Canadian National Railway (CNR) is perennially overvalued. I, therefore, pay very little attention to it despite it being my 19th largest holding at the time of my 2023 Year End FFJ Portfolio Review.

Railroads are attractive in that the barriers to entry are so high; it is cost prohibitive to establish a new Class 1 railroad.

In addition to CNR, the other Class 1 railroads are:

- BNSF Railway (owned by Berkshire Hathaway);

- Union Pacific (UNP);

- Canadian Pacific Kansas City Limited (CP);

- Norfolk Southern (NSC); and

- CSX Corporation (CSX).

I have exposure to CNR and the first 3; my exposure to BNSF is through my ownership of Berkshire Hathaway shares.

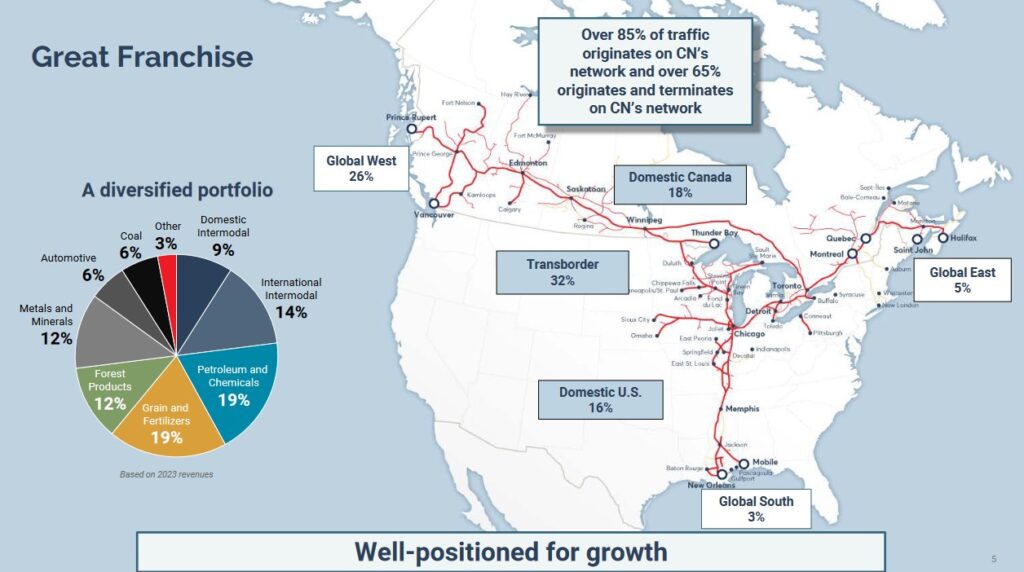

Even though CNR has competition, its rail competitors do not have the same North American geographic coverage. For example, UNP, BNSF, NSC, and CSX do not have tracks in Canada. Similarly, CNR does not have the same geographic coverage in the US as its US competitors.

Another barrier to entry is the capital intensive nature of the business. In FY2014 – FY2023, CNR’s annual capital expenditures (in billions of $) were $2.297, $2.706, $2.695, $2.673, $3.531, $3.865, $2.863, $2.891, $2.75, and $3.187. Operating cash flow (OCF) during the same time frame, was $4.381, $5.14, $5.202, $5.16, $5.918, $5.923, $6.165, $6.971, $6.667, and $6.965. In essence, CNR’s CAPEX was approximately 52%, 53%, 52%, 52%, 60%, 59%, 65%, 46%, 41%, 41%, and 46% of OCF.

The capital intensive nature of the industry acts as a deterrent to new entrants. It is, however, also a drawback. Industry participants must spend billions annually just to remain competitive.

I last reviewed CNR in this January 26, 2022 post at which time the Q4 and FY2021 results had just been released. With the recent release of Q1 2024 results and FY2024 outlook, this is an opportune time to revisit this existing holding.

NOTE: All dollar values are in CDN $.

Business Overview

CNR’s rail network consists of ~18,800 route miles of track (FYE2023). It serves several ports on three coasts and it has 23 strategically located Intermodal terminals across its network.

