Contents

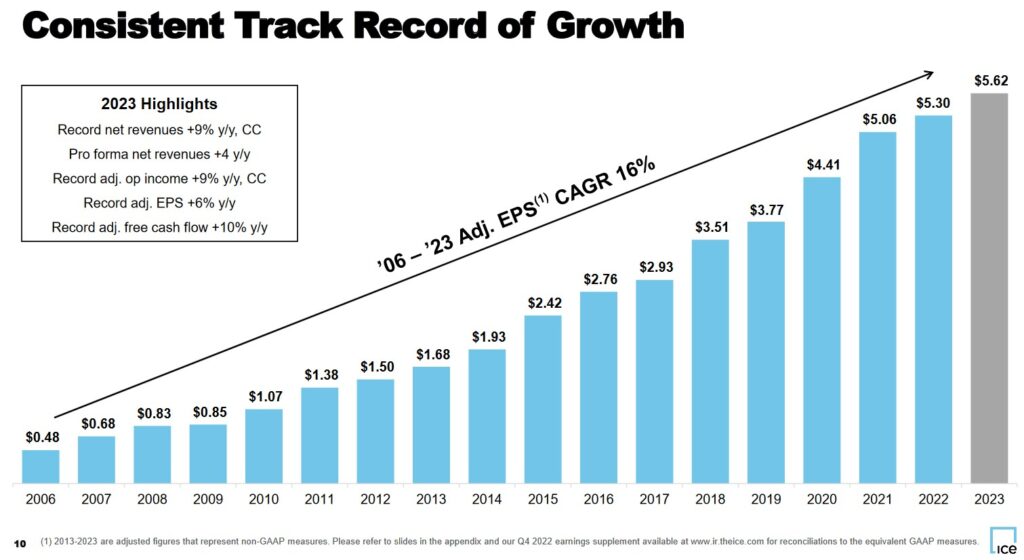

Intercontinental Exchange (ICE) has an enviable growth track record with 18 consecutive year of record revenues, operating income, and adjusted diluted EPS.

I last reviewed ICE in my October 5, 2023 guest post at Dividend Power. At the time, the most currently available results were for Q2 2023 (as of June 30). With the release of Q4 and FY2023 results on February 8, I revisit this existing holding.

Business Overview

Part 1 of ICE’s FY2023 Form 10-K has a comprehensive overview of the company and various risk factors.

Source: ICE – Q4 2023 Earnings Presentation – February 8 2024

Financials

Q4 and FY2023 Results

Material related to the February 8, 2024 Earnings Release, including the earnings call transcript, is accessible here.

