The company has been renamed to Zoom Communications, Inc. from Zoom Video Communications, Inc. effective November 25, 2024.

Valuing a company based on GAAP and non-GAAP EPS can sometimes lead to poor investment decisions. It is for this reason that I like to look at a company’s valuation based on Free Cash Flow (FCF). This metric, however, is a non-GAAP measure and its calculation is not standardized. In my opinion, the magnitude of Zoom Communications’ (ZM) stock based compensation distorts its FCF.

The calculation of FCF often deducts net capital expenditures (CAPEX) from Net cash provided by operating activities. After doing much reading on the topic of FCF and having given this matter more thought, I now adjust FCF by the amount of stock based compensation reflected on the Consolidated Statements of Cash Flows.

I last reviewed ZM in this August 22, 2024 post following the release of the Q2 and YTD2025 results. With the Q3 and YTD2025 earnings release following the November 25 market close, it is now time to revisit this existing holding. It also provides me with the opportunity to demonstrate the rationale behind my conservative approach to the use of FCF.

Business Overview

Part 1, Item 1 in ZM’s FY2024 Form 10-K (see SEC Filings) provides a comprehensive overview of the business, competition, and risks.

On October 9, 2024, ZM held its Zoomtopia Investor Session. I highly recommend reviewing this information to get a better idea of this company’s future potential.

ZM has Class A (publicly traded shares) and Class B shares. The Class A and B shares have 1 and 10 votes per share, respectively.

The Class B shareholders have significant influence over the management and over all matters requiring stockholder approval, including the election of directors and significant corporate transactions, such as a merger or other sale of ZM or its assets, for the foreseeable future. Within the Risk Factors section of ZM’s Form 10-Q and Form 10-K, there is commentary regarding this dual class structure.

Financials

Q3 and YTD2025 Results

ZM’s Q3 and YTD2025 Earnings material (including the transcript of the earnings call) is accessible here.

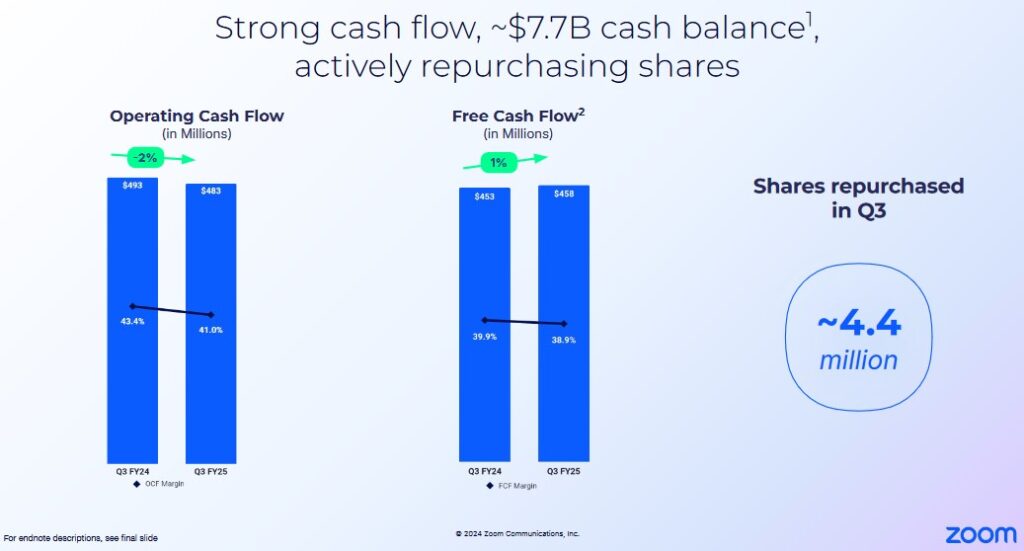

ZM’s cash and cash equivalents and marketable securities at the end of Q3 2025 is ~$7.7B, an increase from ~$7.5B at the end of Q2 2025 and ~$7B at FYE2024.

Its total liabilities at the end of Q3 2025 is ~$2B but ~$1.379B is current and non-current deferred revenue – money received from clients in advance of services having been provided.

