Some investors make investment decisions based on the number of consecutive years in which a company has increased its dividend and classify companies using the following terminology:

- Dividend King;

- Dividend Champion;

- Dividend Contender;

- Dividend Achiever; or

- Dividend Aristocrat

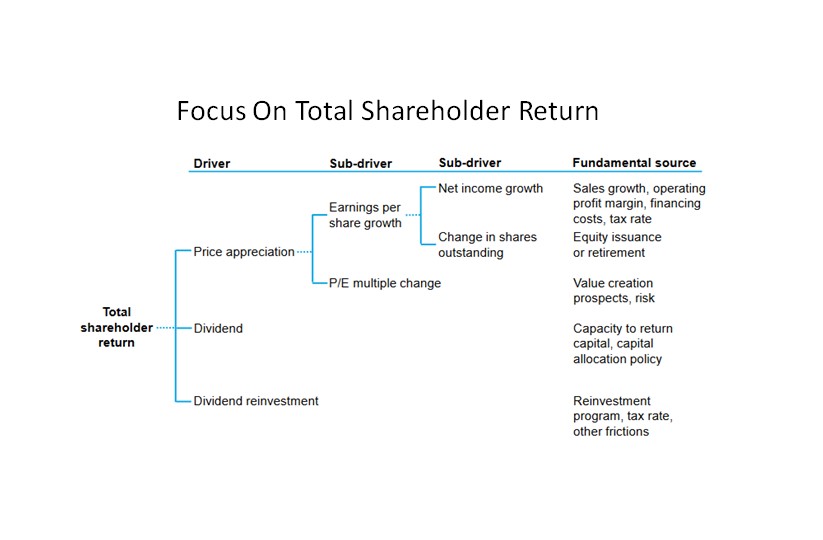

I am at a loss as to why dividend metrics should be relevant in the investment decision making process. The focus should be on Total Shareholder Return (TSR) potential; I state this in several posts (Archives).

Personal experience over the past ~37 years in which I have been an equity investor indicates the dividend component of the TSR pales in comparison to the earnings per share (EPS) growth and price/earnings (P/E) multiple change.

I have a few holdings with 2% - 4.5% dividend yields. Most of my top 20 holdings reported in my 2023 Year End FFJ Portfolio Review, however, have sub 2% dividend yields. In fact, Intuitive Surgical (ISRG), Berkshire Hathaway (BRK.b), and Copart (CPRT), my 15th, 16th, and 23rd largest holdings, distribute no dividend.

Following the completion of that review, I have:

- exited The Toronto-Dominion Bank (TD.to) and The Bank of Montreal (BMO.to) which were amongst my top 20 holdings;

- exited SmartCentres Real Estate Investment Trust (SRU-un.to), BCE (BCE.to), Enbridge (ENB.to), Emera (EMA.to), The Bank of Nova Scotia (BNS.to), and The Canadian Imperial Bank of Commerce (CM.to) which were not top 30 holdings;

- added to my CPRT, Nike (NKE), BlackRock (BLK), and West Pharmaceuticals (WST) exposure; and

- initiated positions in Zoom Video Communications (ZM), Paycom Software (PAYC) and Veeva Systems (VEEV).

I replaced attractive dividend yielding companies with no dividend or low dividend yielding companies. The no dividend or low dividend yielding companies, however, have the potential to generate superior TSRs over the long term.

Given these changes, the dividend income reported monthly will be substantially lower than historical levels. This is of little importance to me in the big picture.

In addition, I have dramatically reduced my exposure to Canadian companies. The vast majority of my purchases in recent years have been US companies; I think I can generate much better TSRs from US companies.

In addition, I am less rigid about a company's valuation when making investment decisions. Higher growth companies such as CPRT, ISRG, WST, and VEEV, for example, are likely to generate superior TSRs than the companies I have exited. It is only logical that higher growth companies would have higher valuations. Naturally, I am not prepared to invest in higher growth companies at any price!

Final Thoughts

A host of factors influence our investment decisions, and therefore, not everyone will agree with my investment strategy. If you, however, fixate on dividend metrics when making investment decisions, I strongly encourage you to read Morgan Stanley Investment Management's Total Shareholder Return Linking The Drivers of Total Returns to Fundamentals!

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.