Contents

When I last reviewed BlackRock (BLK) in this April 15 post, the most currently available financial information was for Q1 2024. I considered shares to be reasonably valued and disclosed the purchase of another 30 shares @ ~$770/share on April 12; this increased my BLK exposure to 160 shares in the FFJ Portfolio.

In several prior posts, I have expressed my opinion that many investors are currently replacing reality for magic. I have, therefore, increased my liquidity in the hope that we experience a sharp broad market correction so I can acquire shares in high quality companies at more favorable valuations.

On the expectation that a broad market correction will occur and based on advice from our tax accountants regarding the recently enacted legislation surrounding the treatment of capital gains in Canada, I:

- liquidated all holdings within a holding company;

- made a commitment to radically limit my exposure to Canadian companies;

- am focusing on increasing my exposure to high quality US companies; and

- intend to restrict the number of companies to which I have exposure.

BLK is one such company in which I intend to increase my exposure. However, I will do so only if I think there is a reasonable probability of being able to generate an average annual double digit total investment return over the long-term.

Now that BLK has released its Q2 and YTD2024 results on July 15, I revisit this existing holding.

Overview

A comprehensive overview of BLK is provided in Part 1 Item 1 in BLK’s FY2023 Form 10-K which is accessible through the SEC Filings section of the company’s website. I also strongly recommend reviewing the company’s website.

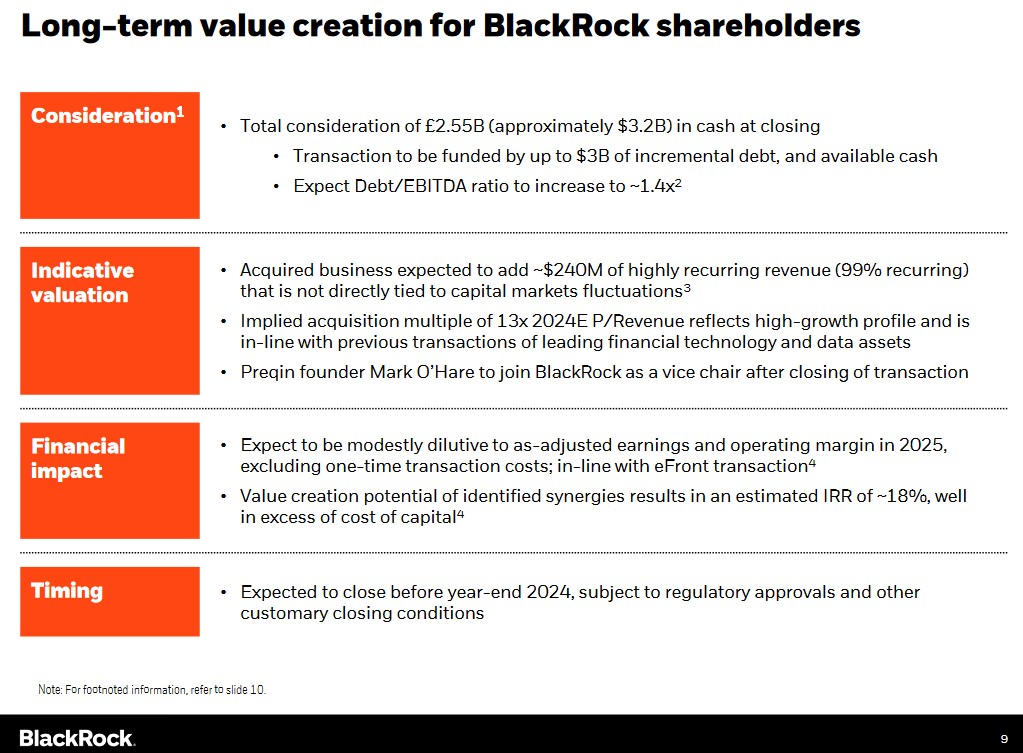

Preqin Acquisition

On June 30, BLK disclosed its intent to acquire Preqin, a leading independent provider of private markets data for £2.55B or ~$3.2B. Details of this acquisition are found in the Press Release and accompanying presentation.

The proposed acquisition is an extension of BLK’s private markets capabilities and will be the launching point into the fast-growing private markets data segment; BLK expects the acquisition will accelerate the growth and revenue contribution of technology services.