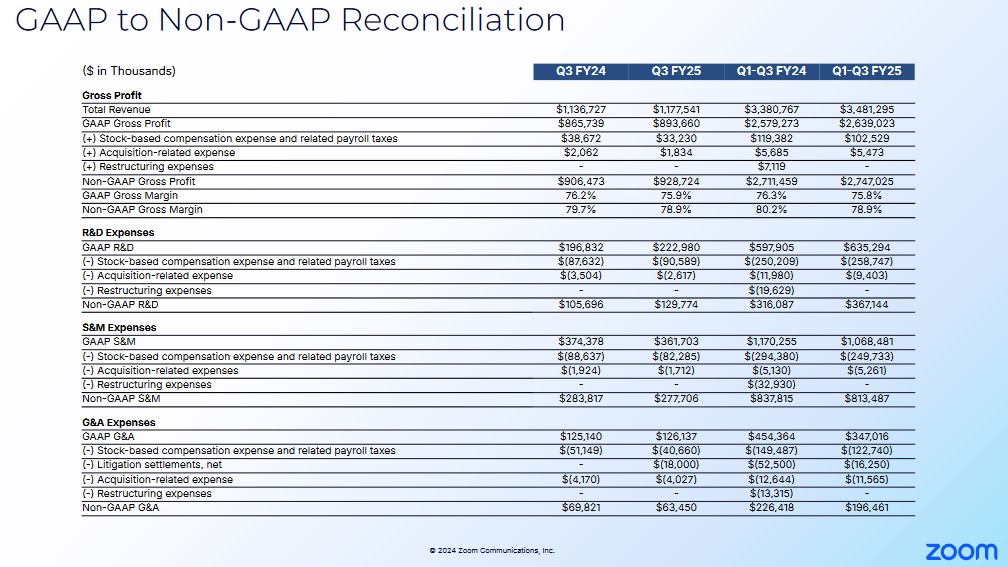

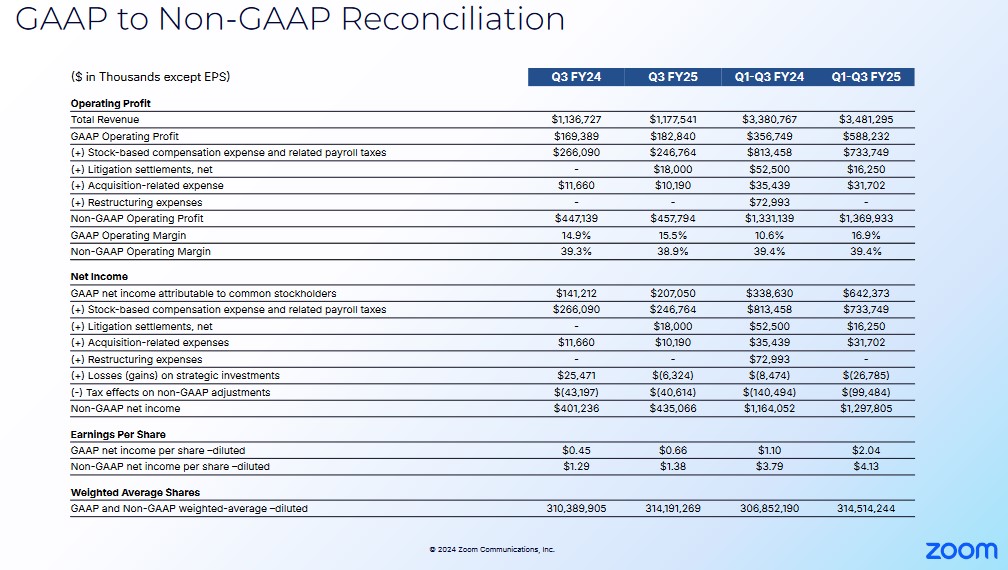

The Q3 and YTD2024 and Q3 and YTD2025 results extracted from the Q3 2025 earnings presentation are provided below for ease of reference.

