I have made my fair share of errors of commission and omission over the years! One of my errors of omission is not initiating a Cintas (CTAS) position when I looked at it in this November 10, 2017 post.

On August 16, 2016, shortly after I retired, CTAS announced its intent to acquire G&K Services, Inc. for a total deal value of ~$2.2B; the acquisition closed on March 21, 2017. This acquisition was CTAS’s largest to date and increased the company’s rental revenue by 25%. Following the completion of this acquisition, the combined company served more than one million businesses and was slated to generate over $6B after the first full year of G&K being part of the CTAS family.

When I reviewed CTAS in 2017, the share price was $145.43. The current share price as I compose this post on December 19, 2024 is just shy of $183…and this is AFTER a 4:1 stock split in September 2024. Without the stock split, CTAS’s share price would be ~$732.

This error of omission stings and I curse myself when I see a CTAS vehicle. I just, however, have not been able to wrap my head around CTAS’s valuation all this time.

As luck would have it, CTAS released its Q2 and YTD2025 results the morning of December 19 – a day after a broad market pullback. Despite the release of decent results, investors did not react kindly to CTAS’s earnings release and its share price fell from the ~204.39 December 18 closing share price to ~$183.

Given this pullback, I initiated a position in one of the FFJ Portfolio’s ‘Side Accounts’ with the purchase of 300 shares @ ~$185.

Business Overview

Part 1 Item 1 in the FY2024 Form 10-K and the company’s website provide a good overview of the company.

Within the Uniform Rental and Facility Services reportable operating segment, CTAS provides its products and services to customers via local delivery routes originating from rental processing plants and branches. Within the First Aid and Safety Services reportable operating segment and All Other, CTAS provides its products and services via its distribution network and local delivery routes or local representatives.

This is a fragmented industry with CTAS being the industry leader.

This is the type of business where significantly increasing a route’s density can improve returns without a corresponding material increase in expenses. If CTAS services company X, there is no material increase in costs by adding new customers within close proximity of Company X.

Looking at CTAS’s track record, we see organic growth and growth through acquisition. As smaller competitors find business conditions to be increasingly difficult, I anticipate that CTAS will continue to have no shortage of acquisition opportunities.

At FY2024 (May 31), CTAS had ~11,700 local delivery routes, 467 operational facilities, and 12 distribution centers. The location finder on the company’s website reflects the extent of CTAS coverage throughout the US and Canada. Its competitors do not come close to CTAS’s geographic coverage.

CTAS’s Acquisition Strategy

In FY2022 – FY2024 and the first half of FY2025, CTAS acquired businesses net of cash acquired totaling (in $ Millions) ~$164.2, $46.4, $186.8, and $154.9.

Because of the assumptions used to value the acquired intangible assets, actual results over time could vary from original estimates. Impairment of service contracts and other assets is determined through specific identification. CTAS, however, has recognized $0 impairment for FY2022 – FY2024 and the first half of FY2025. It appears it is disciplined in the price it is prepared to pay for its acquisitions.

Financials

Q2 and YTD2025 Results

CTAS’s recently released financial results are accessible through the SEC website for which a link is provided on CTAS’s website.

Conventional And Modified Free Cash Flow (FCF) Calculations (FY2020 – YTD2025)

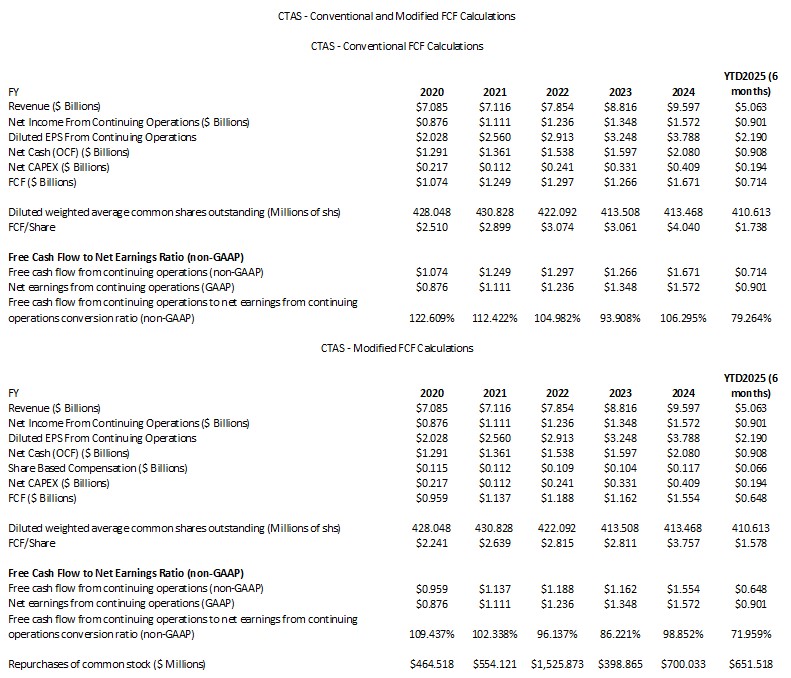

FCF is a non-GAAP measure, and therefore, its method of calculation is open to debate. Most companies subtract capital expenditures (CAPEX) from Net Cash Provided by Operating Activities found in the Consolidated Statement of Cash Flows.

