On February 21, Home Depot (HD) released Q4 and FY2022 results (January 29, 2023 FYE) and FY2023 guidance. Management expects 2023 to be a year of moderation and is targeting approximately flat comp sales and a mid-single-digit percent decline in diluted EPS compared to the prior fiscal year. This guidance has not been well received by the investment community. As I compose this post, HD’s share price has plunged to ~$295 from the previous market close of $317.95. I still think Home Depot is overvalued despite the recent share price pullback. This is because guidance includes a mid-single digits drop in diluted EPS.

When I last reviewed Home Depot (HD) in my November 16 post, I concluded that:

‘HD’s results might be weaker than the current forecast which may present an opportunity to acquire HD shares at a more favourable valuation’.

In this post, I disclose at what level I would consider adding to my HD exposure.

Overview

If you want a good overview of the company that includes the Risk Factors, Part 1 in the FY2021 Form 10-K is a good source of information; the FY2022 Form 10-K is not yet available.

Financials

Q4 and FY2022 Results

Earnings-related material is accessible here.

In FY2022, HD generated $157.4B in revenue. In comparison, it generated ~$110.2B, ~$132.1B, and ~$151.2B in FY2019 – FY2021. However, Q4 total sales were $35.8B, an increase of only ~$0.1B, or 0.3% from Q4 in the prior fiscal year.

HD reported a significant decline in lumber prices relative to a year ago. On average, lumber prices were down over 50% YoY.

HD’s ~33.5% gross margin is similar to the prior fiscal year’s ~33.6% level.

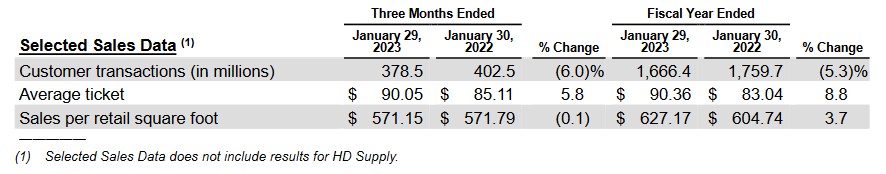

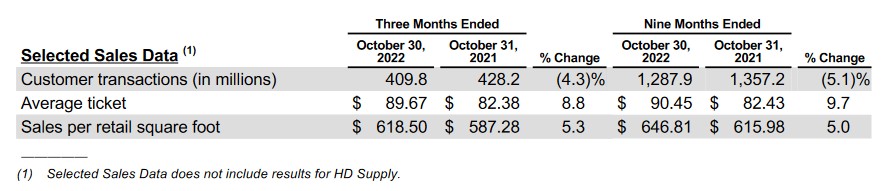

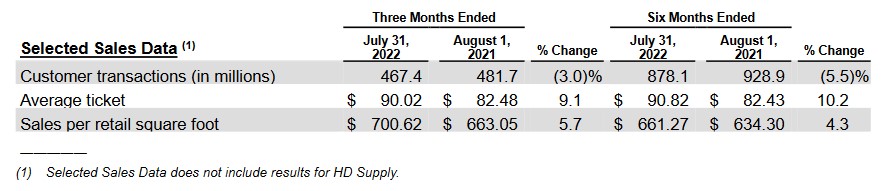

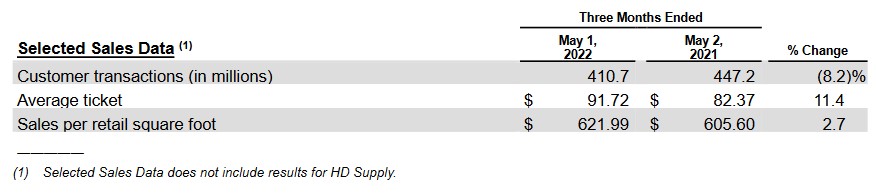

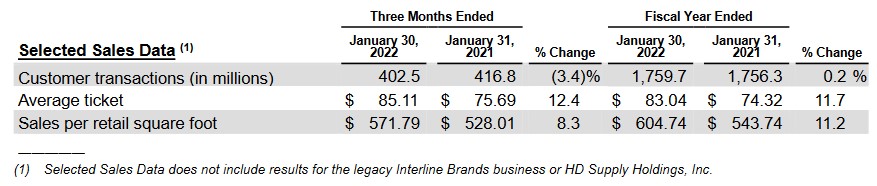

In Q4, HD’s average ticket value increased by 5.8% but customer transactions fell by 6%. The growth in the average ticket was driven primarily by inflation across product categories, as well as demand for new and innovative products. Inflation from core commodity categories positively impacted the average ticket growth, by ~15 bps in Q4.