The bigger longer-term opportunity is leveraging BLK’s engines in Aladdin and indexing with its capital markets expertise. BLK envisions that what the creation of public benchmarks did to drive stock markets (especially visible through iShares) can be replicated for private markets.

Financials

Q2 and YTD2024 Results

Details of BLK’s Q2 2024 results are accessible here.

On the Q2 earnings call, management stated:

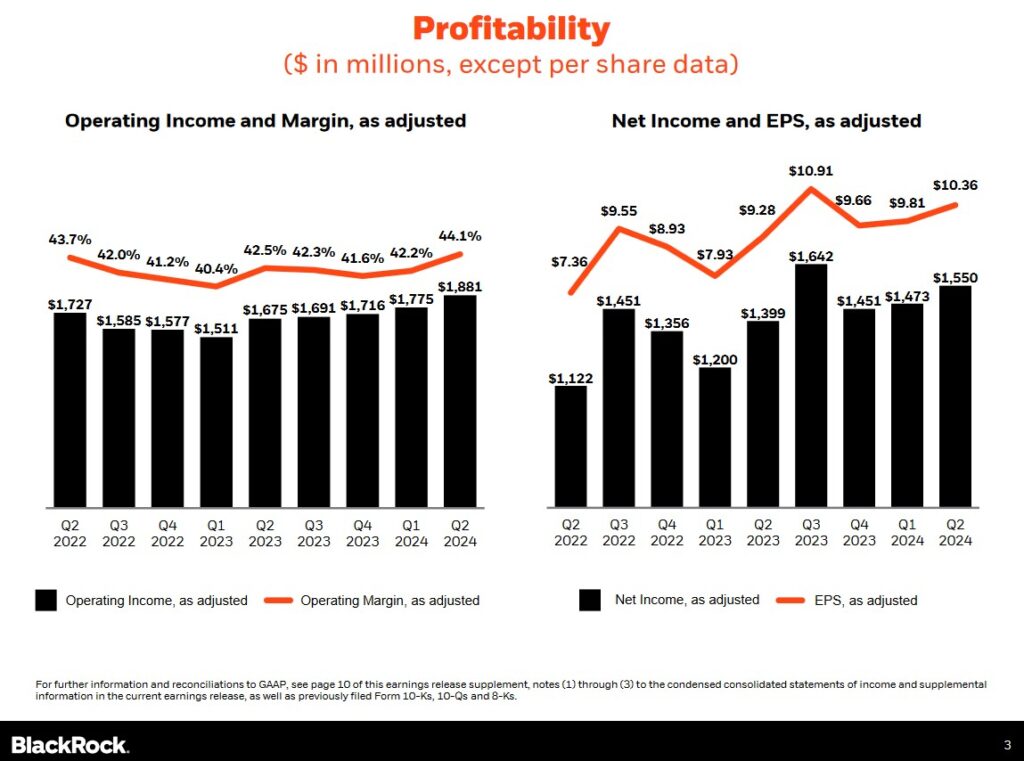

The first half and second quarter of 2024 saw some of BLK’s strongest performance and highest growth rates of the post-pandemic period. We’re growing faster than last year. We delivered double-digit operating income growth and expanded our margin by 160 basis points year-over-year. Clients entrusted us with over $80 billion of net new assets. It was $150B of flows, excluding episodic client activity. We generated 3% annualized organic base fee growth, our highest second quarter in 3 years. We ended the second quarter with record Assets Under Management (AUM) of over $10.6T.

BLK’s business tends to be seasonally stronger in the 2nd half of the year. The acquisition of Global Infrastructure Partners (GIP), which I touched upon in my prior post, is expected to close in Q3 and the acquisition of Preqin is expected to close prior to FYE2024. BLK’s new asset management and technology mandates and these 2 impending acquisitions position the firm to achieve or exceed its 5% organic base fee growth target over the long term.

In Q2, BLK generated total net inflows of $82B, representing ~3% annualized organic asset and ~3% annualized organic base fee growth.

Flows were impacted by a ~$20B active fixed income redemption from a large insurance client linked to M&A activity. Excluding this single-client specific item and low fee institutional index reflows, BLK reported ~$150B of total net inflows in Q2.