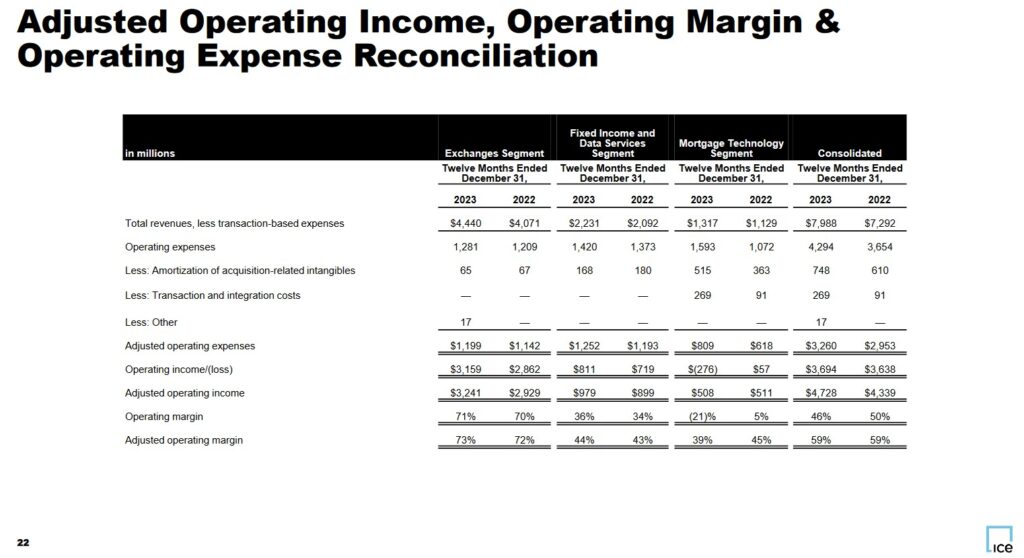

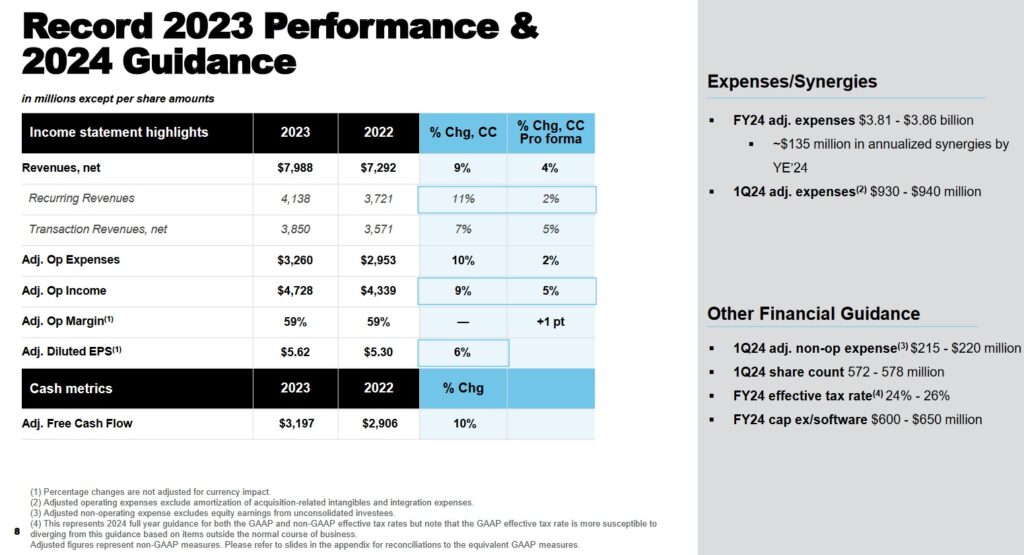

The Earnings Presentation contains a significant amount of information. However, I provide the following for ease of reference.

Source: ICE – Q4 2023 Earnings Presentation – February 8 2024

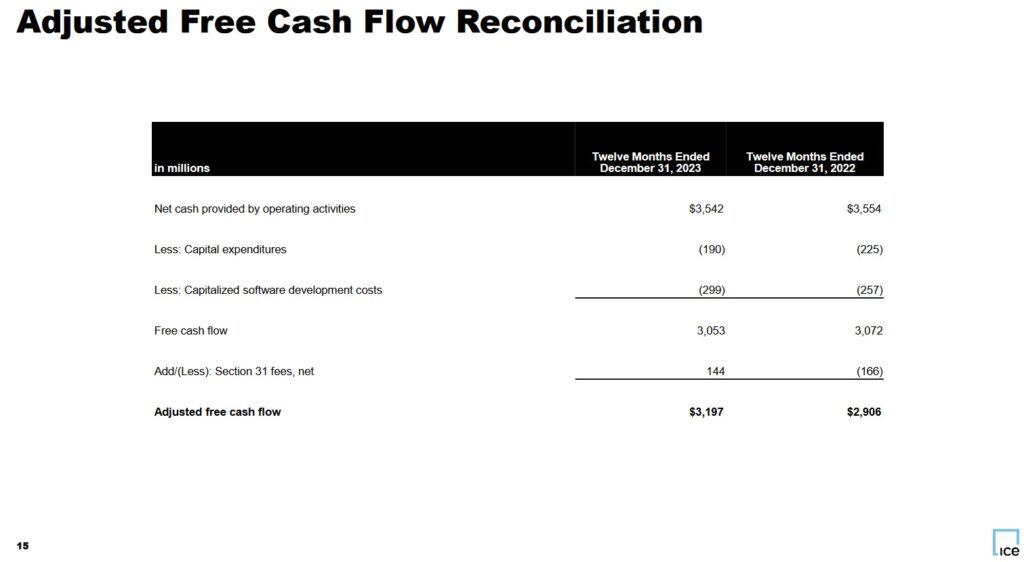

Free Cash Flow

I closely monitor FCF since it provides an indication of what funds are available for reinvesting in the business, debt reduction, share repurchases, and dividend increases.

ICE’s FCF in FY2013 – FY2023 (in billions) is $0.556, $1.264, $1.034, $1.784, $1.728, $2.253, $2.354, $2.471, $2.671, $3.072, and $3.053B. ICE, however, adds or deducts net Section 31 Transaction Fees to arrive at its FCF; this amount is generally nominal.