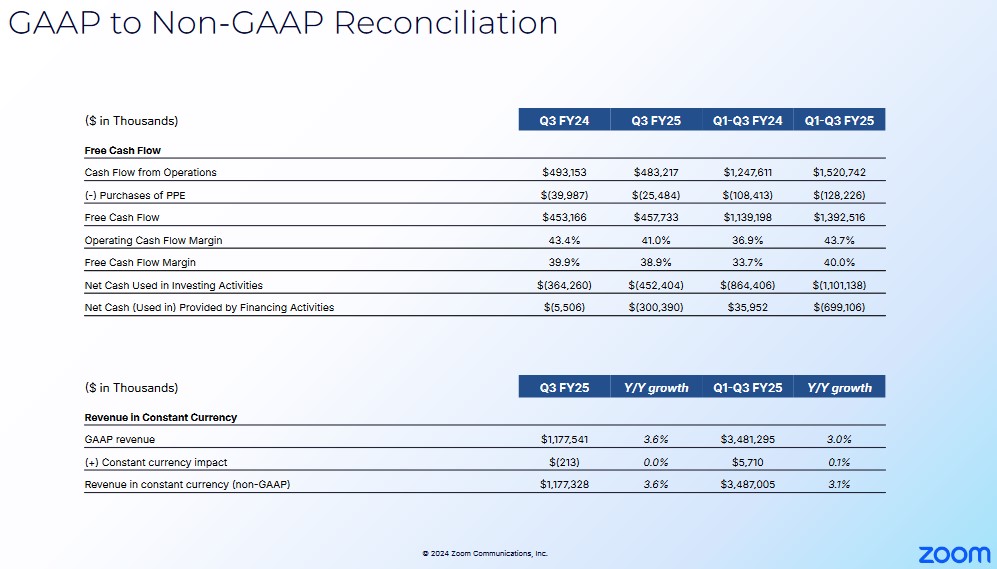

Operating Cash Flow (OCF), Free Cash Flow (FCF), and CAPEX

The following reflects ZM’s Q3 and YTD 2024 and Q3 and YTD 2025 OCF, CAPEX, and FCF. While ZM calculates FCF in the typical manner where CAPEX is deducted from OCF, I think investors should exclude the stock based compensation (SBC) line item on the Consolidated Statements of Cash Flows to arrive at a company’s Net cash provided by operating activities; common forms of SBC are shares, stock options, restricted share units (RSUs), phantom shares, and employee stock ownership plans (ESOP).

Let’s use an extreme example where Company A remunerates its employees solely by way of SBC thereby requiring no use of cash. The income statement will treat the SBC as an expense but the SBC will be added back to determine the Net cash provided by operating activities on the Consolidated Statements of Cash Flows.

On the other hand, Company B compensates its employees 100% by way of wages/salaries. This expense will be reflected on the income statement. On the Consolidated Statements of Cash Flows, however, nothing will be added back to determine the Net cash provided by operating activities.

Both companies could perhaps compensate their respective employees the exact same amount. Because Company A disburses no cash, however, its FCF would be greater than that of Company B by the exact amount of the SBC (assuming all other line items are exactly the same).

Why should the manner by which a company compensates its employees lead to different Price/FCF valuations?

The following is what ZM reflects as OCF, CAPEX, and FCF in its earnings presentations for FY2022, FY2023, FY2024, and YTD2025.

- OCF of ~$1.606B, ~$1.290B, ~$1.599B, and ~$1.521B.

- CAPEX of ~$0.133B, ~$0.104B, ~$0.127B, and ~$0.128B.

- FCF of ~$1.473B, ~$1.186B, ~$1.472B, and ~$1.393B.

Eliminating SBC as a line item on the Consolidated Statements of Cash Flows changes ZM’s Net cash provided by operating activities as follows:

- SBC of ~$0.477B, ~$1.286B, ~$1.057B, and ~$0.708B.

- OCF of ~$1.473B, ~$4 million, ~$0.542B, and ~$0.813B.

- CAPEX of ~$0.133B, ~$0.104B, ~$0.127B, and ~$0.128B.

- FCF of ~$1.340B, ~($0.100B), ~$0.415B, and ~$0.685B.

The SBC component of ZM’s compensation structure is material thus leading to vastly different FCF results!

It remains to be seen to what extent wages and salaries will be adjusted to offset/partially offset the reduction in SBC.

Capital Allocation

The capital allocation priority is to retain funds for growth and M&A. The opportunistic repurchase of Class A shares comes next. Dividend distributions are non-existent.