Q2 revenue of $4.8B was 8% higher YoY and was driven by positive organic base fee growth and the impact of market movements on average AUM over the last 12 months. Higher performance fees and technology services revenue also contributed to revenue growth.

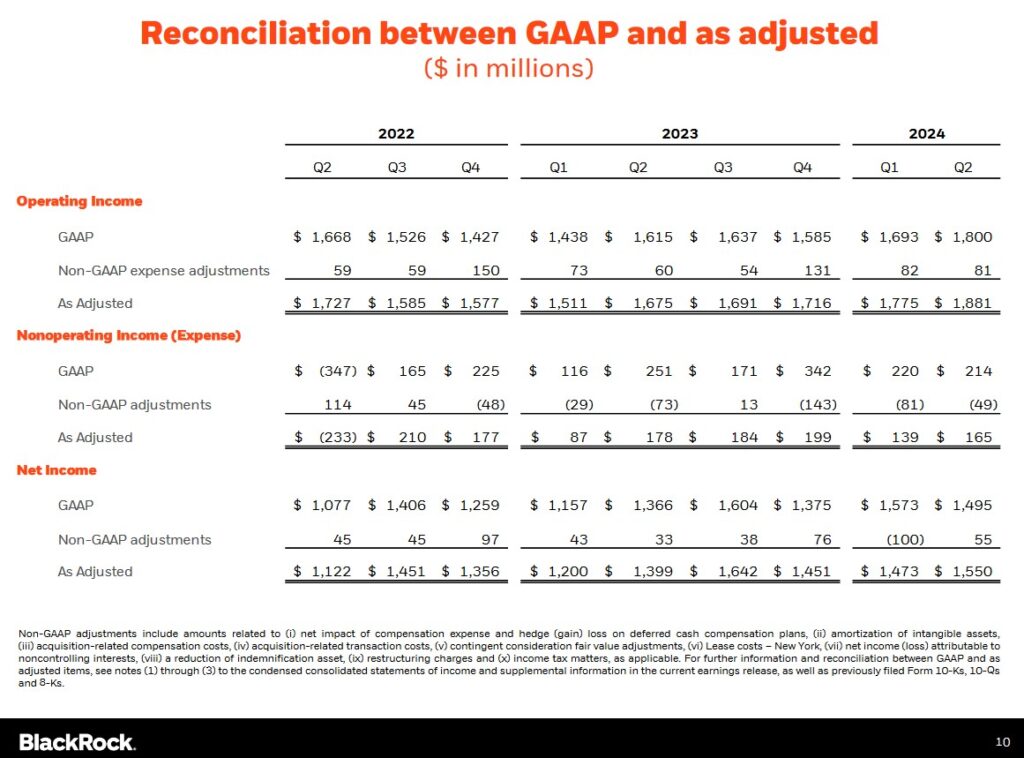

Operating income of $1.9B and $10.36 of EPS were each up 12% YoY.

Source: BLK – Q2 2024 Earnings Release Supplement

Operating Cash Flow (OCF) Free Cash Flow (FCF)

In FY2017 – FY2023, BLK generated OCF of (in $B) 3.950, 3.075, 2.884, 3.743, 4.944, 4.956, and 4.165 and FCF of (in $B) 3.795, 2.871, 2.630, 3.549, 4.603, 4.423, and 3.821.

Capital Allocation

BLK’s capital management priorities are to:

- invest in the business to either scale strategic growth initiatives or drive operational efficiency;

- return excess cash to shareholders through a combination of dividends and share repurchases; and

- make inorganic investments where there is an opportunity to accelerate growth and support strategic initiatives.

FY2024 Outlook

BLK does not provide an outlook for the entire fiscal year. It does, however, state that it will either:

- continue to prioritize investments with differentiated organic growth potential; or

- that will expand operating leverage through enhanced scale.

In line with its January guidance and excluding the impact of GIP, Preqin and related transaction costs, BLK expects:

- its head count to be broadly flat in 2024; and

- a low to mid-single-digit percentage increase in 2024 core G&A expense.

Based on its capital spending plans for the year and subject to market conditions, BLK anticipates repurchasing at least $0.375B of shares quarterly for the balance of FY2024. This is consistent with guidance provided in January.