Because the SEC fee is a provision under Section 31 of the Securities Exchange Act of 1934, it is often referred to as the Section 31 Transaction Fee. The fee is based on the volume of shares traded and applies to the sale of stocks, but not the purchase of stocks. The fee is 1% of one eight-hundredth of the dollar value of the equities sold.

Source: ICE – Q4 2023 Earnings Presentation – February 8 2024

FY2024 Guidance

ICE completed the acquisition of Black Knight (BKI) on September 5, 2023; the focus is now on its integration. ICE’s FY2024 guidance, therefore, includes BKI revenue and expense synergies.

FY2024 guidance calls for total Mortgage Technology revenue growth on a pro forma basis to be in the low single-digit to mid-single-digit range. The low end of the range assumes only a modest improvement in application and origination volumes, while the high end underwrites a more substantial improvement in the double-digit growth range; seasonality tends to benefit both Q2 and Q3 relative to Q1 and Q4.

Expectations are for recurring revenues for the year to be roughly flat with an improvement in the 2nd half of FY2024. This includes a ~$5 – ~$10 million decline in Q1 relative to Q4 2023.

Through the first ~5 months following September 5, 2023, ICE has achieved ~$0.03B of annualized revenue synergies. These synergies have largely been driven by cross-sell success across ICE’s flagship Encompass and MSP platform as well as in data and analytics. This amount is ~24% of the ~$0.125B 5 year target. These signings, however, are not expected to have a material impact on ICE’s 2024 recurring revenues and will largely begin to be recognized in FY2025 and thereafter.

ICE’s FY2024 guidance includes adjusted operating expenses of ~$3.81B – ~$3.86B. While ICE will continue to invest across its various business segments, it is on target to achieve ~$0.135B in annualized synergy savings by FYE2024. This is ahead of original expectations of ~$0.1B by year-end.

Non-operating expenses in Q1 are expected to be ~$0.215B – ~$0.22B. Depending on the future path of short-term interest rates, these expenses could decline slightly in subsequent quarters as ICE continue to pay down outstanding commercial paper and the $1.6B term loan related to the BKI acquisition.

The FY2024 tax rate will likely be ~24% – ~26%, up slightly from 2023 through the impact of a full year of higher UK taxes.

FY2024 CAPEX is forecast to be ~$0.6B – ~$0.65B. This includes ~ $0.1B relating to BKI. The vast majority of this CAPEX is expected to be directed to various technology investments, and ~$0.1B related to new office space and expansion and improvements in New York, London, and Jacksonville.

Credit Ratings

ICE’s leverage is elevated following the BKI acquisition with gross leverage at FYE2023 being ~4.1X pro forma EBITDA. ICE, however, continues to target 3.25X by 2025 and 3X as its normalized leverage level. Once the 3.25x level is attained, the plan is to resume share repurchases; share repurchases were suspended when ICE announced the BK acquisition.

ICE has successfully deleveraged following previous acquisitions and I have no reason to doubt management’s outlook.

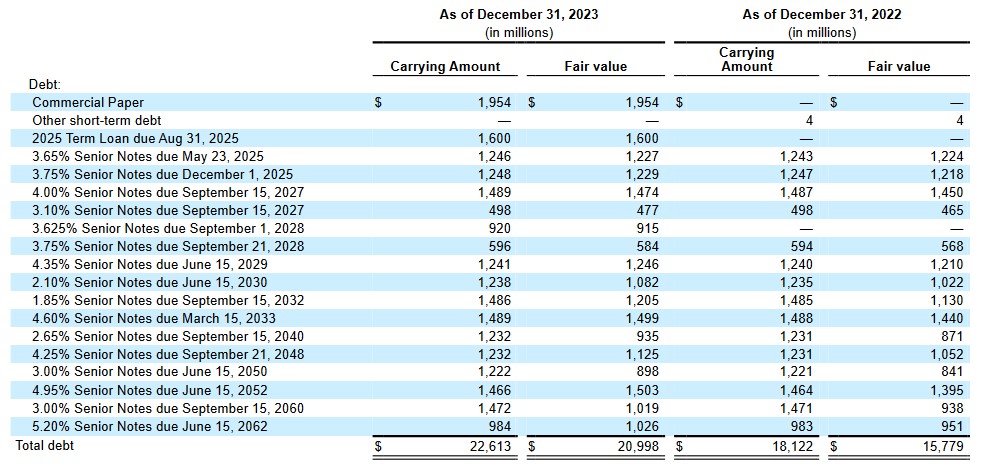

The following table reflects the fair value of ICE’s debt as of December 31, 2023 and December 31, 2022.