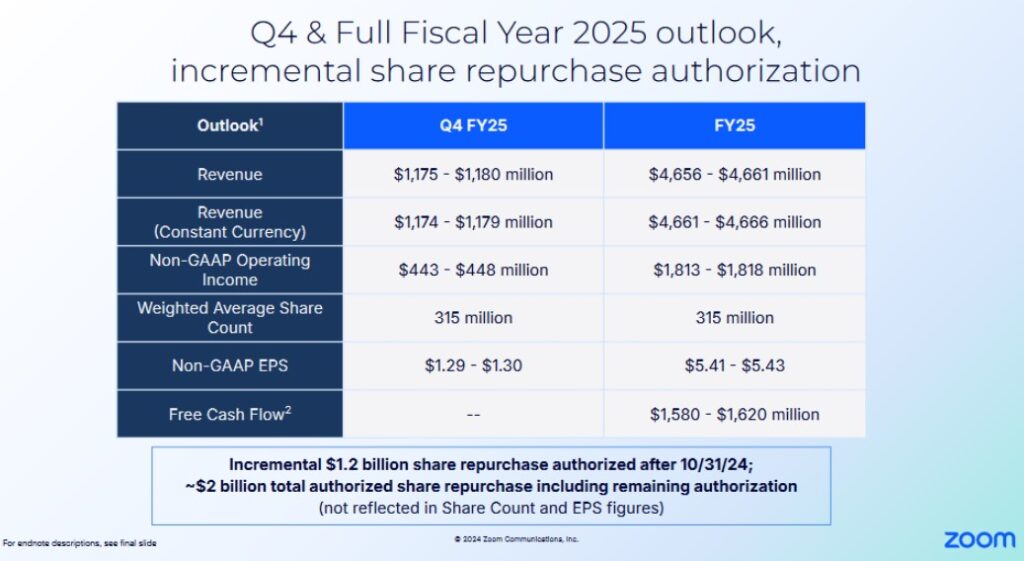

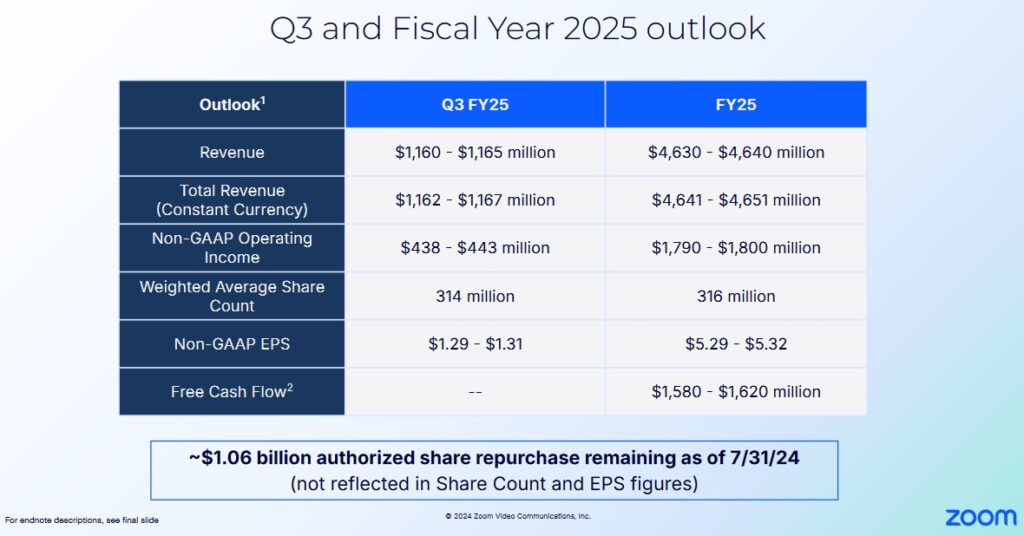

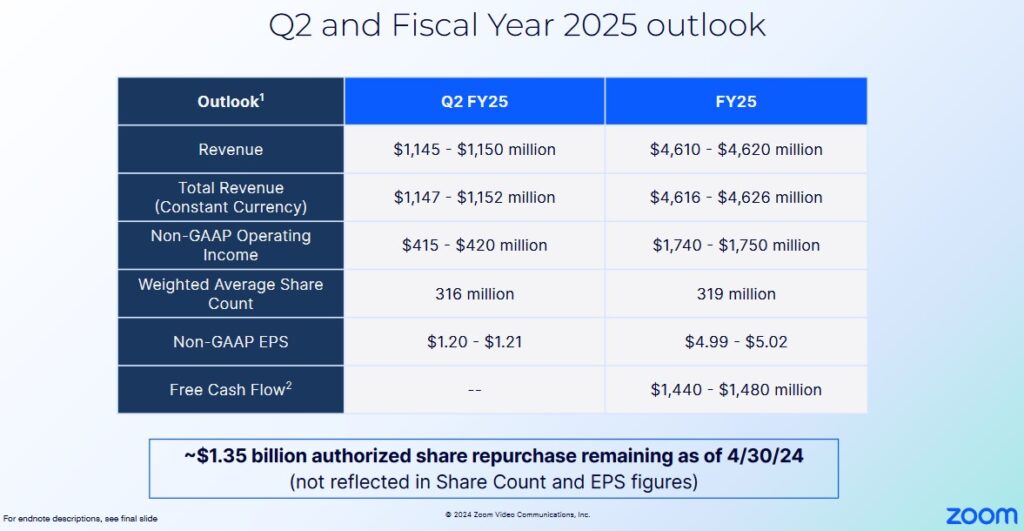

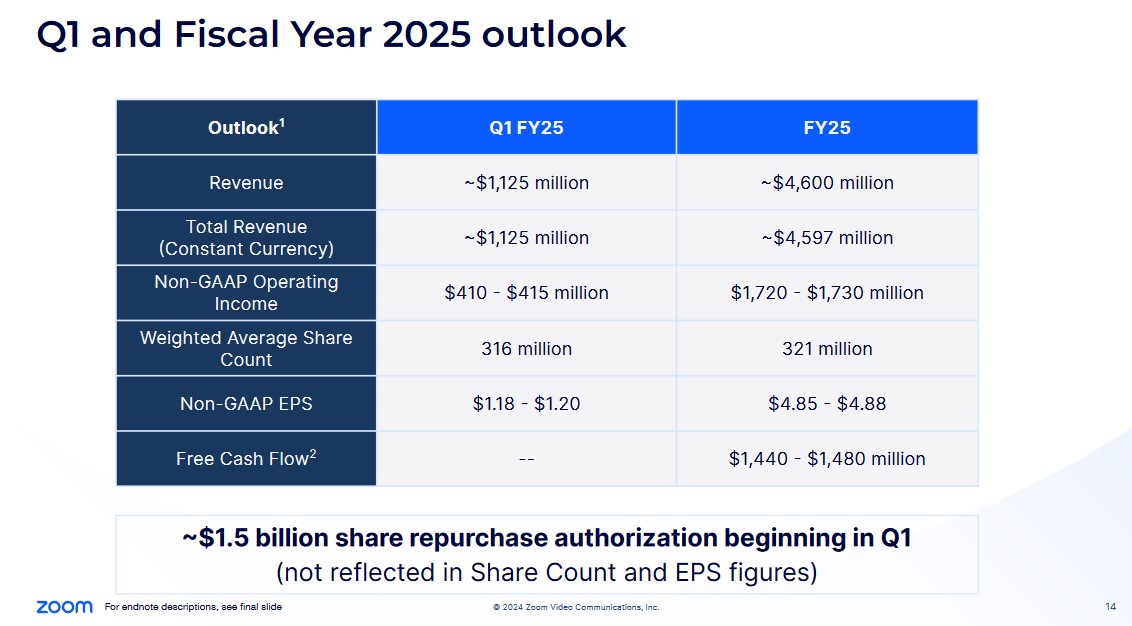

Q4 and FY2025 Outlook

The following reflects the outlook presented by ZM over the past 4 quarters.

Risk Assessment

ZM has no debt to rate.

Dividends and Share Repurchases

Dividend and Dividend Yield

ZM does not distribute a dividend.

Share Repurchases

The diluted weighted-average shares used in computing net income per share in FY2022, FY2023, FY2024, and YTD2025 (in millions of shares) is 305.826, 304.231, 308.520, and 314.514. The YTD2025 increase is despite ZM having repurchased ~$0.739B (~11.6 million shares).

The significant increase in recent quarters is not encouraging. In September 2024, however, ZM’s CEO wrote in a weekly note to employees that equity issued to employees is at an unsustainable rate. ZM is now joining peers such as Salesforce Inc. and Workday Inc. in limiting their reliance on a common compensation technique in the technology industry.