In several posts, I touch upon why investors should deduct share based compensation (SBC) when analyzing a company’s FCF.

The following table reflects CTAS’s FCF using the conventional and modified methods of calculation. All data has been extracted directly from the Form 10-K filings for FY2020 – FY2024 and the Q2 2025 Form 10-Q.

FCF from continuing operations exceeds net earnings from continuing operations under the conventional FCF calculation method. FCF, however, falls just shy of net earnings using the modified calculation method. I anticipate the FY2025 conversion ratio under both methods of calculation will be roughly 100% by the end of FY2025.

FY2025 Outlook

With the release of its Q2 and YTD2025 results, CTAS is updating its annual revenue expectations from $10.22B – $10.32B to $10.255B – $10.32B for a total growth rate of 6.9% – 7.5%. The organic growth rate is expected to be 7.0% – 7.7%.

The annual adjusted diluted EPS outlook has also been revised from $4.17 – $4.25 to $4.28 – $4.34 for a growth rate of 12.9% – 14.5%.

Risk Assessment

At the end of Q2 2025, CTAS had ~$0.631B of debt due within 1 year. The Q2 2025 Form 10-Q is currently unavailable but the data from the Q1 2025 Form 10-Q provides information about amounts, the interest rates, and fiscal year maturity of the short- and long-term debt.

I see no reason why CTAS should be unable to meet its obligations.

CTAS’s domestic senior unsecured long-term debt ratings are:

- Moody’s: A3 with a stable outlook (last reviewed on August 29, 2023)

- S&P Global: A- with a stable outlook (last reviewed on March 27, 2024)

Both ratings are in the bottom tier of the upper medium-grade investment-grade category. These ratings define CTAS as having a strong capacity to meet its financial commitments. It is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

Dividends and Share Repurchases

Dividend and Dividend Yield

CTAS’s dividend history is accessible here. Please keep in mind that CTAS had a 4:1 stock split in September 2024. This explains why the December 2024 dividend is $0.39 and the September 2024 dividend was $1.56.

Little of CTAS’s total long-term shareholder return is likely to come from the quarterly dividend. I recommend you assign little weight to the dividend as part of your analysis.

Stock Splits and Share Repurchases

CTAS’s stock split history is:

- September 11, 2024: 4:1

- November 18, 1997: 2:1

- April 2, 1992: 2:1

- April 2, 1991: 1.5:1

- April 2, 1987: 2:1

The table provided earlier in this post reflects the dollar value of shares repurchased and the diluted weighted average common shares outstanding in FY2016 – FY2024 and YTD2025.

Valuation

CTAS has generated $2.19 of diluted EPS in the first half of FY2025. If we use the current ~$183 share price and conservatively estimate FY2025 diluted EPS of ~$4.25 – ~$4.30, the forward diluted PE is ~42.6 – ~43.06.

Management’s revised FY2025 adjusted diluted EPS is $4.28 – $4.34 giving us a forward adjusted diluted PE of ~42.2 – ~42.8.

Its valuation using the current broker guidance (which will likely be amended slightly over the coming days) is:

- FY2025 – 19 brokers – mean of $4.25 and low/high of $4.21 – $4.34. Using the mean, the forward adjusted diluted PE is ~43.06.

- FY2026 – 19 brokers – mean of $4.70 and low/high of $4.54 – $4.92. Using the mean, the forward adjusted diluted PE was ~39.

- FY2027 – 10 brokers – mean of $5.15 and low/high of $4.91 – $5.53. Using the mean, the forward adjusted diluted PE was ~35.5.

If the second half of the FY2025 FCF is similar to that of the first half, we can reasonably expect CTAS’s FCF/share to be ~$3.44 and ~$3.12 calculated using the conventional and modified methods. With a ~$183 share price, the P/FCF is ~53.2 and 58.7.

Final Thoughts

CTAS is perennially overvalued; shares appear overvalued by at least $25/share. Despite this, CTAS has been added to the FFJ Portfolio. The company is growing and I expect it to be much more profitable a decade from now.

In FY2016, it generated ~$4.8B in revenue and it will likely surpass $10B in revenue in FY2025. A reasonable assumption is that CTAS will generate ~$14B of revenue in FY2035. Should it continue to generate at least an 18% Operating Margin, it stands to reason that its Operating Profit in FY2035 should be ~$2.52B.

If it can continue to generate ~15% – ~17% Net Income From Continuing Operations as a percentage of Revenue, it could generate ~$2.1B – ~$2.38B in FY2035.

If CTAS reduces its debt and continues to steadily repurchase shares, the share price should be much higher a decade from now.

I appreciate how some investors with short investment time horizons have no interest in how CTAS is likely to perform in 10 years. I, however, am investing for the next generation. My investment holding period is, therefore, decades.

Should CTAS’s valuation improve, I intend to add to my exposure. For now, however, my exposure is merely 300 shares.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long CTAS.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.