Summary

- This Genuine Parts Company stock analysis is based on its Q2 2017 results which were reported July 20, 2017.

- Total sales were up 5% to a record setting $4.1B, net income was $0.19B, and EPS increased 1% to $1.29 versus Q2 2016.

- YTD FY2017, businesses with approximately $0.18B in annual revenues have been acquired. GPC has also made a minority investment in a market leading industrial distributor in Australia.

- Management is of the opinion the long-term fundamental drivers for its U.S. automotive aftermarket business remains sound.

- With a track record of 61 consecutive years of dividend increases, GPC is a member of the exclusive Dividend King group of companies (50 consecutive years of dividend increases).

Introduction

First and foremost, I wish to apologize for roughly one month of radio silence. If you read my Financial Plans Should Account for Potential Major Mental Health Issues post I hope you will understand why I have been distracted from blogging.

I sincerely hope you have never experienced, nor will you ever experience what my family has recently experienced. I suspect, however, that some readers will not be so fortunate. Mental illness is far too prevalent in our modern day society!

Our recent life events have reinforced to me that my investment strategy is the right strategy for my family. Using baseball as an analogy, I am not looking to hit “home runs”. My investment strategy is more along the line of getting multiple back to back singles. I will also settle for the occasional extra base hit and I am even willing to get “hit by a pitch” on the condition it is not a career ending hit.

My primary objective is to invest in companies which have a competitive advantage and which have demonstrated an ability to pay an ever increasing stream of dividends to its shareholders. If you ever experience what we have recently experienced you will be grateful that income continues to flow your way without any effort on your part.

This brings us to the subject of today’s post, Genuine Parts Company (NYSE: GPC), which released its Q2 earnings on July 20, 2017. What appeals to me about GPC is its lengthy track record of success and its ability to consistently increase its annual dividend.

Business Overview

GPC is the leading independent U.S. distributor of automotive replacement parts; it also has operations in Canada, Mexico, Australia, and New Zealand.

There are 57 NAPA warehouse distribution centers in the U.S., about 1,100 company-owned jobbing stores, 4 Rayloc auto parts rebuilding plants, 4 Balkamp distribution centers, 2 Altrom America import parts distribution centers, and 20 heavy vehicle parts distribution centers and facilities.

In addition, it owns either a controlling or non-controlling interest in seven corporations which operate approximately 152 auto parts stores in 12 US states.

Expansion continues through a combination of internal growth and acquisitions. In the most recent fiscal year ending December 31, GPC acquired 11 companies in the automotive parts group and 5 in the industrial group, 2 in the office products group, and 1 in the electrical/electronic materials group.

The automotive parts segment (~ 53% of FY2016 revenue) serves about 5,900 NAPA Auto Parts stores, including about 1,100 company-owned stores, which sell to garages, service stations, car and truck dealers, fleet operators, leasing companies, bus and truck lines, etc..

The industrial parts segment (30%) distributes around 3 million industrial replacement parts and related supply items, including bearings, power transmission equipment replacement parts, including hydraulic and pneumatic products, material handling components, agricultural and irrigation equipment, and related items from locations in the U.S. and Canada.

S. P. Richards Co., the office products group (13% of FY2016 revenue), distributes about 50,000 office product items, including information processing supplies and office furniture, machines and supplies to office suppliers, from facilities in the U.S. and Canada.

The EIS electrical/electronics materials group (4% of FY2016 revenue) wholesales and distributes material and supplies to the electrical and electronic industries.

In fiscal 2016, the U.S. accounted for 84% of sales, Canada 9%, Australasia 7%, and Mexico represented less than 1%.

Q2 2017 Results

On July 20, 2017 GPC released its Q2 2017 results for the 6 month period ending June 30, 2017.

Q2’s gross margin was 30.2% compared to 29.9% in Q2 2016 and the objective is to produce an approximate 30% gross margin over the balance of the current fiscal year.

Organic growth (total comparative sales were up 2% in Q2 and improved relative to the last several quarters) and bolt-on acquisitions continue to be a key component of GPC’s growth. The low-single digit comparative sales growth continues to pressure GPC’s net margins but the company’s sales and cost initiatives are expected to drive stronger growth and to improve margins over the long term.

The U.S. operations continue to represent just over 70% of GPC’s Automotive revenues. Total sales were up 4% in Q2. On the commercial side of the U.S. automotive business, sales to GPC’s NAPA AutoCare Centers were up 1% but sales to major accounts and fleet customers remained under pressure and were down low-single digits.