Risk Assessment

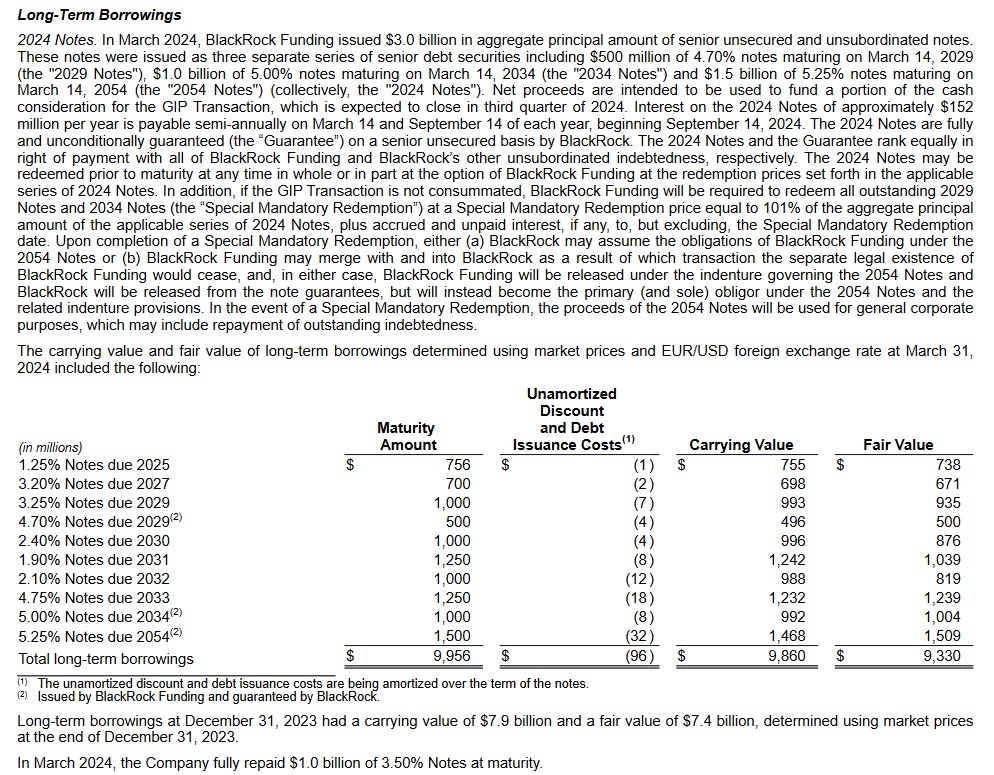

In my April 15 post, I touched upon the planned acquisition of GIP which is expected to close in Q3 2024. The $3B of debt to finance this acquisition consists of 3 tranches of senior unsecured notes across 5-, 10- and 30-year maturities. Proceeds are currently invested at substantially the same rate as the cost of borrowing, effectively eliminating incremental cost of carrying additional debt prior to the close of this transaction.

BLK’s Q2 2024 Form 10-Q is currently unavailable, and therefore, I provide the following note from BLK’s Q1 2024 Form 10-Q.

Moody’s has rated BLK’s domestic senior unsecured credit rating Aa3 since June 2018. The outlook is stable.

S&P Global has rated BLK’s domestic senior unsecured credit rating AA- since May 2014. The outlook is stable.

Both ratings are the bottom tier in the high-grade investment-grade category. These ratings define BLK as having a very strong capacity to meet its financial commitments. The ratings differ from the highest-rated obligors only to a small degree.

These investment-grade ratings are acceptable for my purposes.

