Dividends can be a great way to return value to shareholders. They do, however, have drawbacks.

Do NOT fixate on dividend metrics. Instead, analyze how companies allocate their capital. They can:

- reinvest in the business;

- debt reduction;

- merge or acquire other businesses;

- distribute dividends; and/or

- repurchase shares.

Typically, companies employ one or more of the above.

Companies experiencing minimal, if any, growth that generate Free Cash Flow (FCF) well in excess of what can be efficiently reinvested in the company may choose to return the excess to shareholders in the form of dividends.

Altria Group Inc. (MO) is a good example.

Through its tobacco subsidiaries, MO maintains the leading position in cigarettes and smokeless tobacco in the United States and the #2 spot in machine-made cigars. Its Marlboro brand is the leading cigarette brand in the US with ~42% annual share in 2023. Beyond its core business, it:

- holds an ~8% interest in the world’s largest brewer, Anheuser-Busch InBev;

- owns a ~42% stake in cannabis manufacturer Cronos;

- acquired full global ownership of NJOY’s e-vapor product portfolio in 2023; and

- operates a joint venture with Japan Tobacco in the heated tobacco category.

Looking at its dividend history, we see that it has been very generous with its dividend distributions.

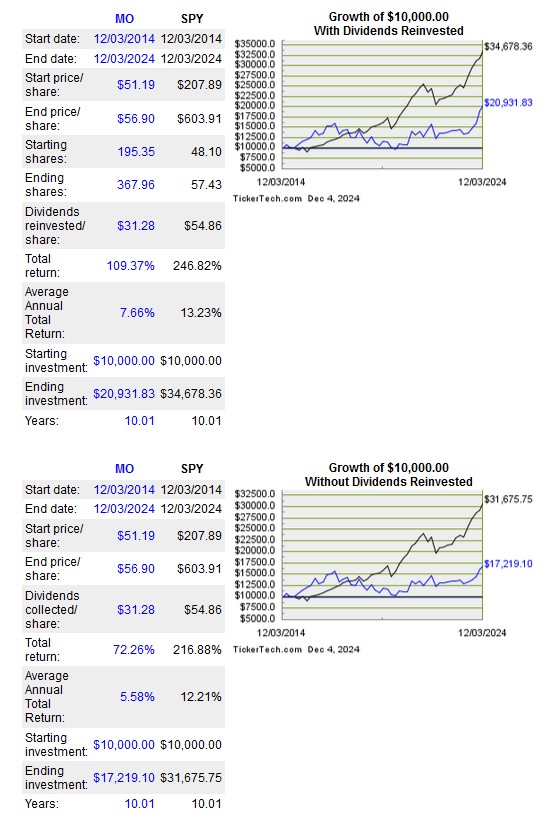

Over the past decade, however, MO’s total annual shareholder return is less than stellar.

Many investors, however, gravitate toward a MO investment because of its attractive dividend metrics.

Foolishly, some investors rely on Dividend Kings, Dividend Champions, Dividend Aristocrats, and Dividend Challengers classifications to make their investment decisions. Instead of looking at a company’s total potential return, some investors actually select their investments based on the number of consecutive years a company has increased its dividend. This, to be blunt, is asinine.

Key Dividend Drawbacks

The following are some key dividend drawbacks.

Reduced Retained Earnings

Dividend distributions result in cash outflows….cash that could have perhaps been allocated more efficiently.

Cash Flow Constraints

Companies periodically hit a rough patch or experience an unexpected downturn. Regular dividend payments can limit a company’s financial flexibility should such events occur.

BCE Inc (BCE.to), a communications company, provides wireless, wireline, Internet, and television (TV) services to residential, business, and wholesale customers in Canada is a good example of a company with severe cash flow constraints.

In each of the last few years, BCE has generated insufficient FCF to cover its dividend. When this happens and a company does not cut its dividend, it either has to sell assets, drastically reduce expenses (slashing the employee workforce is typically the ‘Go To’ strategy), or issue debt.

Tax Implications

There may be tax implications with the receipt of dividend income in non-registered (taxable) accounts. Canadian residents, for example, incur a 15% dividend withholding tax on dividend income received from US companies. Depending on where you reside and the sources of your dividend income, the dividend withholding tax received from foreign companies could be less than or greater than 15%.

For example, I have invested in Blackstone Inc. (BX) for its growth potential. It does, however, distribute a quarterly variable dividend. In November, I received $1,294.30 from the 1505 shares held in one of the ‘Core’ accounts in the FFJ Portfolio. Before the automatic reinvestment of this dividend income, I incurred a 15% ‘haircut’. The amount may be insignificant when viewed in isolation. On a much larger scale over several years, however, these withholding taxes really add up!

In addition, you may be in a tax bracket where each additional $1 of dividend income incurs tax at your marginal tax rate. This will vary depending on your circumstances so you would be wise to determine the after tax impact of investing in companies primarily for the dividend income.

Market Expectations

Emerson Electric (EMR) is a Dividend King because it has consistently increased its annual dividend for at least 50 consecutive years. In my recent Emerson Electric Is A Trapped Dividend King post, I use the term ‘trapped’ because its shareholder base has come to expect annual dividend increases. In order not to alienate its investor base, we see negligible dividend increases in each of the past several years.

Suppose EMR’s Board recommends a suspension of dividend increases in favor of superior forms of capital allocation. I strongly suspect a plunge in EMR’s share price would occur.

Opportunity Cost

By distributing dividends, a company might miss out on lucrative investment opportunities that could generate higher long-term returns.

Final Thoughts

I try to prioritize investments in attractively or fairly valued profitable companies with:

- good returns on capital; and

- honest and talented management teams

that have reinvestment opportunities and strong capital discipline. Typically, I am looking for companies that can reinvest their capital to generate attractive returns over many years.

If you look at the FFJ Portfolio, there are several great companies (Copart, HEICO, Berskhire Hathaway, Intuitive Surgical, Veeva Systems to name a few) with impressive capital allocation strategies; these companies distribute no dividend with the exception of HEICO which distributes a tiny dividend only twice a year. This is because they can generate substantially higher investor returns by reinvesting in the business.

In June, tax changes introduced by the Canadian Federal government prompted a review of our investment holdings. Based on advice from our tax accountants, various changes were made with one of the outcomes being a significant reduction in our annual taxable dividend income (see 2024 FFJ Portfolio Monthly Dividend Income report).

Going forward I expect a greater proportion of our investment returns will be derived from capital gains. Given that I hold investments for the very long-term, I can defer any tax liability well into the future. The same can not be done when I receive dividend income.

By focusing on the potential capital gain component of an investment’s total annual shareholder return, it is increasingly important to pay particularly close attention to valuation. Invest in grossly overvalued companies, and the investment returns could be negligible for several years. Ask anybody who invested in Microsoft, Intel, or Cisco during the height of the dot com bubble.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.