Looking at the Selected Sales Data for the last few quarters we see a significant decline in the quarterly results for customer transactions and sales per retail square foot.

As noted in my prior post, HD has benefitted from a backlog of contracted jobs that piled up during the pandemic. Its results, however, are closely intertwined with those of the US housing market. In recent months US home sales have slowed as US policymakers have sought to blunt the highest inflation in decades by raising interest rates.

According to data released by the Federal Reserve Bank of New York on February 16, 2023, total household debt in Q4 2022 increased by $394B billion (2.4%) to $16.90T. Balances now stand $2.75T higher than at the end of 2019, before the pandemic recession.

Furthermore, the share of current debt becoming delinquent increased again in Q4 for nearly all debt types, following two years of historically low delinquency transitions.

Something has to give. If interest rates continue to rise, I envision fewer homeowners being able to make home improvements relative to when we were in a very low-rate environment. This will likely negatively impact HD’s performance.

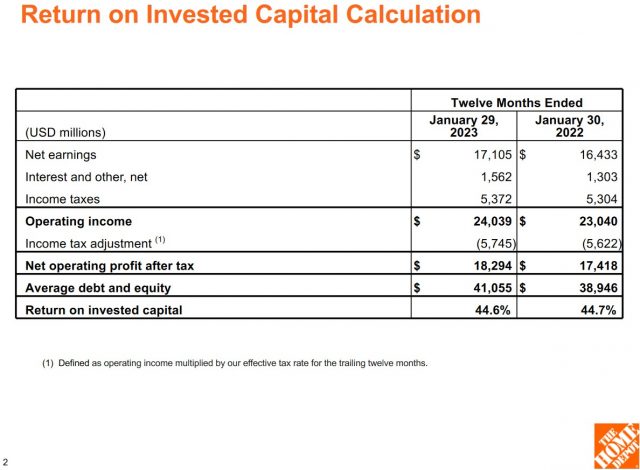

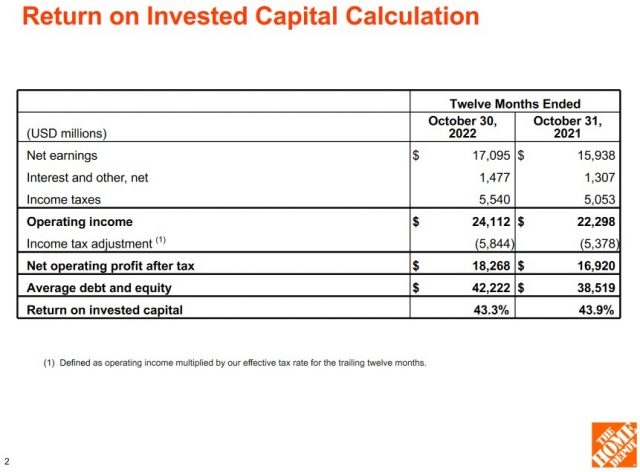

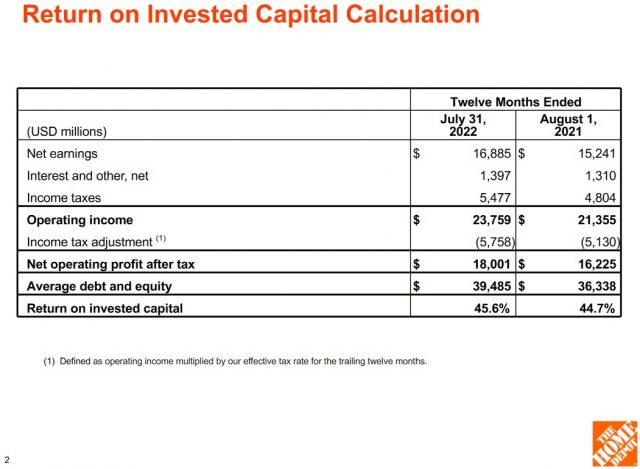

Return on Invested Capital (ROIC)

ROIC, computed on the average of beginning and ending long-term debt and equity for the trailing 12 months, is used to assess a company’s efficiency in allocating capital to profitable investments. It gives investors a sense of how well a company is using its capital to generate profits.