Interactive maps to aid in determining the magnitude of CNR’s operations are accessible here. In addition, I encourage you to read the material in the Reports, Presentations and Archives section of the company’s website as well as Management’s Discussion and Analysis found within the Financial Results section of the company’s website.

Milton Hub

In my January 26, 2022 post, I wrote about CNR’s Milton Logistics Hub (Hub) which was to be located in the southwest part of Milton, Ontario. The rationale for this new Hub was to enable CNR to more efficiently move traffic to the Greater Toronto and Hamilton Area, the fastest growing area in Canada; CNR planned to invest ~$0.25B to build the new Hub.

The site was to be within a kilometre of 34,000 residents, multiple schools and the hospital. As expected, this proposed Hub has been widely opposed by residents’ groups, the Halton Region and the Town of Milton since it was first announced in 2015. Opponents have argued the Hub would significantly increase truck traffic to the community, reduce road safety, and create local pollution.

What many thought was a ‘done deal’, hit a major roadblock when the Federal Court of Canada ruled on March 1, 2024 that it was blocking approval for the planned Hub. The court found that the approval process for the truck-rail facility had failed to consider the adverse health effects the facility’s vehicle traffic would ultimately have on the area. Now, the project cannot continue without first returning to the federal government for reconsideration.

Financial Review

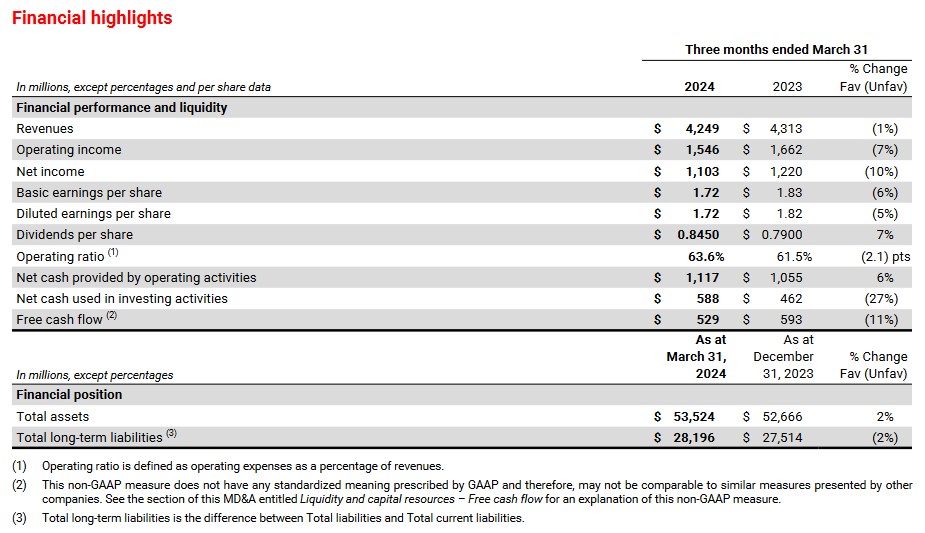

Q1 2024 Results

The financial highlights reflected below are found within CNR’s Q1 2024 material that is accessible here.

Free Cash Flow (FCF)

CNR’s FY2016 – FY2023 FCF track record (in billions of $) is: $2.520, $2.778, $2.514, $1.992, $3.227, $3.296, $4.259, and $3.887. These FCF values are directly from CNR’s NON-GAAP Measures that are accessible here.

FY2024 Outlook

The following reflects CNR’s outlook for the various industries it serves.

Investors should note that CNR generates more revenues than expenses in US dollars. Its results, therefore, are affected by foreign exchange fluctuations. Management estimates that a $0.01 depreciation/appreciation in the value of the Canadian dollar increases/decreases its annual EPS by ~$0.05.