Weather impacts GPC’s automotive business; management indicated in the Q2 conference call that sales trends correlate to the warmer than average winter weather and cooler summer temps in May and June.

GPC continues to expand its NAPA Rewards Program on the retail side of the business; there are roughly 5 million members and the intent is to continue to enhance the program into 2018. This is a loyalty program which is available in-store and online. It is viewed by GPC as an important initiative in the broader scope of its continued retail growth as GPC continues to experience higher retail tickets and more frequent visits from NAPA Rewards members.

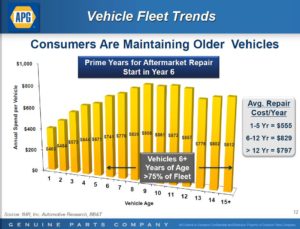

As far as the trends GPC is seeing across the U.S. automotive aftermarket, the long-term fundamental drivers for its business remain sound. The size of the vehicle fleet continues to grow with the average age of the fleet around 11.7 years. Lower fuel prices also remain favorable for the consumer and miles driven continue to post steady gains.

As a reasonably conservative investor, I look for companies with a strong balance sheet. GPC fits the bill with a ~25.5% total debt to capitalization and an average cost of debt is 2.49%.

I also like that GPC has generated $0.345B in cash from operations YTD. The full year cash from operations forecast is $0.9B – $0.95B with projected FCF (excludes CAPEX and dividends) projected to fall in the $0.35B – $0.4B range.

GPC has increased its annual dividend for 61 consecutive years. The 2017 annual dividend of $2.70/share represents approximately 57% of GPC’s prior year earnings. These are both strong selling features for someone like me who is relying on equity investments to pay me an ever growing income stream during my retirement years.

Guidance for Remainder of FY2017

Total sales are expected to be in the 3% – 4% range which is unchanged from initial guidance.

EPS for the full year, however, is being revised downward to $4.70 – $4.75 from previous guidance of $4.75 – $4.85. The reason for the downward revision is that management had expected to be further along with cost saving initiatives at this stage of the year when it released its forecast at the beginning of the current fiscal year.

Improved profitability over the balance of the year is still expected with cost savings expected to come from headcount reductions, facility rationalization, and a broad range of productivity projects that are currently underway across GPC’s businesses.

Dividend

GPC’s current dividend yield is 3.26%.

You can find its dividend distribution history here. I have also calculated the compound annual growth rate of GPC’s dividend for 2001 – 2017. The growth rate is moderate but steady and is skewed lower because of the moderate increases in the early 2000s. The increase in 2017 was also minuscule but I would much prefer management be prudent when raising its annual dividend as opposed to raising the annual dividend merely to appease investors.

GPC is a member of the exclusive Dividend King group of companies. These are companies which have a minimum of 50 consecutive years of dividend increases. GPC has increased its annual dividend for 61 consecutive years thus giving me some level of confidence that management will most likely keep this streak alive going forward.

Valuation

The current mean FY2017 adjusted EPS projections from various brokers is $4.75 and $5.15 for FY 2018. As previously noted, management indicated in the Q2 conference call on July 20, 2017 that the full year EPS outlook was being revised downward to $4.70 – $4.75 from its previous guidance of $4.75 – $4.85.

I will err on the side of caution and will use an annual EPS of $4.70 for the purpose of my calculations.

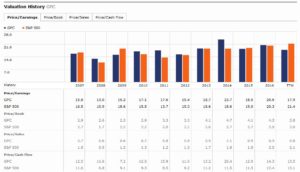

As I compose this post, GPC is trading at $82.71. Using the $4.70 full year EPS forecast I get an adjusted PE of 17.60. If I use the forecast FY 2018 mean EPS of $5.15 I get a projected PE of 16.07. If the FY 2018 EPS were to come in at $4.95, the forward PE using the current market price would be roughly 16.71. I view the aforementioned PE levels as acceptable for the purposes of initiating a position in GPC.

I also view other ratios reflected in the following image as being acceptable for my purposes.

Genuine Parts Company Stock Analysis – Final Thoughts

GPC has been on my radar screen for the last few years. I opted to invest in other companies in early 2016 when GPC’s stock price was relatively similar to the current level. Subsequent to that time frame I have viewed GPC as too expensive for my liking. The recent retracement in price, the company’s dividend track record, its strong balance sheet, and the fact GPC stands to benefit from consumers maintaining older vehicles are reasons why I intend to initiate a position in GPC within the next 72 hours; these shares will be held in the FFJ Portfolio.