A company is thought to be creating value if its ROIC exceeds its weighted average cost of capital (WACC).

HD’s ROIC in the most recent 3 quarters is reasonably stable and safely exceeds HD’s WACC.

FY2023 Guidance

HD’s FY2023 guidance is:

- Approximately flat sales growth and comparable sales growth compared to FY2022;

- Operating margin rate of ~14.5% which reflects ~$1B in additional annual compensation for frontline, hourly associates;

- The tax rate will be ~24.5%; and

- A Diluted EPS percent decline in the mid-single digits.

HD has announced a ~$1B increase in annualized compensation for its frontline hourly associates. The rationale for this increase is to position HD favourably in the market to attract the most qualified talent and retain the exceptional associate base that is already in place. Making the appropriate investments in its associates, stores, digital platforms, supply chain, technology and other strategic initiatives strengthens the company and enables it to deliver exceptional shareholder value over the long term.

Operating Cash Flow (OCF) Free Cash Flow (FCF)

The Condensed Consolidated Statement of Cash Flows in the FY2011 – FY2021 Form 10-Ks reflect OCF of (in $B) 6.65, 6.98, 7.63, 8.24, 9.37, 9.78, 12.03, 13.17, 13.69, 18.84, and 16.57.

Back out capital expenditures (CAPEX) in FY2011 – FY2021 and FCF (in $B) are 5.43, 5.66, 6.24, 6.80, 7.87, 8.16, 10.13, 10.72, 11.01, 16.38, and 14.

In FY2022, HD reported $14.615B in OCF. Back out $3.119B of CAPEX and FCF is ~$11.496B.

Credit Ratings

There is no change to HD’s senior unsecured domestic currency credit ratings following my prior post. The ratings and outlook remain:

- Moody’s: A2 and stable;

- S&P Global: A and stable; and

- Fitch: A and stable.

These ratings are the middle tier of the upper-medium grade category and define HD as having a STRONG capacity to meet its financial commitments. However, it is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

These investment-grade ratings are acceptable for my purposes.

Dividends and Share Repurchases

Dividend and Dividend Yield

When I wrote my June 7, 2021 post, shares were trading at ~$311 and the annual $6.60 dividend yielded ~2.1% (see HD’s dividend history); the $1.65 quarterly dividend was increased to $1.90 in early 2022.

At the time of my April 4, 2022 post, HD was trading at ~$303 and the $1.90 quarterly dividend yield was ~2.5%. The dividend yield was similar when I purchased more shares on August 2, 2022 @ ~$301.64.

When I wrote my August 16 post, shares were trading at ~$330.50 and the dividend yield was ~2.3%.

At the time of my November 16 post, shares were trading at ~$312 and HD was slated to declare its 4th consecutive $1.90 quarterly dividend within days. While the trailing dividend yield was ~2.4%, I expected HD to declare a dividend increase in the second half of February 2023. Based on the past few dividend increases, I envisioned a ~$0.10 – ~$0.15 increase. Using the $0.125 mid-point, I determined the new quarterly dividend payable in March might be ~$2.03.

We now know that on February 21, HD announced a 10% increase in its quarterly dividend to $2.09/share, which equates to an annual dividend of $8.36/share. This dividend is payable on March 23, 2023, to shareholders of record on the close of business on March 9, 2023 and marks the 144th consecutive quarter HD has distributed a cash dividend.

Using the current ~$295.50 share price and the new $2.09 quarterly dividend ($8.36/year), the forward dividend yield is ~2.8%.

During FY2016 – FY2022, HD’s dividend distributions were $3.404B, $4.212B, $4.704B, $5.958B, $6.451B, $6.985B, and $7.789B for a total of ~$39.5B.

Share Repurchases

In FY2016 – FY2022, HD repurchased $6.88B, $8B, $9.963B, $6.965B, $0.791B, $14.809B, and $6.696B of issued and outstanding shares for a total of ~$54.1B. The dramatic drop in the value of shares repurchased in FY2020 is because HD suspended share repurchases in March 2020 when COVID-19 hit North America. HD resumed share repurchases in Q1 2021.