Risk Assessment

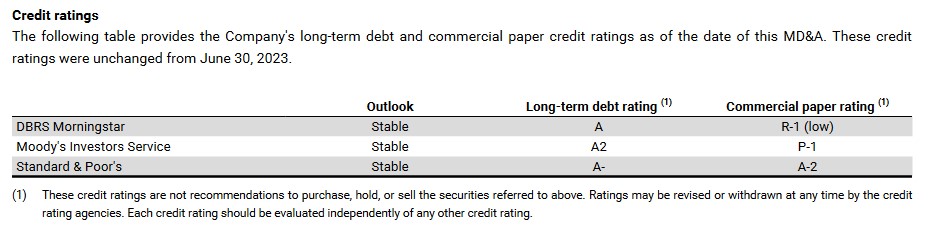

The following reflects CNR’s credit ratings.

- DBRS Morningstar’s long-term debt rating is the top tier of the upper medium-grade investment-grade category.

- Moody’s long-term debt rating is the middle tier of the upper medium-grade investment-grade category.

- S&P Global’s long-term debt rating is the bottom tier of the upper medium-grade investment-grade category.

These ratings define CNR as having a strong capacity to meet its financial commitments. It is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

These ratings satisfy my conservative investment preferences.

Dividends and Dividend Yield

CNR’s FY2012 – FY2024 dividend history is $0.75, $0.86, $1.00, $1.25, $1.50, $1.65, $1.82, $2.15, $2.30, $2.46, $2.93, and $3.16.

On April 23, CNR’s Board announced the approval of an $0.845 dividend payable on June 28, 2024 to shareholders of record at the close of business on June 7, 2024.

I expect CNR to distribute 3 more $0.845 quarterly dividends. In January 2025, I anticipate a ~$0.05 increase in the quarterly dividend. If this materializes, the next 4 quarterly dividend payments will total $3.43 ((3 x $0.845) + ($0.895)).

Based on the April 24th $168.35 closing share price, the estimated forward dividend yield is ~2%.

The weighted average number of shares outstanding is 875, 846, 824, 805, 779, 757, 738, 723, 713, 710, 688, and 659 (in millions) in FY2012 – FY2023. CNR paused its share repurchases in FY2021 because of its efforts to acquire Kansas City Southern (KCS); CP ended up acquiring KCS.

On January 23, 2024, CNR’s Board approved the repurchase of CNR’s shares under a new Normal Course Issuer Bid. CNR may repurchase up to 32.0 million common shares between February 1, 2024 and January 31, 2025.

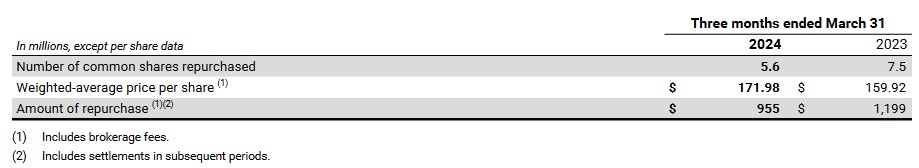

As at March 31, 2024, it had repurchased 3.5 million common shares for $0.597B under its current NCIB. It repurchased 28.7 million common shares under its previous NCIB effective between February 1, 2023 and January 31, 2024.

In Q1, CNR repurchased 5.6 million shares for ~$0.955B leaving it with authorization to repurchase another 26.4 million shares.

At the end of Q1 there were 637.6 million outstanding shares. Naturally, how many shares it repurchases and the timing of the purchases will impact the weighted average number of outstanding shares. It is, however, possible the weighted average outstanding shares in FY2024 could be ~620 million.

Valuation

CNR’s FY2012 – FY2023 diluted PE levels are 14.76, 19.95, 22.41, 18.20, 19.95, 20.32, 13.01, 19.01, 29.34, 23.44, 22.88, and 22.60.

At the time of my January 26, 2022 post, the following were the adjusted diluted earnings estimates from the brokers which cover CNR.

- FY2022 – 22 brokers – mean of $6.97 and low/high of $5.70 – $7.40. Using the mean estimate, the forward adjusted diluted PE is ~22 and ~21 if I use $7.40.

- FY2023 – 18 brokers – mean of $7.84 and low/high of $7.37 – $8.25. Using the mean estimate, the forward adjusted diluted PE is ~20 and ~19 if I use $8.25.