In addition, ZM’s Board recently authorized an incremental $1.2B share repurchase. This incremental authorization brings ZM’s total unexecuted buy-back to ~$2B which ZM expects to execute by the end of FY2026.

Valuation

At the time of my August 22, 2024 post, ZM’s revised FY2025 adjusted diluted EPS was $5.29 – $5.32. Following the release of Q2 2025 results, the share price surged to ~$67.30 thus leading to a forward adjusted diluted PE range of ~11.3 – ~11.4.

Using the currently available adjusted diluted EPS broker estimates, ZM’s forward adjusted diluted PE levels were:

- FY2025 – 30 brokers – ~12.65 using a mean of $5.30 and low/high of $5.00 – $5.72.

- FY2026 – 30 brokers – ~ 12.90 using a mean of $5.22 and low/high of $4.87 – $5.83.

- FY2027 – 17 brokers – ~ 12.77 using a mean of $5.27 and low/high of $4.75 – $5.94.

At the time of that post, I was not adjusted ZM’s FCF forecast to account for SBC. I merely used ZM’s FY2025 FCF outlook of $1.58B – $1.62B. Using $1.60B and the updated 316 million weighted average shares outstanding outlook, the projected FCF/share was ~$5.06. $67.30 divided by $5.06 resulted in a P/FCF valuation of ~13.3.

ZM’s FY2025 adjusted diluted EPS has once again been revised and is now $5.41 – $5.43. The share price is now $ as I compose this post thus leading to a forward adjusted diluted PE range of .

Using the November 25 closing share price of ~$89 and currently available adjusted diluted EPS broker estimates, ZM’s forward adjusted diluted PE levels are:

- FY2025 – 31 brokers – ~ using a mean of $5.40 and low/high of $5.18 – $6.01.

- FY2026 – 30 brokers – ~ using a mean of $5.34 and low/high of $4.87 – $5.91.

- FY2027 – 18 brokers – ~ using a mean of $5.28 and low/high of $2.73- $6.22.

There is a considerable variance estimates but these gaps are likely to close over the coming days as brokers provide their updates. Nevertheless, I place very little reliance on the estimates beyond 2026.

Now that I adjust FCF, the P/FCF valuation is going to be significantly different from prior calculations for company’s such as ZM which have a significant SBC component. I, therefore, look at ZM’s P/FCF using the conventional manner by which FCF is calculated and the more conservative manner in which I now calculate FCF.

Conventional FCF Calculation

ZM’s FY2025 FCF guidance remains unchanged at ~$1.58B – ~$1.62B. Using $1.60B and the updated 315 million weighted average shares outstanding outlook, the projected FCF/share is ~$5.08. Divide the current $89 share price by $5.08 and we get a P/FCF valuation of ~17.52.

Adjusted FCF Calculation

ZM’s YTD2025 FCF is ~$0.685B meaning it has generated an average of ~$0.228B of FCF in each of the first 3 quarters in FY2025. If it generates a similar level in Q4, we can expect FY2025 FCF to be ~$0.913B. Let’s round this to ~$0.920B for current purposes. Leaving the weighted average shares outstanding outlook at 315 million, the projected FCF/share is ~$2.92. Divide the current $89 share price by $2.92 and we get a P/FCF valuation of ~30.5.

Unfortunately, ZM’s share price has surged ~$34 from the ~$56 share price in mid-August 2024. This surge and the change in the manner in which I calculate FCF now make ZM appear expensive.

Final Thoughts

Going forward, I plan to assess a company’s valuation using the conventional and adjusted methods of calculating FCF.

ZM’s future is promising with the consistent introduction of new products and services. It generates considerable cash and it currently has ~$7.7B of cash and cash equivalents and marketable securities and no debt. It plans to aggressively repurchase shares as part of its capital allocation strategy and, fortunately, it is scaling back on the extent to which it issues shares as part of its employee compensation.

I currently only hold 900 shares in a ‘Core’ account within the FFJ Portfolio at an average cost of ~$63.34, making it too small to have been a top 30 holding when I completed my 2024 Mid Year FFJ Portfolio Review.

Following the recent share price surge, I consider shares to be fairly valued. ZM’s share price can be volatile, however, so retracing to the high $70s is entirely possible. Should this happen, I intend to increase my exposure.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long ZM.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.