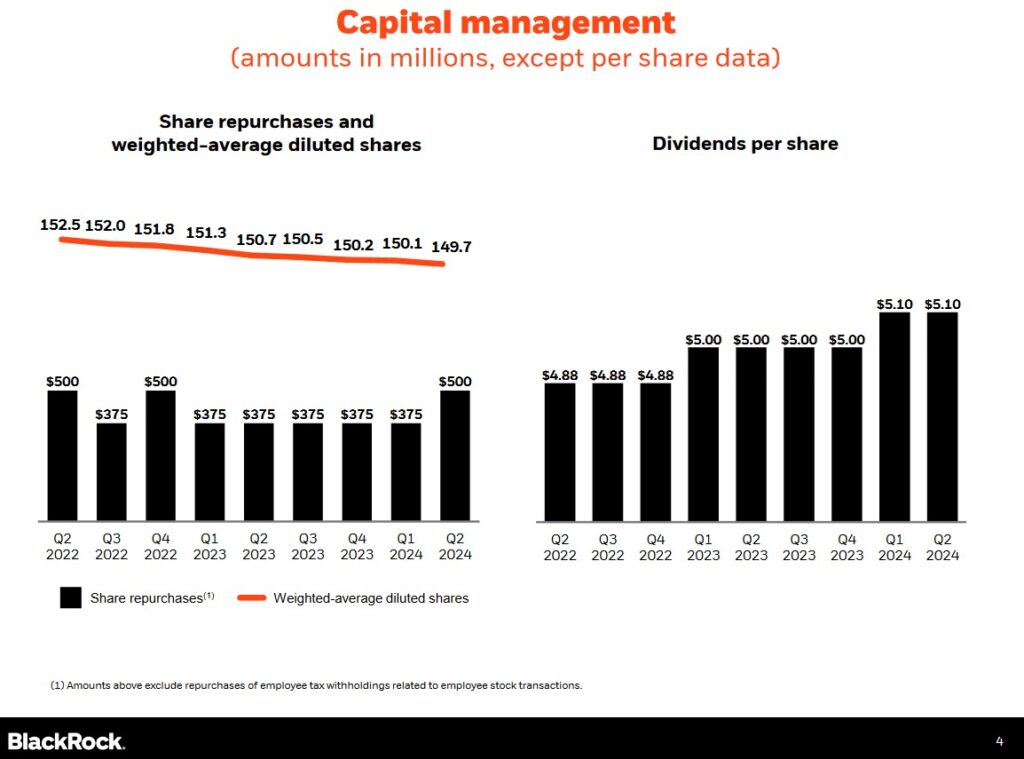

The following reflects BLK’s quarterly capital management allocation for the past 2 fiscal years.

Dividend and Dividend Yield

BLK initiated a quarterly dividend in 2003 (see dividend history).

In mid August, we can expect BLK to declare its third consecutive $5.10 quarterly dividend for distribution in late September. I also expect BLK to increase its quarterly dividend in January by at least $0.05/share. Should this transpire, the next 4 dividend payments would total $20.50 (($5.15 x 2) + ($5.10 x 2)). Using the current ~$823 share price, the forward dividend yield is ~2.5%.

BLK’s capital allocation priority is to invest either to scale strategic growth initiatives or drive operational efficiency. Once this is achieved, BLK returns excess cash to its shareholders through a combination of dividends and share repurchases.

In FY2014, the weighted average number of diluted outstanding shares was ~172 million. This has been reduced to ~149.7 million in Q2 2024.

Based on capital spending plans for 2024 and subject to market conditions, including the relative valuation of BLK’s stock price, the target is to repurchase $1.5B ($0.375B quarterly) of shares during FY2024.

In Q2, BLK repurchased $0.5B of common shares. This exceeded the planned run rate as BLK saw attractive relative valuation opportunities in its stock.

Valuation

BLK’s FY2013 – FY2023 PE levels based on diluted EPS are 19.93, 18.57, 17.58, 20.08, 24.16, 11.30, 19.47, 24.07, 24.45, 19.60, and 34.84.

BLK’s valuation at the time of prior posts are accessible in my April 15, 2024 post. I, however, provide for ease of comparison BLK’s forward adjusted diluted PE level when I purchased additional shares @ ~$770 on April 12.

- FY2024 – 15 brokers – mean of $41.28 and low/high of $39.41 – $43.90. Using the mean estimate: ~18.7.

- FY2025 – 15 brokers – mean of $46.57 and low/high of $42.95 – $51.15. Using the mean estimate: ~16.5.

- FY2026 – 7 brokers – mean of $52.39 and low/high of $44.62 – $56.64. Using the mean estimate: ~14.7.

I expected revisions to these estimates given the recent release of Q1 results but no meaningful changes.

In FY2023, BLK generated ~$3.821B of FCF and the weighted average diluted shares outstanding was ~150.7 million giving us ~$25.36 in FCF/share. Divide my ~$770 purchase price by ~$25.36 and the P/FCF was ~30.36.