- FY2024 – 5 brokers – mean of $8.69 and low/high of $7.98 – $9.05. Using the mean estimate, the forward adjusted diluted PE is ~18 and ~17 if I use $9.05.

We now know that CNR generated adjusted diluted EPS of $7.46 and $7.28 in FY2022 and FY2023.

The disparity between the broker estimates and actual adjusted earnings over a 1 and 2 year time frame is why I refrain from valuing a company based on future earnings estimates well into the future. It is virtually impossible to consistently accurately estimate future earnings beyond a 2 year time frame. Furthermore, a company’s valuation can differ significantly based on the rates of return plugged into earnings models; valuation analyses performed during a low interest environment became virtually meaningless when interest rates surged in 2022.

Rightly or wrongly, I focus on a company’s valuation based on projected earnings and cash flow over the upcoming 1 – 2 years.

When CNR released its FY2024 outlook on January 23, 2024, its forecast was for a ~10% increase in adjusted diluted EPS (~$8.00 using $7.28 generated in FY2023). At the time of the earnings release, shares were trading at ~$169.50 for a forward adjusted diluted PE of ~21.2.

With shares currently trading at $168.35 and using current broker estimates, the following are the forward adjusted diluted PE levels:

- FY2024 – 25 brokers – mean of $8.01 and low/high of $7.86 – $8.13. Using the mean estimate, the forward adjusted diluted PE is ~21.

- FY2025 – 25 brokers – mean of $9.04 and low/high of $8.58 – $9.40. Using the mean estimate, the forward adjusted diluted PE is ~18.6.

- FY2026 – 13 brokers – mean of $10.03 and low/high of $9.29 – $10.65. Using the mean estimate, the forward adjusted diluted PE is ~16.8.

In the Share Repurchases section of this post, I surmised that the weighted average shares outstanding in FY2024 could be 620 million.

Should CNR generate $3.7B of FCF in FY2024, the FCF/share could be ~$5.97 ($3.7B/620 million shares). Using the $168.35 share price, my P/FCF estimate is ~28.2.

Final Thoughts

My current CNR exposure is now 781 shares in the ‘Core’ account 430 shares in the ‘Side’ account.

On February 3, 2016, I acquired 400 CNR shares @ $72.19. I subsequently acquired an additional 300 on April 26, 2016 @ $77.96. Shares are held in the same ‘Core’ account in the FFJ Portfolio.

On January 30, 2018, I acquired 400 shares @ $98.20 in one of the ‘Side’ accounts in the FFJ Portfolio.

To demonstrate the importance of valuation, I use my purchase dates and a couple of dates when CNR was significantly overvalued to determine the Average Annual Total Return with the reinvestment of dividend income relative to that of the S&P500 using the Tickertech website.

I also compare CNR’s Average Annual Total Rate of Return with a March 16, 2020 start date which is when the North American economy went into shutdown because of COVID.

The first rate of return is for CNR and the second is for the S&P500. I use April 24, 2024 as my end date.

- February 3, 2016 12.69% 14.54%

- April 26, 2016 10.84% 13.64%

- January 30, 2018 9.31% 11.68%

- March 16, 2020 17.37% 21.85%

- October 18, 2021 1.69% 6.58%

- March 21, 2022 (1.55%) 7.94%

As expected, CNR’s performance falls short of the broad index because it is a slow growth and highly capital intensive business. It stands to reason that its performance would fall well short of companies such as Microsoft, Apple, Visa, Mastercard, Copart, Intuitive Surgical, etc..

What is also interesting is that investors who disregard valuation can end up (at least in the short term) with an average annual rate of return that falls short of the rate of inflation!

This is why I can’t understand what possesses some investors to compare CNR’s current $168.35 share price with the $181.34 52-week high and to consider CNR attractively valued. Just because the share price is ~$13 lower than the 52-week high has no bearing on a company’s valuation.

A 19X earnings multiple seems fair for CNR. Using management’s $8/share FY2024 earnings outlook, a ~$152 share price seems more reasonable.

Having said this, I have no intention of adding to my CNR exposure. I would rather eventually deploy money toward the purchase of shares in companies that have the potential to generate a far superior total long term return.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long CNR.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.