ICE’s current senior unsecured long-term debt credit ratings and outlook remain unchanged from my prior review.

- Moody’s: A3 (stable and affirmed on August 31, 2023)

- S&P Global: A- (stable and last reviewed on September 5, 2023)

Both ratings are at the bottom of the upper-medium grade investment-grade category. These ratings define ICE as having a strong capacity to meet its financial commitments. It is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

ICE’s ratings are acceptable for my purposes.

Dividend and Dividend Yield

ICE’s dividend history is accessible on the NASDAQ website; it does not maintain a dividend history on its website.

In FY2020 – FY2023, ICE distributed dividends of $0.669, $0.747, $0.853, and $0.955 (in billions).

On February 8, ICE declared a ~7.1% increase in its quarterly dividend from $0.42/share to $0.45/share commencing with the dividend payable at the end of March 2024.

Using the current ~$135 share price, the forward dividend yield is ~1.33%.

Although some may perceive this dividend yield to be unsatisfactory, the focus should be on total potential shareholder return and not dividend metrics.

ICE’s weighted average diluted shares outstanding in FY2012 – FY2023 (in millions) are 365, 396, 573, 559, 599, 594, 579, 565, 555, 565, 561, and 565.

In FY2023, ICE repurchased no shares as the focus is on reducing its leverage below 3.25X. This is anticipated to occur in 2025.

Stock Splits

ICE’s stock split history consists of a 5-for-1 stock split on November 04, 2016.

Valuation

ICE’s diluted PE in FY2011 – FY2022 is 18.52, 16.46, 29.52, 66.86, 24.11, 23.09, 25.66, 17.00, 25.15, 31.76, 25.23, and 37.52.

The company has undergone a significant transformation over the years and the BKI acquisition will result in a vastly different ICE from several years ago. As a result, do not to compare historical PE levels to current and forward PE ratios.

In FY2023, ICE generated diluted EPS and adjusted diluted EPS of $4.19 and $5.62, respectively. With shares trading at ~$135, the diluted PE and adjusted diluted PE are ~32.2 and ~24.

FY2023’s adjusted FCF that incorporates net Section 31 fees was $3.197B. The weighted average diluted shares outstanding in FY2023 was ~565 million thus giving us ~$5.69 FCF/share and a P/FCF/share of ~23.7.

ICE does not provide FY2024 adjusted diluted EPS guidance. We do, however, have broker estimates with which to estimate ICE’s forward adjusted diluted PE.

- FY2024 – 16 brokers – mean of $5.90 and low/high of $5.56 – $6.23. Using the mean estimate, the forward adjusted diluted PE is ~22.9.

- FY2025 – 15 brokers – mean of $6.56 and low/high of $6.04 – $6.85. Using the mean estimate, the forward adjusted diluted PE is ~20.6.

- FY2026 – 5 brokers – mean of $7.44 and low/high of $7.24 – $7.62. Using the mean estimate, the forward adjusted diluted PE is ~18.1.

I envision ICE’s forward adjusted FCF will be somewhat similar to its forward adjusted diluted EPS. The forward P/FCF should, therefore, be similar to the forward adjusted diluted PE.

Using current management’s FY2024 guidance and broker estimates, I consider ICE’s valuation to be ‘fair’.

Final Thoughts

ICE’s impressive track record of 18 consecutive years of record revenues, operating income, and adjusted EPS is possible because of its diversification across asset classes and geographies. This means it there is no restriction to any one cyclical trend or macroeconomic environment.

In my October 5, 2023 guest post, I conclude that ICE’s valuation is attractive given its long-term growth potential. Fast forward 4 months and a ~$25 share price increase and ICE’s valuation is now ‘fair’. Nevertheless, ICE’s long-term outlook is bright and investors can likely expect a low double digit (10% – 13.5%) long term shareholder return.

I currently hold 400 ICE shares in the FFJ Portfolio and more shares in a retirement account.

In my 2023 Year End FFJ Portfolio Review, ICE was my 29th largest holding. When I completed this review, ICE was trading at ~$128 versus the current ~$135. The share price of other holdings has also changed so I have no idea if ICE is still within the top 30 holdings.

I hope to be in a position add to my exposure if ICE’s valuation based on FY2024 and FY2025 broker estimates retraces to the upper teens or better. Naturally, this will be dependent on what other opportunities present themselves.

I wish you much success on your journey to financial freedom!

Note: Thanks for reading this article. Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long ICE.

Disclaimer: I do not know your circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decisions without conducting your research and due diligence. You should also consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.