As I compose this post, shares are trading at ~$823. BlackRock’s current valuation using this share price and current broker forward adjusted diluted EPS estimates are:

- FY2024 – 14 brokers – mean of $41.59 and low/high of $40.20 – $42.80. Using the mean estimate: ~19.8.

- FY2025 – 15 brokers – mean of $46.70 and low/high of $42.90 – $50.57. Using the mean estimate: ~17.6.

- FY2026 – 8 brokers – mean of $52.00 and low/high of $44.43 – $56.98. Using the mean estimate: ~15.9.

I expect revisions to existing analyst estimates over the coming days. I do not, however, expect any meaningful change to the current mean forward adjusted diluted EPS estimates.

The weighted average diluted shares outstanding in Q2 was 149.7 million. If BLK repurchases $0.375B of its issued and outstanding shares in each of the next two quarters, it is entirely possible that the weighted average diluted shares outstanding in FY2024 could be ~149.7 million.

BLK does not provide FCF guidance. Looking at the level of FCF generated in FY2017 – FY2023 (see above), however, ~$3.8B of FCF in FY2024 is a reasonable assumption.

Divide ~$3.8B by ~149.7 million shares and we get ~$25.38 of FCF/share. With shares trading at ~$823, the current forward P/FCF is ~32.43.

Final Thoughts

BLK invests client funds (eg. through iShares ETFs) in multiple publicly traded companies. Because of the size and scope of BLK’s funds, it is often among the top institutional holders of many companies. Although the underlying shares are ultimately owned by BLK’s clients and not by BLK itself, it can exercise shareholder votes on behalf of these clients. In many cases BLK can vote without any client input!

BLK, however, argues that it is:

committed to helping our clients experience financial well-being. The money we manage is not our own. It belongs to the individuals and organizations around the world who rely on BlackRock to help them reach their long-term goals.

Furthermore, it states that its job is to:

offer investment choices to meet our clients’ objectives; provide transparency into how those decisions can affect the portfolio’s risk-return profile; and share our perspective on how macroeconomic, geopolitical, and structural forces impact asset prices and how we believe those trends are likely to unfold over time.

Given BLK’s power and influence in the corporate world, I elected to initiate a position in one of the ‘Core’ accounts within the FFJ Portfolio on March 9, 2023. At the time of my 2023 Year End FFJ Portfolio Review, I owned 130 shares and it was my 26th largest holding.

On April 12, 2024, I acquired another 30 shares @ ~$770/share thus increasing my exposure to 160 shares. The increase in the number of shares held and the value per share contributed to BLK being my 21st largest holding when I completed my 2024 Mid Year FFJ Portfolio Review.

Every investor’s objectives and goals and circumstances requires a customized investment strategy. In some cases, the need for a consistent and reliable stream of dividend income is essential. This, however, is not my priority. My focus is on the potential long term total return of an investment. An attractive dividend yield is of little interest to me if the long term total investment return is likely to be in the low single digits.

Given this, I must pay attention to a company’s valuation which is why I:

- try to acquire shares in wonderful companies if I perceive share price weakness to be temporary rather than because of a permanent impairment in the underlying business;

- hesitate to invest in a wonderful company if I think the company’s share price has become detached from the underlying fundamentals; and

- shy away from a company with an exceedingly attractive valuation under normal market conditions. Such companies are typically where your money ‘goes to die’.

Although I assess a company’s valuation, earnings can be manipulated or impacted by non-recurring items. I do, therefore, take much more into consideration in my investment decision making process.

BLK’s share price is volatile and as recently as October 2023, the share price was in the low $600s. My current average cost is ~$673.73 and while I would like BLK’s share price to revisit the $600s, I think this is a long shot.

We know that BLK deemed its shares to be undervalued in Q2 because it repurchased $0.5B of its shares versus its $0.375B quarterly repurchase target; it likely repurchased shares in April when its share price dipped. This suggests that BLK considers its shares to be attractively valued at (likely) under the ~$760 – ~$780 level. Since the company is not radically different now than it was in April, I would consider acquiring additional shares below ~$780. For now, however, BlackRock’s valuation is insufficiently compelling if I want an average annual double-digit total investment return.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long BLK.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.