My investment time horizon is several years. I caution you that if you choose to initiate a position in GPC, do not expect this investment to be a grand slam home run in the short term.

What I expect from my investment in GPC is moderate capital appreciation over the next 15 – 25 years. Most importantly, I expect the company to maintain its track record of continuing to reward its shareholders with moderate annual dividend increases. This suits me just fine!

Note: I sincerely appreciate the time you took to read this post. As always, please leave any feedback and questions you may have in the “Contact Me Here” section to the right.

Disclosure: I do not currently hold a position in GPC but may initiate a position within 72 hours.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.

X,

I listen to some management teams…where the companies have a reasonably good history of generating the results management said would be achieved.

Not familiar with some of those companies (especially your Dogs with the exception of IBM which I never bought).

I agree. Continuing to be a good business is probably easier than developing a good new business.

Keep in touch.

Hello, my prayers are with you and your family. I appreciate every and all your posts!

Do you plan to write about your due diligence process? – How many old 10k do you skim through. What would be things you look for?

After some mistakes, I try to be disciplined and compile my own spreadsheet of key indicators of company history. I case of auto industry, I would like to go back to 2004 to see how things. It’s lot work.

Sincerely,

Your follower from central europe in his 28.

X,

Thanks for reading. Good questions! I generally look at the most recent annual report (and quarterly report if my analysis is being conducted during the company’s fiscal year), several years of financial data so I can see how various metrics are trending, recent Investor Day or other recent conference presentations, and various analyst reports which I can obtain through the web based service offered by two discount brokers (major Canadian financial institutions) through which I conduct my trading actviity.

10Ks and 10Qs are like looking through the rearview mirror. I agree it is important to see where the company has been but I really want to see where management plans to take the company and how they plan to go about achieving their strategic objectives.

I will read the transcripts of the most recent analyst conference calls and will pour over the company’s wesbite. I also search the internet for information that pertains to the industry in which the company operates. As you can appreciate, this can be a bit time consuming. You have clearly found this out judging from your comment.

I like to buy high-quality, mostly dividend paying stocks and evenly spread my investments over the five main economic sectors (Resources, Manufacturing, Finance, Utilities and Consumer).

When it comes to the automotive industry, like you mention above, I avoid all major auto manufacturers. Their financial results are too volatile for my liking.

I like to pay special attention to:

Free Cash Flow as this is the lifeblood of a company;

the extent to which the company is indebted, the cost of that debt, and when the debt is due;

revenue and profitability trends;

the diversity of the company’s product line and sources of revenue (eg. is the company relying primarily on 1 or 2 key products and is the revenue coming from various parts of the world or just 1 or 2 countries);

dividend track record which includes compound annual growth rate, dividend payout ratio, and the sustainability of the dividend growth rate;

the number of shares outstanding (sometimes a company might not have an attractive dividend yield but it is buying back a ton of its o/s shares).

Spoiler alert…I am currently working on a post re: Enbridge Inc. (TSX: ENB and NYSE: ENB). Within the last several months they closed a major acquisition (Spectra Energy) which has transformed their business. It probably would not be a valuable use of my time to look at too much historical information because the ENB of today is not the same ENB of a year ago.

Keep in mind that I focus on investing in well established companies with a track record of profitability. Other investors out there are trying to identify companies where there is strong suspicion that management might be fudging things (eg. Enron, Worldcom, Sino Forest) so they can short the company’s stock. Other investors are also looking for the next “Holy Grail”. In these cases, you have to do considerably more due diligence.

I hope this helps.

Thank You for your thorough answer!!

You are right that old annual report are backward looking. However, I found I cannot convince myself to listen too much to the management. Especially in case of finding and monetizing new business opportunities.

It’s not mistrust. I appreciate that management mostly believes what they say. However, I learned you cannot predict business prospects especially in future.

I think it is easier to continue being good business then develop new good business. So, my process is mostly backward looking. The following are the positions where I analyzed history in length and made profit. On other occasions, I believed what management said and lost big (IBM, LQDT, TMQ, RSH, SUNE).

Long GLW, PM, UL, DEO, VFC, BRK, HON, JNJ, UTX, HRL, RTN, BEN, MMM, PPG, AER, BASF, SIE, ASSA-B, NVO, KNEBV

Recently trimming ORCL, WMT, MAN, DE, CMI

The only exception to the rule is BBBY which had good metrics whenever you looked, but turned to be value trap atm.

Kind regards, X