The diluted weighted average common shares outstanding in FY2019 – FY2022 (in millions) are 1,097, 1,078, 1,058, and 1,025.

Valuation

HD’s FY2011 – FY2021 historical PE levels based on diluted EPS are 18.04, 21.93, 22.25, 23.86, 24.77, 21.73, 26.29, 18.76, 21.71, 22.96, and 27.72.

My November 16, 2022 post reflects HD’s valuation at the time of my prior HD posts. However, I provide below for ease of comparison my valuation calculations based on management’s guidance and broker estimates that were provided when Q3 earnings were released.

At the end of Q3 2022, HD reported YTD diluted EPS of $13.37. Based on HD’s YTD results, I estimated it would generate $4.20 of diluted EPS in Q4 (Q3 diluted EPS was $4.24) giving us FY2022 diluted EPS of $17.57. With shares trading at ~$312, the forward diluted PE estimate based on GAAP results was ~17.76.

I expected the brokers which cover HD to amend their adjusted diluted EPS estimates over the coming days. However, based on existing estimates when I wrote my post, HD’s forward-adjusted diluted PE levels were:

- FY2023 – 35 brokers – mean of $16.59 and low/high of $16.33 – $16.63. Using the mean estimate, the forward adjusted diluted PE is ~18.8.

- FY2024 – 35 brokers – mean of $16.99 and low/high of $15.10 – $18.36. Using the mean estimate, the forward adjusted diluted PE is ~18.4.

- FY2025 – 2 brokers – mean of $17.97 and low/high of $14.50 – $19.84. Using the mean estimate, the forward adjusted diluted PE is ~17.4.

HD has now reported $16.69 in diluted EPS for the prior fiscal year. With shares currently trading at ~$295.50, the diluted PE is ~17.7.

Management’s FY2023 guidance is for a Diluted EPS percent decline in the mid-single digits. If we use a 5% decline, FY2023 diluted EPS will likely be ~$15.86 thus giving us a forward diluted PE of ~18.6.

I expect adjusted diluted EPS broker estimates to be amended lower over the coming days but for now, this is HD’s forward valuation based on currently available estimates:

- FY2024 – 37 brokers – mean of $16.13 and low/high of $15.08 – $17.53. Using the mean estimate, the forward adjusted diluted PE is ~18.3.

- FY2025 – 32 brokers – mean of $17.01 and low/high of $14.50 – $18.75. Using the mean estimate, the forward adjusted diluted PE is ~17.4.

- FY2026 – 15 brokers – mean of $18.15 and low/high of $16.59 – $20.72. Using the mean estimate, the forward adjusted diluted PE is ~16.3.

REMINDER: HD’s fiscal year end is at the end of January. The FY2024 broker estimates, therefore, are for 11 months in 2023 and 1 month in 2024.

If HD’s share price were to decline to ~$270, we would be looking at a ~17 PE using FY2023 diluted EPS of ~$15.86. I would consider adding to my exposure if the share price were to come close to, or fall below, this level.

Final Thoughts

HD’s management expects 2023 to be a year of moderation in demand for home improvement and thus the reason for their weak guidance.

Many executives on earnings calls to which I listen also express caution. In some cases, expectations are for the first half of 2023 to be weak with an improvement in the second half. I am not so sure we will see much of a recovery in the second half.

In the past 12 months, the Fed has hiked rates seven times to combat rising inflation. As of January 2023, the federal funds rate is 4.43%. However, the FOMC predicts that it could continue to rise and peak at around 4.9% in 2023. Policymakers, however, could raise rates to 5% – 5.25% and some Fed officials see a scenario where rates could rise even higher, with the most aggressive forecasts in a 5.5% – 5.75% target range; this would be the highest since 2000.

Naturally, where rates end up depends on inflation and the labour market.

Changes in interest rates typically take time to filter through the economy with the job market often one of the last places impacted. It is entirely possible that it could take several months for the full effect of the rate hikes to translate into slower job growth and fewer job openings.

In early 2022, interest rates were near-zero percent. Now that economic growth is no longer being stimulated by low interest rates, it is entirely likely that further interest rate increases could have an increasingly detrimental impact on the US economy.

Although HD’s share price has pulled back by more than $40/share since early February 2023, I am in no rush to add to my HD exposure. The weak earnings guidance means there is no improvement in HD’s valuation from when I last reviewed it.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long HD.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.