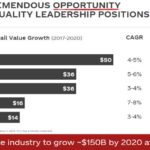

Source: KO’s 2018 CAGNY 2018 Presentation – February 20, 2018

Source: KO’s 2018 CAGNY 2018 Presentation – February 20, 2018

KO is also pursuing revenue growth management initiatives across key markets, including the South Latin and Central & Eastern Europe business units. To date, this has led to revenues and transactions growing ahead of volume. It will also continue to make disciplined decisions around profitable growth which will include making low-margin water brands in major markets such as China, Japan, and Mexico a lower priority.

The U.S. system is now fully refranchised after the recent closing of two important territories. Liberty Coca-Cola Beverages, a newly formed bottler, began operations in the former Tri-State Metro Operating Unit, and Reyes Coca-Cola Bottling took on new bottling territories in the former West Operating Unit. Efforts are underway to improve in key areas such as portfolio diversification, packaging innovation, production, procurement, and technology.

Management is clearly focused on improving KO’s results and making it an attractive long-term investment despite the headwinds the company faces.

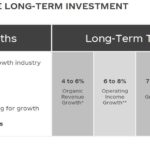

Source: KO’s 2018 CAGNY 2018 Presentation – February 20, 2018

Source: KO’s 2018 CAGNY 2018 Presentation – February 20, 2018

Credit Ratings

Moody’s rates KO’s senior unsecured debt Aa3 while Standard & Poor’s rates it AA-. Both ratings are at the lower end of the ‘High Grade’ scale. These ratings are 3 notches below the coveted AAA credit rating.

Free Cash Flow (FCF)

FCF (a non GAAP measure) amounted to $5.32B in FY2017. This compares with $6.534B in FY2016, $7.975B in FY2015, and $8.209B in FY2014.

Valuation

FY2017 Diluted EPS (GAAP) and adjusted Diluted EPS (Non GAAP) amounted to $0.27 and $1.91 respectively. Management has forecast 8% to 10% growth from the $1.91 FY2017 adjusted Diluted EPS thus resulting in a range of $2.06 – $2.10 for FY2018.

KO closed at ~$44 on February 20, 2018. Based on FY2017’s adjusted EPS of $1.91, KO is currently trading at an adjusted PE of ~23. On the basis of management’s FY2018 forecast range reflected above, we get a forward adjusted PE range of ~21 – ~21.4.

I do not view KO shares to be attractively valued at current levels. A forward PE of 19 or less seems more reasonable to me.

Dividend, Dividend Yield, and Dividend Payout Ratio

Long-term KO investors have certainly been extremely well rewarded! You can access KO’s investment calculator here to gauge the extent to which KO has rewarded investors over different timeframes.

KO’s dividend history can be found here and its stock split history can be found here.

Management reiterated the importance of rewarding shareholders with dividend increases and share repurchases. These are priorities #2 and #4.

Source: KO’s 2018 CAGNY 2018 Presentation – February 20, 2018

Source: KO’s 2018 CAGNY 2018 Presentation – February 20, 2018

On February 15, 2018, KO’s Board of Directors approved the 56th consecutive annual dividend increase. Shareholders of record as at March 15, 2018 can now expect a 5.4% quarterly dividend increase ($0.37/share increase to $0.39/share) effective with the April 2, 2018 dividend. KO’s new $1.56 annual dividend provides investors with a ~3.55% forward dividend yield using the current $44 stock price.

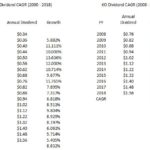

While KO’s dividend compound annual growth rate is in excess of 8.8% if we analyze the dividend increase for the 2000 – 2018 timeframe, this growth drops of ~7.5% if we analyze the dividend increases for the 2008 – 2018 timeframe.

In FY2017, KO returned $6.3B in dividends to shareholders thus bringing the total amount of dividends returned shareholders since January 1, 2010 to $41.5B.

In FY2017, KO returned $6.3B in dividends to shareholders thus bringing the total amount of dividends returned shareholders since January 1, 2010 to $41.5B.

FY2017’s $1.48 annual dividend is well in excess of KO’s FY2017 Diluted EPS (GAAP) of $0.27/share but is ~77.5 % of $1.91 adjusted Diluted EPS (Non GAAP). The new $1.56 annual dividend will represent a dividend payout ratio of ~74.3% – ~75.7% based on the projected adjusted Diluted EPS range of $2.06 – $2.10 for FY2018.

Share Repurchases

Full year purchases of stock for treasury were $3.682B ($3.681B in FY2016, $3.564B in FY2015, and $4.162B in FY2014) with net treasury share repurchases (non-GAAP) amounting to $2.012B ($2.309B in FY2016, $2.3B in FY2015, and $2.606B in FY2014). This negative trend is expected to persist in FY2018 as net treasury share repurchases (non-GAAP) of ~$1B are expected.

Final Thoughts

KO faces numerous headwinds in its turnaround plan and long-term growth strategy. Net Operating Revenue and FCF are trending down but management is optimistic its plans to boost cash flow over the next few years (ie. cost-cutting, expanding Operating Margin, and refranchising to earn much higher margins) will yield positive results.

KO will likely appeal to dividend seeking investors given its ~3.55% forward dividend yield. While this might be appealing in the current low interest rate environment, I expect interest rates to rise in the short-term. This will likely put pressure on stocks that have been purchased predominantly for their attractive dividend yield.

Another strike against KO is that the historical growth rate in the annual dividend is unlikely to be evidenced in the foreseeable future. Investors should expect dividend growth in the 4% – 6% range versus the high single digit/low double digit percentage increases evidenced through most of 2002 – 2015.

While we currently own several hundred KO shares and have no intention of selling them at this juncture, I do not intend to acquire additional KO shares.

I hope you enjoyed this post and I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long KO.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.